Practice Compliance makes preparing, lodging, and tracking activity statements easier, and we’ve built in new capabilities to ensure you can get it all done quickly and with no fuss.

Click Compliance in the top menu bar to access all tax features.

What are the benefits?

We'll automatically create the activity statement from the Activity statement lodgment report (ASLR) and ATO data is pre-filled when you access the statement.

Import GST return report from MYOB Business and AccountRight files helping you connect with your clients.

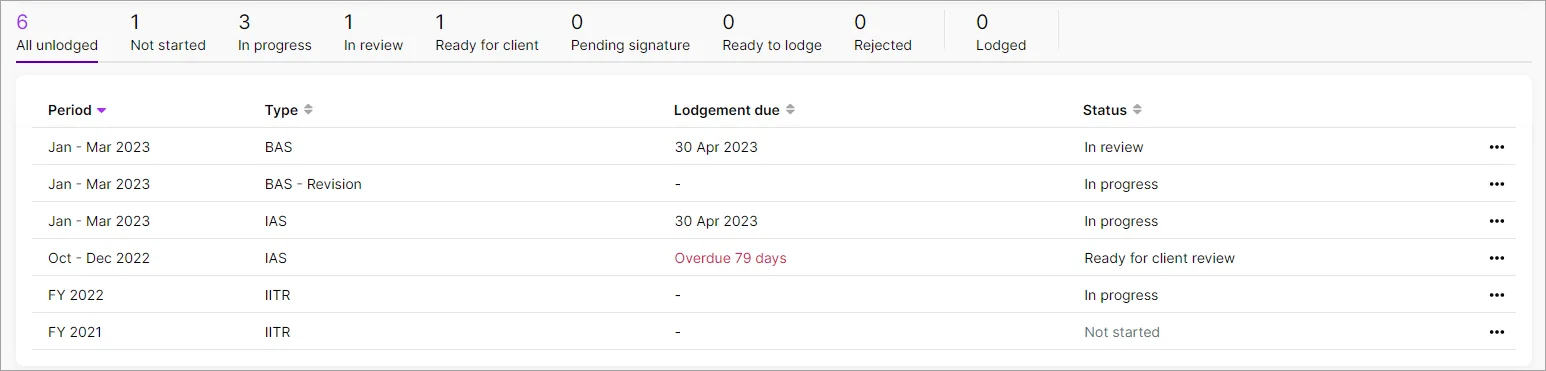

Use status and filter options, so you can easily find forms and closely track the progress of activity statements.

Assign different lodging agents to your clients.

Get your client to digitally approve and sign.

Bulk lodge activity statements.

Watch this video to see an overview of activity statements in Practice Compliance.

A faster way to get client approval with digital signature

With Practice Compliance, you can get clients to sign their return electronically for activity statements before you lodge it with the ATO. That saves you from having to download, email or print and send the form. You’ll be notified as soon as they approve or reject the form.

To enable this feature for a client, make sure you’ve set up a portal for them before you prepare their return. Then you can send the form to their portal as part of the form preparation process, and they’ll get an email requesting approval.

Let's get started

To get started with activity statements, set up your ATO agent, add and complete your activity statement, and lodge to the ATO.

Start your activity statement journey by adding an ATO agent and assigning an agent to the client.

You need to do this step only once.

Add your activity statements, complete and lodge them.

When you add your activity statement, we'll check for any outstanding activity statement obligations with the ATO and pre-fill with the details. You can save time by importing GST or PAYGW data from a MYOB Business or AccountRight ledger.

Find all your activity statements on the Compliance page.

Make sure that you've entered an Organisation name in AE/AO. This is a pre-requisite for the activity statement to be created from the Activity statement lodgment report from the ATO.