Here are all the new features and improvements in Practice Compliance.

Something not working as expected? Find out if it’s reported on the Known issues page.

January 2026

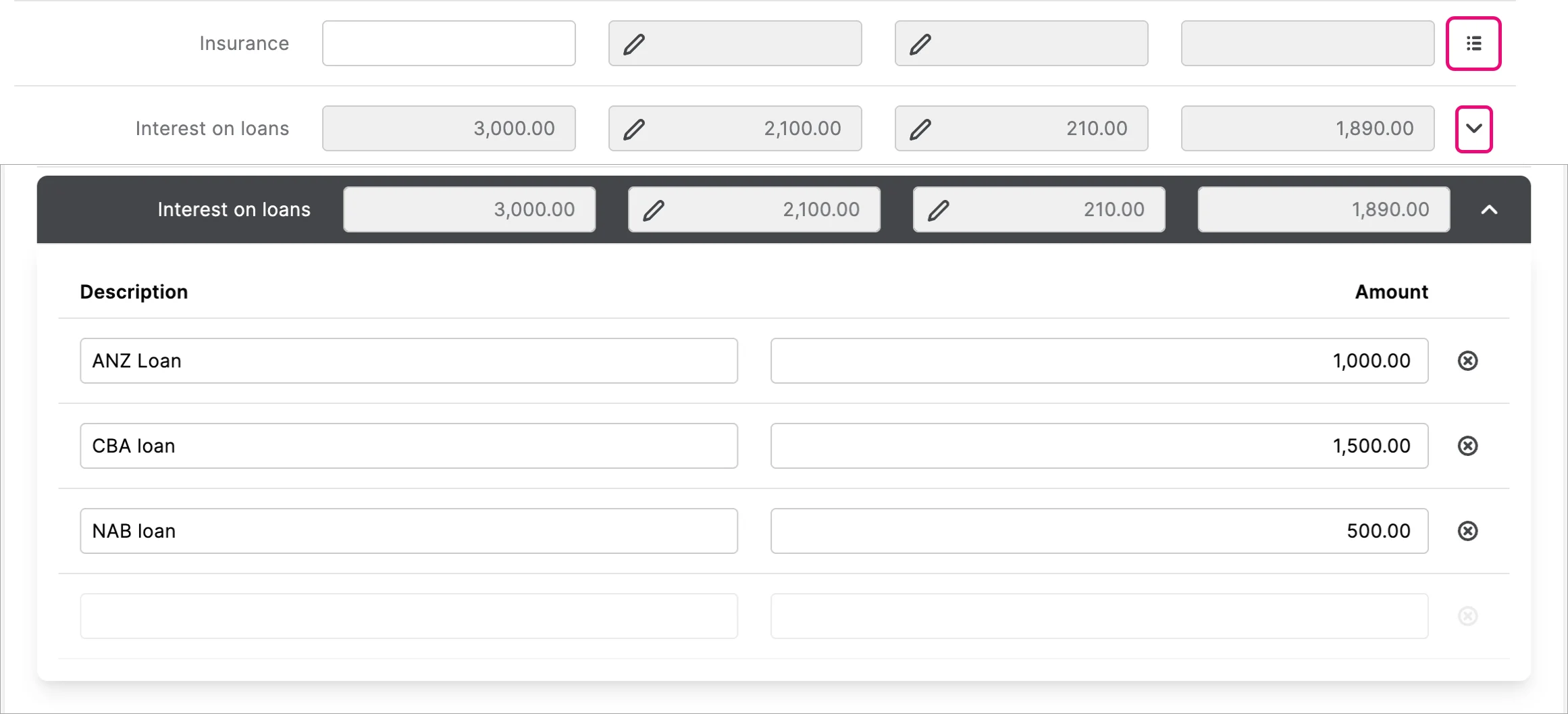

Breakdown of amounts at the field level

Individual returns, rental property schedule only

You can now enter a detailed breakdown directly under a field, so you know exactly how the amount is calculated without leaving the schedule. This improves clarity and transparency by clearly showing how the total is made up.

The breakdown of the amounts can be sourced from other worksheets, such as Borrowing expenses and Tax depreciation, and will also be displayed when printing the tax return. Learn more

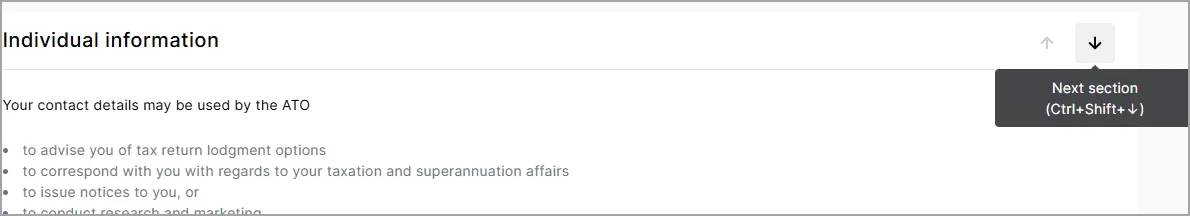

Navigate your tax returns faster with new section arrows

The up and down arrows at the top right of each section let you jump straight to the next or previous item, so you can move through the return without scrolling. The return now loads faster as you work through each section separately.

If you prefer using the keyboard for navigation, use Ctrl + Shift + ↑/↓ (Windows) or Cmd + Shift + ↑/↓ (Mac).

November 2025

Rental property worksheet in a Company return

We've created a rental property worksheet in a company tax return to help you with calculating the gross rental income. This amount from the worksheet will integrate into Item 6 label G. This worksheet is not lodged to the ATO.

October 2025

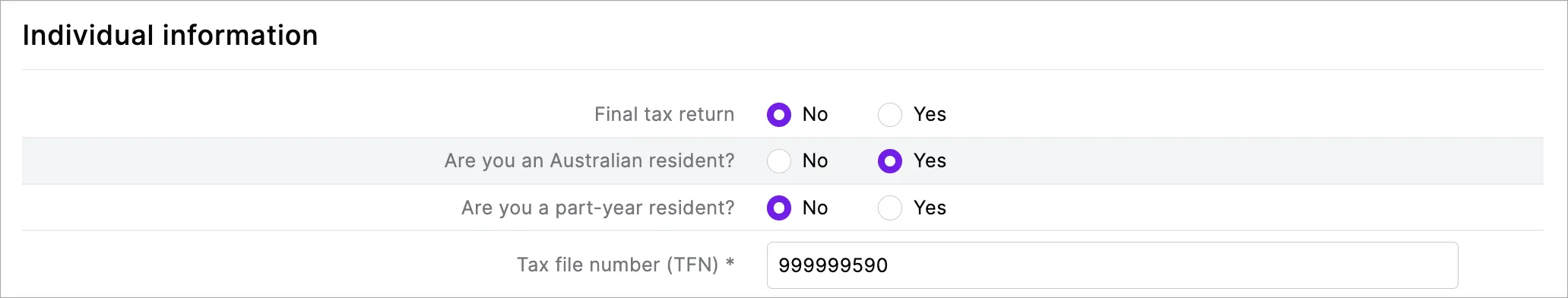

Visual improvements make more tax fields easier to read and navigate

All tax fields that have one label and one field have had the following layout improvements.

To make it easier to see which labels, fields and buttons are grouped together in the same row:

Field rows are now separated from each other by a line.

Hovering over a field row will add a highlight to the row.

No/Yes radio buttons have more space between the No and Yes option.

All tax fields that have one label and one field make better use of horizontal space. This lets more information fit on the page and means less scrolling.

Before

After

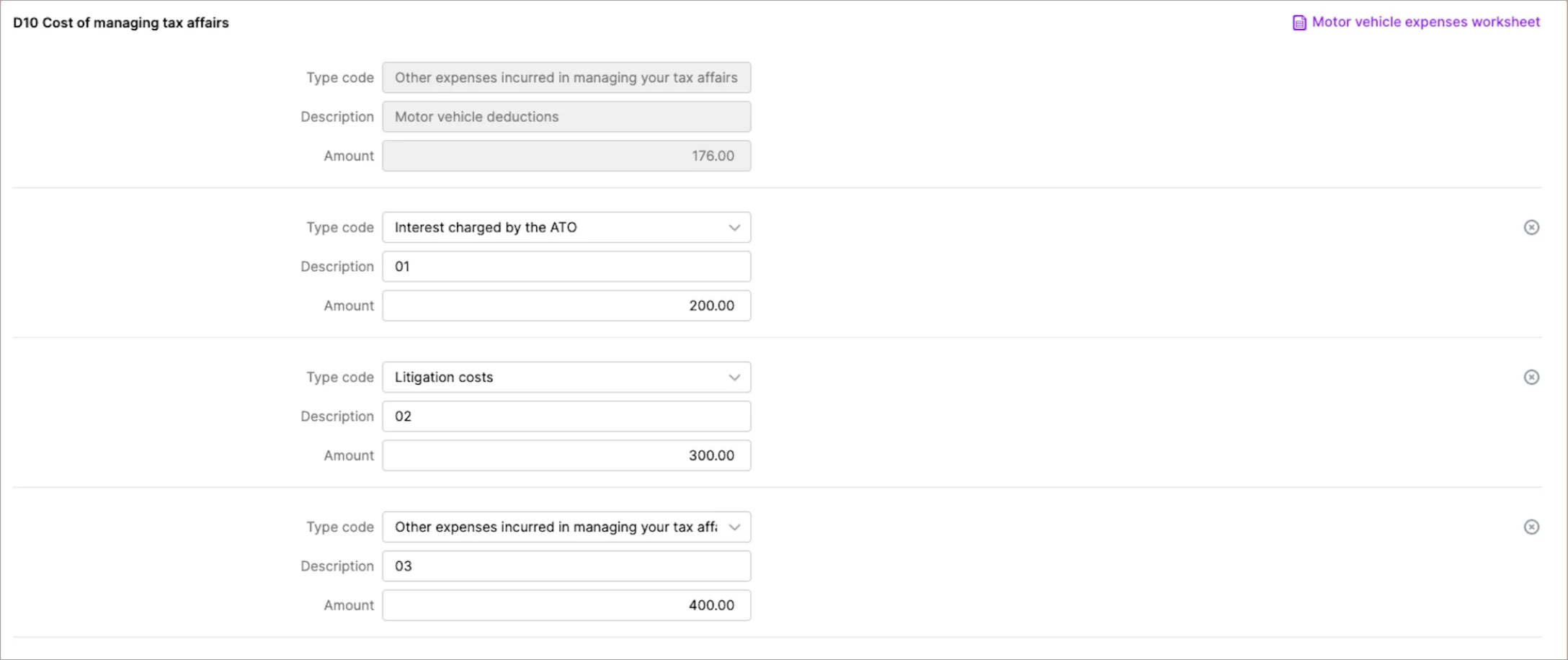

Less scrolling in the Deductions schedule with an improved field layout

Most repeating fields in the Deductions schedule are now displayed in a table format instead of stacked vertically. This saves space and lets you see more data without the need to scroll.

Before

After

In existing returns, you'll only see this change if the return is not in a locked status. For new returns, you'll see this change in the Deductions schedule.

Tax forms look better and are easier to read

Fields in worksheets and schedules now appear in the middle of the page and have a fixed width. This means you'll see less empty white space, and will make information more readable on large screens.TFN Withholding and TFN Reporting forms in Trust returns.

The TFN Withholding and TFN Reporting forms are now available to lodge for Closely held trusts.Capital gains tax worksheet is here

The Capital Gains Tax (CGT) worksheet is now available in Practice Compliance for individual returns. Enter your asset sale details, and we’ll calculate gains or losses. When you’re done, the values will integrate into the CGT schedule and the return. Learn more

September 2025

Foreign rental property worksheet

A new worksheet for foreign rental properties is now available in the Individual tax return for 2024 and 2025. This worksheet helps calculate values at Item 20 and integrates from other worksheets. Learn more.In-house validation for partnership, trust and company returns for 2025 onwards

We've implemented the ATO's validation rules in MYOB Practice Compliance for 2025 partnership, trust and company returns. This was previously only available for individual returns.

Validating returns before lodging to the ATO is faster than relying on ATO validation, reduces the risk of ATO rejections, and isn’t impacted by ATO system maintenance. Learn more about validating in Practice Compliance.

New tax estimate sections

The tax estimate PDF now includes the following:Summary of taxable income section.

This section shows the different types of income that are added up to get your taxable income.

This helps you and your clients easily see how the income is calculated and quickly verify that everything looks correct.Carried forward for use in later years section.

This includes amounts of primary production, non-primary production and capital losses, as well as carried forward offsets.

August 2025

Validation error tests implemented to avoid rejections from the ATO

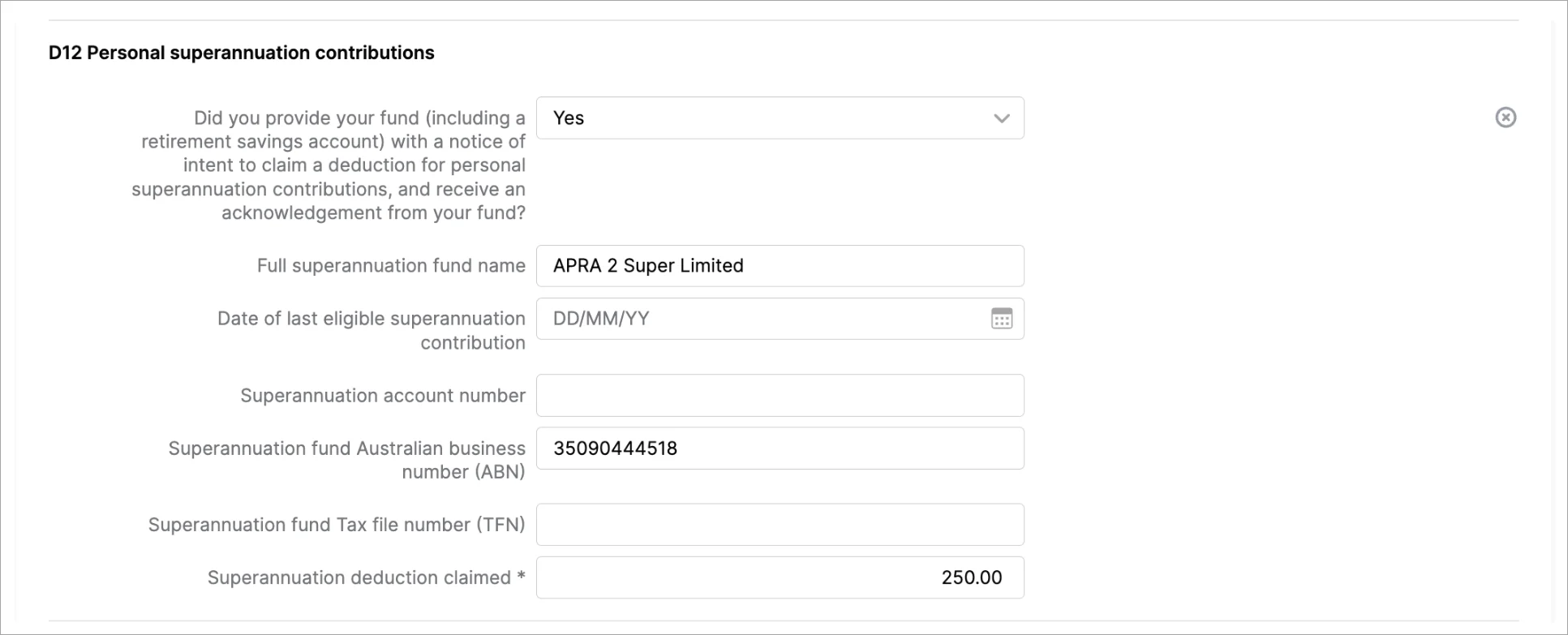

Individual tax return: We've added validation tests to the following fields to prevent CMN.ATO.GEN.XBRL03.

- Mobile number on the Front cover

- Description fields in the Deductions schedule.

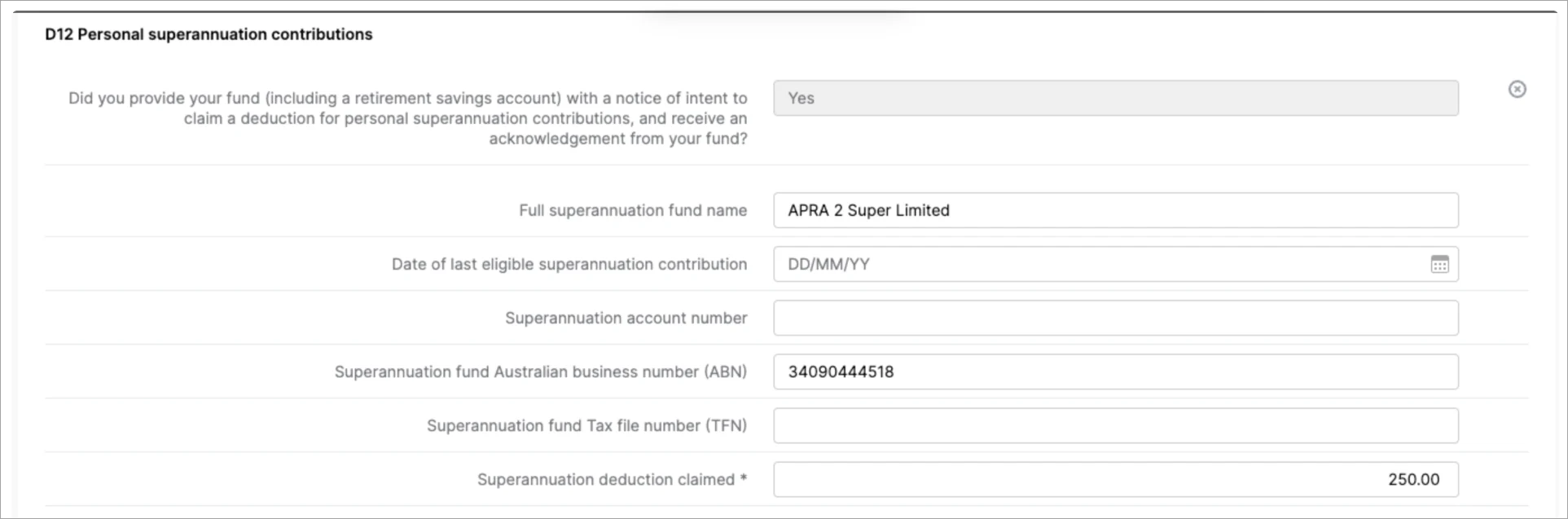

- D12 - Warning message if you've completed the amounts but have not answered - Did you provide your fund with a notice of intent to claim a deduction

Company, Trust & Partnership: We've added validation tests to prevent CMN.ATO.GEN.XBRL01 for returns that have a Non-individual PAYG payment summary.

All return types: We've added validation tests if a field name includes invalid characters.In-house validation checks for all 2024 return types

We've implemented the ATO's validation rules for all return types, where previously this was available only in individual returns. Check and correct validation errors when preparing tax returns to avoid rejection from the ATO. It's just like pressing F3 in MYOB AE/AO.This process is significantly faster than ATO's validation and can be performed even if ATO systems are down or busy.

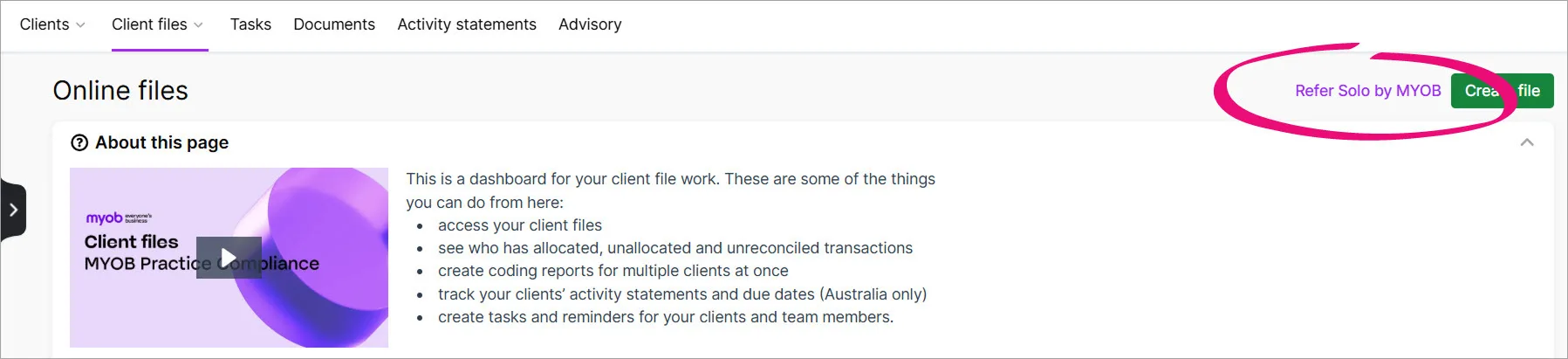

Refer your clients to Solo by MYOB from within Practice Compliance

You'll find a Refer Solo by MYOB link in the Online files page.

Referring sends your clients a discounted sign-up link. Once signed up, they can share access to their business information with you.

July 2025

International Dealings schedule (IDS): We've added additional validation messages items 35a and 35b where all fields are mandatory for applicable taxpayers. Previously leaving a field blank that is marked as mandatory would generate a 400 error on validation.

We've added the Number of dependent children field to M2 Medicare levy surcharge (MLS) label. This field shares the same value as IT8 and will be used to calculate the Medicare levy surcharge.

Small business income worksheet in Partnership and trust tax returns

You can now use the small business income worksheet to calculate the net small business income. In this worksheet, you can differentiate the business income and deductions, such as personal services income, capital gains, etc. This will also help with calculating the small business income tax offset.

You can access the worksheet from Item 5 Label V or the worksheet drop-down on the left side.Fix for Status code 400 errors

We've added validation errors to Partnership returns to fix the We've encountered an error. If the issue persists, contact MYOB support. Status Code: (400) error.Partnership returns - Make sure there is

at least one partner in the statement of distribution

a name for non-individual partners

a family name for individual partners.

Trust returns

We've fixed the rounding error to prevent the Status code 400 error.

New Foreign income section in Distribution received - managed fund schedule

We have added a foreign income section to the Managed fund schedule and implemented the new ATO validation rules. We've also fixed ATO rejection errors (CMN.ATO.GEN.XBRL03), which was happening due to rounding issues.In field validations for business address

Additional validation logic has been added to address fields on the front cover and item P6 Business address of main address. This will prevent ATO rejections (CMN.ATO.GEN.XBRL03, CMN.ATO.GEN.XBRL04) where the state was entered in mixed case instead of all in capitals like VIC, QLD etc.Subscribe to Income Tax Client Report (ITCRPT)

You can now subscribe to the income tax client report in Practice Compliance and view all the due dates for your client's tax returns.

Learn how to subscribe to ITCRPTStandalone Family trust election and Interposed entity election forms available

2024 tax year onwards

Tax now provides the following forms without the need to lodge a tax return:Interposed entity election schedule

Family trust election schedule.

You can select these forms when you create a tax return.

June 2025

2025 tax compliance changes are here!

You've got all the latest updates you need for the new tax year, including changes to:rates

tax returns

worksheets and schedules.

Deductions schedules can pull in data from multiple sources

2025 individual returns onlySome of the labels in the Deductions schedule can now get data from multiple sources like rollover from prior year and ATO pre-fill.

The descriptions in D2 Work-related travel expenses and D5 Other work-related expenses will rollover from AE/AO

D5 Union fees will be pre-filled from ATO.

We've enhanced the layout of the Deductions schedules for more clarity. The Motor vehicle expenses and Tax depreciation worksheets will only display when there is an amount.

Rental schedule improvements to help with validation

Trust and partnership returns only

An error message will be shown if any expense rows are calculated with net amount less than zero.

Negative amounts are displayed in brackets, not with a minus symbol.

Foreign income worksheets are easier to work with and have better integration

For 2025 partnership and trust returns

We’ve redesigned the worksheet with a clearer, more modern layout that lets you enter and reconcile foreign income types in a structured, easy-to-read format.

The worksheet now automatically totals and maps data to Items 22 and 23, saving time and improving compliance confidence. It also supports integrations from trust income schedules, ensuring consistency and reducing double handling.

April 2025

FBT 2025 is available

You can now create FBT 2025 returns in Tax in Practice Compliance. Amending an FBT return is also available from 2025 onwards

You can also create FBT returns in Tax in Practice Compliance from within AE/AO. Make sure you've installed the latest version.

March 2025

Asset disposal amounts are now available in the tax depreciation worksheet

You can now integrate the assessable or deductible balancing adjustment amounts into the Tax Depreciation Worksheet. You previously had to manually enter the disposal amounts from Assets into the tax return.Amending Partnership returns

Following the trust return amendment, you can now amend a partnership return from the tax year 2023 onward.

February 2025

New worksheets in Company returns

We've added four new worksheets to company tax returns so you can see a breakdown of the amounts shown in the return. The totals from these worksheets update the labels in the return.Other income worksheet (Updates Item 6 Label R)

Other Expenses worksheet (Updates Item 6 Label S)

Other Assessable income worksheet (Updates Item 7 Label B)

Non deductible expenses worksheet (Updates Item 7 Label W)

Other income non assessable worksheet (Updates Item 7 Label Q)

Other deductible expenses worksheet (Updates Item 7 Label X)

Amending Trust returns

Following the company return amendment, you can now amend a trust return from tax year 2023 onwards.Tax returns PDFs have been redesigned for clarity and professionalism

Based on your feedback, we’ve redesigned the tax return PDFs. When you open a tax return and select Preview (PDF), you’ll notice improved readability, enhanced layout and a revamped presentation for a professional look.

This update applies to 2023 and 2024 individual, company, partnership and trust tax returns.

Learn more about tax return PDFs.Amending company returns

You can amend your company tax return if you have made a mistake, forgotten to add items, or if something has changed after you've lodged your tax return.Add rental property owners from your existing contacts or associations

In a Rental property schedule, you can easily add an owner by selecting from a list of your contacts or associations. This means you don't need to fill in their details manually each time.

You can still add the details manually if you like.View and download the ATO prefill report (Individual tax return)

You can now view the ATO prefill data in a report. We'll save the ATO prefill report in your client's Documents folder for quick access. Note that we don't prefill all the data that is in the report.

Each time you click Prefill from ATO, a new version of the report (including the date and time) will be saved in Documents. If the prefill is not successful, you can't see the report.

January 2025

A better way to manage file access

You can give users access to client files all within Practice Compliance. You no longer need to go to my.myob to manage file access. This new method is faster, more reliable and gives you a more consistent experience all within Practice Compliance.

Integrate depreciating assets all from one place

Keep all the asset information in one place and integrate them into different worksheets/schedules in a tax return. Integrate the depreciating assets to company, trust and partnership tax returns.

Check out the new tax depreciation worksheet to allocate the amounts to the necessary schedules and worksheet fields.

Identify which tax return sections have data

The tax return navigation bar shows a purple indicator on which items have data. This gives you visibility on which sections have been completed when preparing or reviewing tax returns.

The indicators will appear if items have:

yes or no default selected, such as the Australian resident question on the Front cover

rolled over data from prior year such as tax agent details.

As you enter data into the return, the purple indicators will appear after you refresh the return or click Validate.

Previous releases

To learn about changes in previous years, visit Practice Compliance release history.

Can't see these features in Practice Compliance? Clear your browser's cache and refresh the Practice Compliance tab. If you still can't see it, your practice may not have access to that feature.