Online payments is a secure payment service that gives your customers an easier and faster way to pay you by simply clicking Pay securely in their online invoices. Customers can pay online using their VISA, MasterCard, AMEX, BPAY, Apple Pay, Google PayTM or PayPal (you can choose to exclude BPAY as a payment option on your online invoices).

This lets your customers pay how they want to pay.

Why use online payments?

Get paid faster – the sooner a customer receives an invoice, the quicker they can pay you. Also, the Pay securely button in the invoice makes payment quicker and easier with multiple payment options.

Better security – online payments use several layers of protection to identify fraudulent behaviour.

More ways to get invoices in front of customers – along with emailing your invoices, choose to send an invoice link via SMS.

Easier reconciliation – online payments and fees are handled automatically so you don't need to manually record anything. Less data entry means fewer errors and more time for you to run your business.

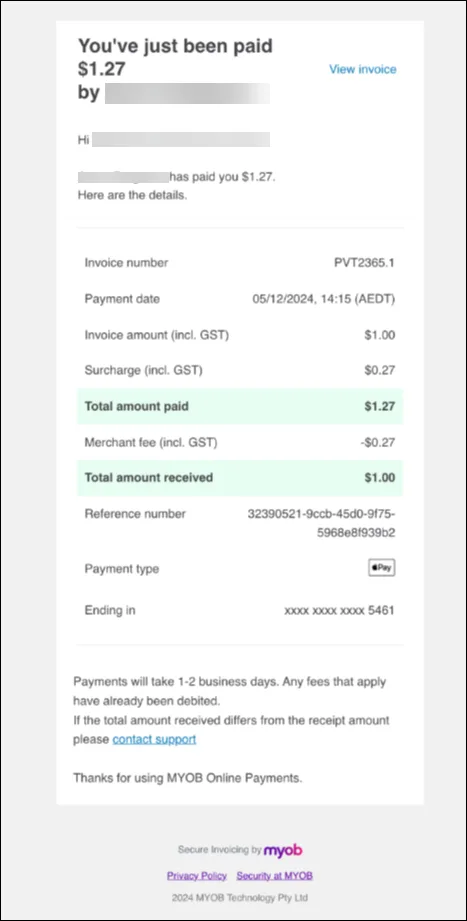

Instant customer receipts – when a customer makes an online payment, they'll receive a confirmation email and can also view a receipt from their online invoice.

Fees and charges

There are no setup or cancellation fees with online payments, but there is a transaction fee that will apply to all payments made online.

Transaction fees: 1.8% of the invoice total + $0.25 per transaction. You can surcharge these fees to your customers, excluding BPAY. But you can choose to exclude BPAY as a payment option.

Fees are debited when the customer pays their invoice, so you'll receive the invoice value minus fees. Learn more about the fees and charges and what happens when a customer pays you.

When you first set up online payments, surcharging is automatically enabled and BPAY payments are automatically disabled – but you can change these settings at any time.

Verify your business for online payments

It's easy to get set up with online payments – just have the following information ready to verify your business (find out why we need this information):

Make sure you have your:

-

Australian Business Number (ABN)

-

Proof of identity – have your driver's licence or passport handy

-

Bank details for the account into which your customer payments (minus fees) will be deposited

-

Estimates of total annual sales in dollars and number of online invoice transactions per month (see your Sales reports).

You can start the verification process by visiting the sign-up website, or from within MYOB by following the steps in 'Get set up' below.

We'll ask you a few simple questions so that we can verify your business and account details to make sure that your information is kept safe and secure.

We'll email you once your business has been verified.

Get set up

It's easy to set up online payments.

You can also set up online payments from your business settings > Sales settings > Payments tab > Set up online payments options.

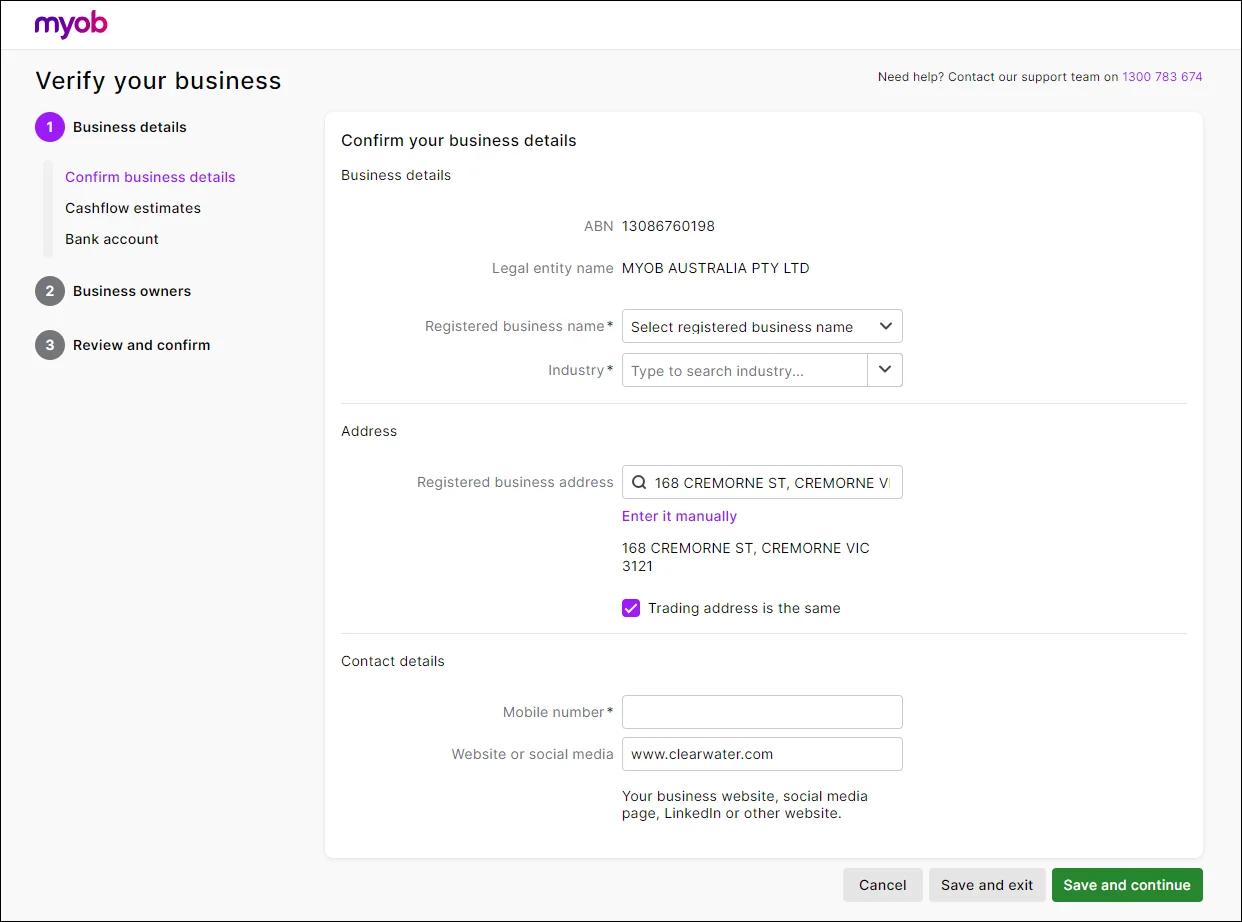

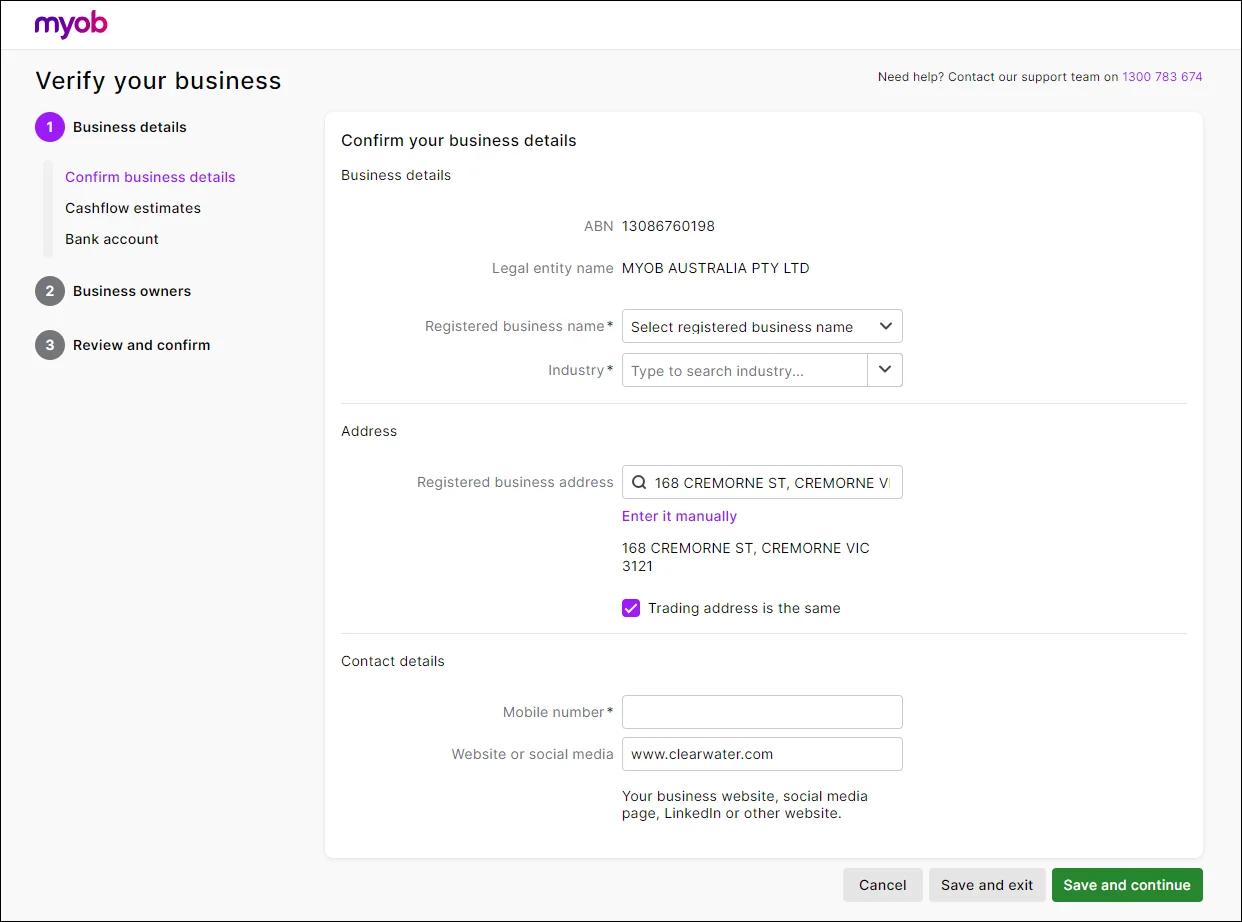

Open the sign-up website. Then, follow the prompts to verify your business:

Business details:

Confirm business details – like your ABN, business name and industry. This is to help confirm and protect the information provided.

Cashflow estimates – choose options that best estimate annual turnover by credit card, the average invoice value and the percentage of deposits taken on invoices (if your business takes deposits). If you're a new business, enter forecasts of these figures.

Bank account – confirm and authorise the settlement bank account where your customers' payments will be deposited. Choose the ledger categories in MYOB you'll use to categorise your customers' payments and associated fees. If bank feeds are linked to these categories, your customers' payments will be handled automatically in MYOB.

Business owners:

Confirm your business owners. Check the email address and mobile number of the beneficial owner(s). They’ll be contacted by email to verify their identity. If they are not listed you can add them.

Identify check. Enter details from the driver's licence or passport of one or more owners.

Supporting documents – Certain types of businesses may need to upload some business documents to verify their business, like trust deeds, business constitution and meeting minutes.

Review and confirm – check over the details you’ve entered and agree to the terms and conditions.

To save and resume the verification later, click Save and exit. To resume, go to the sign-up page and click Resume.

When you're done, click Confirm and submit.

Once the application is submitted, we'll begin the verification process. If more information is required, we'll get in touch with you within two business days.

Verification status. Once your business is verified, you'll receive an email from us letting you know you're ready to use online payments.

Once your business has been verified, all new invoices will have online payments enabled by default.

Sending an invoice

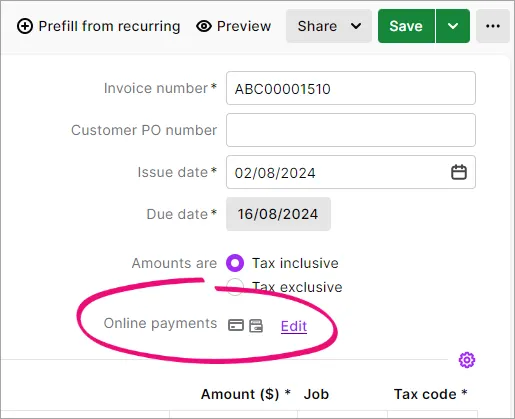

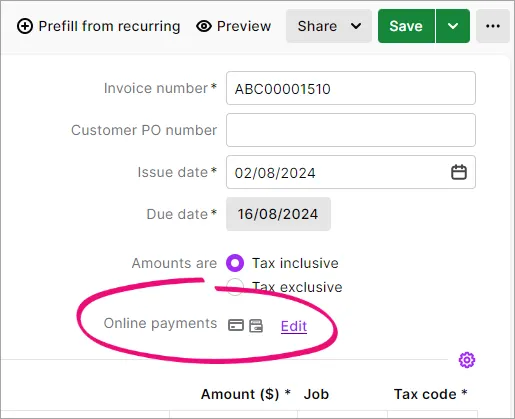

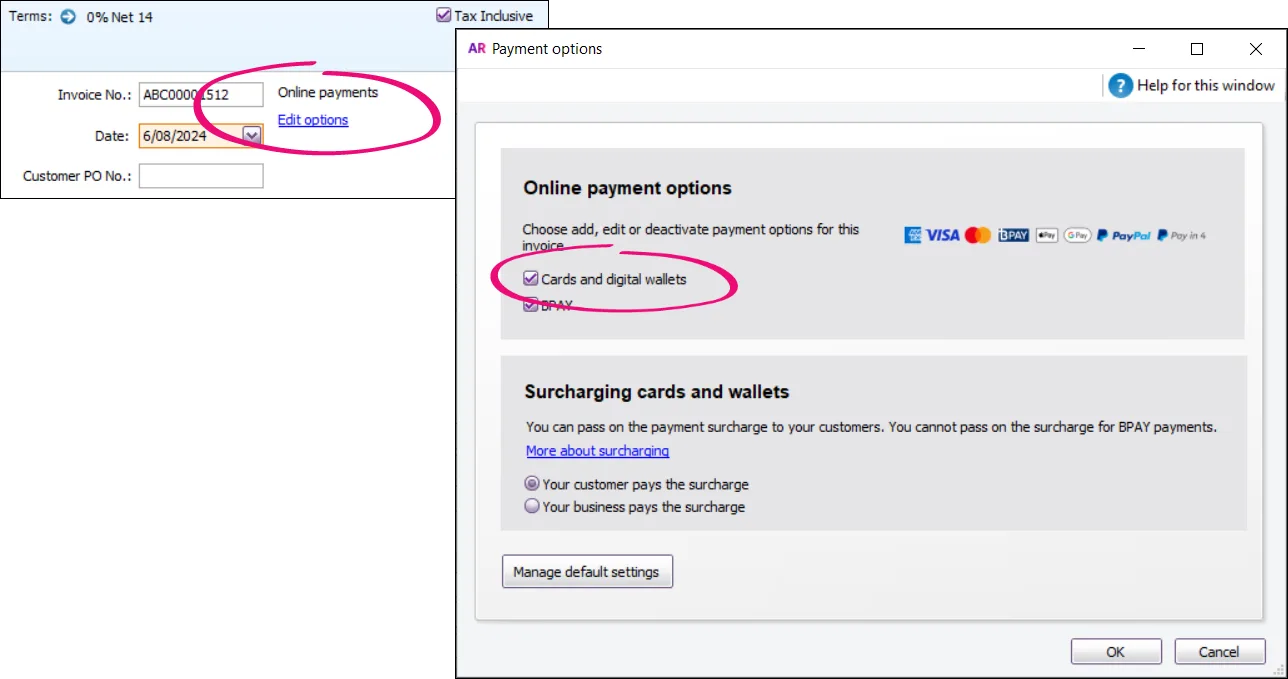

Create your invoice as you usually do. You'll see the online payment options that'll apply for that invoice.

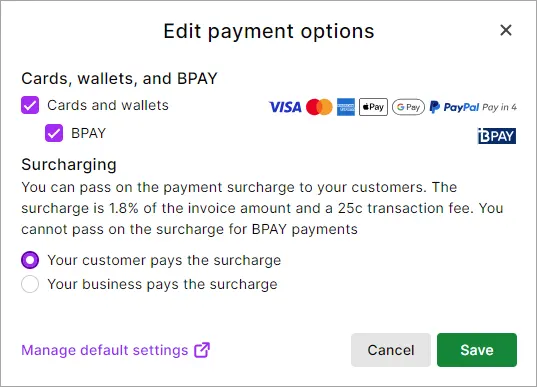

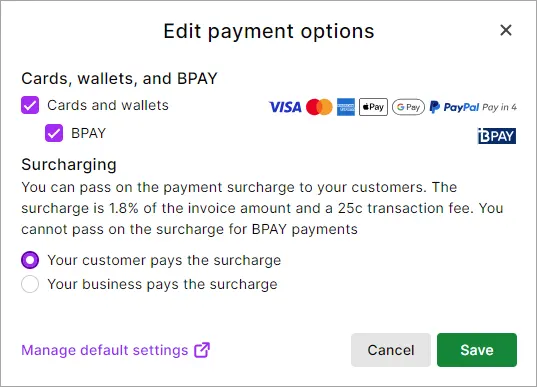

Click Edit to see the payment and surcharging options that'll apply for this invoice. Click Save if you make any changes.

For open invoices you sent before setting up online payments, you’ll need to resend the invoice – so the customer can see their online payment options.

You're not able to pass on the surcharge for BPAY payments.

Email the invoice to your customer.

You can also send an SMS notification to the customer to pay their invoice. For all the details, see Email, SMS or print, sales.

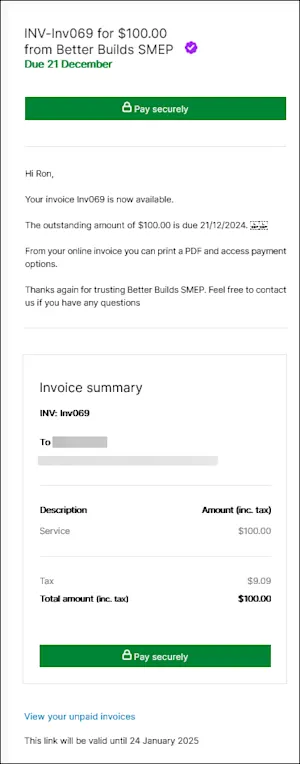

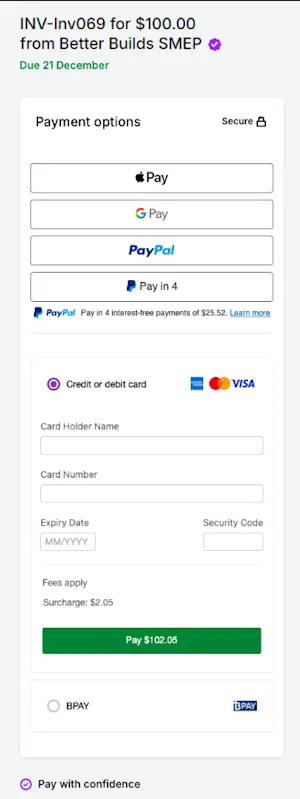

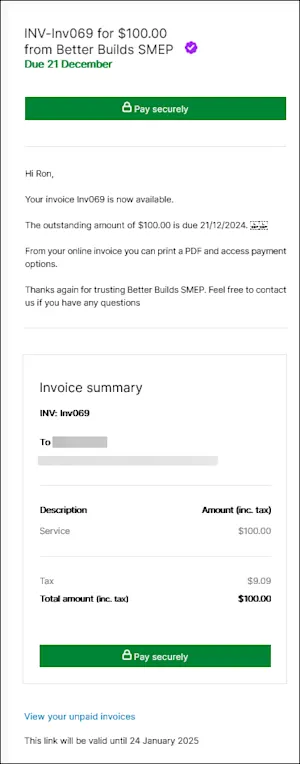

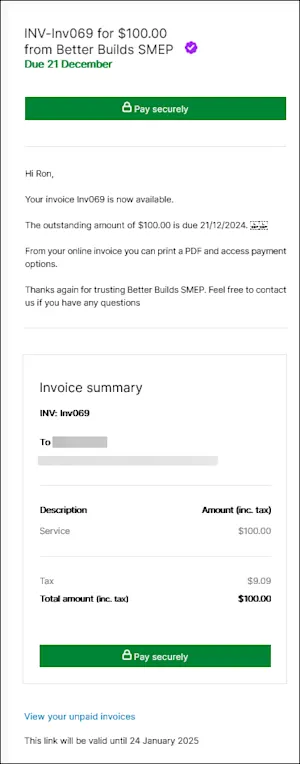

How the invoice looks to your customers

The customer receives their invoice as they normally would, but they'll now see a Pay securely button and a summary of the invoice:

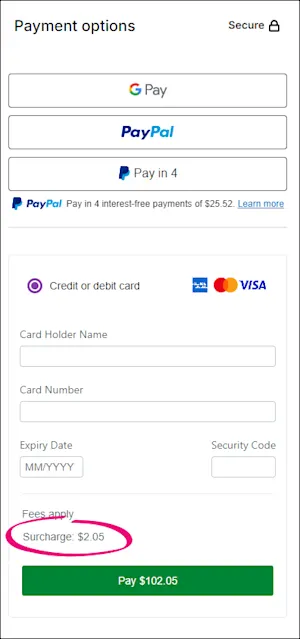

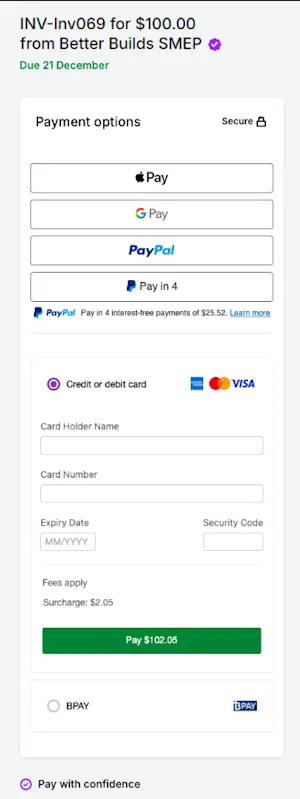

Clicking Pay securely prompts them to choose their payment method and view their payment details:

If you've chosen to exclude BPAY as a payment option, it won't appear as a payment option.

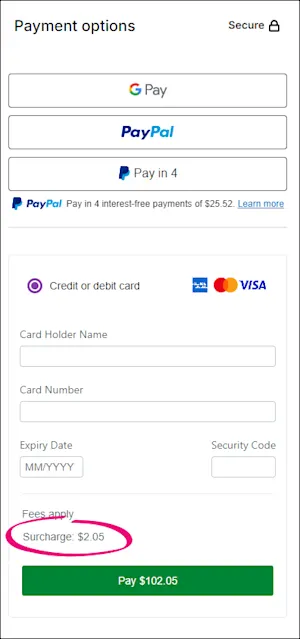

If you've chosen to pass the surcharge onto the customer for this invoice (and they're not paying by BPAY), the surcharge will be automatically applied:

Once they've entered their payment details, they click Pay Securely.

When a customer pays you

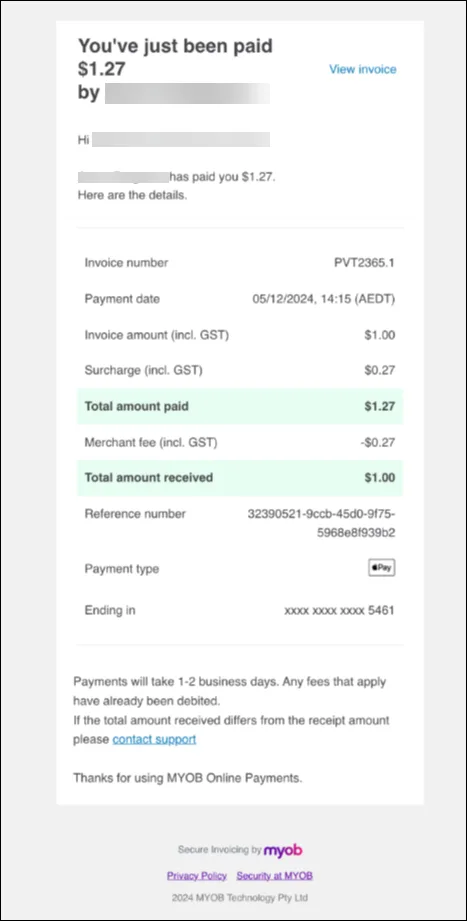

When a customer makes an online payment, the fees will be deducted from their payment and the balance will be settled into your nominated bank account.

The payment will be automatically recorded in your MYOB software and the associated invoice will be closed off. Both you and the customer will receive an email confirmation about the payment.

Learn how your MYOB software handles online payments and how to troubleshoot any issues.

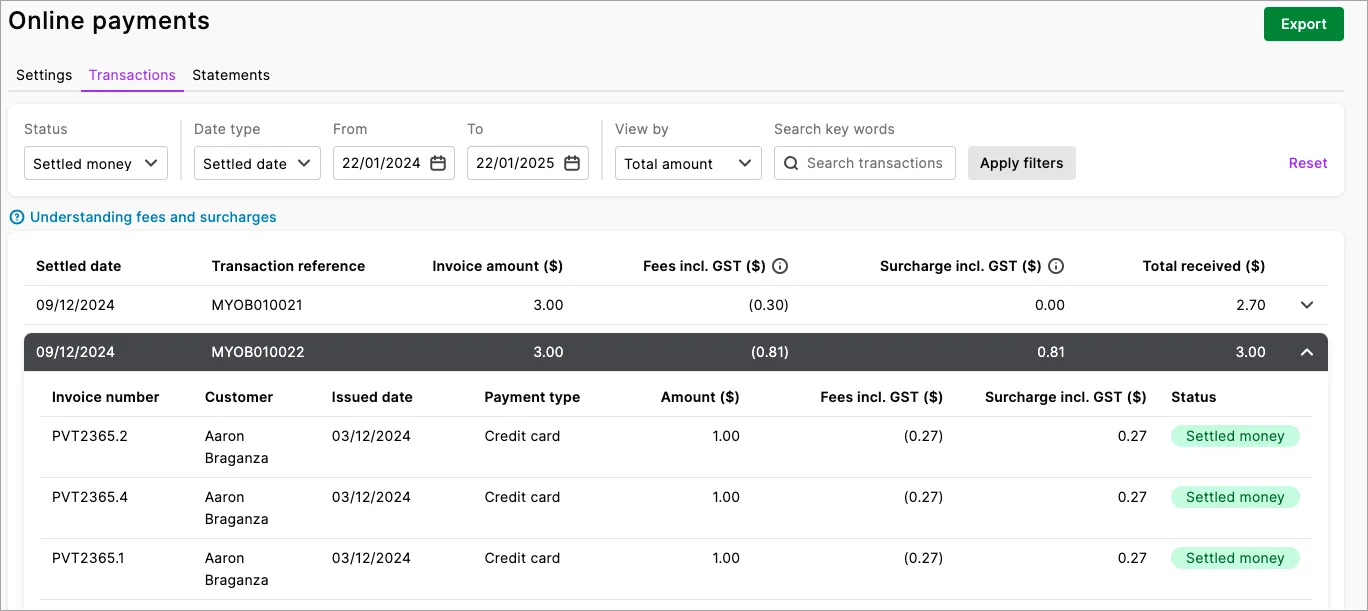

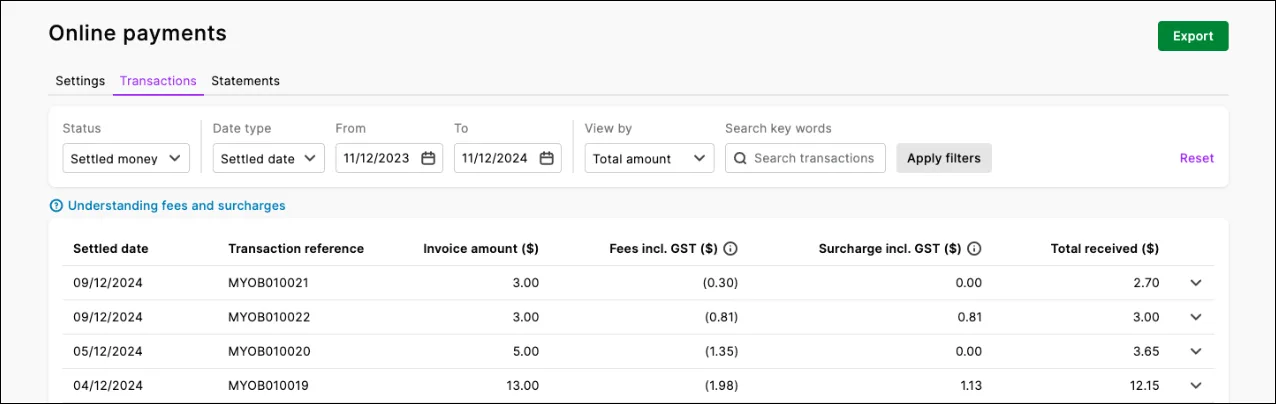

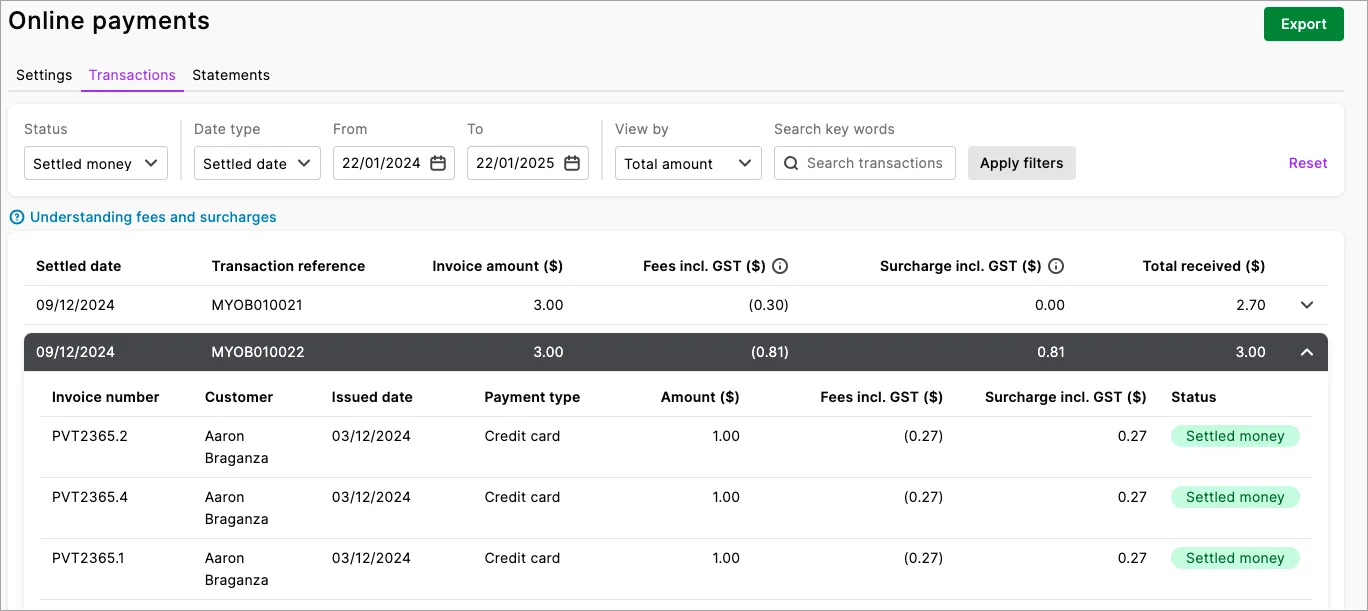

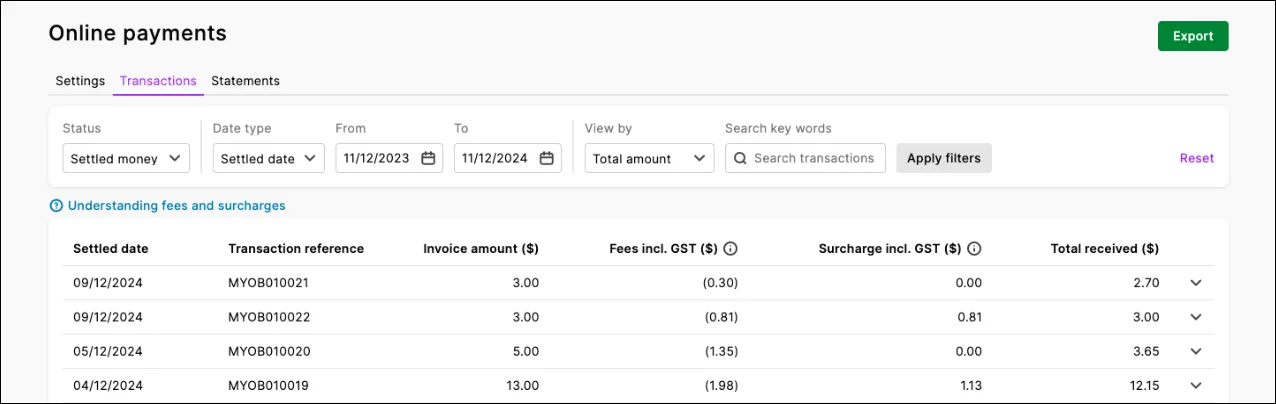

Multiple payments paid on the same day

If multiple online payments are made on the same day, they'll be grouped into a bulk deposit made up of all the customer payments, and any applicable fee transactions, disbursed on that day.

To see which invoices are included in a bulk deposit, check the online payment report.

Find the Transaction reference that corresponds to the deposit – check your bank statement or bank feed description to find this reference. You can then click the down arrow to expand that transaction to see all the payments contained in the deposit.

You'll see above that deposit MYOB010022 included 3 payments for invoices PVT2365.1, PVT2365.2 and PVT2365.4

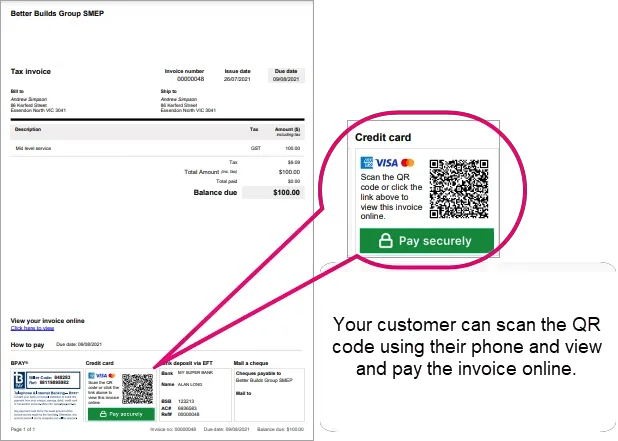

Customers can pay you online — even from a printed invoice

No matter how you invoice your customers, they'll be able to pay you online. So if you prefer to download an invoice as a PDF and email it to your customer – and you've set up online payments – they can still view and pay the invoice online. A QR code is automatically added to your invoice when you print it or export it as a PDF. When the customer scans this QR code using their phone, they can view the online invoice and easily pay it online.

Learn more about Sending an invoice link to a customer.

Google Pay is a trademark of Google LLC.

FAQs

Can I disable online payments for one invoice?

You can change the online payment and surcharging options on individual invoices by clicking Edit in the invoice.

You can then enable or disable online payments, BPAY payments and whether or not you want to pass on the surcharge to the customer (excluding BPAY payments).

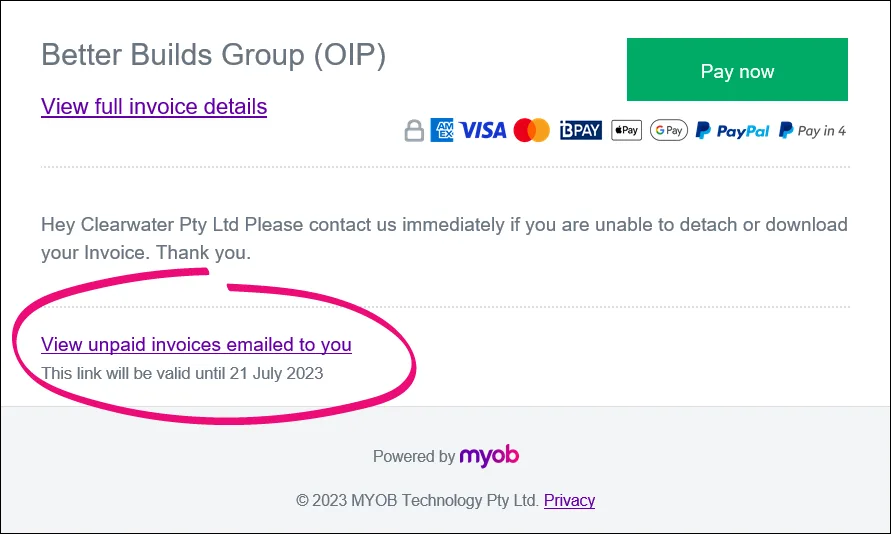

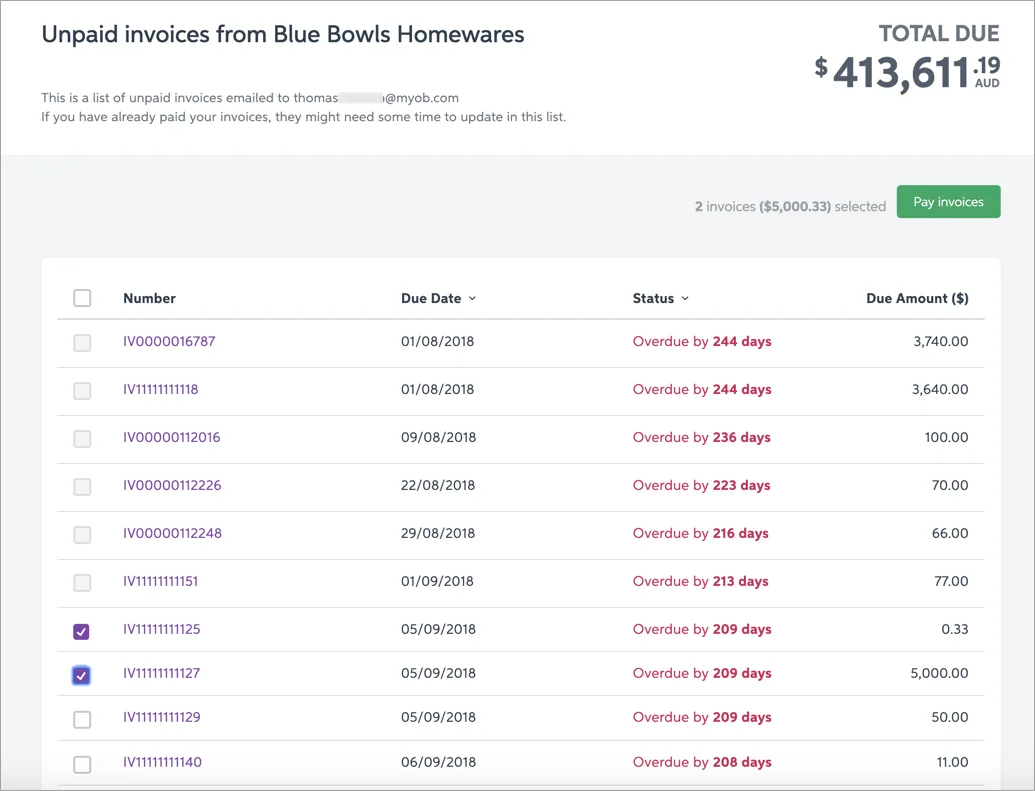

Can customers pay multiple invoices at once?

Customers can pay multiple invoices in one go through their list of unpaid invoices. All they need to do is select the invoices they wish to pay and click Pay invoices.

The total amount of invoices selected cannot exceed $99,999.

There are two ways they can access this list:

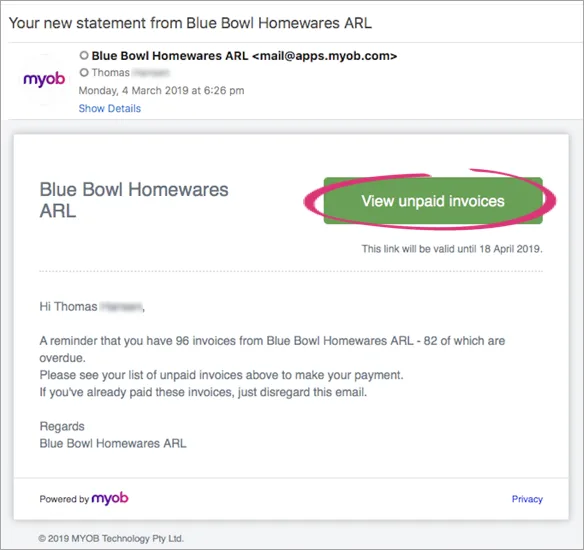

By clicking the link View unpaid invoices emailed to you at the bottom of any invoice emailed to them.

Through a reminders email.

How long does it take for a payment to appear in my bank account?

Depending on when the payment was made and the bank's processing cut off time, it can take between 1 and 2 business days for the payment to appear in your bank account.

We'll email you as soon as the customer has paid the invoice, so you'll know when you can expect the money in your bank.

The payee also receives an email confirming that they've paid.

You can also check the Transaction Details report (Reporting menu > Reports > Online invoice payments tab) – any paid transactions will have a status of Settled money:

Learn more about the Transaction details report.

How do I refund an online payment?

Refunds for online payments should only be provided to a cardholder if it's a genuine refund for a sale. The refund must be processed to the same card used in the original sale, and must be in the form of a credit and not via cash or cheque (as per the Online Payments Terms and Conditions).

To process a refund, contact our payments team by submitting a support request via My Account (log in at myaccount.myob.com and click Contact support).

Can a customer part-pay an invoice?

Unfortunately, no. Online payments only allows for full payment to be made on an online invoice – partial payments can't be made.

If you have an invoice that requires deposits or multiple payments, you should set these payments up as multiple invoices in MYOB Business and send them to the customer, so they can pay those invoices individually.

If the amount the customer will pay each time is the same, you can save yourself some effort by setting up a recurring invoice. MYOB Business will automatically create as many invoices you want according to a schedule you choose – you then just need to send each invoice to the customer. Find out more about Recurring transactions.

What if my payee requests a receipt?

When the payee pays the invoice (using the Pay securely button), they receive an email notification that they have paid. In the email, they need to click View invoice – they can then view or download the receipt.

Why are some payment options not available?

Depending on the nature of your business, some payment options may not be available due to certain eligibility criteria.

How do Online payments work in recurring invoices?

Online payment settings for recurring invoices reflect those set in the recurring invoice template. They can be different from your default payment settings.

If you’ve verified your business for online payments, online payments options will be automatically added to any recurring invoice templates. This includes recurring invoice templates created before you verified your business. By default, online payments are enabled, the customer is surcharged (so the customer pays any fees), and BPAY is turned off as a payment option.

You can turn these settings off or on in the recurring invoice template or an invoice created from the recurring template. For the details, see Recurring transactions.

PayPal FAQs

How do I make PayPal available for my customers?

Once you verify your business for Online Payments, PayPal (and PayPal Pay in 4) is automatically one of the payment options your customers have, there is nothing additional you need to do.

Will PayPal be available for all merchants?

PayPal will be available for most merchants. However, it's not available for these business and transaction types:

Non-profit

Gambling

Security Brokers/Dealers

Foreign Currency, Money Orders

Stored Value Cards

Do I need a PayPal account to accept PayPal payments?

No, you don't need a PayPal account, only your customers do.

Can I turn on customer surcharging for PayPal?

Yes, you have the option to pass on surcharging fees associated with online payments to customers paying with PayPal. You can turn on customer surcharging for an invoice or all invoices for PayPal, just as you can for any other payment method (except BPAY).

The surcharge will appear as ‘Handling’ in the payer's PayPal wallet.

Can I have Online Payments funds settled into my PayPal wallet?

No. If you have a PayPal account, you're not able to have Online Payment funds settled into it. Payments can only be settled into the settlement bank account you nominated when you verified your business for Online Payments.

Why is MYOB shown as the merchant in my payers' notification emails and PayPal account?

As MYOB is the master merchant for PayPal Online Payments, MYOB will be displayed as the merchant name in the email payment notification and viewing transactions from the PayPal account. Your trading name appears in the bank statement and in an automated email receipt the payer receives from MYOB.

Does PayPal's Pay in 4 payment option split the payouts to merchants?

No, the merchant receives the full amount upfront. Customers repay PayPal in four installments.

Online company files only

Online payments is a secure payment service that gives your customers an easier and faster way to pay you. Customers can pay online using their VISA, MasterCard, AMEX, BPAY, Apple Pay, Google PayTM or PayPal (you can choose to exclude BPAY as a payment option on your online invoices).

This lets your customers pay how they want to pay.

Why use online payments?

Get paid faster – the sooner a customer receives an invoice, the quicker they can pay you. Also, the Pay securely button in the invoice makes payment quicker and easier with multiple payment options.

Better security – online payments use several layers of protection to identify fraudulent behaviour.

More ways to get invoices in front of customers – along with emailing your invoices, choose to send an invoice link via SMS.

Easier reconciliation – online payments and fees are handled automatically so you don't need to manually record anything. Less data entry means fewer errors and more time for you to run your business.

Instant customer receipts – when a customer makes an online payment, they'll receive a confirmation email and can also view a receipt from their online invoice.

Fees and charges

There are no setup or cancellation fees with online payments, but there is a transaction fee that will apply to all payments made online.

Transaction fees: 1.8% of the invoice total + $0.25 per transaction. You can surcharge these fees to your customers, excluding BPAY. But you can choose to exclude BPAY as a payment option.

Fees are debited when the customer pays their invoice, so you'll receive the invoice value minus fees. Learn more about the fees and charges.

When you first set up online payments, surcharging is automatically enabled and BPAY payments are automatically disabled – but you can change these settings at any time.

Verify your business for online payments

It's easy to get set up with online payments – just have the following information ready to verify your business (find out why we need this information):

Make sure you have your:

-

Australian Business Number (ABN)

-

Proof of identity — have your driver's licence or passport handy

-

Bank details for the account into which your customer payments (minus fees) will be deposited

-

Estimates of total annual sales in dollars and number of online invoice transactions per month (see your Sales reports).

You can start the verification process by visiting this website, or from within MYOB by following the steps in 'Get set up' below.

We'll ask you a few simple questions so that we can verify your business and account details to make sure that your information is kept safe and secure.

Get set up

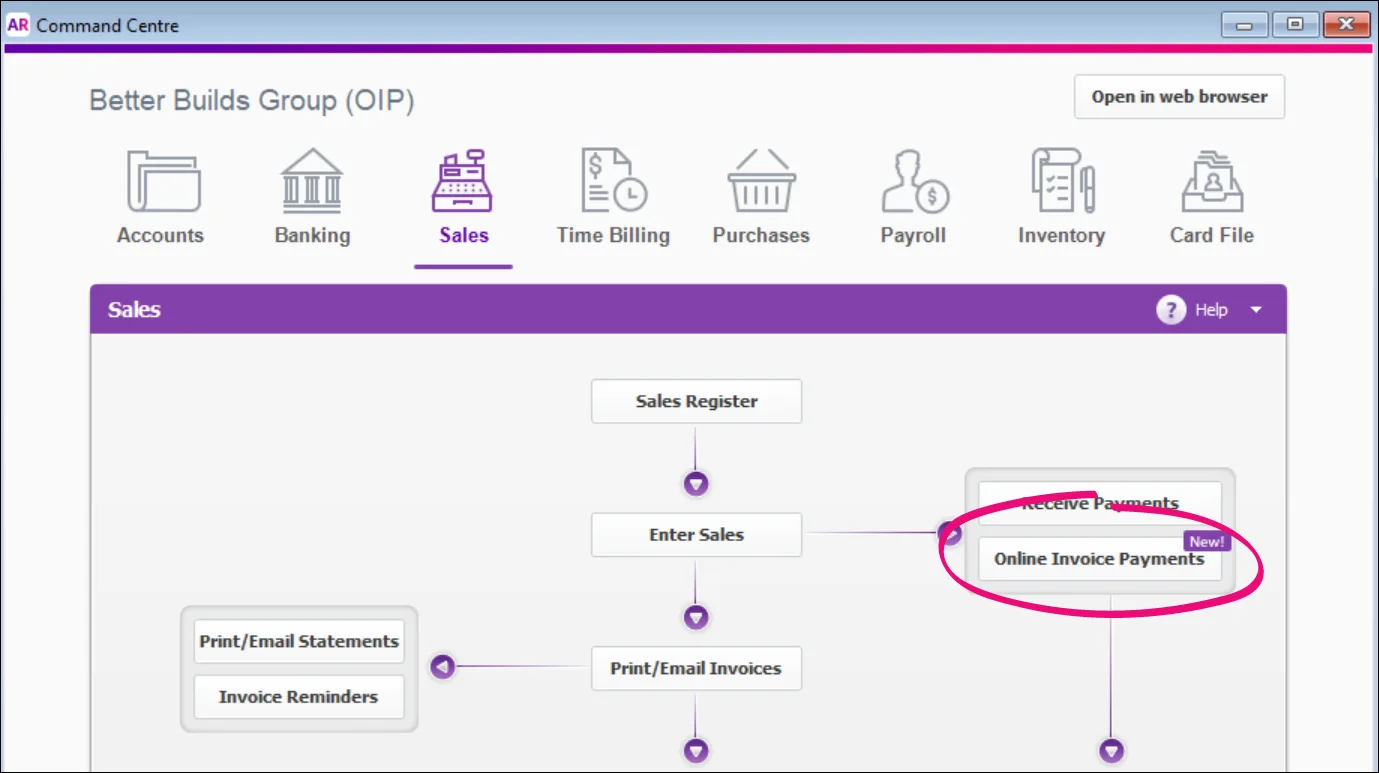

It's easy to set up online payments — you can do this when you're entering an invoice.

You can also set up online payments from the Setup menu > Preferences > Emailing tab > Get set up button.

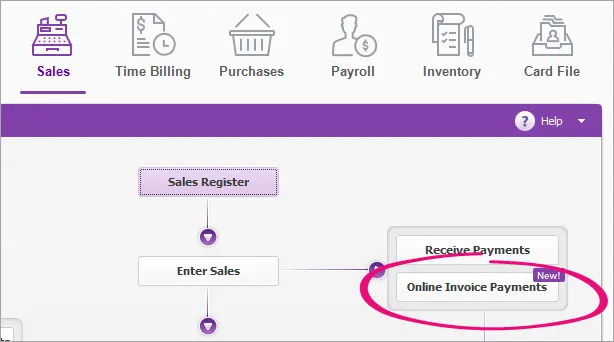

Click the the Online Invoice Payments button in the Sales command centre:

Then follow the prompts to complete the business verification:

Business details:

Confirm business details – like your ABN, business name and industry. This is to help confirm and protect the information provided.

Cashflow estimates – choose options that best estimate annual turnover by credit card, the average invoice value and the percentage of deposits taken on invoices (if your business takes deposits). If you're a new business, enter forecasts of these figures.

Bank account – confirm and authorise the settlement bank account where your customers' payments will be deposited. Choose the ledger categories in MYOB you'll use to categorise your customers' payments and associated fees. If bank feeds are linked to these categories, your customers' payments will be handled automatically in MYOB.

Business owners:

Confirm your business owners. Check the email address and mobile number of the beneficial owner(s). They’ll be contacted by email to verify their identity. If they are not listed you can add them.

Identify check. Enter details from the driver's licence or passport of one or more owners.

Supporting documents – Certain types of businesses may need to upload some business documents to verify their business, like trust deeds, business constitution and meeting minutes.

Review and confirm – check over the details you’ve entered and agree to the terms and conditions.

When you're done, click Confirm and submit.

If more information is required, we'll get in touch with you within two business days.

Verification status. Once your business is verified, you'll receive an email from us letting you know you're ready to use online payments.

What to do once your business has been verified

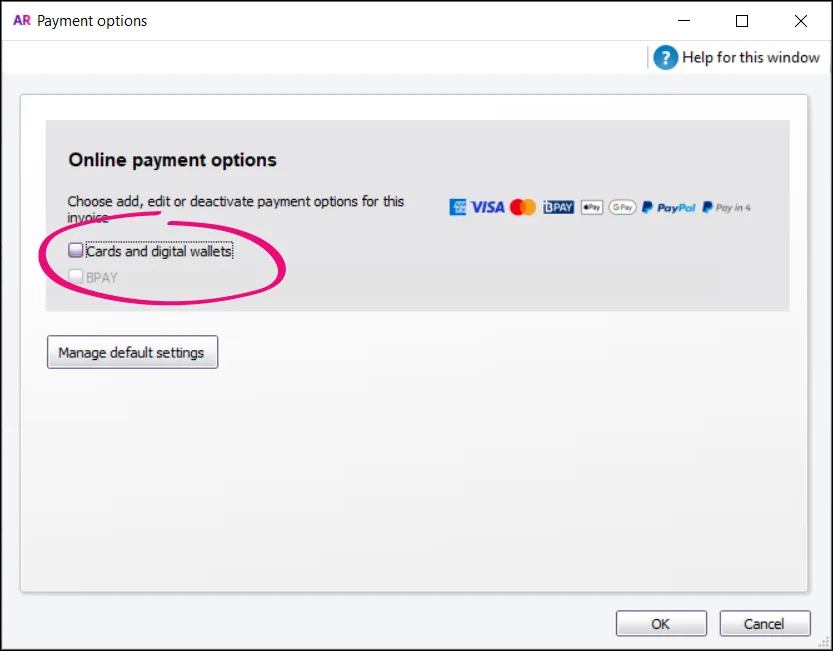

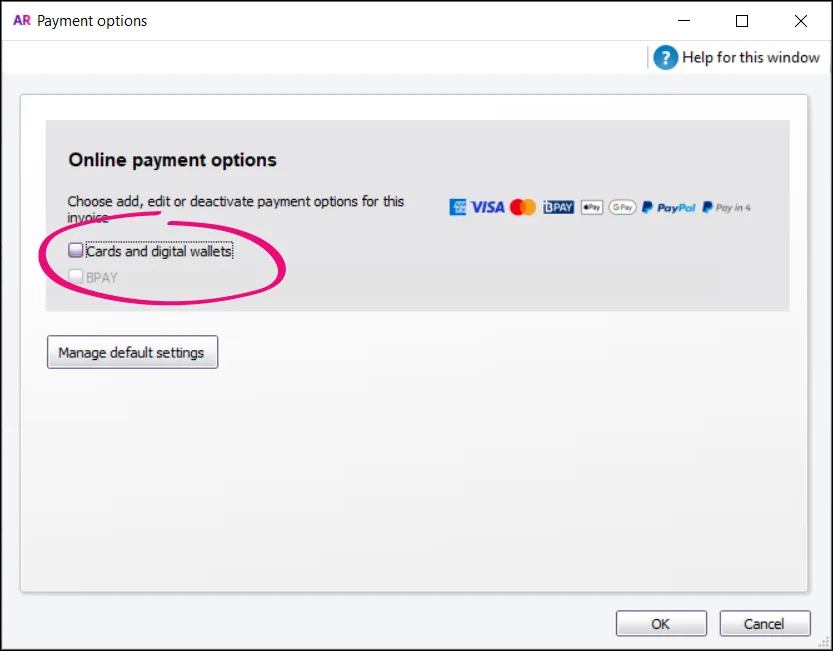

Once your your business has been verified, all new invoices will have the online payments option, Cards and digital wallets, is selected by default. You can see this when you click Edit options in an invoice:

For existing open invoices, you’ll need to resend the invoice, so the customer can see their online payment options.

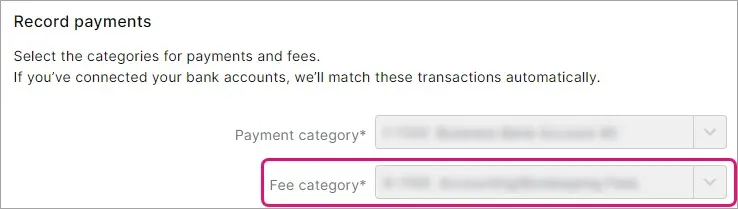

If you use bank feeds or import bank statements, you can set up AccountRight to automatically reconcile your invoice payments to your bank feed to save time on admin. To do this, you need to choose the AccountRight account to record online payments:

Go to the Sales command centre and click Online Invoice Payments to open Online payments settings in a browser.

Choose the Fee category.

If you want to pass on credit card surcharges to your customers, select the surcharging option. Learn more about Customer surcharging for online payments.

Click Save.

After you've set up online payments, you have the option to switch on online invoice payments when you import invoices. See Importing data.

Sending an invoice

You can select whether to enable online invoice payments for each individual invoice by clicking Edit options in an invoice (as seen below).

Create your invoice as you usually do. Need a refresher?

Click Edit options.

If you'd like to pass on the fees of 1.8% of the invoice value + the $0.25 transaction fee for debit and credit card payments, and you've set up customer surcharging, select the Your customer pays the surcharge option in the Payment options window.

You're not able to pass on (surcharge) fees for BPAY payments yet.

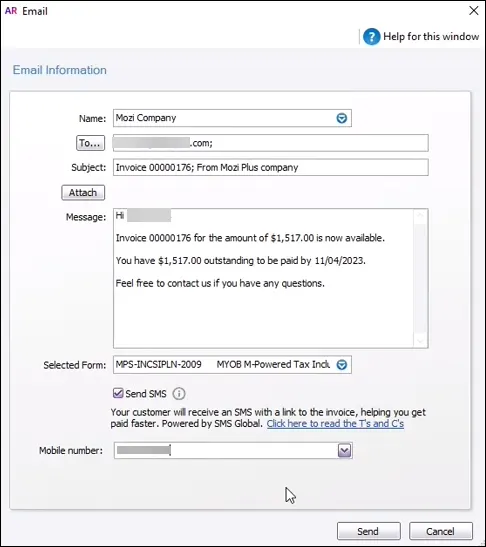

Click Send To and choose Email.

Check the details of the email and update if required.

(Optional) Click Attach to select an additional file to attach to the email.

(Optional) Click To if you have additional email addresses in a contact's card in a contact’s card which you want to use. Or type email addresses directly into the To field, separated by semi-colons (;).

(Optional) Send a link to the online invoice via an SMS message*:

SMS is only available when you email an online payments-enabled invoice using AccountRight's email service. It's not available when you email invoices via Microsoft Outlook.

Select the Send SMS option.

Choose the customer's Mobile number (if it has been entered into the customer's card), or enter a valid mobile number here.

If you key in an SMS number, it won't be added to the customer's card. You'll need to update the customer if you want to retain this number.

When you're ready, click Send.

Your customer clicks the automatically generated link that’s in the email or SMS message they receive, and their full invoice will appear online.

They can click the Pay now button to make their payment on the spot.

If you'd like to avoid paying a surcharge for a large invoice, you can remove the online payment option from that particular invoice. When creating the invoice, click Edit options, deselect the Cards and digital wallets option and click OK.

See Deactivating online payments for more information.

* SMS is provided by a third party service, SMS Global (read their Terms and Conditions). SMS is included as part of online payments – you don't need to sign up to SMS Global separately.

How the invoice looks to your customers

The customer receives their invoice as they normally would, but they'll now see a Pay securely button and a summary of the invoice:

Clicking Pay securely prompts them to choose their payment method and view their payment details:

If you've chosen to exclude BPAY as a payment option, it won't appear as a payment option.

If you've chosen to pass the surcharge onto the customer for this invoice (and they're not paying by BPAY), the surcharge will be automatically applied:

Once they've entered their payment details, they click Pay Securely.

When a customer pays you

When a customer makes an online payment, the fees will be deducted from their payment and the balance will be settled into your nominated bank account.

The payment will be automatically recorded in your MYOB software and the associated invoice will be closed off. Both you and the customer will receive an email confirmation about the payment.

Learn how your MYOB software handles online payments and how to troubleshoot any issues.

Multiple payments paid on the same day

If multiple online payments are made on the same day, they'll be grouped into a bulk deposit made up of all the customer payments, and any applicable fee transactions, disbursed on that day.

To see which invoices are included in a bulk deposit, check the online payment report.

Find the Transaction reference that corresponds to the deposit – check your bank statement or bank feed description to find this reference. You can then click the down arrow to expand that transaction to see all the payments contained in the deposit.

You'll see above that deposit MYOB010022 included 3 payments for invoices PVT2365.1, PVT2365.2 and PVT2365.4

Google Pay is a trademark of Google LLC.

FAQs

Can I disable online payments for one invoice?

Yes. In the invoice, click Edit options. In the Payment options window, deselect Cards and digital wallets and click OK.

Can customers pay multiple invoices at once?

If you send customers emails from AccountRight, they can pay multiple invoices in one go through their list of unpaid invoices. All they need to do is select the invoices they wish to pay and click the Pay invoices button below.

The total amount of invoices selected cannot exceed $99,999.

They can access the list of their unpaid invoices in a number of ways:

From invoices using online payments emailed from AccountRight, (this feature isn't yet available for those sent via Microsoft Outlook):

Through their monthly statement of unpaid invoices

Through a reminders email.

How long does it take for a payment to appear in my bank account?

Depending on when the payment was made and the bank's processing cut off time, it can take between 1 and 2 business days for the payment to appear in your bank account.

We'll email you as soon as the customer has paid the invoice, so you'll know when you can expect the money in your bank.

The payee also receives an email confirming that they've paid.

You can also check the Transaction details report:

Go to the Reports menu and choose Index to Reports.

Click the Sales tab.

In the Online invoice payments section, click View reports then click Display Report. The report displays in a web browser.

On the Reports page, click Transaction details to open the Transaction details report.

Can a customer part-pay an invoice?

Unfortunately, no. Online payments only allows for full payment to be made on an online invoice – partial payments are not able to be recorded.

If you have an invoice that requires deposits or multiple payments, you should set these payments up as multiple invoices in AccountRight and send them to the customer so they can pay those invoices individually.

If the amount the customer will pay each time is the same, you can save yourself some effort by setting up a recurring invoice. AccountRight will automatically create as many invoices you want according to a schedule you choose – you then just need to send each invoice to the customer. Find out more about Recurring transactions.

What if my payee requests a receipt?

When the payee pays the invoice (using the Pay Now button), they receive an email notification that they have paid. In the email, they need to click View invoice – they can then view or download the receipt.

Can I change the SMS message text?

No, the SMS message template is fixed and can't be changed.

Can I send an invoice SMS without sending an email?

No, an SMS message can only be sent when you send an email for an online payments-enabled invoice using AccountRight's email service (not via Microsoft Outlook).

Can I send multiple invoice SMS messages at a time?

No, you can only send SMS message for a single invoice at a time.

You can resend an email and SMS for an invoice – go to the Sales command centre > Sales Register > Open Invoices, click the number of the invoice you want to message and click Send to > Email.... Refer to the steps in 'Sending an invoice', above.

Why are some payment options not available?

Depending on the nature of your business, some online payments options may not be available due to certain eligibility criteria.

PayPal FAQs

How do I make PayPal available for my customers?

Once you verify your business for online payments, PayPal (and PayPal Pay in 4) is automatically one of the payment options your customers have, there is nothing additional you need to do.

Will PayPal be available for all merchants?

PayPal will be available for most merchants. However, it's not available for these business and transaction types:

Non-profit

Gambling

Security Brokers/Dealers

Foreign Currency, Money Orders

Stored Value Cards

Do I need a PayPal account to accept PayPal payments?

No, you don't need a PayPal account, only your customers do.

Can I turn on customer surcharging for PayPal?

Yes, you have the option to pass on surcharging fees associated with online payments to customers paying with PayPal. You can turn on customer surcharging for an invoice or all invoices for PayPal, just as you can for any other payment method (except BPAY).

The surcharge will appear as ‘Handling’ in the payer's PayPal wallet.

Can I have online payments funds settled into my PayPal wallet?

No. If you have a PayPal account, you're not able to have online payment funds settled into it. Payments can only be settled into the settlement bank account you nominated when you applied for online payments.

Why is MYOB shown as the merchant in my payers' notification emails and PayPal account?

As MYOB is the master merchant for PayPal online payments, MYOB will be displayed as the merchant name in the email payment notification and viewing transactions from the PayPal account. Your trading name appears in the bank statement and in an automated email receipt the payer receives from MYOB.

Does PayPal's Pay in 4 payment option split the payouts to merchants?

No, the merchant receives the full amount upfront. Customers repay PayPal in four installments.