Payday Super is coming 1 July 2026 - find out how to get ready and stay compliant.

The minimum super guarantee rate increased to 12% on 1 July 2025. Find out how to automatically stay compliant.

After you’ve recorded pays for your employees, you can make super payments to their funds directly from MYOB with Pay Super.

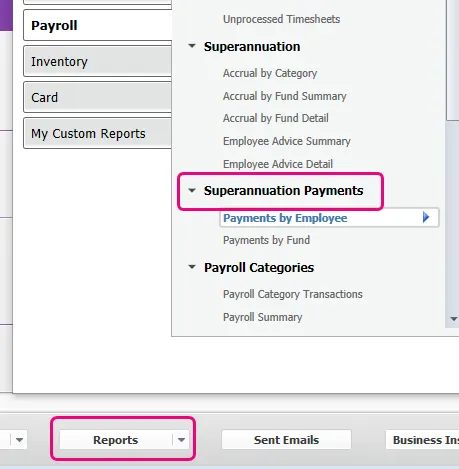

See the super payments you've paid and need to pay using the Superannuation payments report (Reporting menu > Reports > Payroll tab > Superannuation payments).

Super payment due dates

You are required to pay superannuation guarantee contributions at least quarterly. These contributions must be paid within 28 days of making the final contribution for the quarter.

Superannuation guarantee | Cut-off date for superannuation guarantee contributions |

|---|---|

1 January–31 March | 28 April |

1 October–31 December | 28 January |

1 April–30 June | 28 July |

1 July–30 September | 28 October |

To ensure the funds receive your payments in time, you should authorise the super payments in MYOB at least 5 business days before they are due.

To make superannuation payments

Go to the Payroll menu and choose Super payments.

Click Create super payment.

Use the Transactions from and Transactions to fields to specify the date range of the pays containing super payments you need to make, then click Apply filters.

If you can't see super payments for your employees, check that you've selected the option Pay using PaySuper for each of your employee's super funds. See Set up superannuation funds for details.

In the Account field, choose the bank account from which you're paying.

Your super payments will always be taken out of the bank account you nominated (and verified) when you set up Pay Super. But choosing the wrong account here will affect the accuracy of your data in MYOB, so make sure you choose the account that corresponds to the one you selected when signing up for Pay Super. To change the bank account your super payments come from, see Changing your Pay Super payment details.

In the Date of payment field, enter the date that you're recording this transaction.

This date is the journal date, not the date that the funds will be debited from your bank account. The payment will be processed on the day that the payment is authorised, even if a transaction date entered in this page is different.

Select the payments you want to process.

Click Record.

If prompted, log in with your MYOB account details.

If you don’t have permission to authorise the payment, or you want to authorise it later, click No. You don’t need to do anything else for now. The payment can be authorised later from the Super payments page.

If you do have permission to authorise the payment, and want to do it now, click Yes and continue with the following steps.

Click Authorise.

If prompted, log in with your MYOB account details and click Get code. An authorisation code will be sent by SMS to your mobile phone.

It may take up to twenty minutes to receive the SMS, so make sure you give it enough time. Also, make sure you're checking the same mobile number you registered with us when signing up for this service.Still haven't got the SMS after twenty minutes? Click Resend authorisation code to receive another one, or contact us for help.

Retrieve the SMS code, enter it in the Authorisation code field and click Authorise.

The Success! message will appear and your payment has started being processed.

If more than one authoriser needs to authorise each super payment, the Almost there! window will appear instead. Click OK to go through the authorisation process again.Click OK to finish.

What is the status of my super payment?

Once you've recorded a payment, you can view its status or authorise it from the Super payments window.

If you have a question about a super payment or its status, contact us and we'll be happy to help.

Status | Description |

|---|---|

Pending Authorisation | The payment has been recorded, but needs to be authorised before it can be processed. |

Partially Authorised | The payment has been authorised by at least one authoriser or Pay Super Administrator, but needs to be authorised by at least one more before it can be processed. |

Authorised | The payment has been authorised and has started being processed, but the funds haven't yet been withdrawn from your bank account. |

Processing Payment | The payment has been sent for processing and the direct debit has been initiated. This status may remain for up to 3 business days. If this status is showing for more than 5 days, contact us to look into it. |

Completed | The payment has been processed, and contributions are being paid into your employees' superannuation funds. |

Payment Failed | There was an error making this payment and you'll need to contact us. |

Reversal Required | There was an error which prevented the contributions being paid into your employees' superannuation funds. MYOB will transfer the funds back into your bank account. You'll need to reverse the payment in MYOB, and record it again. |

Reversal Completed | When you reverse a super payment that has a status of Reversal Required or Payment Failed , the status will change to Reversal Completed once the reversal has been processed. |

FAQs

How long does it take for superannuation funds to receive payments?

It usually takes around five business days for superannuation payments to be authorised, processed and received by super funds. However, delays can occur (such as payments being rejected due to data errors), so we recommend allowing up to 10 business days for your payment to process. If your payment hasn't been completed after 10 business days, contact us.

What if a super payment has been authorised in error?

MYOB can't stop authorised payments.

But if it's before 4pm (Melbourne time) and the payment hasn't been debited from your account, contact your bank and request them to stop the direct debit.

If the payment has already been debited from your account and your bank can't recall the funds, you'll need to contact the super funds and request a refund.

If you need payment reference numbers for any super payments, contact our support team who will be happy to help.

How do I change my Pay Super authoriser?

If you're a Pay Super Administrator, you can make this change online. If there's no Pay Super Administrators in the business, you'll need to submit a form to change an authoriser.

For more info, see Add a Pay Super payment authoriser.

How do I check the super calculation or adjust a super payment?

MYOB calculates the amount of superannuation you need to pay on behalf of your employees, but on occasions the figure calculated might appear to be wrong. Our help topic Checking and adjusting superannuation guides you through the areas you need to check, and how to adjust over- or under-paid superannuation amounts.

Who are PayClear and SuperChoice and what do they do?

Super contributions made using MYOB's PaySuper service are facilitated by a clearing house. Due to banking laws you may see these payments in your bank records as payments to SuperChoice or its related entity PayClear Services.

You can read more about this relationship in the MYOB PaySuper Financial Services Guide and Product Disclosure Statement.

AccountRight Plus and Premier only

The minimum super guarantee rate increased to 12% on 1 July 2025. Find out how to automatically stay compliant.

After you’ve recorded pays for your employees, you can make super payments to their funds directly from AccountRight with Pay Super.

Having trouble with Pay Super or something needs fixing? Check our troubleshooting suggestions.

Super payment due dates

You are required to pay superannuation guarantee contributions at least quarterly. These contributions must be paid within 28 days of making the final contribution for the quarter.

Superannuation guarantee | Cut-off date for superannuation guarantee contributions |

|---|---|

1 July–30 September | 28 October |

1 October–31 December | 28 January |

1 January–31 March | 28 April |

1 April–30 June | 28 July |

To ensure the funds receive your payments in time, you should authorise the super payments in AccountRight at least 5 business days before they are due.

To make superannuation payments

Go to the Payroll command centre and click Pay Superannuation.

In the Pay From Account field, select the bank account from which you're paying.

Your super payments will always be taken out of the bank account you nominated (and verified) when you set up Pay Super. But choosing the wrong account here will affect the accuracy of your data in AccountRight, so make sure you choose the account that corresponds to the one you selected when signing up for Pay Super. To change the bank account your super payments come from, see Changing your Pay Super payment details.

In the Payment Start Date and Payment End Date fields, select the date range for which you want to view payments.

If you can't see super payments for your employees, check that you've selected the Pay directly from AccountRight option in the Superannuation Fund Information window for each of your employee funds. Check your super fund and employee details.

In the Date field, enter the date that you are recording this transaction.

This date is the journal date, not the date that the funds will be debited from your bank account. The payment will be processed on the day that you authorise the payment, even if a transaction date entered in this window is different.

Click in the select column next to those payments you want to process.

Seeing a red cross next to a super payment or experiencing a different issue? See our troubleshooting topic for a solution.

Click Record.

If prompted, log in with your MYOB account details. The Authorise and process now? window will appear.

If you don’t have permission to authorise the payment, or you want to authorise it later, click No. You don’t need to do anything else for now. The payment can be authorised later from the Manage Payments window.

If you do have permission to authorise the payment, and want to do it now, click Yes and continue with the following steps.

In the Pay Superannuation window, click Authorise.

If prompted, log in with your MYOB account details and click Get code. An authorisation code will be sent by SMS to your mobile phone.

It may take up to twenty minutes to receive the SMS, so make sure you give it enough time. Also, make sure you're checking the same mobile number you registered with us when signing up for this service.Still haven't got the SMS after twenty minutes? Click Resend authorisation code to receive another one, or contact our support team.

Retrieve the SMS code, enter it in the Authorisation code field and click Authorise.

The Success! message will appear and your payment has started being processed.

If more than one authoriser needs to authorise each super payment, the Almost there! window will appear instead. Click OK to go through the authorisation process again.Click OK to return to the Pay Superannuation window.

What is the status of my super payment?

Once you've recorded a payment, you can view its status or authorise it from the Manage Payments window.

If you have a question about a super payment or its status, contact us.

Status | Description |

|---|---|

Pending Authorisation | The payment has been recorded, but needs to be authorised before it can be processed. |

Partially Authorised | The payment has been authorised by at least one authoriser or Pay Super Administrator, but needs to be authorised by at least one more before it can be processed. |

Authorised | The payment has been authorised and has started being processed, but the funds haven't yet been withdrawn from your bank account. |

Processing Payment | The payment has been sent for processing and the direct debit has been initiated. This status may remain for up to 3 business days. If this status is showing for more than 5 days, contact us to look into it. |

Completed | The payment has been processed, and contributions are being paid into your employees' superannuation funds. |

Payment Failed | There was an error making this payment and you'll need to contact us. |

Reversal Required | There was an error which prevented the contributions being paid into your employees' superannuation funds. MYOB will transfer the funds back into your bank account. You'll need to reverse the payment in MYOB, and record it again. |

Reversal Completed | When you reverse a super payment that has a status of Reversal Required or Payment Failed, the status will change to Reversal Completed once the reversal has been processed. |

Need to print the super contributions you've made to funds?

Go to Reports > Payroll > Superannuation payments:

FAQs

How long does it take for superannuation funds to receive payments?

It usually takes around five business days for superannuation payments to be authorised, processed and received by super funds. However, delays can occur (such as payments being rejected due to data errors), so we recommend allowing up to 10 business days for your payment to process. If your payment hasn't been completed after 10 business days, please contact our support team.

Can I future date a super payment?

No. The superannuation payment will be processed once it has been authorised. If you enter a future date in the Date field of the Pay Superannuation window, but authorise the payment today, it will be processed today.

How do I change my Pay Super payment limit and other details?

To change Pay Super details including payment limit, user access, or the bank account your super payments come from, see Changing your Pay Super payment details.

What can I do about negative superannuation payments?

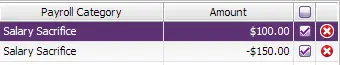

You can only process a pay super transaction if the total of selected payments is a positive value for each employee and payroll category.

For example, if you have one super payment for $100 and a pay reversal has created another super payment of -$150, the total is -$50, which can't be processed.

In this case, you'll need to wait until you have one or more additional super payments to make the total a positive value for that employee.

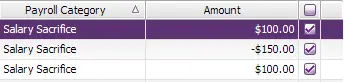

You can then select all payments to be processed. In our example there's an additional $100 super payment which makes the total for that employee positive $50. This can now be processed.

How do I check the super calculation or adjust a super payment?

AccountRight calculates the amount of superannuation you need to pay on behalf of your employees, but on occasions the figure calculated might appear to be wrong. Our help topic Checking and adjusting superannuation guides you through the areas you need to check, and how to adjust over- or under-paid superannuation amounts.

How do I fix an issue with a super payment?

If something's going wrong when making a super payment, see Troubleshooting Pay Super payments.

Who are PayClear and SuperChoice and what do they do?

Super contributions made using MYOB's PaySuper service are facilitated by a clearing house. Due to banking laws you may see these payments in your bank records as payments to SuperChoice or its related entity PayClear Services.

You can read more about this relationship in the MYOB PaySuper Financial Services Guide and Product Disclosure Statement.