We have everything in one place, so you're always ready for 2026 tax time.

The Australian Financial Year commences on 1 July and concludes on 30 June. End of Financial Year (EOFY) is an important time for Australian businesses and individuals. You'll need to make sure your books are up to date, complete tax returns and plan for the new financial year.

MYOB helps create a smart and organised system that makes tax time easy.

Stay ahead with the key EOFY dates you need to know

Unsure when you need to make payments for GST, income tax and employer deductions to the ATO? We've created a handy overview for you right here.

January key dates

21 January

Lodge and pay quarter 2, 2025–26 PAYG instalment activity statement for head companies of consolidated groups.

28 January

Make quarter 2, 2025–26 super guarantee contributions to funds by this date.

31 January

Lodge TFN report for closely held trusts if any beneficiary quoted their TFN to a trustee in quarter 2, 2025–26.

Lodge tax return for taxable large and medium entities as per the latest year lodged (all entities other than individuals), unless required earlier.

February key dates

21 February

Lodge and pay January 2026 monthly business activity statement.

28 February

Lodge tax return for non-taxable large and medium entities as per the latest year lodged (except individuals).

Payment (if required) for companies and super funds is also due on this date.

Lodge and pay quarter 2, 2025–26 activity statement for all lodgement methods.

Pay quarter 2, 2025–26 instalment notice (form R, S or T). Lodge the notice only if you vary the instalment amount.

Annual GST return – lodge (and pay if applicable) if the taxpayer does not have a tax return lodgement obligation.

Lodge and pay quarter 2, 2025–26 Superannuation guarantee charge statement if the employer did not pay enough contributions on time.

March key dates

21 March

Lodge and pay February 2026 monthly business activity statement.

31 March

Lodge tax return for companies and super funds with total income of more than $2 million in the latest year lodged (excluding large and medium taxpayers), unless the return was due earlier.

Payment for companies and super funds in this category is also due by this date.

Lodge tax return for individuals and trusts whose latest return resulted in a tax liability of $20,000 or more, excluding large and medium trusts.

Payment for individuals and trusts in this category is due as advised on their notice of assessment.

April key dates

21 April

Lodge and pay March 2025 monthly business activity statement.

28 April

Lodge and pay quarter 3, 2025–26 activity statement if lodging by paper.

Pay quarter 3, 2025–26 instalment notice (form R, S or T). Lodge the notice only if you are varying the instalment amount.

Make super guarantee contributions for quarter 3, 2025–26 to the funds by this date.

Note: Employers who do not pay minimum super contributions for quarter 3 by this date must pay the super guarantee charge and lodge a Superannuation guarantee charge statement by 28 May 2026.

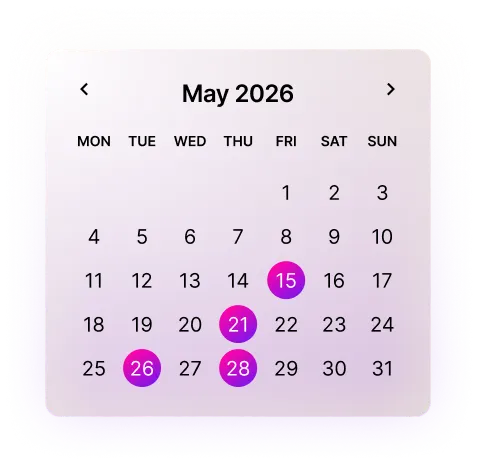

May key dates

28 May

Lodge and pay quarter 3, 2025–26 Superannuation guarantee charge statement if the employer did not pay enough contributions on time.

Note: Employers who lodge a Superannuation guarantee charge statement can choose to offset contributions they paid late to a fund against their super guarantee charge for the quarter. They still have to pay the remaining super guarantee charge.

Get started with MYOB today

Expert on-demand tutorials

Explore these EOFY resources

7 key things to get on top of for EOFY

There’s nothing like a bit of a deadline pressure to really get you into gear, and there’s no deadline quite like end of financial year (EOFY) for business owners (that’s 30 June for the majority of businesses).

It’s your first year in business – Here’s what you need to know about EOFY

EOFY can be a stressful time especially if you’re in your first year of business. But you don’t have to feel like you’re lost in the wilderness, here's why.

How does tax work in Australia?

As a business owner, you may have wondered, “How does tax work in Australia?” or “When do you have to pay tax in Australia?”

Sole trader tax deductions: How to maximise your tax return

A sole trader is the simplest form of business structure. The owner is legally responsible for all aspects of the business, including any debts and losses.

Are you an MYOB customer?

Frequently asked questions

When is End of Financial Year?

The End of the Financial Year (EOFY) in Australia is on June 30th. It is the date on which the Australian financial year ends and the next financial year begins. EOFY is an important date for businesses and individuals in Australia.

June 30 makes the deadline for various financial reporting and compliance requirements, such as tax returns, financial statements and superannuation contributions. Additionally, it is a common time for businesses to review their financial performance and plan for the upcoming year.

What key tasks do I need to do at EOFY?

The specific tasks you need to do for the end of the financial year in Australia will depend on your circumstances. If you’re an individual taxpayer, a sole trader, or a business owner, tax time will be a different story.

However, here are some general tasks you may need to consider:

Organise your receipts, invoices and other financial documents from throughout the year.

Lodge your tax returns with the ATO. The due dates for this are 31st October for individuals and 31st December for businesses.

If you’re an employer, you need to make sure you have made all required superannuation contributions for your employees by the end of the financial year.

These are just some of the tasks you may need to consider for the end of the financial year in Australia. It’s always a good idea to stay informed about your obligations and seek professional advice if needed.

When can I lodge my tax return?

The lodgement period for individual tax returns in Australia typically begins on 1 July and runs through to 31 October of the following year.

How do I complete a business tax return?

Completing a business tax return in Australia can be a complex process, but here’s a general outline of the steps involved:

1. Gather your financial records

Including all your business income and expenses for the financial year. It’s helpful to have any other relevant financial information on hand, such as bank statements, balance sheets and profit and loss statements.

2. Complete the tax return form

The form you need to complete will depend on your business structure. For example, sole traders and partnerships generally need to complete an individual tax return. However, companies and trusts need to complete a company tax return.

3. Include all income

Make sure that you include all income earned by your business during the financial year, including any interest, dividends, or capital gains.

4. Deduct expenses

Deduct any business expenses that you are eligible to claim, such as rent, utilities, salaries and office supplies. Be sure to keep accurate records of all expenses.

5. Calculate depreciation

If you have any depreciable assets (e.g plants and equipment), you may be able to claim a deduction for their depreciation.

6. Review your tax return

Check your tax return carefully to ensure that all information is accurate and complete.

7. Lodge your tax return

Lodge your tax return with the Australian Taxation Office (ATO) by the relevant deadline. The end of February of the following year is the deadline for company tax returns. Partnerships and trusts are due in May and sole traders are due in October.

It's important to note that completing a business tax return can be complex, and the tax rules and regulations can change from year to year. It may be helpful to seek advice from a qualified accountant or tax professional.