Keypoints

-

You can share rental property income between individual returns only with multiple owners (more than 2 owners) Sharing with non-individual entity type is coming soon

-

When sharing data with other owners, you will be pushing the data from the current tax return into other returns.

-

When the rental property income is shared, the schedule will automatically be created in the other return.

-

You can edit data in any tax return you've shared into. This will adjust the values in the other tax returns when you click share.

The ATO requires that a Rental schedule be prepared and lodged for each rental property that is the subject of assessable income/loss.

In Tax in Practice Compliance, you can create one or more rental schedules in an individual tax return and share rental income with multiple owners, wherein MYOB AO you could share only with 2 owners.

To access the rental schedule, from the Tax workpapers & schedules drop-down, select Rental property schedule.

Individual returns only

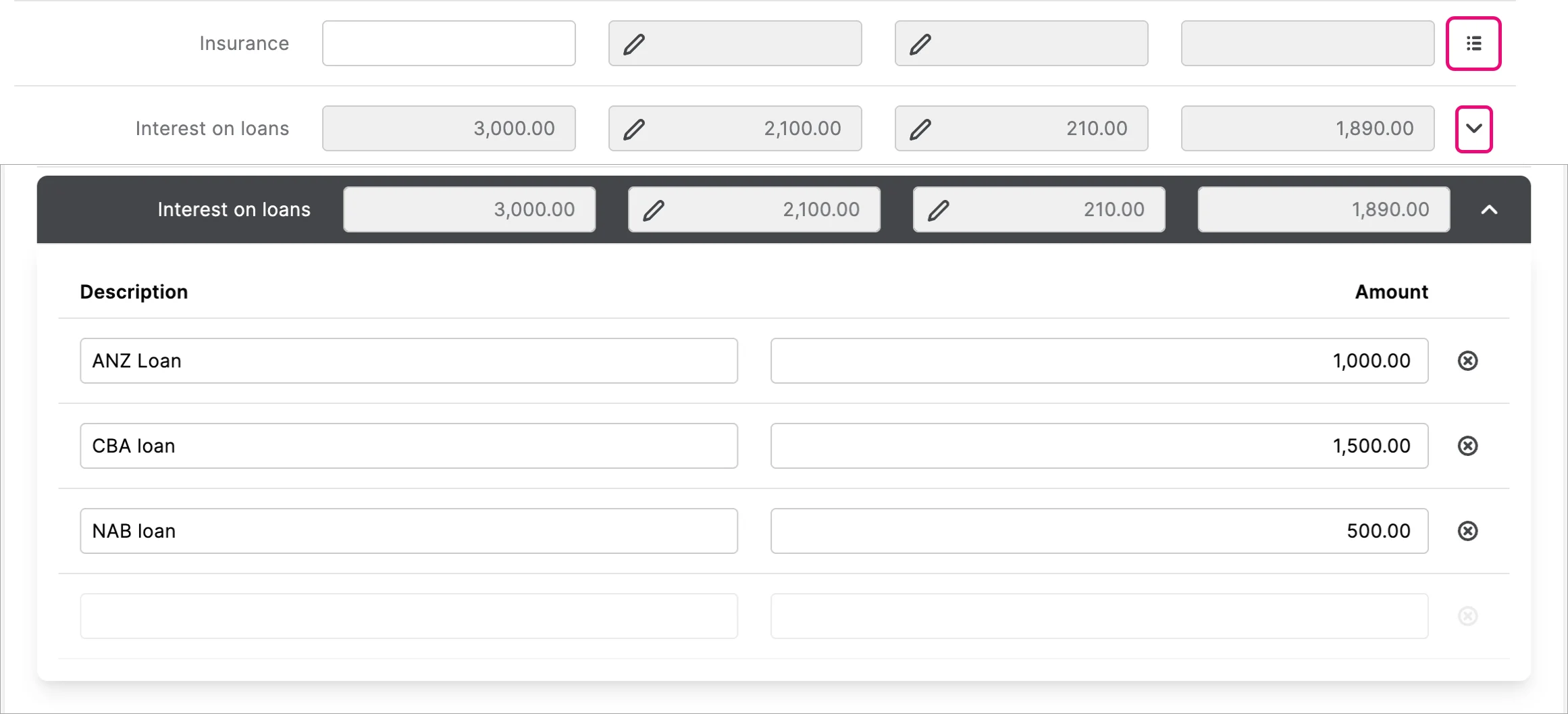

If you need to add a breakdown of the amounts that make up the total, you can use the itemisation located icon next to the field.

Some things to know

Itemised amounts can be sourced from sources like worksheets, ATO pre-fill.

If a field is sourced from another worksheet, such as Borrowing expenses, the schedule will show a single total for that item, even when there are multiple worksheets of the same type. To make changes to a sourced amount, go to the source worksheet.

When printing the return, the breakdown will show below the main total of the item.

When sharing the rental property, only the total amount is shared, not the breakdown.

Company returns only

The rental property is a worksheet in a company return. This is a MYOB worksheet and is not lodged to the ATO.

To create rental schedule

To access the rental schedule, from the Tax workpapers & schedules drop down, select Rental property schedule.

To add more than one rental property, select Rental property schedule again from the drop-down.

If there is more than one rental property, the property address will be displayed.

Private use

If the rental property is used for private use by the owner, then you can enter a number in private use percentage field and this will be applied to all expenses.

But if the private is only for certain expenses, enter an amount in the private use amount field at the respective expenses.

You can edit all Ownership share and Private use fields where the values were automatically populated using the small pen icon located in the field. To reset the value, click the reset icon.

Sharing rental property data

Before you begin

-

Make sure the tax return you're sharing into has an In Progress status. You cannot share the data to a return with a status of Approved or Lodged.

-

You can share rental property data between individual returns only.

-

If you're selecting a rental owner from a list of your existing clients, open their return and make sure it is updated. Otherwise, you'll see an error.

Open the tax return and create a Rental property schedule.

Go to the Owners section.

Select Add owner details from associations or contacts if you want to select from your client list or to add the details manually select Add owner details.

Make sure the tax return you're sharing into has In Progress status. You cannot share the data to a return with a status Approved or Lodged.

If you see an Unexpected error when updating forms form this client. Please check the schedules and try again error, open the tax return you've selected and make sure it is upgraded.

Complete the details if entering data manually or check the details if selecting from your existing client list.

Select Share data to other owners.

The rental schedules are auto-created when sharing links using the first line of the rental property address, if there's a schedule with the same address it will be over-written. A schedule will be created if there's no schedule with the same address.In the Share rental property data window, select Share to selected. The rental property schedule will automatically be created in other owner's returns and the income and other details will be shared.

If you see 'Action required' section in the Share rental property data window, fix the error as per the description (you can do this in another browser tab) and then select Refresh list.

FAQs

How can I create multi-property rental schedule?

You'll need to add a rental schedule for each property you want to add.Can I share with a owner who is not in my database?

Yes, you can add an owner who is not your client for reference. This section is not lodged with the ATO.Can I edit data on all the returns shared into?

Data can be edited in any return that has been shared into and then click Share data into other returns to update.