Linked categories are the default categories used for various functions in MYOB. They work behind the scenes to make sure that the right categories are used consistently and correctly. This saves you from needing to choose an category every time you use a function.

There are two types of linked categories used in MYOB: feature-level and record-level linked categories.

You can change the default linked categories and turn some off. However, some feature-level categories can't be changed or turned off, even if you don't use the feature they're linked to.

There are some linked categories in MYOB for features that don't yet exist. These are identified below.

Feature-level linked categories

Feature-level linked categories are the default categories that MYOB uses for some of its main features. For example, there’s a linked category for tracking receivables (your trade debtors) and a banking category for receiving customer payments. So whenever you record a credit sale, MYOB knows which category you use to track what customers owe you, and will update it automatically. Likewise, when you receive a customer payment, the linked bank category you’ve selected will be used by default.

You can set or change feature-level linked categories by going to the Accounting menu and choosing Manage linked categories. From here you can set up the following linked categories.

Categories & Banking

Equity category for current earnings: This category helps you track your profit (or loss) for the current financial year. At the start of a new financial year the balance of this category is transferred to the equity category for retained earnings. You can’t change this category. See also Income allocation.

Equity category for retained earnings: This category helps you track the cumulative profit (or loss) of the business up to the start of the current financial year. At the start of a new financial year, the balance of the equity category for current earnings is transferred to this category. You can’t change this category. See also Income allocation.

Equity category for historical balancing: This category is used to balance your categories list and balance sheet report. As a rule, the value of your assets must equal the combined value of your liabilities and equity. If you haven’t entered all of your opening balances, or a value was entered incorrectly, a “balancing” amount will be allocated to the Historical Balancing category. Once you enter all your opening balances accurately, this category will return to zero. See also Entering opening balances.

Bank category for electronic payments: This is a clearing category that’s used to keep track of electronic payments that haven’t been processed yet. The payments are cleared from this category and withdrawn from your bank account when you pay your employees or suppliers electronically.

Bank category for undeposited funds: (feature not yet available) This is a clearing category that you use to keep track of receipts that haven’t been deposited directly to your bank account (such as cash and cheques).

Sales

Asset category for tracking receivables: This category is used to track the total amount that customers currently owe you. The balance will increase automatically when you record an invoice, and decrease when a payment is made.

Bank category for customer receipts: This is the default bank category into which customer payments are deposited. If you have more than one bank category for this purpose, select the one that will be used most. You can select a different bank category when recording the receipt.

Income category for freight: This is the category you want to use for freight you charge to customers on invoices. Amounts you enter into the Freight field on a sale will be allocated to this category.

Liability category for customer deposits: (feature not yet available) This category is used to track deposits you collect from customers when recording a sales order. If you enter an category in the Amount paid field of a sales order, the amount will be allocated to this category.

Expense or cost of sales category for discounts: This category is used to track payment discounts you give to customers when entering their payments.

Income category for late charges and surcharges: This category is used to track finance charges you collect from customers. By default this category is used for customer surcharge payments for online invoice payments.

Purchases

Liability category for tracking payables: This category is used to track the total amount you currently owe to suppliers. The balance will increase automatically when you record a bill, and decrease when you make a payment.

Bank category for paying bills: This is the default bank category from which bill payments are made to suppliers. If you have more than one bank category for this purpose, select the one that will be used the most. You can select a different bank category when recording the payment.

Liability category for item receipt: (feature not yet available) This category tracks the stock you receive from a supplier without a bill on a Receive Items transaction. This category will be cleared when you record the bill for the stock received.

Expense or cost of sales category for freight: This category is used to track freight amounts you pay to suppliers.

Asset category for supplier deposits: This category is used to track deposits you make on purchase orders. If you make a payment against a purchase order, it's considered a supplier deposit and the amount will be allocated to this category.

Expense (or Contra) category for discounts: This category is used to track payment discounts suppliers give you which you enter when making a supplier payment. Learn about Supplier discounts.

Expense category for late charges: (feature not yet available) This category is used to track finance charges you pay to suppliers.

Payroll

Choose your country to learn more about the payroll linked accounts:

I'm in Australia

Bank category for cash payments: This is the bank account from which you withdraw cash to pay employees. This includes employees you pay by manually transferring funds into their bank account (not via bank file or direct payments from MYOB). Amounts will be posted to this account when you record a pay run, based on the employees whose Payment method you've set to Cash. Alternatively, this can be a clearing account that helps you track the total cash that needs to be withdrawn from your bank account.

Bank account for cheque payments: This is the bank account from which you write cheques to pay employees. Amounts will be posted to this account when you record a pay run, based on the employees whose Payment method you've set to Cheque.

Bank account for electronic payments: This is a clearing account that’s used to keep track of electronic payments that haven’t been processed yet for your employees. Amounts will be posted to this account when you record a pay run, based on the employees whose Payment method you've set to Electronic. The payments are cleared from this account and withdrawn from your bank account when you make electronic payments. Learn more about electronic payments.

Default employer expense account: This is the default account that’s used for Employer Expense type pay items. Employer Expense pay items are used to track payments you make on behalf of your employees, eg. WorkCover Insurance. You can specify a different account when setting up the pay items.

Default wages expense account: This is the default account that’s used for Wages type pay items. Wages pay items are used to track employee wage and salary expenses. You can specify a different account when setting up the pay items.

Default tax/deductions payable account: This is the default account used for Deductions and the Tax type pay items. You can specify a different account when setting up these pay items.

I'm in New Zealand

Bank category for cash payments: Not currently used

Bank category for cheque payments: Not currently used

Bank category for electronic payments: This is a clearing category that’s used to keep track of electronic payments that haven’t been processed yet for your employees. Amounts will be posted to this category when you record a pay run for those employees who have been set up for electronic payments. The payments are cleared from this category and withdrawn from your bank account when you make electronic payments. Learn more about electronic payments.

Default wages expense category: This is the default category that’s used for earnings pay items (wages, salary and allowances). You can specify a different category when setting up your earnings.

Default KiwiSaver expense category: This is the default category that’s used for employer KiwiSaver contributions and ECST tax (expenses).

Default employer deductions payable category: This is the default category used for employee, employer and ECST for Kiwisaver to be paid to IR. This includes child support and PAYE.

Default other deductions payable category: This is the default category that’s used for any other deductions.

Record-level linked categories

Categories linked at the record level are those that you’ve selected as the default categories used for particular records, like inventory items or pay items. For example, when setting up an inventory item, you can choose a default category to use for tracking sales of that item, and a different category for tracking purchases of that item. Likewise, when setting up wage pay items, you can choose to track payments of that wage pay item by using a specific expense category.

Add new categories on-the-fly

Click the dropdown arrow for a linked category and choose Create category. Enter the new category's details and click Save. You can always go back later and edit the category details.

FAQs

How do I turn off a linked category?

Only linked categories with a checkbox can be turned on or off. To turn off one of these linked categories, deselect the checkbox.

For example, if you don't pay deposits on supplier purchase orders, you can turn off this linked category by deselecting this checkbox.

Why can’t I turn off some linked categories?

Some feature-level categories can only be changed but not turned off, even if you don't use the feature they're linked to. These linked categories are the ones without a checkbox next to them on the Linked categories page, like the Asset category for tracking receivables and the Bank category for customer receipts.

Also, if you've selected one of the optional linked categories (those that have a checkbox next to the linked category such as I charge freight on sales) and used it in a transaction (for example, you've recorded a supplier deposit on a purchase order), then you can't turn off that linked category option. This ensures that MYOB can maintain a complete audit trail.

Why can’t some linked categories be changed?

There are two feature-level linked categories that can’t be changed - The Current Year Earnings and Retained Earnings categories. These must be kept as is. If you have a partnership or trust and want to split the current or retained earnings, see Income allocation to learn how to best handle this requirement.

Why are some linked categories not shown as linked in the category list?

The categories list only indicates the linked categories are set up at the feature level. When setting up items and other records, you can specify additional linked (default) categories —see 'Record-level linked categories' above. These accounts won’t be shown as linked in the Categories (Chart of accounts) page.

Can I change a linked category at any time?

You can, but it can affect your reports, especially reconciliation reports. These reports assume the linked category has not changed during the selected reporting period, and so may not show complete information.

What are linked categories for tax paid and tax collected?

When you buy and sell, any applicable tax/GST needs to be tracked. This helps with your tax reporting obligations. This is handled in MYOB by using tax codes.

Some types of tax codes require linked categories for tracking tax collected and tax paid. The balances of these linked categories represent how much tax you have collected on sales and how much tax you have paid on purchases. These values are used when lodging your activity statements (Australia) or GST return (New Zealand).

If you're not sure which categories should be used for tracking tax collected or tax paid, check with your accounting advisor.

Linked accounts are accounts in AccountRight that are used for specific features or functions. They work behind the scenes so you don’t have to choose an account every time you record a transaction.

There are two types of linked, or default, accounts used in AccountRight: feature-level and record-level linked accounts.

You can change the default linked accounts and turn some off. However, some feature-level accounts can't be changed or turned off, even if you don't use the feature they're linked to.

Want to link your bank or credit card to AccountRight? Learn about bank feeds.

Feature-level linked accounts

Feature-level linked accounts are the default accounts that AccountRight uses for some of its main features. For example, there’s a linked account for tracking receivables (your trade debtors) and a banking account for receiving customer payments. So whenever you record a credit sale, AccountRight knows which account you use to track what customers owe you, and will update it automatically. Likewise, when you receive a customer payment, the linked bank account you’ve selected will be used by default.

You can see which accounts are linked to features by going to the Accounts List window. Linked accounts are indicated by a tick in the Linked column. You can also view or print the Linked Accounts report to see the full list of feature-based linked accounts (Reports menu > Accounts tab > Linked Accounts).

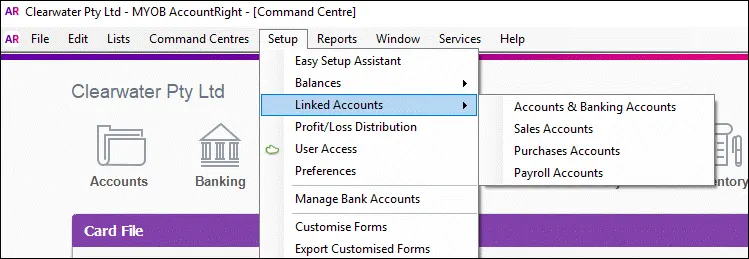

You can set or change feature-level linked accounts by going to the Setup menu > Linked Accounts. From this menu you can choose to set up the following linked accounts.

Accounts and banking linked accounts

To set your accounts and banking linked accounts, go to Setup menu > Linked Accounts > Accounts & Banking Accounts.

Equity Account for Current Earnings: This account helps you track your profit (or loss) for the current financial year. When you close the financial year, the balance of this account is transferred to the equity account for retained earnings. You can’t change this account. See also Distributing profit and loss.

Equity Account for Retained Earnings: This account helps you track the cumulative profit (or loss) of the business up to the start of the current financial year. When you close the financial year, the balance of the equity account for current earnings is transferred to this account. You can’t change this account. See also Distributing profit and loss.

Equity Account for Historical Balancing: This account is used to balance your accounts list and balance sheet report. As a rule, the value of your assets must equal the combined value of your liabilities and equity. If you haven’t entered all of your opening balances, or a value was entered incorrectly, a “balancing” amount will be allocated to the Historical Balancing account. Once you enter all your opening balances accurately, this account will return to zero. See also Entering account opening balances.

Bank Account for Electronic Payments: This is a clearing account that’s used to keep track of electronic payments that haven’t been processed yet. The payments are cleared from this account and withdrawn from your bank account when you process them using the Prepare Electronic Payments window. See also Electronic payments.

Bank Account for Undeposited Funds: This is a clearing account that you used to keep track of receipts that haven’t been deposited directly to your bank account (such as cash and cheques). The receipts will be cleared from this account and deposited to your bank account when you process them using the Prepare Bank Deposit window. See also Preparing a bank deposit.

Account for Currency Gains/Losses: If you deal in multiple currencies, fluctuations in the exchange rate between currencies can affect the value of your transactions and account. These fluctuations are referred to as unrealised gains or losses. For example, if you sell goods to a Japanese firm and you conducted the transaction in Japanese yen, any changes to the value of the yen will affect the overall profitability of the transaction. If the yen gains value against your local currency, this is a currency gain. If the yen loses value against your local currency, this is a currency loss. The linked account for currency gain/loss keeps track of these amounts. This account is referred to as your Currency Gain/Loss account. By default the linked account is set to 4-999 Currency Gain/Loss (the account created when you turn on the multi-currency preference) but you can change this account if required.

Sales linked accounts

To set your sales linked accounts, go to Setup menu > Linked Accounts > Sales Accounts.

Asset Account for Tracking Receivables: This account is used to track the total amount that customers currently owe you. The balance will increase automatically when you record an invoice, and decrease when a payment is made.

Bank Account for Customer Receipts: This is the default bank account into which customer payments are deposited. If you have more than one bank account for this purpose, select the one that will be used most. You can select a different bank account when recording the receipt.

Income Account for Freight: This is the account you want to use for freight you charge to customers on invoices. Amounts you enter into the Freight field on a sale will be allocated to this account.

Liability Account for Customer Deposits: This account is used to track deposits you collect from customers when recording a sales order. If you enter an amount in the Paid Today field of a sales order, the amount will be allocated to this account.

Expense or Cost of Sales Account for Discounts: This account is used to track early-payment discounts you give to customers when they pay their invoice in full. Early payment discount conditions are set up in the credit terms of the sale, and can also be entered in the Receive Payments window.

Income Account for Late Charges: This account is used to track finance charges you collect from customers. The late payment finance charge conditions are set up in the credit terms of the sale, and can also be entered in the Receive Payments window.

Purchase linked accounts

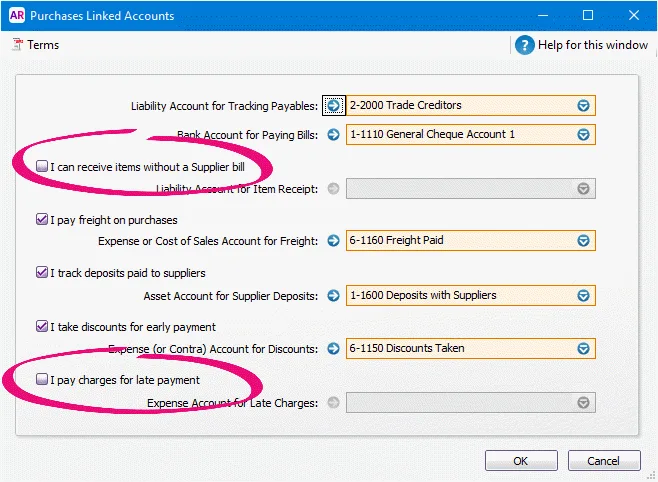

To set purchases linked accounts, go to Setup menu > Linked Accounts > Purchases Accounts.

Liability Account for Tracking Payables: This account is used to track the total amount you currently owe to suppliers. The balance will increase automatically when you record a bill, and decrease when you make a payment.

Bank Account for Paying Bills: This is the default bank account from which bill payments are made to suppliers. If you have more than one bank account for this purpose, select the one that will be used the most. You can select a different bank account when recording the payment.

Liability Account for Item Receipt: This account tracks the stock you receive from a supplier without a bill on a Receive Items transaction. This account will be cleared when you record the bill for the stock received. See also Recording items received without a supplier bill.

Expense or Cost of Sales Account for Freight: This account is used to track freight amounts you pay to suppliers. Amounts you enter into the Freight field on a purchase will be allocated to this account.

Asset Account for Supplier Deposits: This account is used to track deposits you make on purchase orders. If you enter an amount in the Paid Today field of a purchase order, the amount will be allocated to this account.

Expense (or Contra) Account for Discounts: This account is used to track early-payment discounts suppliers give you when you pay your bill in full. Early payment discount conditions are set up in the credit terms of the purchase, and can also be entered in the Pay Bills window.

Expense Account for Late Charges: This account is used to track finance charges you pay to suppliers. The late payment finance charge conditions are set up in the credit terms of the purchase, and can also be entered in the Pay Bills window.

Payroll linked accounts [Plus, Premier Australia only]

To set payroll linked accounts, go to Setup menu > Linked Accounts > Payroll Accounts.

Bank Account for Cash Payments: This is the bank account from which you withdraw cash to pay employees. This includes employees you pay by manually transferring funds into their bank account (not via bank file or direct payments from AccountRight). Amounts will be posted to this account when you record a pay run, based on the employees whose Payment Method you've set to Cash. Alternatively, this can be a clearing account that helps you track the total cash that needs to be withdrawn from your bank account. See also Process cash, cheque and electronic pays.

Bank Account for Cheque Payments: This is the bank account from which you write cheques to pay employees. Amounts will be posted to this account when you record a pay run, based on the employees whose Payment Method you've set to Cheque.

Bank Account for Electronic Payments: This is a clearing account that’s used to keep track of electronic payments that haven’t been processed yet for your employees. Amounts will be posted to this account when you record a pay run, based on the employees whose Payment Method you've set to Electronic. The payments are cleared from this account and withdrawn from your bank account when you process them using the Prepare Electronic Payments window. Learn more about Electronic payments.

Default Employer Expense Account: This is the default account that’s used for Employer Expense type payroll categories. Employer Expense categories are used to track payments you make on behalf of your employees, eg. WorkCover Insurance. You can specify a different account when setting up the payroll categories. See also Payroll categories.

Default Wages Expense Account: This is the default account that’s used for Wages type payroll categories. Wages categories are used to track employee wage and salary expenses. You can specify a different account when setting up the payroll categories. See also Payroll categories.

Default Tax/Deductions Payable Account: This is the default account used for Deductions and the Tax type payroll categories. You can specify a different account when setting up the payroll categories. See also Payroll categories.

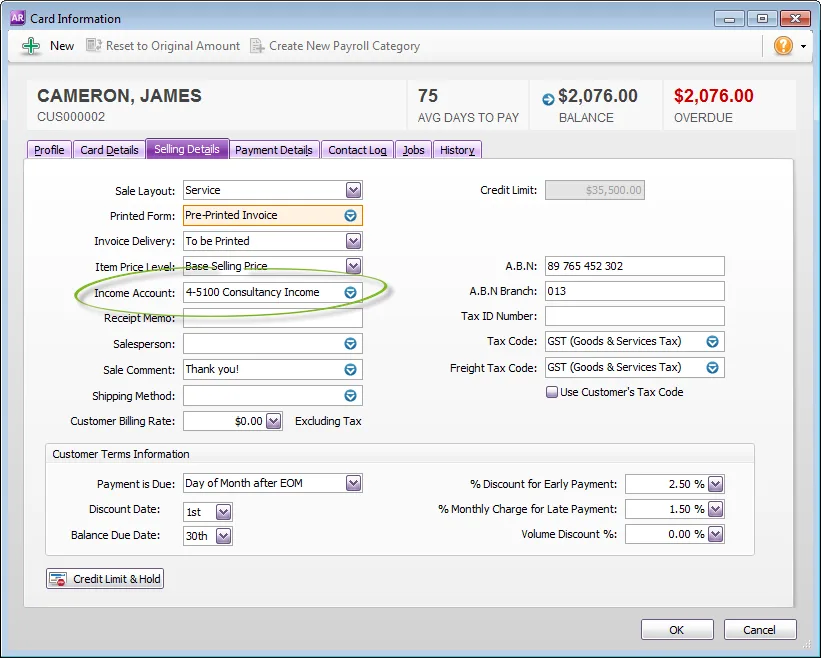

Record-level linked accounts

Accounts linked at the record level are those that you’ve selected as the default accounts used for particular cards, items, tax codes, payroll categories, and other records. For example, when setting up a customer card, you can select a default income account to use when creating a sale for them. That account is now linked to the card.

Linked account FAQs

How do I turn off a linked account?

To turn off a linked account, deselect the option for that linked account. Here's an example where 2 linked accounts have been turned off.

Why can’t some linked accounts be changed?

There are two feature-level linked accounts that can’t be changed - The Current Earnings and Retained Earnings accounts. These must be kept as is. If you have a partnership or trust and want to split the current or retained earnings, see Distributing profit and loss to learn how to best handle this requirement.

Why are some linked accounts not shown as linked in the Accounts List?

The Accounts List only indicates the linked accounts that are set up at the feature level. When setting up items, cards and other records, you can specify additional linked (default) accounts—see 'Record-level linked accounts' above. These accounts won’t be shown as linked in the Accounts List window.

Can I change a linked account at any time?

You can, but it can affect your reports, especially reconciliation reports, like the Receivables Reconciliation, Payables Reconciliation and Inventory Reconciliation reports. These reports assume the linked account has not changed during the selected reporting period, and so may not show complete information.

What are linked accounts for tax paid and tax collected?

When you buy and sell, any applicable tax/GST needs to be tracked. This helps with your tax/GST reporting obligations. This is handled in AccountRight by using Tax/GST codes.

Some types of tax codes (Australia) or GST codes (New Zealand) require linked accounts for tracking tax collected and tax paid. The balances of these linked accounts represent how much tax/GST you have collected on sales and how much tax/GST you have paid on purchases. These values are used when lodging your activity statements (Australia) or your GST returns (New Zealand).

If you're not sure which accounts should be used for tracking tax/GST collected or tax/GST paid, check with your accounting advisor.