-

This page lists improvements made to Practice Compliance in previous years.

-

For improvements made to Practice Compliance in the current year, see What's new in MYOB Practice Compliance.

-

For tax issues, see also the known issues page.

Can't see these features in Practice Compliance? Clear your browser's cache and refresh the Practice Compliance tab. If you still can't see it, your practice may not have access to that feature.

2024 improvements

Activity statements and tax

Quick access to payable (refundable) amounts

18 December

The Compliance list now has a Payable/(refundable) column. This lets you quickly review the amounts without opening individual tax returns.

This column shows amounts for returns that meet the following conditions:

Return types other than PTR and TRT.

Status of Ready for client review. If the status changes back to In progress, the amounts won’t be shown until the return is no longer in progress.

Newly created returns for the 2023 tax year onwards. In 2025, we’ll make these columns available for existing returns for the 2023 tax year.

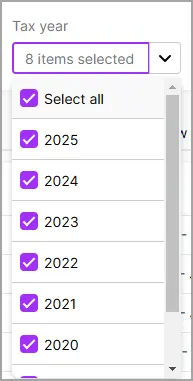

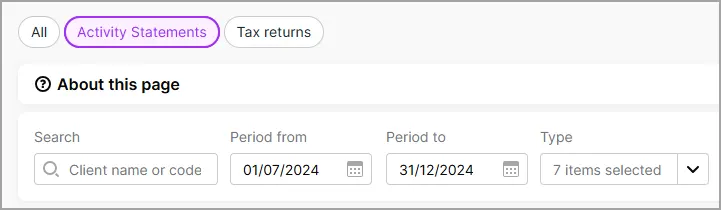

Tax Year and Type filters

2 Dec

Use the Tax Year and Type filters to select multiple years and return types to find tax returns quickly.

Filter by activity statements or tax returns, and view the lodgment periods making it simple to identify the forms that need your attention and require lodgment. Keep track of your activity statements by filtering for different periods.

We've also added a tax payable/refundable column so you know the taxable position of your client

New features

Company, Trust and Partnership tax returns are now available online!

26 Nov

We've released Company, Trust and Partnership tax returns in MYOB Practice. You can now easily share data between tax returns, and keep all your tax returns in one place.

If you use MYOB AE/AO, you can prepare and lodge Company, Trust and Partnership tax returns in MYOB Practice Tax. Learn more.

International Dealings schedule

8 Nov

The International Dealings Schedule (IDS) is now available for company, trust and partnership returns in 2023 and 2024 returns. Learn more.

Validation error improvements (Company and Partnership returns)

25 Nov

If you use Company or Partnership returns in MYOB Practice, you'll see improvements when validating the returns. This makes sure the information you're entering is accurate and helps you avoid ATO rejections.

See errors as you type

As you complete certain fields, we'll check for any errors and show a red message below the field so you can fix it straight away.Go directly to the source of the error

For validation errors, click the error message to go directly to the field that needs attention. This means you can find and fix errors quickly without searching.

Improved columns and filters

6 Nov

View the lodgment periods and form types to help you identify the forms that need attention and must be lodged.

Error indicator on the tax return navigation bar to easily locate the error

31 October

The tax return navigation bar will show an indicator highlighting any validation errors linked to items. This will help you find where the error happened more easily.

You'll see red error or yellow warning indicators after you've validated the tax return. The indicators will show in the main label, sub-labels and any schedules or worksheets.

Only the most common errors will be indicated on the navigation bar and won't include error details. The full list of errors will be displayed on the top of the tax return as usual.

More tax returns let you add associations from existing data (EAP only)

21 October

In addition to spouse details in individual tax returns, you can now also add association details in 2024 tax returns onwards for:

beneficiaries in trust returns

partners in partnership returns

investors (shareholders) in company returns.

Investors will no longer be rolled over from MYOB AE/AO for a dividend and interest schedule when migrating a company tax return. The Dividend income schedule and Interest income schedule aren’t affected.

Integrate the depreciating assets from Assets to an individual tax return

18 October

Keep all the asset information in one place and integrate them into different worksheets/schedules in a tax return.

Check out the new tax depreciation worksheet to allocate the amounts to the necessary schedules and worksheet fields.

New and improved tax estimate

23 October

We've improved the tax estimate by organising the information for better clarity. This new layout will highlight key information such as tax payable/refundable. This is part of the continued improvements to MYOB Practice. The latest enhancements include:

Improved visual hierarchy of information and visibility of key amounts.

Better layout and readability, such as updated fonts and fresh text styles, such as bold, underlines, and shading, and a new look for the header and footer.

No more overdue messages on Non lodgable status in the Activity statement list

4 October

Any activity statement with a non-lodgable status will now show on the lodged list after the due date has passed. You'll no longer see the overdue message in the lodgement due column for any obligation past the due date. This will avoid any confusion for any outstanding obligation that may not be required.

Tax return opens in a new tab

4 October

You can now right-click on the Compliance type in the Client workspace or Compliance page and choose Open in a new tab. This feature allows you to easily switch between windows while working on a tax return, helping you stay focused.

Improvements to validation errors in Trust return schedules

3 October

Following our improvements to validation errors in trust returns, we've extended this to rental, capital gains, losses, and trust income schedules within the trust return. You can now see errors as you type and go directly to the source of the error on these schedules.

29 September - New status date field in compliance

On the Compliance page, we've created a new Status date column. You can sort the returns using this field and keep the progress of your returns.

3 September - Validation error improvements (Trust return)

If you use trust return in MYOB Practice, you'll see improvements when validating the return. This makes sure the information you're entering is accurate and helps you avoid ATO rejections.

See errors as you type

As you complete certain fields, we'll check for any errors and show a red message below the field so you can fix it straight away.Go directly to the source of the error

For any validation errors, just click the error message to go directly to the field that needs attention. This means you can find and fix errors quickly without searching.

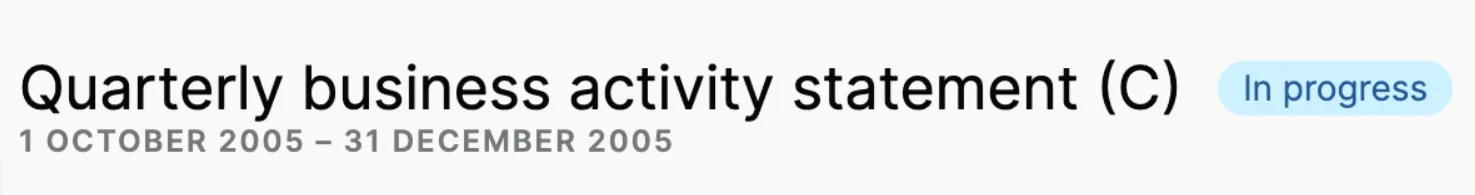

1 September - Displaying activity statement form types and period

When you open the activity statement, you will see the form name, type, and period on top of the form. This includes revisions.

This will make it easier and simplify the process of identifying the obligations that you need to prepare and lodge for your client.

27 August - Sharing income from trust and partnership returns to other non-individual returns

You can now distribute income from a trust or partnership return to the Company, Trust and Partnership entities. This will reduce manual data entry into the income labels and you can avoid potential errors.

1 August – Tax return printing enhancements

We've changed the order of pages when printing the tax return. This will make it easy to look at the important information such as estimates and ELD to get your client's signature.

The printing order now is as follows:

Tax estimate

Electronic Lodgement Declaration

Tax return

Schedules and workpapers.

(Previously the estimate was printed at the end of the tax return, before the schedules and workpapers)

10 July - Small business instant asset write-off increase

The threshold to increase the Small business instant asset write-off to $20,000 is now law. We’ve updated the threshold amount in the software. Read more about the Small business energy incentive in the 2024 tax compliance changes page.

27 June

Tax compliance for 2024 is here!

You've got all the latest updates you need for the new tax year, including changes to:Rate changes

Trust income schedule

Small business energy incentive

Government benefit certainty indicator

Digital games tax offset

For individual tax returns from 2024 onwards, if spouse details are required, the relevant fields will have 0 by default to help avoid potential filing rejections for blank fields.

We’ve also updated individual tax returns to let you easily add spouse association details using existing data.

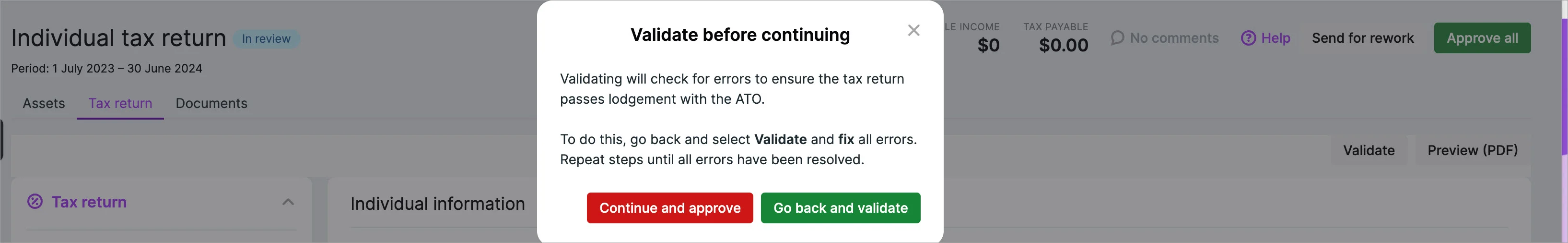

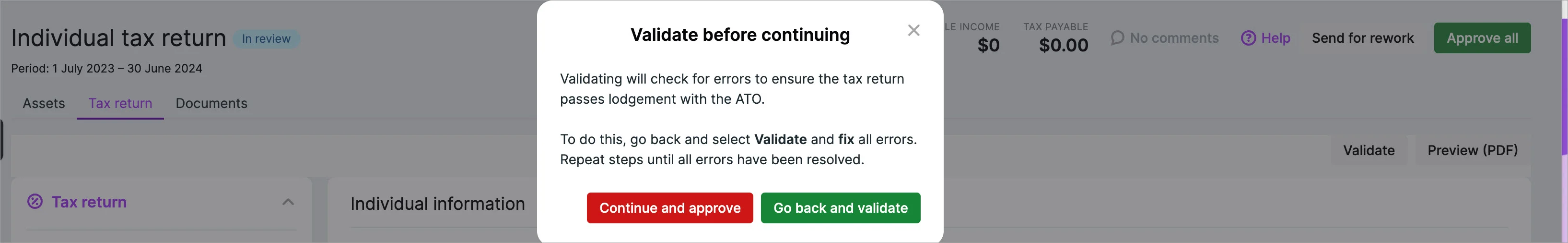

23 April - Tax validation message

You'll see a message to warn you if you approve a tax return that has validation errors or hasn't been validated, with an option to continue or go back and validate.

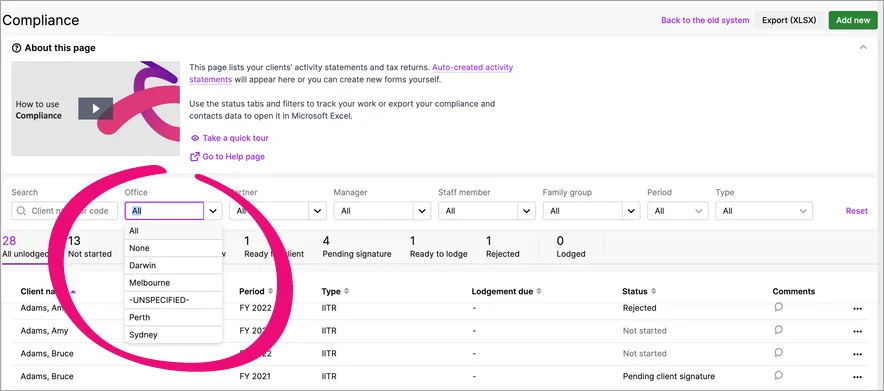

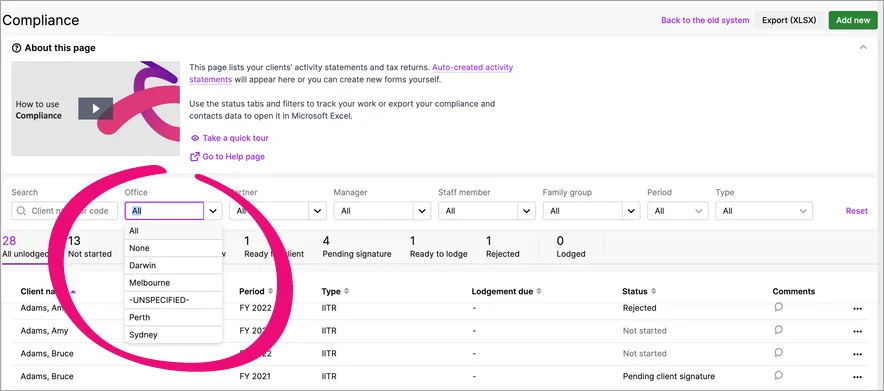

23 April - Filter tax returns by the client’s office category

This information only applies if you have MYOB Practice and MYOB AE/AO

If you applied multiple office categories to your clients in MYOB AE/AO, you can filter by office on the MYOB Practice Compliance list in All clients view. For example, if you want to find all tax returns or activity statements from clients with an office category of Melbourne.

-

The Office filter option is useful if you applied multiple office categories to your clients in MYOB AE/AO.

-

Filtering Office by None will include listing clients that have the default office value of UNSPECIFIED in AE/AO.

-

To see the Offices in the MYOB Practice Compliance filters, you need AE or AO version 5.4.50 (2023.3) released April 2024.

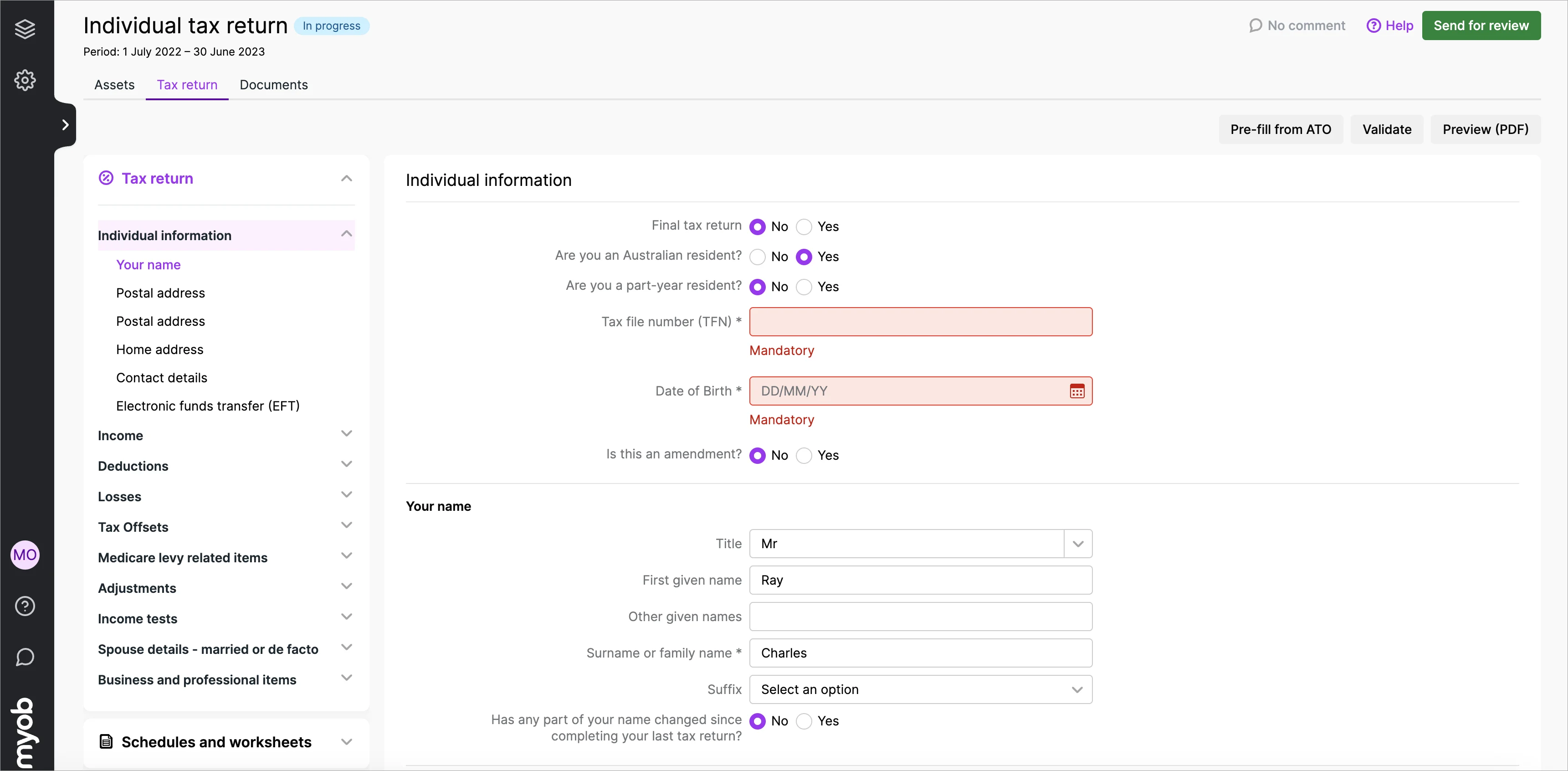

23 April - Individual tax returns are now available

We've released Individual tax returns in MYOB Practice.

If you use MYOB AE/AO, you can prepare and lodge individual tax returns in MYOB Practice Tax. See our onboarding guide on how to set up and get started.

15 April - Easily find and fix errors as you enter data in a tax return

We’ve improved error validations in individual tax returns and schedules. This makes sure the information you're entering is accurate and helps you avoid ATO rejections.

See errors as you type

While entering data into certain fields, we'll check for any errors and display a message in red below the field so you can fix it straight away.

Go directly to the source of the error

For any validation errors, just click the error message to go directly to the field that needs attention. This means you can find and fix errors quickly without searching.

This feature is available on the

Individual tax return fields

Schedules that are completed to enter income such as salary and wages, interest income etc.

Rental property schedule

Deductions schedule

We're planning to introduce it across other form types and schedules.

15 March - Quick view of the tax estimate

You can now get a running balance of the taxable income and tax payable or refundable on top of the tax return.

This gives you quick visibility of estimated amounts based on what's currently entered in the tax return.

What are the fields displayed?

Return type | Fields displayed |

|---|---|

Individual and Company | - Taxable income |

Trust and Partnership | - Taxable income |

12 March - Populating distributions from trust and partnership income amounts into individual tax return

When you distribute to an individual beneficiary in a trust return or to an individual partner in a Partnership return, the amounts will automatically populate the individual tax return labels you're distributing into.

This feature is available only when distributing into an individual tax return. Distributing to non-individual tax return types is coming soon.

23 April - Tax validation message

You'll see a message to warn you if you approve a tax return that has validation errors or hasn't been validated, with an option to continue or go back and validate.

23 April - Filter tax returns by the client’s office category

This information only applies if you have MYOB Practice and MYOB AE/AO

If you applied multiple office categories to your clients in MYOB AE/AO, you can filter by office on the MYOB Practice Compliance list in All clients view. For example, if you want to find all tax returns or activity statements from clients with an office category of Melbourne.

-

The Office filter option is useful if you applied multiple office categories to your clients in MYOB AE/AO.

-

Filtering Office by None will include listing clients that have the default office value of UNSPECIFIED in AE/AO.

-

To see the Offices in the MYOB Practice Compliance filters, you need AE or AO version 5.4.50 (2023.3) released April 2024.

23 April - Individual tax returns are now available

We've released Individual tax returns in MYOB Practice.

If you use MYOB AE/AO, you can prepare and lodge individual tax returns in MYOB Practice Tax. See our onboarding guide on how to set up and get started.

15 April - Easily find and fix errors as you enter data in a tax return

We’ve improved error validations in individual tax returns and schedules. This makes sure the information you're entering is accurate and helps you avoid ATO rejections.

See errors as you type

While entering data into certain fields, we'll check for any errors and display a message in red below the field so you can fix it straight away.

Go directly to the source of the error

For any validation errors, just click the error message to go directly to the field that needs attention. This means you can find and fix errors quickly without searching.

This feature is available on the

Individual tax return fields

Schedules that are completed to enter income such as salary and wages, interest income etc.

Rental property schedule

Deductions schedule

We're planning to introduce it across other form types and schedules.

15 March - Quick view of the tax estimate

You can now get a running balance of the taxable income and tax payable or refundable on top of the tax return.

This gives you quick visibility of estimated amounts based on what's currently entered in the tax return.

What are the fields displayed?

Return type | Fields displayed |

|---|---|

Individual and Company | - Taxable income |

Trust and Partnership | - Taxable income |

12 March - Populating distributions from trust and partnership income amounts into individual tax return

When you distribute to an individual beneficiary in a trust return or to an individual partner in a Partnership return, the amounts will automatically populate the individual tax return labels you're distributing into.

This feature is available only when distributing into an individual tax return. Distributing to non-individual tax return types is coming soon.

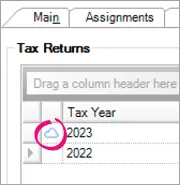

1 February - Improvements to moving a tax return from MYOB AE/AO to MYOB Practice

You'll have a better experience when moving tax returns from AE/AO to MYOB Practice thanks to many improvements we've made throughout the process.

Moving a tax return from AE/AO to MYOB Practice is supported for IITR, CTR, PTR and TRT in 2022 and later years.

The Move the tax return online window's performance, visuals, descriptions and linked resources have been updated and improved.

The Live button with the cloud icon at the top of AE/AO is now called MYOB Practice.

Previously, you'd need to create, rollover, open and close a tax return in AE/AO before you could open the Move the tax return online window.

Now the Move the tax return online window opens as soon as you click Create Return in AE/AO.Previously, with some computer screen resolutions, the Move the tax return online window would be cropped. Now it'll look good with all resolutions.

Previously, the Move the tax return online window would momentarily not be viewable when you click the Move the return online button. Now this won't happen when you click the button.

Previously, when moving the return was finished and you closed the Move the return online window without launching the return, there'd be nothing on the AE/AO window to indicate that the return was moved.

Now, the AE/AO window will automatically refresh and show the new return with a little cloud icon next to it, indicating it's a return in MYOB Practice.

Previously, after moving a return to MYOB Practice, you may have seen errors for your assets. This was caused by the depreciation worksheet in AE/AO not requiring an asset class, while MYOB Practice does require an asset class.

Now, we've fixed this by adding a Default Asset Class value in Client Files > Assets. You can transfer the asset class after moving the return to MYOB Practice at your convenience, instead of needing to fix all the assets before being able to move returns without issue.If you experience an issue with the migration process, you'll see more detailed error messages than before, most with links to more help.

Learn more about the process in the following pages:

24 January - More ways to find a tax return

Above the list of returns on the Compliance page:

the Search field lets you search by client code.

there's a new field that lets you filter by manager

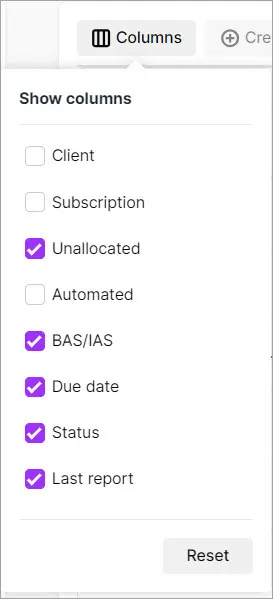

15 January - Adding columns to the Online files page

Click the Columns icon to add and remove the columns displayed.

9 January - Focus on information in schedules with a cleaner interface

When you open a schedule, it'll expand to fill the whole browser tab. Other settings, menus and the client sidebar will be hidden. You'll see the client name and client code above the schedule.

User management

14 August - Simplified workflow for removing client file access

This only applies if you have MYOB Practice without MYOB AE/AO

When you remove a user, their access to client files will also be removed. This means you no longer need to remove file access in my.myob. By keeping more of your workflow within MYOB Practice, you get a more consistent, focussed experience.

Deleting the user won't remove their access to client files if the user is marked as Admin in my.myob.com > My account > Manage online file access. To remove file access for Admin users, contact us.

25 June - User management improvements

MYOB Practice users without MYOB AE/AO only

It's easier than ever to add new users to MYOB Practice. You no longer need to create a my.myob account, and you can do all the setup steps from within MYOB Practice.

There are also two new permissions available to control who can manage practice users and online file access.

You may notice some updated permission and label names while doing user management tasks. For example, the Administrator permission is now Practice administrator, the Staff menu is now User and the Roles menu is now Permissions.

Read all about the details about adding users and assigning permissions.

2023 improvements

In-product help improvements

MYOB Practice in-product help is here!

Learn about the workflows by watching a video, reading our Help pages, or taking a quick tour without having to leave the product.

You'll see this banner on the following pages in MYOB Practice

Transaction Processing

Contacts

Portals

Compliance list page

Activity Statements

Use the toggle button (up arrow) on the top right of the panel to close the window if you no longer need it.

Partner Hub improvements

To find the Partner Hub, select Practice (the stack of three squares) on the left side of MYOB Practice.

6 December

Reward preferences in Partner Hub

You now view and edit your reward preferences from Partner Hub instead of through my.myob. This lets you control more in one location, from MYOB Practice.

Learn more about selecting your reward preferences.

23 February

Improvements to finding your way around the Partner Hub

We've added a new navigation bar to the top of the Partner Hub, so that you can easily find everything you need to know about the Partner Program and your team activity.

Client files and Contacts

4 October

Import contacts in bulk

Quickly add multiple contacts by downloading a CSV template, entering their details, and import the CSV into MYOB Practice. Learn more about importing in bulk.

26 September

Link a client file to multiple practices

When a client invites you to work on a file, accepting their invitation takes you to a new page where you can select which practice or practices you want to link to the file.

11 May

Find clients that staff are working on

In the Contacts list, you can now filter to see the clients that staff are working on.If you’re using MYOB Practice and not AE/AO, you can now also assign the staff to clients in MYOB Practice.

If you use AE/AO with MYOB Practice, you can still assign staff in AE/AO that will appear in MYOB Practice.

Learn more about assigning staff to clients.

8 February

A better look and feel

We’ve improved the visuals in MYOB Practice. You may notice a difference in the colours, buttons and other areas. These changes improve accessibility, making MYOB Practice easier to read and work with.This just changes the way things look; you don’t have to learn anything new and the way you work won’t change.

18 January

Record proof of identity (POI)

If you use only MYOB Practice, you can now record, edit and delete your client verification for POI in MYOB Practice.

If you use MYOB AE/AO, the POI information you've recorded in the desktop software will be synced to MYOB Practice. You'll be able to see the information you entered in MYOB AE/AO.

Activity statements and tax improvements

18 December

Changes to ATO pre-fill in MYOB Practice

In MYOB Practice, you can now pre-fill a tax return multiple times with the ATO pre-fill data. This saves time when completing a tax return and ensures that data is accurate.

Pre-filling tax return multiple times is available for tax returns created after 1 December 2023. For any returns before that date, you can enable this feature by deleting and re-creating the return.

15 December

2023 Individual tax return

Borrowing expenses worksheet

In a Rental property schedule, you can use the borrowing expenses worksheet to calculate the expenses directly incurred in taking out a loan for the property.

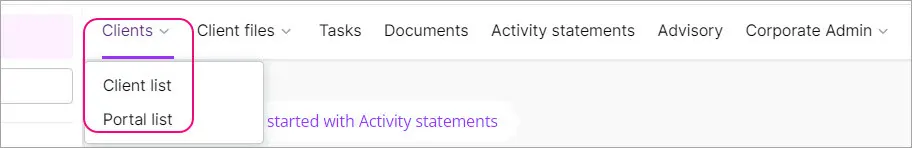

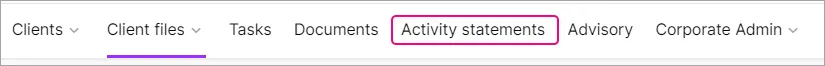

New navigation menus

We've changed some of the menu items in the top navigation bar as part of our new and improved experience. There are no changes to the functionality of the software, just a fresh new name.

You'll notice:

Contacts is now called Clients with a submenu of Client list and Portal list.

Transaction processing is now called Client files with submenus for Online files and Desktop files.

Compliance is now called Activity statements or Tax (see note below).

If you're part of the Early Access Program for MYOB Practice tax, you'll see Tax in the menu. For all users of Practice, you can access activity statements on the same page.

13 December

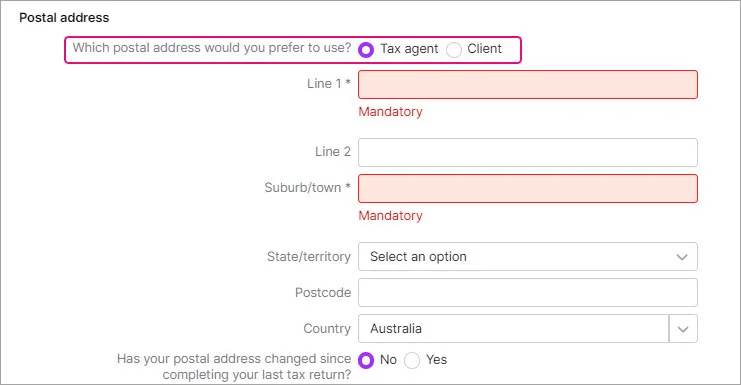

Choosing Postal address tax returns in MYOB Practice

On the Front cover of a tax return, you now have the option to choose between Tax agent's or client's postal address and decide where the ATO communications should be sent. Learn more.

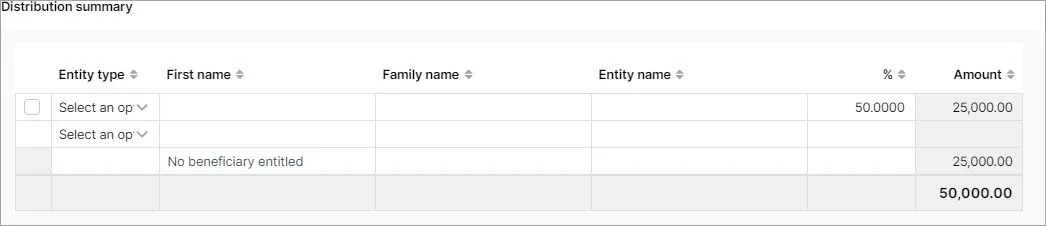

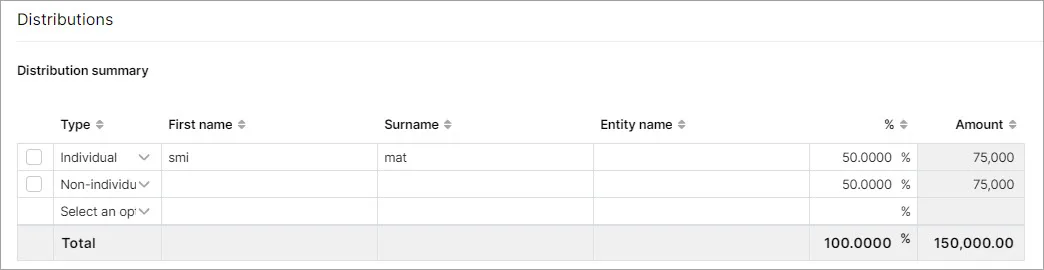

Trust and Partnership returns

In a 2023 Trust and partnership tax return, we've added a Distribution summary in the Distributions section. This will display a summary of the beneficiaries and partners.

Trust summary

Partnership Summary

11 December

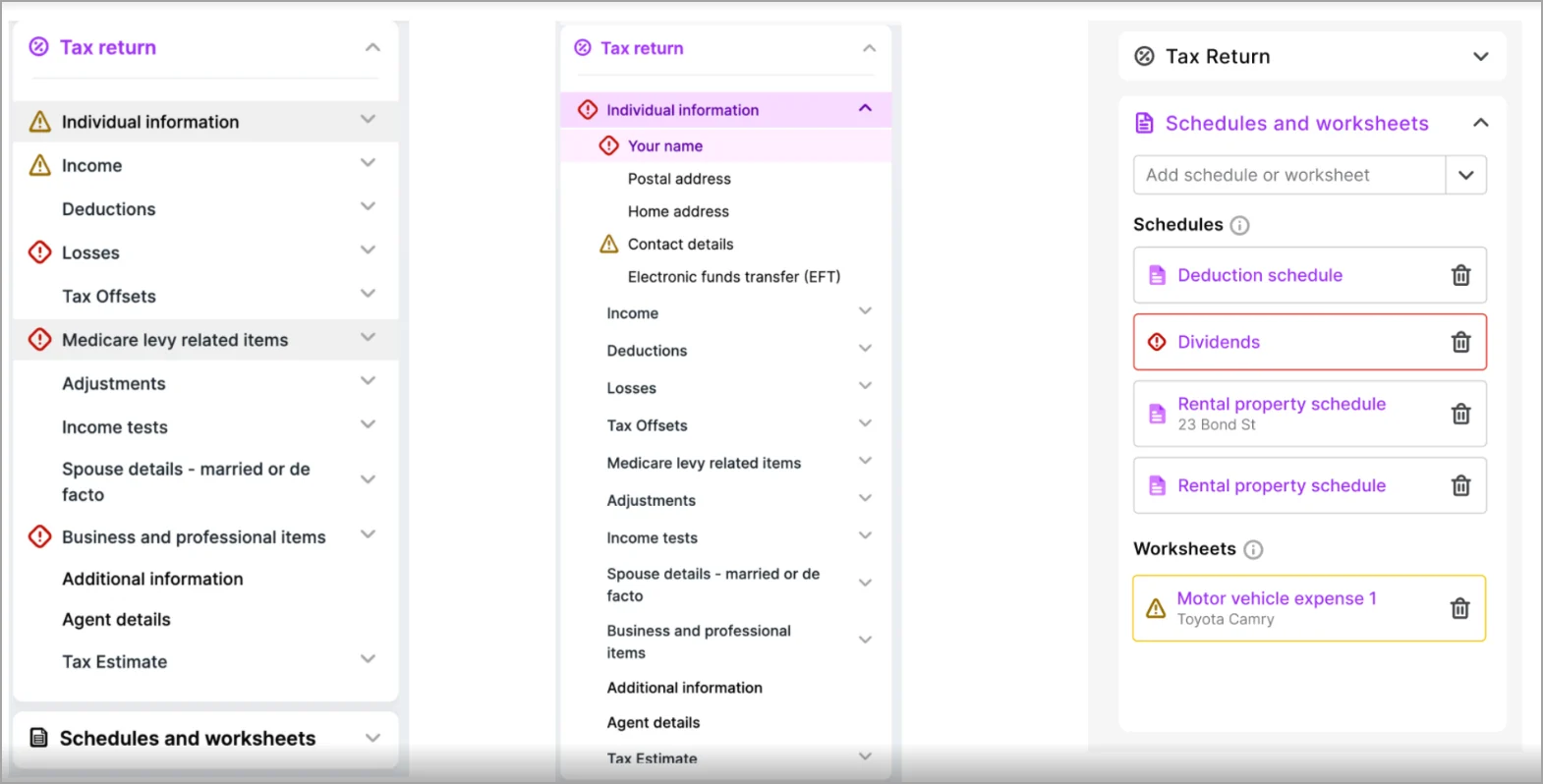

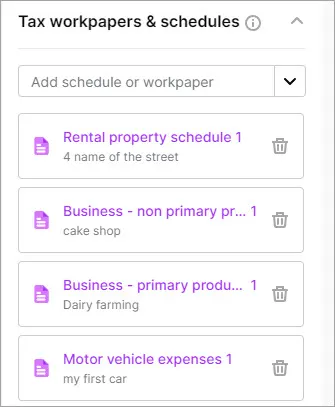

Improved tax return navigation experience

The navigation panel is moved from the right of the page to the left.

The navigation panel will highlight which section and subsection you're in to help you quickly scan the list of sections and see where you’re located.

Each section of the navigation panel has its own scroll bar, instead of the one scroll bar for the whole panel. When you scroll one section, the other sections will no longer be scrolled out of view.

The Tax workpapers & schedules section is now called Schedules and worksheets and is divided into subsections for both of these types of attachments.

You may notice some other changes to the navigation bar order to create a consistent experience.

When you scroll through a tax return, the section header will remain at the top of the page so that you always know which section you’re in.

When you open a tax return, the Contacts side menu will be hidden to let you focus on the tax return. You can always show the side menu again by clicking Open side menu (the > greater than symbol) or by pressing the square bracket ([) keyboard shortcut.

Franking account worksheet improvements

In a 2023 Company tax return, when completing a Franking account worksheet, the opening balance will now integrate into Items 8P and 8M. You can choose to use the Franking worksheet or enter the amounts manually in the labels.

20 November

2023 Partnership tax returns

We've made the following enhancements to the Distributions section:The Partnership distribution is now available within the tax return.

8 November

2023 trust tax returns

We've made the following enhancements to the Distributions section:Total distributable amounts will automatically populate from the tax return labels

You can enter a distribution percentage for beneficiaries that will automatically calculate the distributable income based on the percentage share.

20 October

2023 tax returns - Contact name integrates from AE/AO

In a company, trust, or partnership return if you have an employee assigned in MYOB AE/AO under the Responsibility tab, you'll be able to select the names under the Agent details in the tax return created in MYOB Practice.

2023 tax returns - Displaying identifiers in workpapers and schedules

We've made it easier to identify the work papers and schedules with a unique identifier. For example, a rental property schedule will display the street name, and a motor vehicle schedule will display the make and model of the vehicle.

2023 Company return

We've added the motor vehicle expenses worksheet to a 2023 Company tax return. You can use this worksheet to calculate the motor vehicle expenses and integrate into the relevant label in the tax return.

4 October

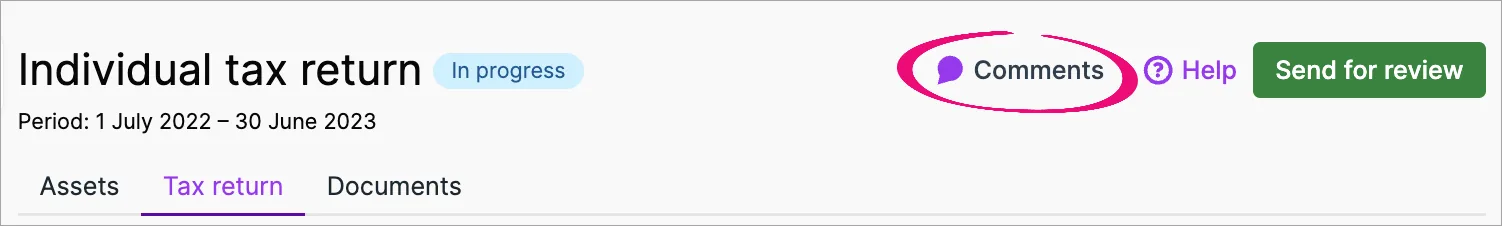

More ways to add comments to tax returns and activity statements

In September we introduced the ability to add comments to the Compliance page.

Now you can also add comments when you open an individual tax return or activity statement from the Compliance page. You can add and view the comment from the Assets, Tax return or Documents sub tabs.

Comments are synced between an opened tax return or activity statement and the Compliance list views.

Learn more about adding comments.

1 October

Front cover information in the tax return (Individual, Company, Trust and Partnerships)

When you add a new tax return in MYOB Practice, some of the front cover details will integrate from the client details. This will save time as most of the mandatory fields such as TFN, Name, and addresses, are populated.You can edit these fields in the tax return but the details will not integrate to AE/AO. That's why recommend making any changes in MYOB AE/AO.

27 September

Make notes about tax returns and share your thoughts with your colleagues

You can add comments to tax returns to track and share information with other users in your practice. Learn more about adding comments.

1 September

2023 Individual tax return:

We've added a new field STP Finalised to the following workpapers:Salary and Wages payment summary

Employment termination payment summary

Foreign employment income payment summary.

This field is populated by ATO pre-fill. The values in the STP finalised field are:

TRUE - Data is finalised via Single Touch Payroll (STP). Review the data and lodge the return.

FALSE - Data is not finalised via STP. Check the data before lodging the return.

If your data isn't finalised, you can't pre-fill the tax return again using ATO pre-fill. This field is not lodged to the ATO.

N/A - this indicates the payer has submitted their finalised payment summaries for the payee using the PSAR or EMPDUPE arrangements. You'll need to manually complete the details.

Trust and partnership returns

We've added the Motor vehicle expenses workpaper. You'll be able to allocate the motor vehicle expenses to the required income item, such as rental or business income.

Company tax return improvements

When you enter amounts in the tax return, it will now integrate into the Calculation statement. This will then apply relevant tax offsets (in the priority order) and the tax on taxable income is calculated.

31 August

Improvements to working with workpapers and schedules

When you enter data in a workpaper or schedule and the changes are automatically saved, you'll see a message saying "Autosaved. Close browser tab when done." This helps you know that it's safe to navigate away from the page without losing data.

Your browser tab title shows the name of the workpaper or schedule that's opened, along with initials to help identify the client or contact (for example, WN). This makes it easier to switch between tabs without gettings lost when you have multiple MYOB Practice tabs open. Previously, all MYOB Practice tabs had the same title.

The workpaper or schedule name will remain displayed at the top of the page if you scroll down the page. This makes it easier to remember which workpaper or schedule you're in if you switch to another tab or window and then return to the workpaper or schedule.

24 August

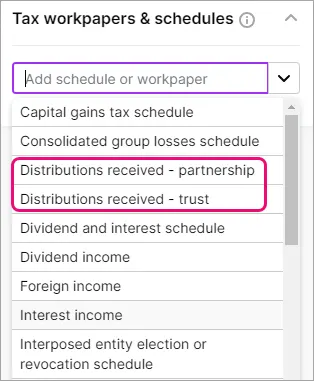

Trust and partnership returns

We've added new workpapers:

Distribution received - partnership

Distribution received - trust

Rental property schedule

You can edit all Ownership share and Private use fields where the values were automatically populated using the small pen icon located in the field. To reset the value, click the reset icon.

3 August

Improved tax return header

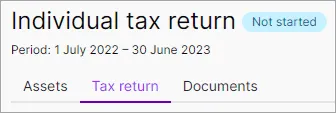

We've improved the header area at the top of tax returns. Most of the changes were made to display the information in a way that uses less space, so that you see more of the tax return by default. Here's what's changed:Replaced the Assets, Tax return and Documents tiles with smaller tabs.

Moved the status indicator (for example, Not started) next to the tax return title.

Example of the new header.

1 August

2023 Individual, Trust and Partnership tax return - Rental property schedule

You can edit all Ownership share and Private use fields where the values were automatically populated using the small pen icon located in the field. To reset the value, click the reset icon.

12 July

Quickly see the most relevant activity statements and tax returns

The Compliance Period filter defaults to the current financial year.

5 July

Tax compliance for 2023 is here!

You've got all the latest updates you need for the new tax year, including:Reducing compliance costs for self education

Removal of low and middle income tax offset

Small business skills and training boost

Small business technology investment boost

Company returns

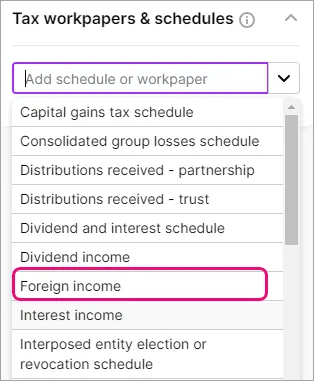

We've added new workpapers:Distribution workpapers:

Distribution received - partnership

Distribution received - trust

Foreign income workpaper:

Individual returns

We’ve split the Payment summaries and income statements schedule into 6 separate schedules:

Salary or wages payment summaryForeign employment income payment summary

Employment termination payment summary

Australian superannuation income stream payment summary

Australian superannuation lump sum payments

Attributed personal services income payments

29 May

Data validation of mandatory fields

We'll now display errors if you've not completed mandatory fields in a tax return. Clicking the error will take you to the specific field that is missing the data. Learn more.

12 May

More data in spreadsheet exports

The TFN and other contacts information is included when you export compliance data to a spreadsheet.

20 April

Import from ledger

You can import the values from MYOB Business or AccountRight ledger into an activity statement. Learn more.

5 April

Revising an activity statement

You can now revise an activity statement in MYOB Practice. Learn more.

31 March

Better staff management for tax-related tasks

You can now turn on roles that let you decide which staff in your practice can approve, unlock and lodge tax returns. Learn more about the new tax roles.

Auto-create activity statements using ATO reports

We'll automatically create the activity statement from the Activity statement lodgment report (ASLR) and ATO data is pre-filled when you access the statement. Learn more.The auto-create activity statements is not available for all. If you would like to use this feature, contact support so we can switch it on for your practice.

Filtering activity statements if lodged by your client

You can filter the statements lodged by your client from your outstanding list of obligations. Learn more.

31 January

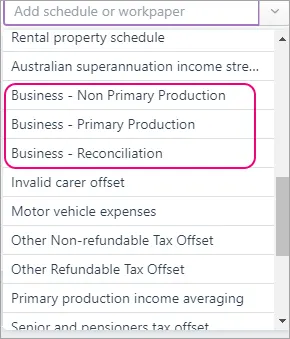

Partnership returns–Business workpapers

We've created 3 new workpapers for the Business income. Use these workpapers to enter a breakdown down of the business (PP and NPP) income and deductions

25 January

Trust returns–Business workpapers

We've created 3 new workpapers for the Business income. Use these workpapers to enter a breakdown down of the business (PP and NPP) income and deductions

12 January

Partnership and Trust returns - Rental property schedule

You can now add private use amounts to the rental property schedule.

3 January

Printing changes and enhancements

We've made enhancements to printing with new formats, and page breaks. You can print the workpapers that are attached to a tax return. Learn more

2022 improvements

General improvements

11 November

Less disruption and waiting, more productivity and efficiency!

MYOB Practice got a speed boost. We think you’ll notice improvements in a few different places, including tax rollover and upgrades completing within 10 to 20 seconds, and some key pages loading faster. Load times are halved in some cases, helping you stay in the flow while you work.

AU tax improvements

21 December

Foreign income tax offset (FITO)

calculation: If you're claiming foreign income tax offset in your tax return, we'll calculate the offset limit (if you're claiming more than $1000) based on the foreign income and foreign tax paid entered in the tax return. The calculated offset will appear at Item 20 label O and on the tax estimate.

15 December

Partnership return - Accessing the tax schedules/workpapers from the tax return label

You can now access the schedules/workpapers from within the tax return next to the label. Simply click the Related schedule/workpapers link.

9 December

Amend tax returns

Individuals only, 2022 onwards

You can amend your tax return if you have made a mistake, forgotten to add items, or if something has changed after you've lodged your tax return. Learn more.

Item IT5 - Net financial investment loss calculation

MYOB Practice calculates the IT5 amount.

Financial investment losses are added back to taxable income when calculating adjusted income (ATI) for certain income tests. The IT5 label calculates values entered in the income return that is used to calculate Adjusted taxable income (ATI).Improved IITR layout

We've rearranged and relabelled some sections in the IITR to make them easier to navigate.

23 November

Foreign employment income non-payment summary and Foreign pensionsor annuities workpapers

We've made enhancements to the foreign income workpapers and they are ready to use. You can now complete Items 20T, 20N, 20L, and 20D using these workpapers.

18 November

Individual return (2022) - Multi-property rental schedule

You can now add private use amounts to the rental property schedule. Learn more.Payment summaries and income statements

The Net foreign employment income will now integrate into Item 20U Foreign employment income in the main return.

3 November

Distribution received - Trust workpaper

You can now add multiple Distribution received - Trust workpaper.Distribution received workpapers:

The following amounts from the Distribution received workpapers (Partnerships, Trust, and Manged fund) will now integrate into the labels in the main return:T7: Early stage venture capital limited partnership tax offset

T8: Early stage investor tax offset

T9: Exploration credits.

Add the respective workpapers at T7, T8, and T9 for the amounts to appear on the main return label.

24 October

Tax returns can be made Ready to lodge in bulk

You can change the status of multiple tax returns at the same time from Pending signature to Ready to lodge.

Lodging in bulk was previously mostly useful if you used portal in MYOB Practice to automatically move returns to a Ready to lodge status. This change makes it easier to lodge tax returns in bulk if you’re not a portal user.

Learn more.

12 October

We've temporarily disabled the Foreign employment income non-payment summary and Foreign pensionsor annuities schedules while we work on improving them. If you need to complete Items 20D, 20L, 20N, and 20T, go to the desktop version.

21 September

SBITO workpaper: We've created a small business income tax offset workpaper to help with calculating the small business tax offset. Learn more.

15 August

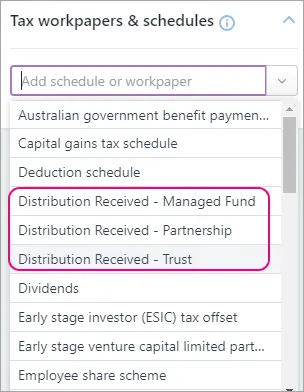

Distribution workpapers: We've created 3 new workpapers for the distribution received income

Distribution received - Partnership

Distribution received - Trust

Distribution received - Managed fund

29 July

Tax compliance for 2022 is here!

You've got all the latest updates you need for the new tax year, including:create tax returns in MYOB Practice and rollover from the previous year (if you have a return already in MYOB Practice).

new business worksheets

rate changes

tax estimate improvements

R&D schedule in a company return

improved payment summary schedules in partnership and trust returns.

Learn more

Create new tax returns in MYOB Practice. Learn more

Individual returns — Business workpapers

We've created 3 new workpapers for the Business income. Use these workpapers to enter a breakdown down of the business (PP and NPP) income and deductions

8 June

Lodging tax returns is faster and more convenient

You can lodge tax returns in bulk! Select all the returns you want to lodge from the Compliance list and click Lodge to send them all to the ATO.

Learn more.

19 May

Tax estimate improvements

Zone offset: The offset calculation will display when the taxpayer had dependants or was living in multiple zones or overseas zones.

Beneficiary tax offset: The offset will display on the estimate when there is an amount at Item 5 Australian Government allowances and payments.

T3 Superannuation contributions on behalf of spouse tax offset: This offset includes the spouse's income in the calculation.

Seniors and Pensioners Tax Offset (SAPTO): The estimate will now display the offset on a separate line.

Small Business Income Tax offset: The offset includes Item 15A: Net Small Business income in the calculation.

Study and training loan rates: We've updated the 8% repayment threshold income.

19 April

Display local date and time

Timestamps will be based on your system's local date and time and will use a consistent format. You'll notice these changes in timestamps throughout your compliance work. For example, in the timestamps of lodged returns.

Portal improvements

21 July

Save time when managing your tasks

We’ve redesigned tasks so that you can select up to 100 tasks to complete and reopen in one action. You can also now sort tasks by client and due date so that you quickly find the most relevant tasks. Learn more about tasks.

20 July

Improved task reminders

We’ve improved the interface for Tasks so that it’s clearer that you’re sending your clients a reminder, not a new task. Your clients will also be sent improved email reminders that clearly show they’re task reminders, not new tasks. Learn more about sending a task reminder.

9 May

Improvements for Client Portal

Your clients can now upload multiple documents in one process. When clients do this, you'll receive one email notification for all the documents they've added in one upload.

Documents improvements

5 April

Client’s profile automatically added to documents

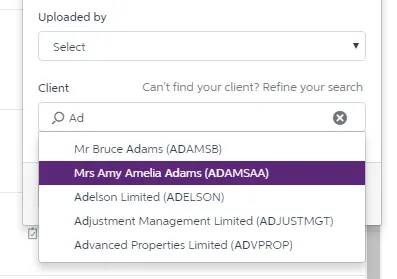

When you receive documents in MYOB Practice from your clients through the Client Portal, the documents will now automatically have the client’s profile added to them. We’ll only add a client’s profile to documents when there is one client in the Client Portal.

Learn more about profiling documents.

25 March

Fix for profiled documents

Previously, you may have had some issues with loading the Documents page when you’d added more than three profiles to a document. We’ve fixed this by reducing the amount of profiles you can see when you hover over the Clients column. Now, you will see up to three clients and if you’ve added more than three clients, it will show as Client, Client, Client, … more+

You can still view and edit all the profiles added to a document when you’re looking at the document’s details. The Client search also still works for finding clients that are profiled to a document. Learn more about profiling documents.

Contacts improvements

1 December

Group your clients and contacts

If you only use MYOB Practice, you can now group:individuals

companies

trusts

other organisations.

When you've created a group, you can search for members using their group name and navigate between them more easily. Each client and contact can belong to multiple groups. Learn more about groups.

If you use MYOB AE/AO, you’ll be able to see your family groups from the desktop software in MYOB Practice through contact sync.

25 October

Add and view salutations for your clients and contacts

If you only use MYOB Practice, you can now add salutations for your clients. Go to Contacts > Contact list and select a client by clicking anywhere in the client row to view their details on the same page. On the right side, you can edit the client and add their preferred name or title in the Salutation field.

If you use MYOB AE/AO, you’ll now see the salutation when you look at a client in your Contact list and in Client details.Record and view director ID in MYOB Practice

If you only use MYOB Practice, you can now add a director ID for company directors. Go to Contacts > Contact list and select a client by clicking anywhere in the client row to view their details on the same page. On the right side, you can edit the client and add a director ID. Learn more.If you use MYOB AE/AO, you now see the director ID that you’ve recorded in AE/AO in their client details. You can view the number in Contact list and the client’s Client details page. Learn more about recording director IDs in AE/AO.

Corp Admin improvements

17 March

Director identification (ID) number in Corporate Admin

When you're registering a new company, you can now see an existing contact's director ID number that you've added into AE/AO when you're appointing a director (step 2) and reviewing the form (step 5).

8 March

Bulk 484 forms in Corporate Admin (AU)

We've added a bulk update feature for 484 forms. In one process, you can now change an officeholder or a member's name and address across multiple companies. Learn more about bulk updates for changing an address or changing a name.

Partner Hub improvements

25 October

Added referrals and active files to Overview page

As part of our updates to the Partner Program, you can now earn points through referrals and active client files. The points you earn from referrals and active files are now visible in the Overview page of the Partner Hub. We've also improved the Activities summary area on the Overview page so that it's clearer to see the activities that earn you points and a summary of your practice's progress.

1 June

Share your practice's Partner Program tier

In the Partner Hub, you can now download your status logo with your practice's Partner Program tier. Add the logos to your website, email signature or social media to showcase your tier. Learn more.

26 May

View the status credits you've earned from events

If your practice has earned status credits from attending an event, you can now see this under Program Activities. To see more detail and check who has registered for an event, click View Team Progress History and select the Events tab. Learn more about viewing team activities.

4 April

View your promotional status credits

If you’ve earned status credits during a promotion, you can now see this under Program Activities. To see more detail, you can click View Team Progress History to view your team activities.

17 March

Added Program Activities to Overview page

On the Overview page, you can now view your team’s activities, including their progress with certifications, and the amount of status credits they've earned. You’ll also be able to look at your team’s progress in more detail so that you know what to work on to reach the next tier. Learn more.

18 February

You can now update your team size so that your practice earns the right amount of status credits. Learn more.

15 February

In the Partner Hub Overview, we've added a progress bar for status credits so that you can now see how many status credits you've got.

2021 improvements

General improvements

15 June

We've added a What's coming link to the help menu in the left menu bar. This lets you see what features we'll be adding in the coming months. Learn more.

6 May

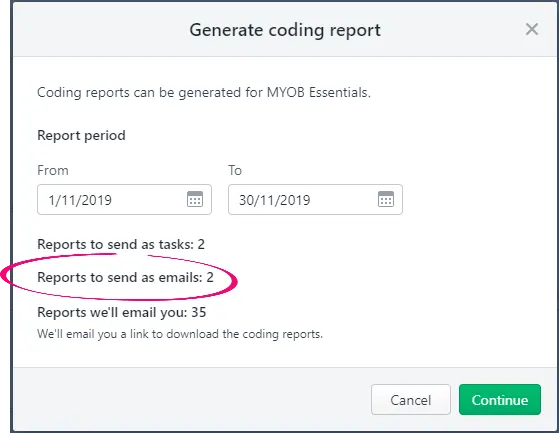

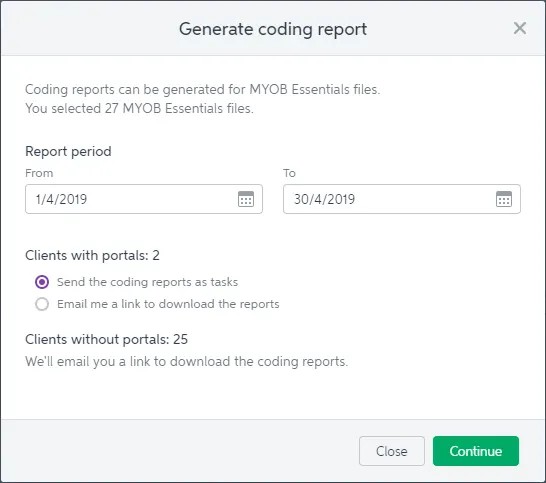

Create coding reports for MYOB Business files

You can now generate coding reports for clients with MYOB Business files. Previously, this was only possible for MYOB Essentials and MYOB AccountRight files.

AU tax

2 December

Rollover of additional fields

The following fields will roll over when you move a tax return from AE/AO to Practice tax.Rental property schedule

Property address details

Ownership%

Date property first earned rental income

Borrowing expenses

Motor vehicle expenses

Make and model

Date and year purchased

Registration number

Fuel election method.

27 October

Performance improvements on locked forms

We've improved the time it takes to open locked forms when you're lodging a return.

7 October

Easier access to help for tax

We've added a handy link in the tax return to access all help topics and updates.

Click Help and support to access the page in the product or check out the page.

4 October

Hide TFN

You can mask (hide) TFN in a tax return and tax estimate. Learn more.

29 September

Draft watermark when printing tax returns

You can mark the tax return and the estimate with a DRAFT watermark. Learn more.

20 September

Validation error improvements

Click See a list of common errors to access the validation error help page to help you fix the error. Clicking the validation message will also take you to the field you need to fix. Learn more.

The Validate, Prefill from ATO, and Preview (PDF) buttons will be visible when working on the tax return.

14 September

Printing improvements

You can choose to preview or download the PDF copy of the tax return and tax estimate. Learn more

9 September

Audit history

Administrators now have access to an audit history. It shows any changes made to the status of tax returns and any changes made to staff role assignment. Learn more.

2 September

Accessing the tax schedules/workpapers from the tax return label

You can now access the schedules/workpapers from within the tax return next to the label. Simply click the Related schedule/workpapers link. Learn more.

31 August

Managed Fund distributions to Distribution received, Early stage investor (ESIC), Early stage venture capital limited partnership (ESVCLP) workpapers

Partnership distributions to Distribution received worpaper.

26 August

25 August

Early Stage Innovation Companies (ESIC) to Early stage investor (ESIC) workpaper.

23 August

Item D5: PAYGW - Union / Professional Association Fees in DDCTNS.

Item D9: PAYGW - Workplace Giving in DDCTNS.

Item D10: ATO Interest: Interest Charge Debit in Deductions schedule (DDCTNS)

PAYGW - Deductible amount of UPP of the annuity to INCDTLS Annuity deductible amount of undeducted purchase price

18 August

Estimate enhancements

We've improved workflows in the Tax estimation & calculation workpaper, and enhanced estimate calculations.Auto creation of schedules

The relevant schedules are created automatically created and pre-filled with the data from the ATO. Learn more.ATO pre-fill data.Learn more.

Item 4 - Employment Termination Payment (ETP)

Item 9 - Superannuation lump sum

ATO Interest fields:

Item 10:

Interest on Overpayment to Interest section in INCDTLS

Interest on Early Payment to Interest section in INCDTLS

Interest on Interest on Delayed Refund to Interest section in INCDTLS

Item 24X - Interest Charge Credit to Other Income section in INCDTLS

16 August

Tax estimation & calculation workpaper

A new tax workpaper is available to enter the PAYG instalments and HECS-HELP study loans. This data can also be pre-filled from the ATO report. Learn more.Item 12: Employee Share Scheme - Income details schedule (INCDTLS)

Item D12: Personal Superannuation contributions deduction - Deductions schedule (DDCTNS).

Printing

Print a pdf copy of the tax return and estimate at any time. Learn more.

13 August

Rental property sharing in

You can now share the rental property income between tax individual tax returns in Practice Tax AU. Learn more.

2 July

Download a summary and full copy pdf copy of the 2021 tax return in MYOB Practice. Learn more

15 July

Company tax return - Research and development schedule (R&D) schedule

The (R&D) schedule is available in the company tax return.

30 June

Tax 2021 is now available

You can create 2021 tax returns in MYOB Practice Tax. Learn more.

1 June

We've released compliance changes to Assets online.

The instant asset write off has been extended till 30 June 2021

Apply Temporary full expensing for assets.

Learn more.

You can add a bank reconciliation workpaper to an asset account in the Trial balance. You can use this workpaper to reconcile the closing balance of the account with your bank statement.

You can create a report showing all the portals and portal members. Learn more.

18 May

Add a Professional Liability Limitation statement footer to the Financial Statements.

14 May

Removed Partner and Family group filters for non AE/AO users

If you’re an MYOB Practice user who hasn’t come from MYOB AE/AO, we’ve removed the Partner and Family group filters from the Compliance. This is because partner and family group filters require data from AE/AO. You can still use the Staff member filter.

4 May

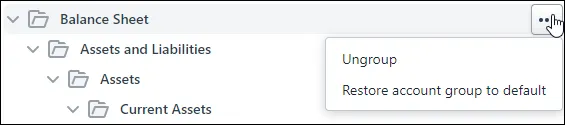

Access the account groups and see the allocation of the accounts, right down the folder level.

8 April

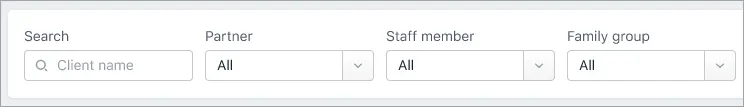

Filter Compliance list by staff, partner and/or family group

Effectively organise your workload with new filters for staff, partners and family group in the All clients view of the Compliance page.

Staff and partner assignments come from your clients' Responsibility tab in AE/AO, so make sure you've set up your team responsibility first. For family groups, you'll need to have set up family groups in AE/AO also.

Update: 14 May – We've removed Partner and Family group filters for non AE/AO users. See the 14 May What's new update to learn more.

31 March

Accessing the tax schedules/workpapers from the tax return label

You can now access the schdules/workpapers from within the tax return next to the label. Simply click the Related schedule/workpapers link. Learn more.

30 March

Pre-filling data from ATO report (AU)

Pre-filling from the ATO reports is available for a 2020 individual tax return. By using the pre-fill data from the ATO, you can save time, and avoid errors that can happen with manual data entry. Learn how to pre-fill.

Portal

1 November

Role to manage task templates

MYOB Practice administrators can assign users to a role that allows them to manage task templates. Learn more about creating task templates and assigning roles.26 October

Save time with task templates

You can save time by creating and using a task template when sending general tasks to your clients. Learn more.

Documents

29 October

Document tile in Compliance

Access and upload documents for a particular year within the compliance. Learn more.

12 August

Documents - New limits when downloading from Documents within MYOB Practice

To improve the performance of Documents within MYOB Practice, we've introduced limits on the quantity and size of documents you can download in one go. You can now download 150 documents or 1 GB worth of documents, whichever one of these limits you reach first. Learn more.

12 August

Documents - New limits when downloading from Documents within MYOB Practice

To improve the performance of Documents within MYOB Practice, we've introduced limits on the quantity and size of documents you can download in one go. You can now download 150 documents or 1 GB worth of documents, whichever one of these limits you reach first. Learn more.

1 July

New documents features

We're beginning the rollout of a new system for documents within MYOB Practice. When your practice has the features of the new document, you can learn more here.

11 January

Easily navigate tax returns: Use the Navigation options on the right of the Tax return page to jump straight to the section you want to view or update. Learn more.

13 January

Rounding balances: You can round balances in the financial statements. Learn more.

Contacts

6 August

Search, filter, and sort contacts

Change display name to be last name first name.

17 February

More intuitive contact sync icons

We've updated the icons that indicate the status of contacts syncing. Learn more.To see the latest icons, you need to have installed hotfix 59067593.

Corp Admin

22 June

Dividends in Corporate Admin (AU)

We've released the Dividends feature in Corporate Admin. You can now:track tax and income obligations over time for members

produce dividend statements for keeping records of members' tax

produce legal documents necessary to disburse company profits.

25 March

Improved Corporate Admin form options

When preparing company forms, you can select multiple signatories, the meeting address and date, and the officers present at the meeting.

For annual statements, you'll find these options in a new Prepare forms window. For the rest of the forms, you'll find these options integrated into the existing forms preparation pages.

For 484 forms, you can edit these details any time before they reach the Ready to lodge status.

You can see the documents that will be included with forms when you're assigning a task as part of form preparation.Learn more about company forms, annual statements and client lodgments.

10 February

New and improved Corporate admin document templates

Document templates in Corporate admin have a new look and feel. To use the new minute templates, you'll need to change the template style to New in the Corporate admin template settings. Learn how.

These changes won't affect any past documents you've already generated.

2020 improvements

General

November:

Add a logo to the cover page of your financial report. Learn more.

In the Balance sheet, you can hover over an account and click on it to see what the amount is made up of. Learn more.

December:

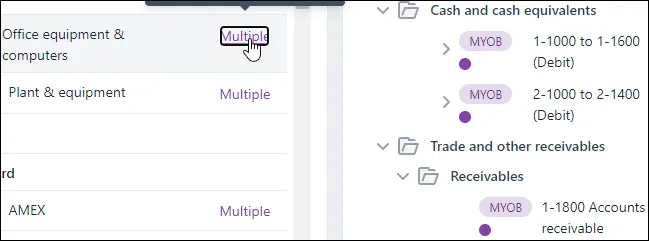

Account grouping updates: we've introduced many improvements to make the account grouping process more intuitive.

You'll see steps to guide you through grouping accounts.

Search for accounts and groups.

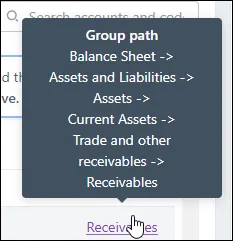

See where an account is grouped by hovering over an account link. Click to open the path location.

Hovering over the Multiple account link shows you where accounts or their debits and credits are grouped to multiple locations. Click Multiple to open the multiple locations.

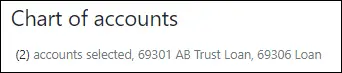

We'll show you all the accounts and codes that you have selected.

Group selected accounts with one click.

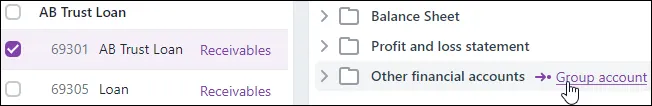

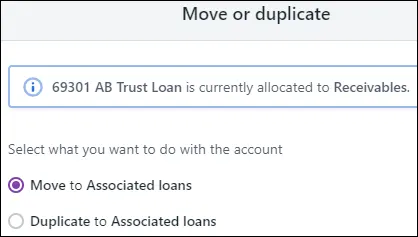

Easily move or duplicate selected accounts. Grouping an already-grouped account gives you options to change the grouping.

Ungroup accounts at the folder level instead of at each individual account level.

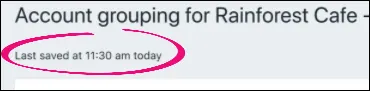

We'll autosave all your changes. You'll see a spinning icon when your changes are being saved and you'll see the save status at the top of the page.

You'll see the last save date and time or, if autosaving fails, you'll see a message here notifying you that there are unsaved changes. In this case, you can still click Save grouping.

We've protected the industry/chart type option behind an edit button instead of making it directly available in a dropdown. Changes here apply to all financial years.

All these changes simplify the way account grouping works in other ways too:

only 2 panels to work with, instead of 3

no Group account button out of context of where the account will be grouped to

a more intuitive popup window for grouping

a faster process for moving a group to another group

improved text descriptions on the page

the Financial year dropdown shows the tax year end instead of a two-year span. For example, FY 2020 instead of 2019 - 2020.

6 October

Track and manage coding reports: We've added a Last report column to the Online files page. This shows you the status of all the coding reports you've generated, so you can easily see if there are any reports you might need to follow up. Learn more.

23 September

You can now show or hide zero balance accounts in the Trial balance. We now hide accounts that have no attachments nor workpapers, and have a zero balance in the Client bal, Closing bal and Prior year columns, by default. To view these accounts, select the Show zero balances checkbox at the top of the Trial balance page.

This feature is available if you are part of the AU Compliance beta program.

22 September

We'll remember all your filter preferences: When you filter the Transaction processing page, we'll remember your filter preferences when you return to the page. Note, if you've previously applied filter preferences, you may need to reapply your preferences once after this update. Learn more.

7 September

Launch AccountRight files in your web browser: When you click an AccountRight file in the MYOB Practice Transaction processing or Client workspace pages, the file opens instantly in a new tab. No need to sign in to AccountRight on your desktop app! This means you can work on the file using any device with an internet browser, like your computer (PC or Mac), tablet, or phone. Learn more about:

how to open an AccountRight file from the Transaction processing page or Client workspace page

accessing AccountRight files in your browser.

-

When you try to access the file from transaction processing the first time, you may see a list of all of your client's businesses rather than the dashboard for that business. Click the business again to access it.

-

You can still access all your files in AccountRight on the desktop. There are still some features on the way for working with AccountRight files in the browser. For these features, you'll need to work with the file in AccountRight on the desktop.

-

You may have previously been opening AccountRight files on the desktop via the Transaction processing page. If so, you no longer need the AccountRight Launcher that you had to install to access those files on the desktop, since the files now open in the browser.

-

3 September

Schedule coding report reminders: Send emails to remind staff to generate coding reports for your clients. You can use templates for the coding report email or task that your staff in turn send to your clients. Learn more.

We'll remember which columns you want to see: When you apply your column preferences on the Transaction processing page, we'll remember your preferences when you return to the page. Learn more.

12 August

Create multiple files: Partners can save time by purchasing up to 20 ledger files of the same type in one transaction. Learn more.

6 August

Transaction processing usability enhancements: You can now assign staff members to a client in MYOB Practice. We've also made a few usability enhancements, including a new way of filtering files, a detailed client file view, and some style changes for a new look and feel. Learn more.

5 August

Corporate admin detailed share history: You can now track individual share parcels and keep a detailed register of all your current and previous shareholders. Learn more.

1 July

Create and update AE/AO contacts from Corporate admin: When you create a new contact or update an existing contact’s details from Corporate admin, we’ll now create a contact, or update the contact’s details in AE/AO for you. Changes to name and addresses will also be reflected in AE/AO. Learn more.

3 June

Staff roles: If you’re an MYOB Partner with administrator privileges, and you don’t use MYOB AE/AO in your practice, you can now assign the Administrator role to other staff. Learn more.

Staff access to MYOB Practice: If you use MYOB AE/AO and have administrator privileges, you can now see a list of staff members with access to MYOB Practice. Just click the Settings icon on the left of MYOB Practice and choose Staff. Learn more.

21 May

Accelerated depreciation rules: The ATO introduced the option for small businesses to deduct the cost of depreciating assets at an accelerated rate. We've updated the Assets page to let you use the accelerated depreciation rate. To apply the rate, you need to meet the eligibility criteria. Learn more.

11 May

This feature is available if you are part of the AU Compliance beta program.

Financial reports: The newly arrived Financial reports feature completes the compliance workflow in MYOB Practice. It will create a professional set of financial reports which are easy to use, customisable for your practice, and most importantly, will automatically bring across any data entered in a tax return. This first release includes a basic set of statutory reports, with limited customisation. Reports for Companies are available first, with Trusts and Partnerships coming soon. Learn more.

7 April

Enhanced user interface: MYOB Practice has a slick new look. To make things easy to find onscreen, the left menu bar is darker, and client and staff avatars have a splash of colour. Colours are given to avatars randomly, but each avatar keeps their given colour throughout MYOB Practice.

20 February

Advisory: Advisory reports now include a detailed accounts payable analysis that highlights who and what clients owe, and which payments to focus on first. Great for keeping their cashflow, and supplier relationships, in check. Learn more.

2019 improvements

17 December:

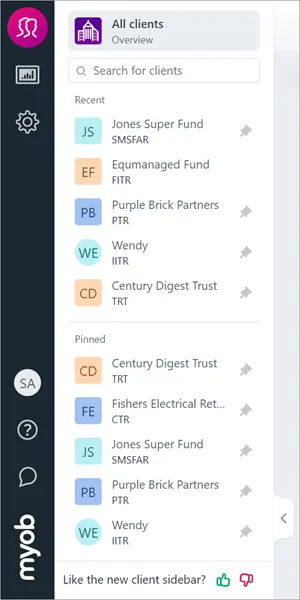

My List: The last 5 clients you accessed will now appear in the Recent section of Client sidebar. You can keep a client permanently in My List by pinning them.

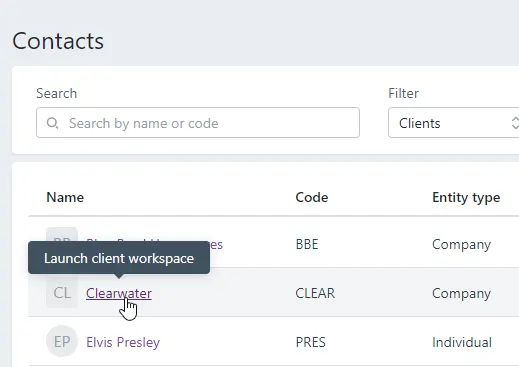

Client workspace: You can now access a client's workspace page by clicking their name in the Contacts list.

16 December:

Coding reports: Now you can choose to email coding reports to your clients direct from MYOB Practice.

Just select Email sent to client as the delivery preference in the client’s coding report settings, and when you generate a coding report for the client we’ll email them a unique link to access their report.

Protecting your clients' details: In MYOB Practice, you can email an AccountRight v19 file owner and ask them to upload their file so you can upgrade it to the latest version. Previously, we'd automatically fill the owner's name and email address in the email dialogs based on the serial number you entered. Now, to protect the AccountRight file owner's details, we'll no longer prefill their name or email address - you will need to enter these details.

18 November:

Clients: Now you can restrict access to clients whose details and activities you want to keep confidential. Only administrators and the selected staff members will be able to view or edit their details.

If you're an MYOB Partner and don’t use MYOB AE/AO, you can set up client restrictions within MYOB Practice.

If you use MYOB AE, or MYOB AO (NZ), the Team Security settings you define in your desktop software will apply automatically in MYOB Practice.

Learn what can be restricted, and how to set up restrictions on the Restricting user access to clients help page.

Note that we’re rolling out these features over the next two weeks, so these features may not be immediately available to your practice.

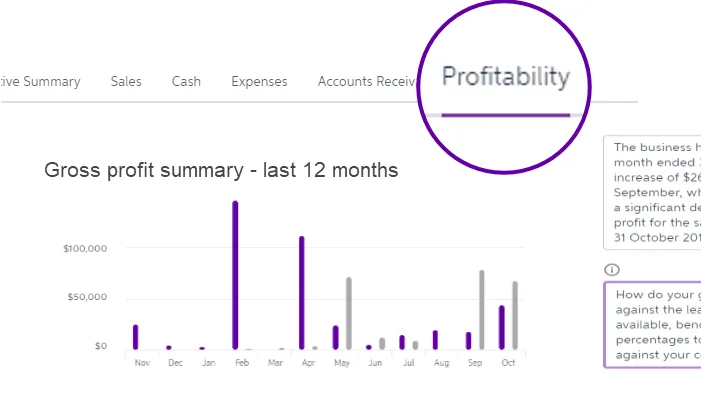

MYOB Advisor: Advisory reports now include profitability charts.

You can analyse:profit (dollars): Gross, operating and net profit (monthly and cumulative).

profit margin (percentages): Gross, operating and net profit.

current profit results versus previous period results

actual profits versus budgets.

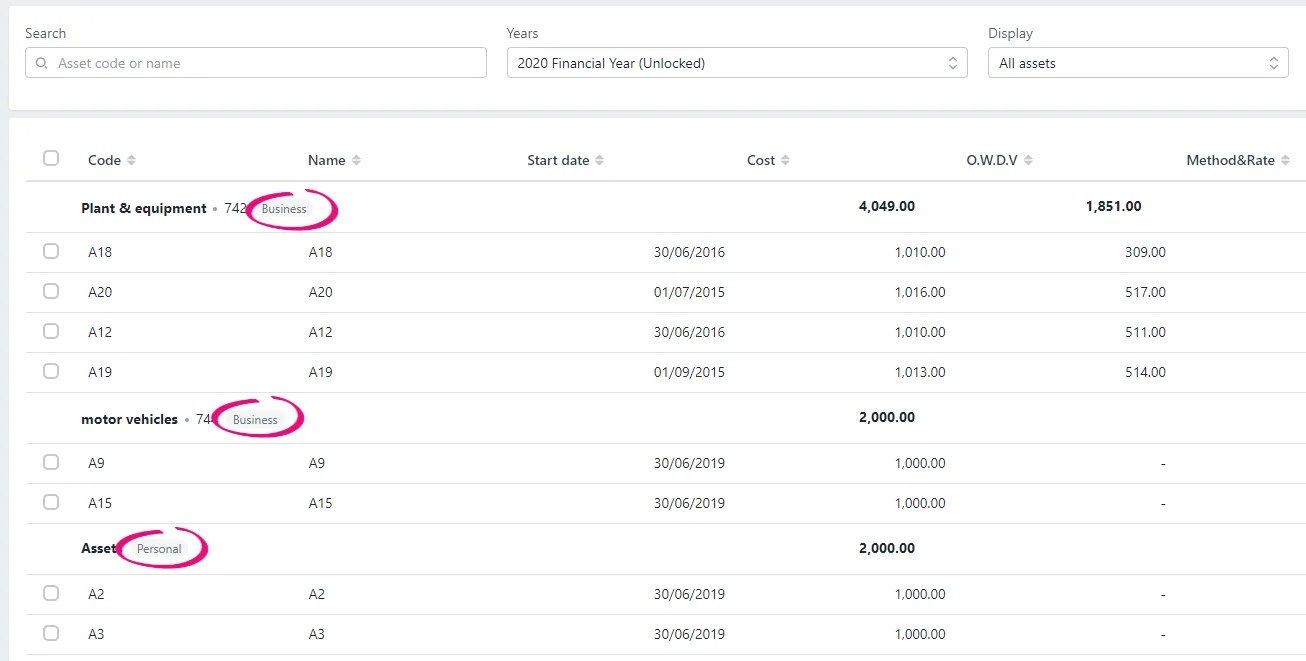

7 November:

Assets: We've updated Assets to support the upcoming individual tax return release in Compliance.

You can access an asset register that is not integrated into a ledger.

You can create:a business asset class by linking to an account code

a personal asset class by not linking to an account code.

A personal asset class and the associated assets won't appear under the Accounting tab. Accounting details aren't required when you add a personal asset.

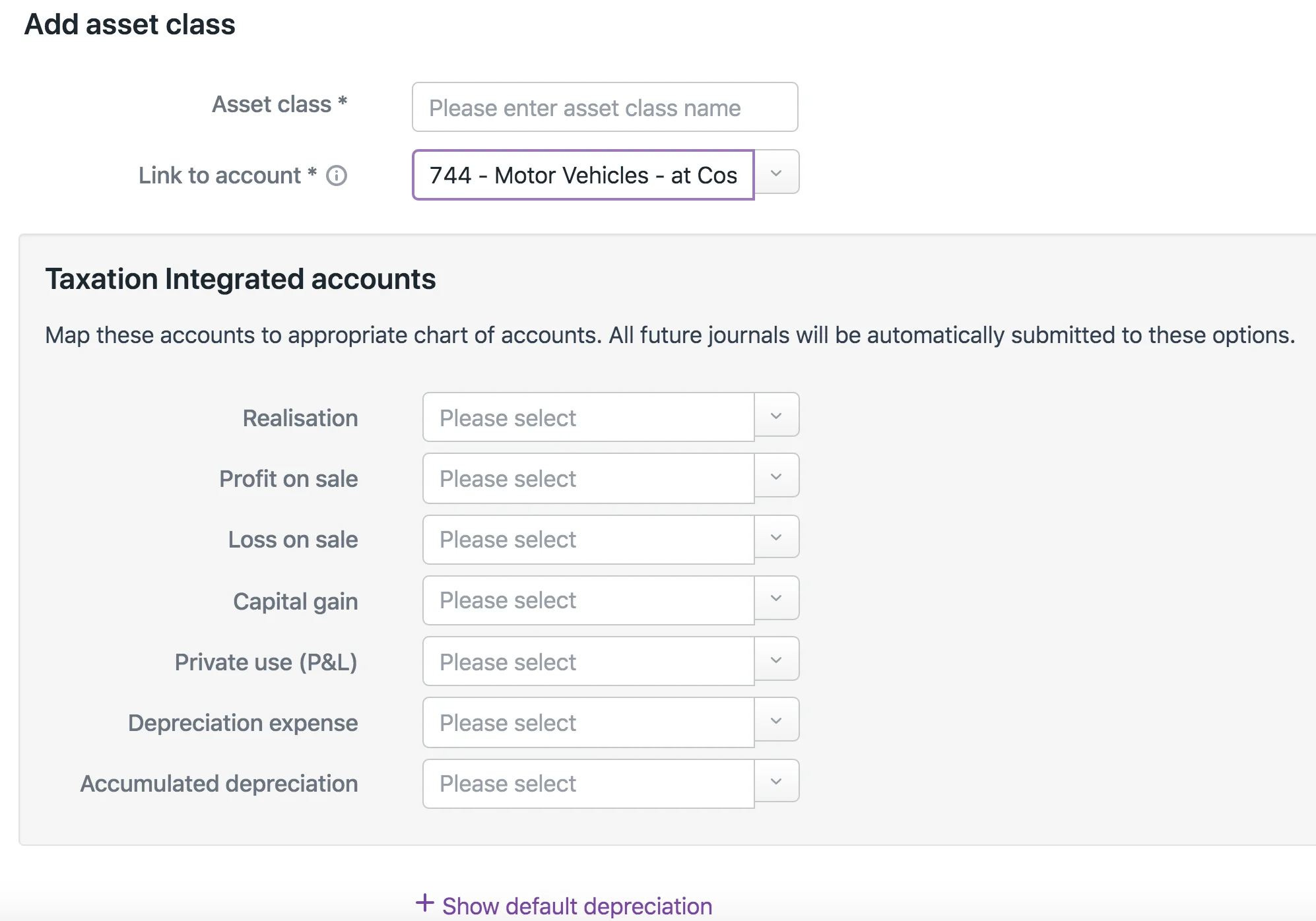

We've also enhanced the user interface when you add an asset class. The taxation integrated accounts will only be displayed after you select a Link to account.

14 October:

BAS:

We've updated our designs in line with MYOB Practice and made some improvements to make it easier to create, manage and lodge activity statements online. For more information, visit our FAQs: Activity statement upgrade page.

8 October:

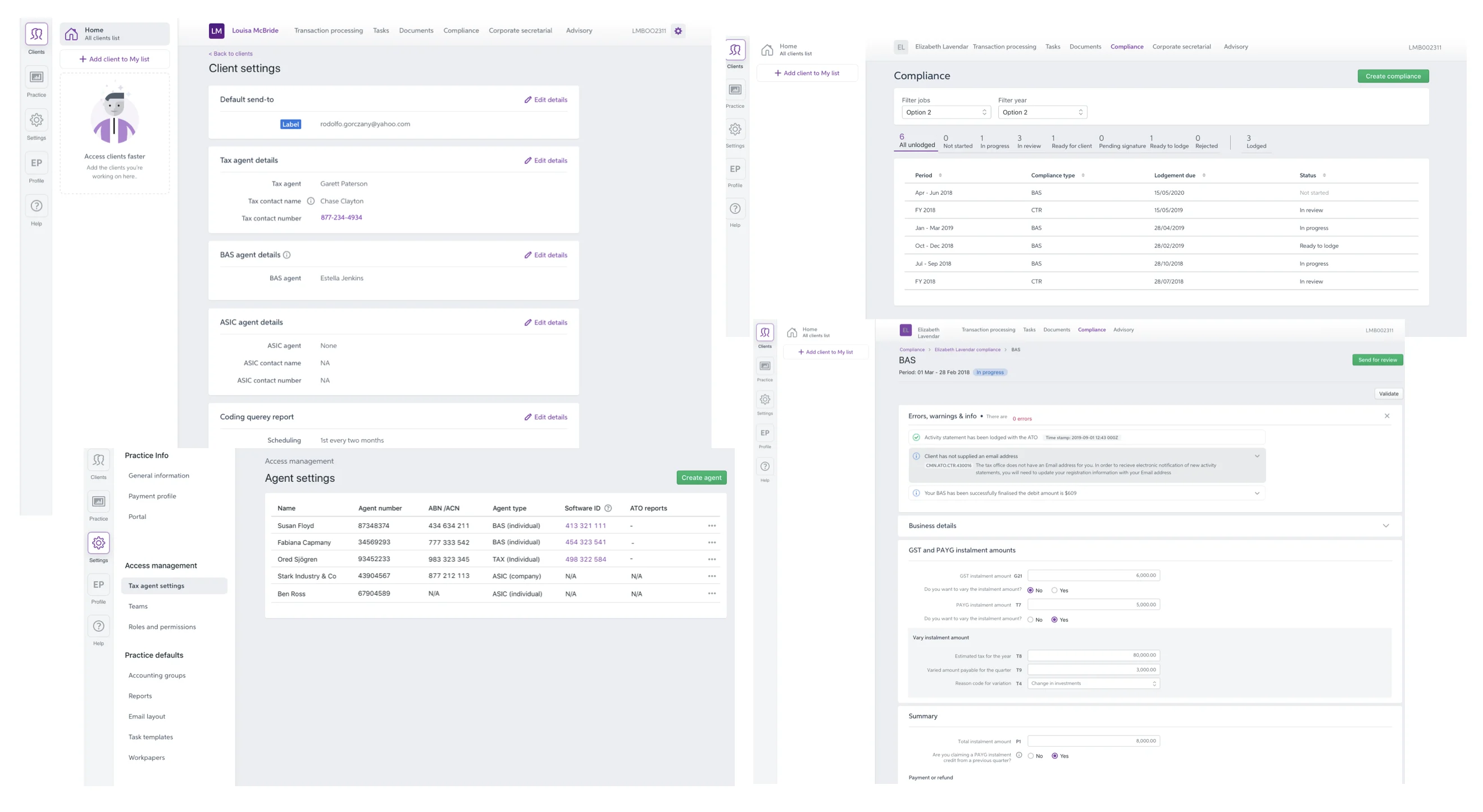

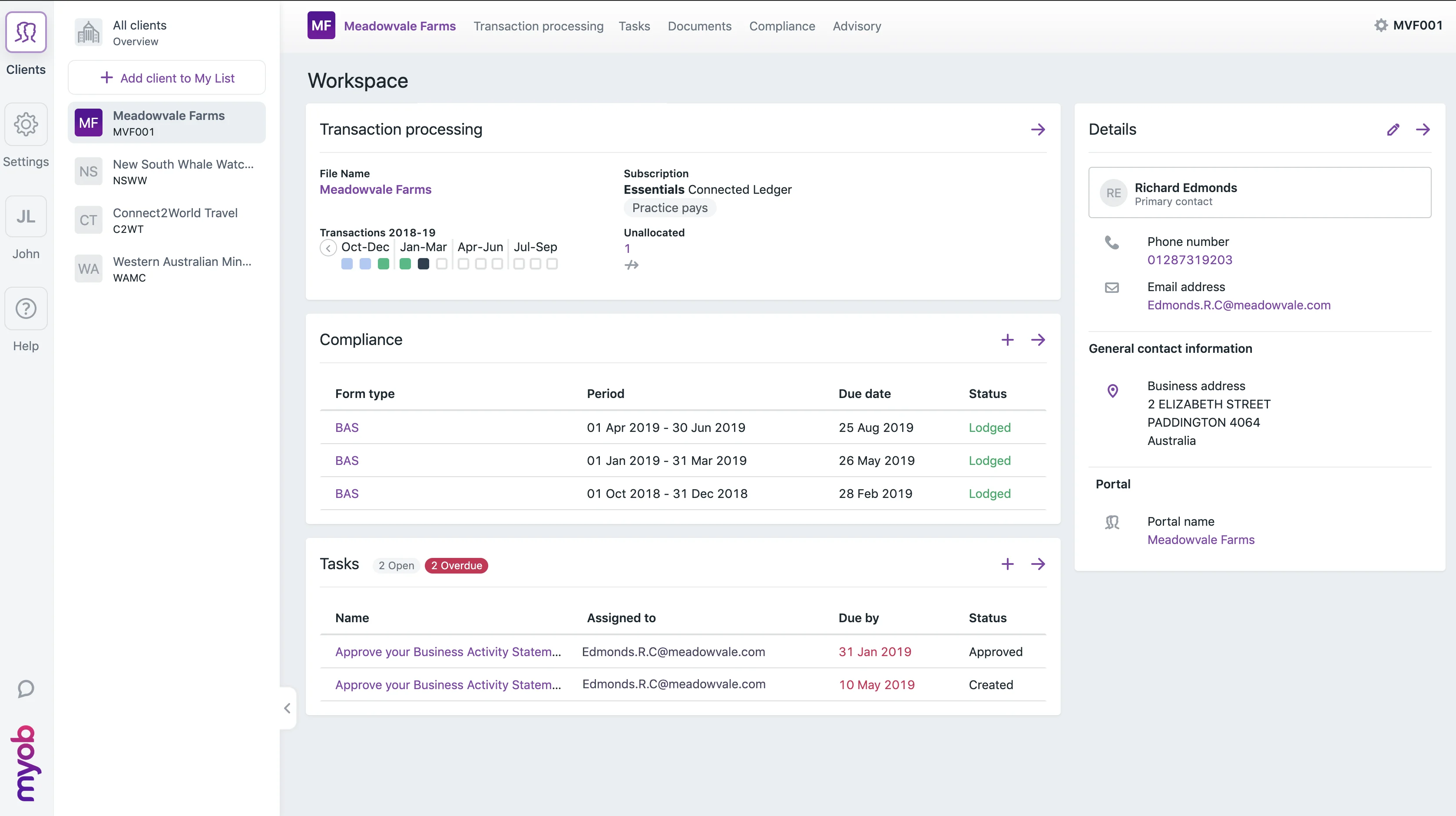

Clients: To help you stay on top of your clients we’ve introduced the

Client workspace page. It shows you a client’s contact details, linked portal, tasks, MYOB Essentials or AccountRight file, and open compliance work (Australia only) all on the one page.

To access a client’s workspace, the client needs to be added to My List. We’ll automatically show you a client’s workspace the first time you select them from My List in a session. You can view a workspace again at any time by clicking their name in the top menu bar.

29 August:

MYOB Advisor: If you’ve spent time and effort setting up budgets for your MYOB Essentials and AccountRight clients, good news – you can now instantly add budget comparisons to the revenue and expense charts and narratives in their advisory reports!

For MYOB Essentials files, you can choose which budget to compare when creating a new report.

For AccountRight files, you can only set up one budget per file, so just click the Budget checkbox and you’re set.

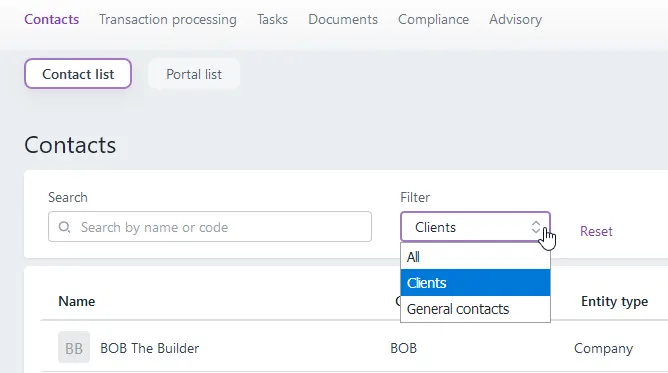

1 August:

Clients: If you use MYOB AE/AO in your practice, your general contacts, the ones who are not marked as "clients", will now sync with MYOB Practice. This means your clients and general contacts will all be accessible from MYOB Practice.

To enable this sync, make sure you've activated contact migration.

Use the new filter to see just your clients, just your general contacts, or a combined list.

To help differentiate individuals from other organisations in your contact list, the person's initials will now be shown in a circle, while all other entity types will still show in a square.

We've renamed the Clients menu bar item to Contacts, and the Client list button to Contact list.

31 July:

We've renamed the Portal notifications settings page to Email notifications. This is in preparation of some new features we're working on that are beyond the scope of portals. Stay tuned...

23 July:

Tax (Australia): Now all MYOB AE/AO Tax users can see the status of their clients' activity statements on the Transaction processing page. Just select the Refresh ATO details daily option on the Tax settings page to turn it on. Learn more about statuses.

10 July:

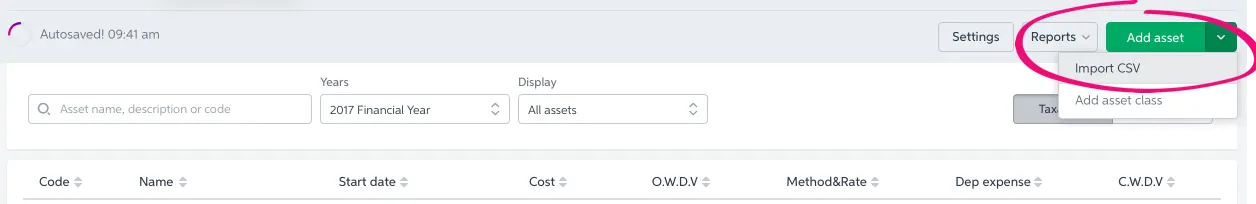

Assets in a browser:

These features are available if you are part of the Assets beta program.

You can now import assets into the asset register using a CSV file that you have created in Excel, or exported from another system. Learn more about quickly adding a number of assets to the asset register instead of adding them one by one.

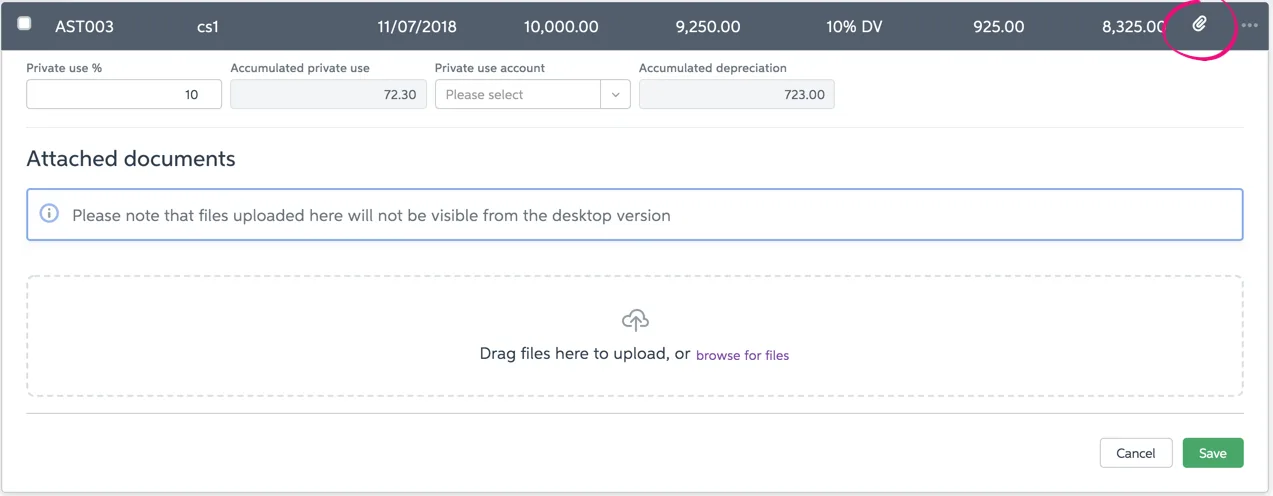

You can attach any related documents to an asset by clicking the paperclip icon or by dragging and dropping the document in the expanded view of an asset.

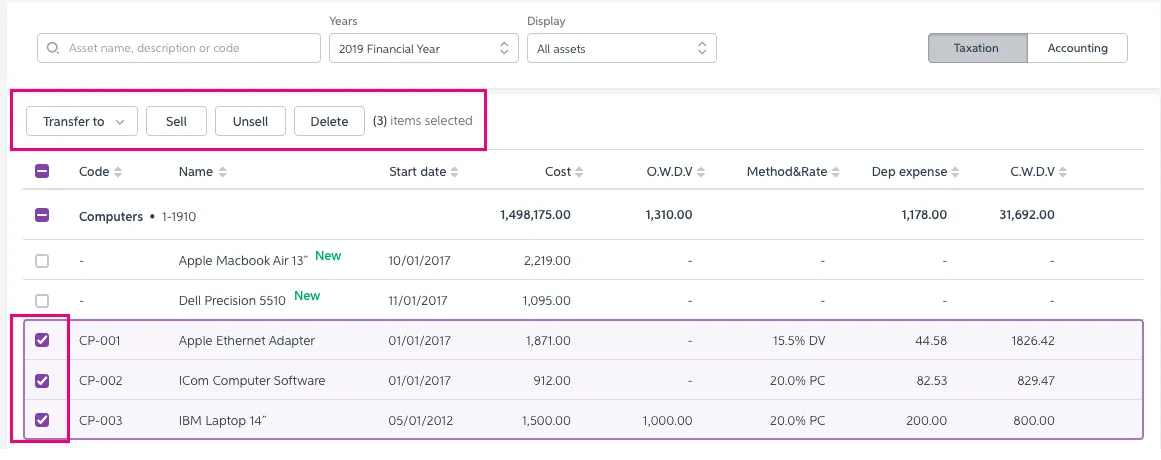

You can now perform bulk actions on multiple assets by selecting two or more assets and then choosing your bulk action: transfer, sell, unsell or delete.

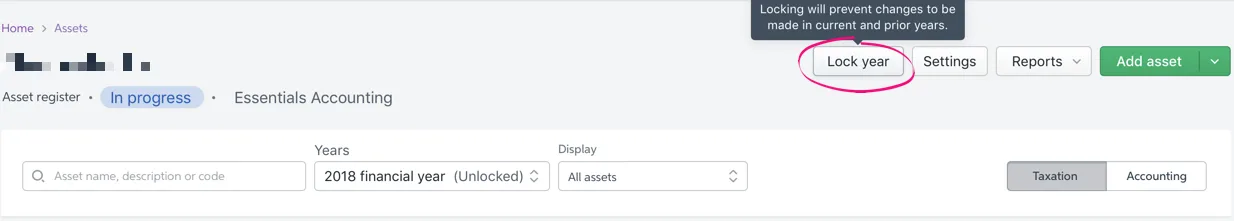

Lock and unlock the asset register when needed. This prevents accidental changes to an asset, which will cause a re-calculation of depreciation values for the current year and later years.

If you lock the asset register for the current year, any available prior years are locked.

If you unlock the asset register for the current year, any available subsequent years are unlocked.

8 July:

MYOB Advisor:

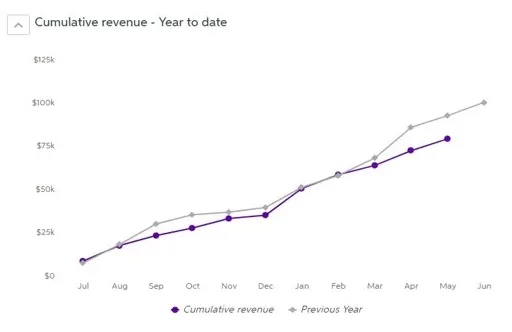

This year vs last year: You can now easily compare this year's and last year's results, side by side, on these reports:

Revenue

Cumulative revenue

Cost of sales

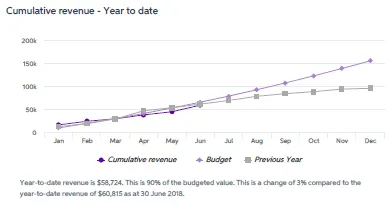

Operating expenses

Simplified cumulative revenue: Monthly revenue results no longer show as bars on the Cumulative revenue chart. This makes the chart easier to read, and if you need this information, you can view it in the Revenue chart.

31 May:

Client details: Now you can see which portal a client belongs to from the Client Details page. And if they don't have a portal yet, you can either create one for them or add them to an existing portal.

08 May:

Coding reports: You can now specify default coding report frequencies for each client. Then you can filter the Transaction processing page to show just the clients you need to prepare coding reports for. Learn more about coding report preferences.

06 May:

Client list: Now you can see key information about your clients from the main Client list page. You can see their primary contact name, phone number and email address in the main list, as well as their ABN or IRD numbers.

Coding reports: We've tweaked the coding report workflow a little, so that you now select the transaction date range on the first window.

15 April:

Tax: For MYOB Partners in Australia who don't use MYOB AE/AO in their practice, you can now prepare and lodge activity statements for your clients using MYOB Practice. It's a secure and integrated workflow that lets you request digital signatures as approval for their forms, saving lots of time and effort. Watch the video, and read more here.

02 April:

Transaction processing: For MYOB Partners who don't use MYOB AE/AO in their practice, you can now create a client on the Transaction processing page and link them to their MYOB Essentials or MYOB AccountRight file in the one workflow. When creating a client this way, some of their details will be prefilled for you based on their file information. Click Link/Create client for a file to give it a go. Learn more

01 April:

MYOB Advisor: For more consistency and clarity, we've simplified the titles of most charts in the advisory report:

Revised chart titles

Previous chart titles | New chart titles |

|---|---|

Accounts receivable breakdown | Aged receivables |

Accounts receivable monthly balance | Receivables balance - Last 12 months |

Business performance | Performance summary |

Business position | Financial position |

Cash at Bank | Cash at bank |

Cash balance trend | Cash balance - Last 12 months |

Cash flow summary | Cash flow overview - Month/Period |

Cost of sales summary - Last 12 months | Cost of sales - Last 12 months |

Cumulative year-to-date revenue vs. prior year | Cumulative revenue - Year to date |

Current top debtors | Top debtors by amount owed |

Operating expenses summary- Last 12 months | Operating expenses - Last 12 months |

Operating expenses variation | Operating expenses variation |

Outliers report: Invoices more than 3 months Largest invoices to pay attention to | Outliers: Invoices overdue more than 3 months Largest overdue invoices |

Revenue summary | Revenue – last 12 months |

Top customers by revenue | Top customers by revenue - Month/Period |

Top debtors invoice summary | Top debtors’ outstanding invoices |

Top operating expense | Top operating expenses - Month/Period |

Top products by revenue | Top products by revenue - Month/Period |

07 February:

For each portal you can now choose 'bulk task assignees', that is, the people who should be assigned tasks created from the Transaction processing page. Previously these tasks would be assigned to all full access users.

The Create task feature on the Transaction processing page has been updated. You can now drag-and-drop files into the task from your PC, and the task will be assigned to 'bulk task assignees' if they have been set up, instead of all full-access users.

29 January:

The Documents within MYOB Practice and Tasks pages have been updated so you have easier access to the filters. We’ve also added counters to show how many documents (sent/received) or tasks (open/closed) are in the list, based on the selected client, or the filters you’ve applied to the list.

When creating a task, or adding comments, you can now attach files by dragging and dropping them from your PC into the task. You can even add multiple files at one time.

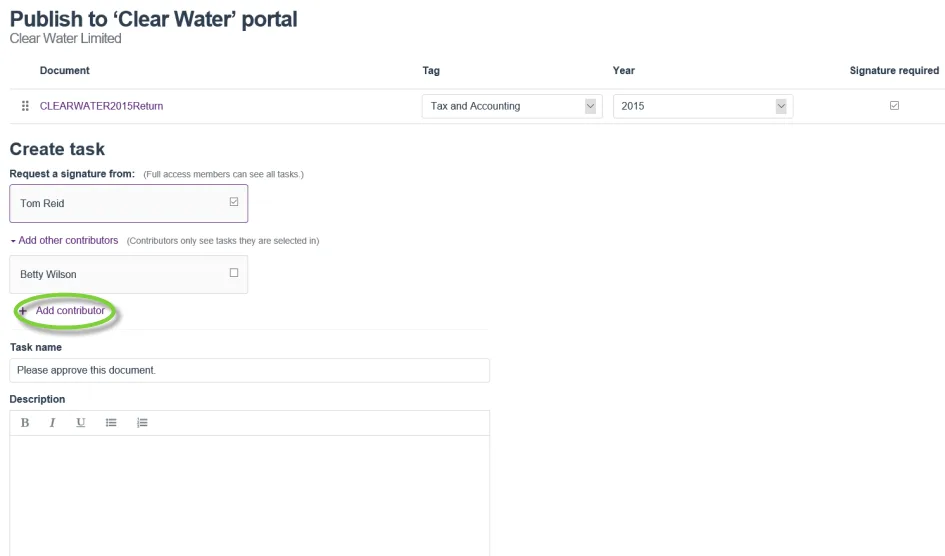

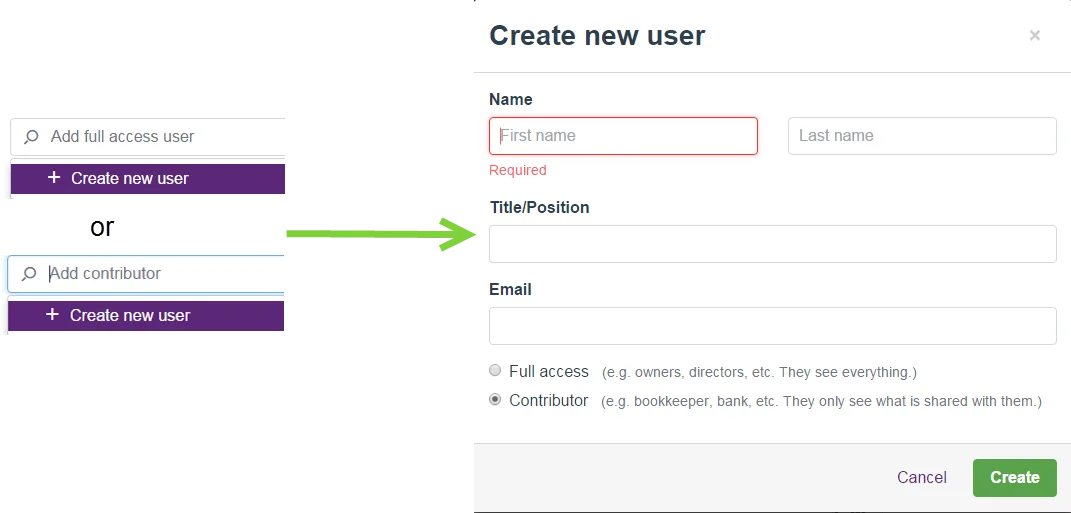

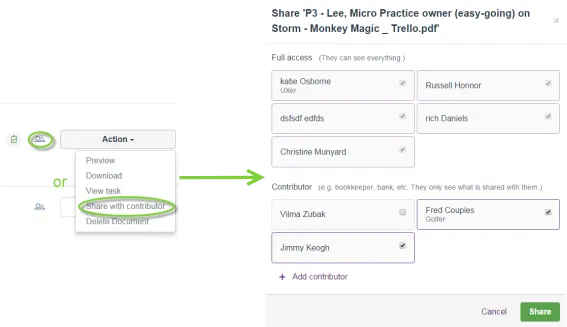

We’ve updated the MYOB AE/AO document publishing workflow, so it’s easier for you to get docs uploaded to your clients’ portals.

2018 improvements

7 December:

MYOB Advisor: To make it easier for your clients to review their business expenses, we’ve separated the “Cost of Sales & Operating Expenses Summary” line chart into two bar charts. This also gives you more flexibility as you can hide a chart if it isn’t relevant, or add more recommendations in the additional note field that’s now available.

27 November:

MYOB Advisor: In response to your feedback, we've tweaked how historical data is presented in the following charts:

Revenue summary

Cash balance trend

Cost of sales and operating expenses summary

Accounts receivable monthly balance

For these charts, we'll always show historical results for a full year, either as 12 individual months, 4 quarters, or 6 two-month periods (depending on the report filter you selected). Previously these reports would show 6 months, 6 quarters or 6 two-month periods.

7 November:

Navigation: If you're not using the new navigation, you'll notice we renamed the "Accounting" dashboard option in the side menu to "Transaction Processing". This more accurately describes what you can do on that page.

29 October:

Navigation: If you’ve added a few clients to My List, good news! They’ll now show up on each device and browser you log into automatically. Previously, changes to My List were saved only on the device and browser you were using. And the list will be remembered, even if you clear your browser’s history and files.

23 October:

MYOB Advisor: If you hide a section or chart series and save the client's report, this setting will be remembered, and will apply when anyone creates a new report for that client.

24 September:

Navigation: The new client-centric navigation experience is now also available to users who don't use MYOB AE/AO in their practice. Click the "Try the new navigation" alert in the top right of the page to give it a go.

3 September:

MYOB Advisor: Previously for some advisory charts you could choose to hide one or more series when viewing the report (like shown below), but any changes you made wouldn't be saved, and they wouldn't appear in the exported report. Now if you edit a chart, the changes will be saved and reflected in the PDF report.

15 August:

MYOB Advisor:

The & symbol now appears correctly in the PDF reports.