Categories provide a means for grouping similar transactions. For example, if your business pays rent for the use of its premises, you would create a rent expense category and then allocate all rent payments to it.

Some categories can be linked to specific system features and transactions. We call these linked categories and they save you time by not having to select the category each time you need to use it. Learn more about linked categories. If you're just getting started, find out how to import categories into MYOB.

Accessing your categories

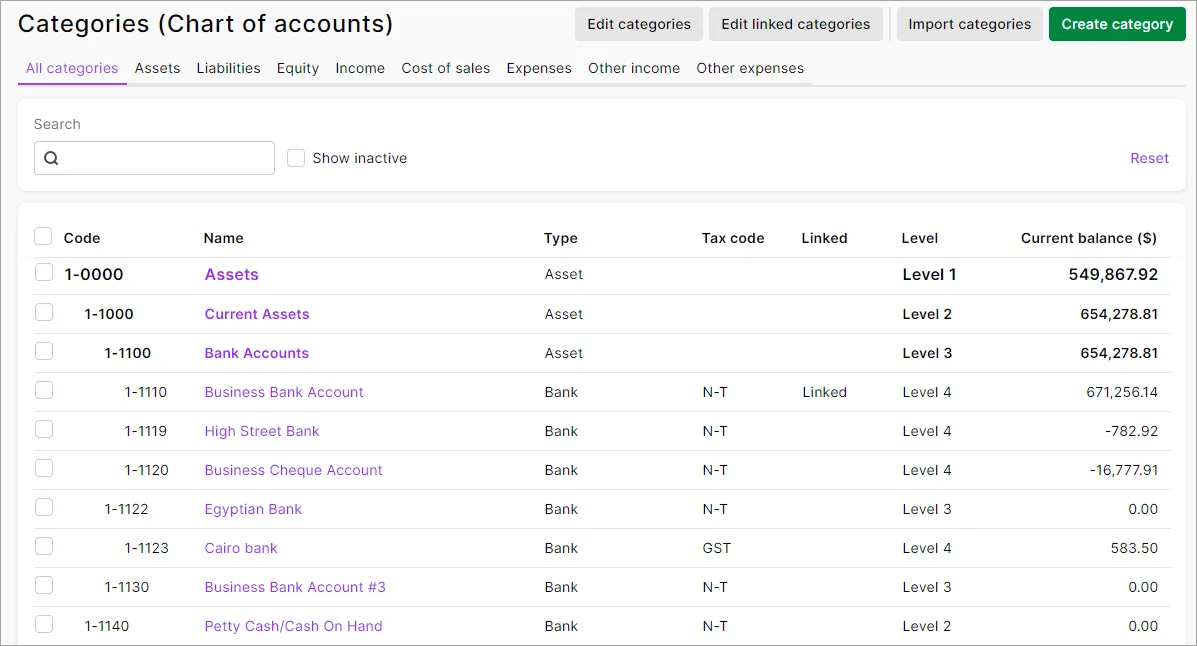

You can see all the categories that are already set up for you by going to the Accounting menu and choosing Categories (Chart of accounts).

MYOB may already have the catgories you need. If not, learn how to add, edit and delete categories.

If you're unsure, ask your accountant which categories you'll need (you can invite them to access your MYOB business - see Invite your accountant or bookkeeper).

Need to print or export your categories?

Try the Categories list report (Reporting menu > Reports > Categories list).

Header and detail categories

Your categories list consists of:

detail categories—sometimes called sub-categories, these are the categories to which you allocate transactions.

header categories—these categories group related detail categories to help you organise your categories list.

For example, you could group your telephone, electricity and gas expenses using a Utilities header category. This makes it easier for you to locate the utility expense categories in the categories list and to see your combined utility expenses.

You group categories by indenting the detail categories located directly below a header category. For more information, see Adding, editing and deleting categories.

Note that:

-

You cannot allocate transactions to a header category.

-

The balance of a header category is the sum of the detail categories indented directly below it.

-

You can have up to three header category levels.

-

How you group your categories can affect how totals and subtotals are calculated on reports.

-

Top level header categories, such as 2-0000, cannot be edited.

Code numbers

Each category is identified by a unique five-digit code number. The first digit indicates the category's classification (for example, categories starting with 1 are asset categories). The remaining four digits determine its location within the classification. The lower the number, the higher up in the list it appears. For example, account 1-1100 appears above 1-1200.

Category classifications and types

The Categories (Chart of accounts) list groups categories into eight classifications—Asset, Liability, Equity, Income, Cost of Sales, Expense, Other Income and Other Expense. Within each category classification there is at least one type.

Category classifications and types are described in the following table.

Classification | Type | Description |

|---|---|---|

Asset | Bank | Money in the bank, for example, in a cheque or savings account. |

Accounts Receivable | Money owed to you by your customers. | |

Other Current Asset | Assets that, if required, can be turned into cash within a year. These may include your term deposits. | |

Fixed Asset | Assets which have a long life, for example, buildings, cars and computers. Fixed assets are usually depreciated. | |

Other Asset | Other assets you own such as loans made to others and goodwill. | |

Liability | Credit Card | Repayments required to service credit card debt. |

Accounts Payable | Money owed by you to your suppliers. | |

Other Current Liability | Money owed by you that is due in less than a year, for example, GST. | |

Long Term Liability | Money owed by you that is due in more than one year, for example, a business loan. | |

Other Liability | Other money you owe. | |

Equity | Equity | The business’s net worth, that is, its assets minus its liabilities. Common equity accounts are current year earnings, retained earnings and shareholders’ equity. |

Income | Income | Revenue from the sale of goods and services. |

Cost of Sales | Cost of Sales | The direct cost of selling your goods and providing services, for example, purchase costs and freight charges. |

Expense | Expense | The day-to-day expenses of running your business, for example, utility bills, employee wages and cleaning. |

Other Income | Other Income | Other revenues, for example, interest earned on savings and dividends paid from shares. |

Other Expense | Other Expense | Other expenses, for example, interest charged. |

Bank account types

For a bank account, indicate what the account is used for. Is it for savings, day-to-day purchases, overdrafts, loans, or a holding account?

Choose an appropriate option from the list in the Bank account type field.

The Bank account type field only appears if you've chosen Bank in the Category type field.

Bank account type | Description |

|---|---|

Savings account | Used for setting money aside away from day-to-day spending and generally earns a higher interest rate. For example, term deposits or cash management accounts. |

Everyday account | Main account for day-to-day deposits and withdrawals. For example, the main trading account, or the main transactional account. |

Overdraft account | An account that allows you to overdraw your money by an agreed amount (similar to a loan). It can change from having a positive balance when there's cash on hand to a negative balance when you owe the bank money. |

Foreign account | An account that's based outside of Australia or uses a foreign currency. |

Third party account | An account managed by another party, like Paypal, Shopify, or Afterpay. |

Clearing account | Used for temporarily holding transactions until they can be permanently allocated to another category, for example, electronic payments, employee payments or POS transactions. |

Cash on hand | Cash that is available for immediate use and isn't held by a financial institution, like petty cash, or cash takings. |

FAQs

What is the 'GST Balance' category?

The GST collected and paid on sales and purchases are sometimes tracked using default GST Paid and GST Collected categories.

But if your categories list has a single GST Balance category instead, this ensures that the net GST amount on your BAS matches the net amount in the ledger. You can also set this category as your GST clearing category under your Report settings.

Why a single category ?

Benefits include:

The ledger records net GST by transaction regardless of the account type selected. A GST Balance category in the ledger prevents a mismatch between how GST is allocated in the ledger compared to the BAS allocations.

It saves time when allocating BAS payments as the payment doesn't need to be split between GST collected and paid.

Accountants love it because they often combine GST collected and paid categories when preparing financial statements.

Gross and GST amounts can be viewed on the General ledger report, and the GST reports also can show Category Name and Code with sorting options.

Accounts are now called categories

Accounts, which you use in MYOB Business to group similar transactions, are now called categories. We've made this change because we know that categories is a more familiar word for this type of function. It also helps to distinguish bank and credit card accounts in the real world, from how you 'categorise' transactions in MYOB.

The Chart of accounts page is now Categories (Chart of accounts):

Categories work exactly the same as accounts

Apart from their new name, categories are exactly the same as accounts. They're grouped exactly as they were previously. You're still be able to create, edit, delete and import them, assign them to transactions and view them in reports.

With the change of accounts to categories, the Categories feature in the AccountRight desktop app has been renamed to Cost Centres.

The accounts list could be set up to provide a basic overview of your business’s overall performance. For example, a car dealership might set up their accounts to distinguish new and used car sales, from service and parts income.

If you're accessing your AccountRight company file in a web browser, accounts are called categories.

The following income accounts could be used:

4-0000 Income | [Header] |

4-1000 Car Sales | [Header] |

4-1010 New Car Sales | [Detail] |

4-1020 Pre-owned Car Sales | [Detail] |

4-2000 Service and Parts Income | [Header] |

4-2010 Service Income | [Detail] |

4-2020 Parts Income | [Detail] |

4-2030 Accessories Income | [Detail] |

When entering a transaction, the transaction amount is allocated to an appropriate account. A standard profit and loss statement can then be printed for the business to show income and expenses generated by the business.

Take a look at this quick overview of accounts:

Setting up accounts

You can set up your accounts using the Easy Setup Assistant or in the Accounts command centre (see Set up accounts).

To print or export your accounts list

Run the Accounts List (Detail) report (Reports menu > Index to Reports > Accounts). You can then print or email or export the report.

Deleting or deactivating accounts

Have an account you no longer need? If it hasn't been used, you can delete the account. Otherwise you can make the account inactive.

Inactive accounts have a shaded zoom arrow in your accounts list, like this example:

Editing accounts

You can edit some account information in detail accounts, for example, the Account Name, Account Number, Description and Banking details.

You can't edit the Account Type if you have cheques or deposits recorded against the account. You're also not able to edit the Account Type and Account Number of top level header accounts.

You can edit the account numbers of detail accounts to change the order they appear in. Each account is identified by a unique five-digit number. The first digit indicates the account’s classification (for example, accounts starting with 1 are asset accounts). The remaining four digits determine its location within the classification. The lower the number, the higher up in the list it appears. For example, account 1-1100 appears above 1-1200.