You can integrate depreciating assets from the Assets tab into the tax return. This helps reduce manual data entry, minimise errors, and saves you time. You can keep all your asset information in one place and let the system automatically calculate depreciation.

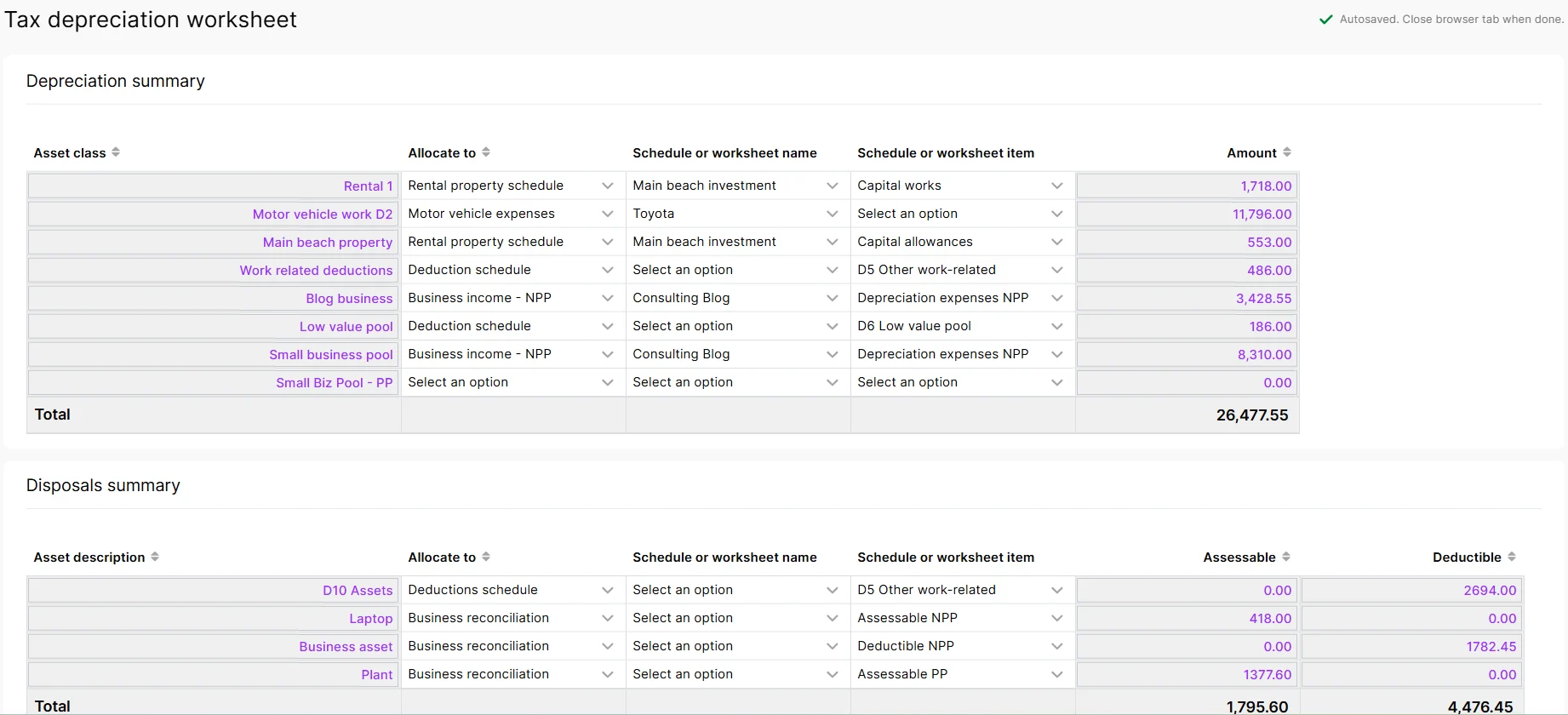

We’ve added a new Tax depreciation worksheet that will automatically import the depreciation expenses from Assets. You can then allocate the amounts to the required schedules and worksheet fields.

Key things to know

Allocate assets by asset class: In Assets, assets are grouped into asset classes. In the tax depreciation worksheet, for the depreciation summary, you need to allocate asset classes, not individual assets, to the schedules and worksheet fields.

Default depreciation class: If you see the Default depreciation class in the worksheet, it means you've not set up any asset classes and allocated the asset to specific asset classes.

If you make changes in Assets that you want to show in an existing worksheet: We recommend updating your asset register before adding the tax depreciation worksheet, as any changes made to your assets afterwards won't sync to the existing worksheet.

If you've already created a worksheet, you'll need to delete the worksheet and add it again for the depreciation and disposal amounts to come through to the worksheet. You'll also need to re-allocate the amounts to the schedules and worksheets.

Allocate the amounts from the tax depreciation worksheet

Follow the How to use this worksheet steps on the Tax depreciation worksheet window. Make sure you've set up asset classes and allocated those classes.

When you're ready, select Yes at Are you ready to allocate your depreciation expenses? question.

In the Depreciation and Disposal summaries, use the columns to allocate the amounts to the schedule or worksheets.

Allocate to: Select the schedule or worksheet you want to allocate the depreciation to.

Schedule or worksheet name: Select the name of the schedule or worksheet. For example, if you have multiple rental schedules, you can pick the one you want to allocate to.

Schedule or worksheet item: Select the field in the schedule or worksheet where the amounts should be integrated. For example, you can allocate rental schedules to capital allowances or works fields.

These amounts will integrate into the respective schedules and worksheets and will be included in the tax return.

Disposals

If you no longer hold or use a depreciating asset (e.g. if you sell the asset), you can integrate the assessable or the deductible amounts into the tax depreciation worksheet and then allocate to the tax return labels, schedules or worksheets.

FAQs

How do I allocate a single asset to the schedule or worksheet?

If you want to allocate a single asset, first create an asset class and add that asset to that class. This asset class will then be available on your tax depreciation worksheet for you to allocate.Why are amounts different in the Tax schedule report?

The tax schedule report includes the correct private use % (if applicable). This percentage is reflected in the amount allocated to private use.