If you've manually set up an employee (instead of the employee self-onboarding), or you want an employee to confirm their details are up to date, you can send them a secure request to review their details.

This request is sent via email and an optional text message to ensure the employee sees it – and responds – as soon as possible.

The employee can then correct anything that's wrong or missing, and submit any changes straight into your MYOB Business*.

To send a review request

Go to the Payroll menu > Employees.

Click the employee.

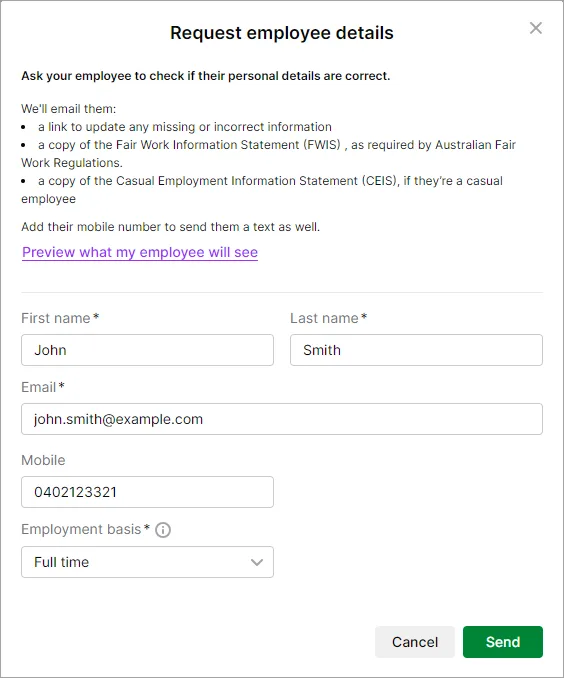

On the Contact details tab, click Request employee details.

Enter or confirm the employee's name and email address. The email address must be unique for each employee.

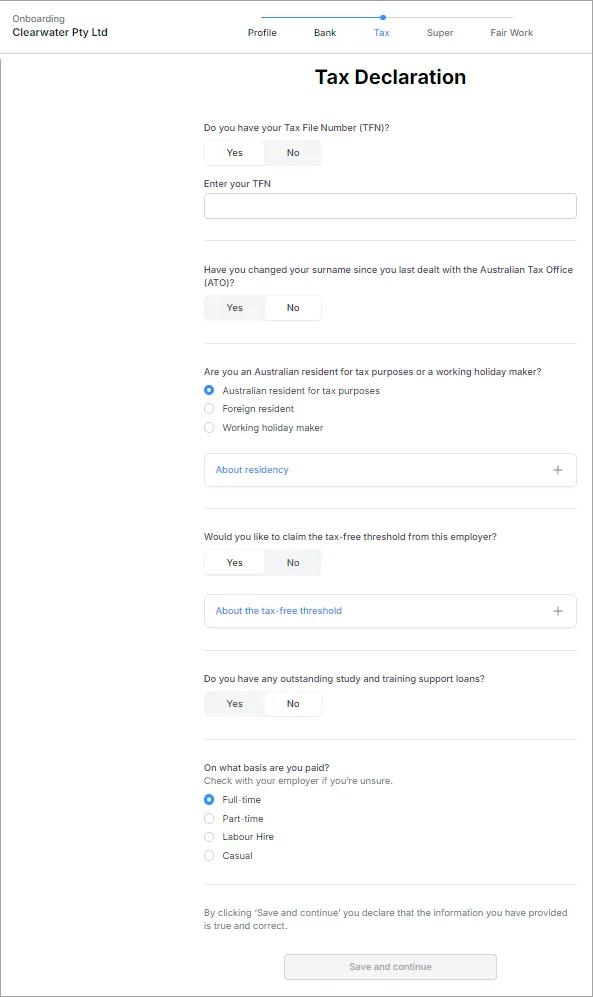

If you need the employee to submit a new or updated tax file number declaration, make sure there's no tax file number in their employee record (Payroll details tab > Taxes tab).If you'd like to also send the request via SMS text, enter the employee's mobile number.

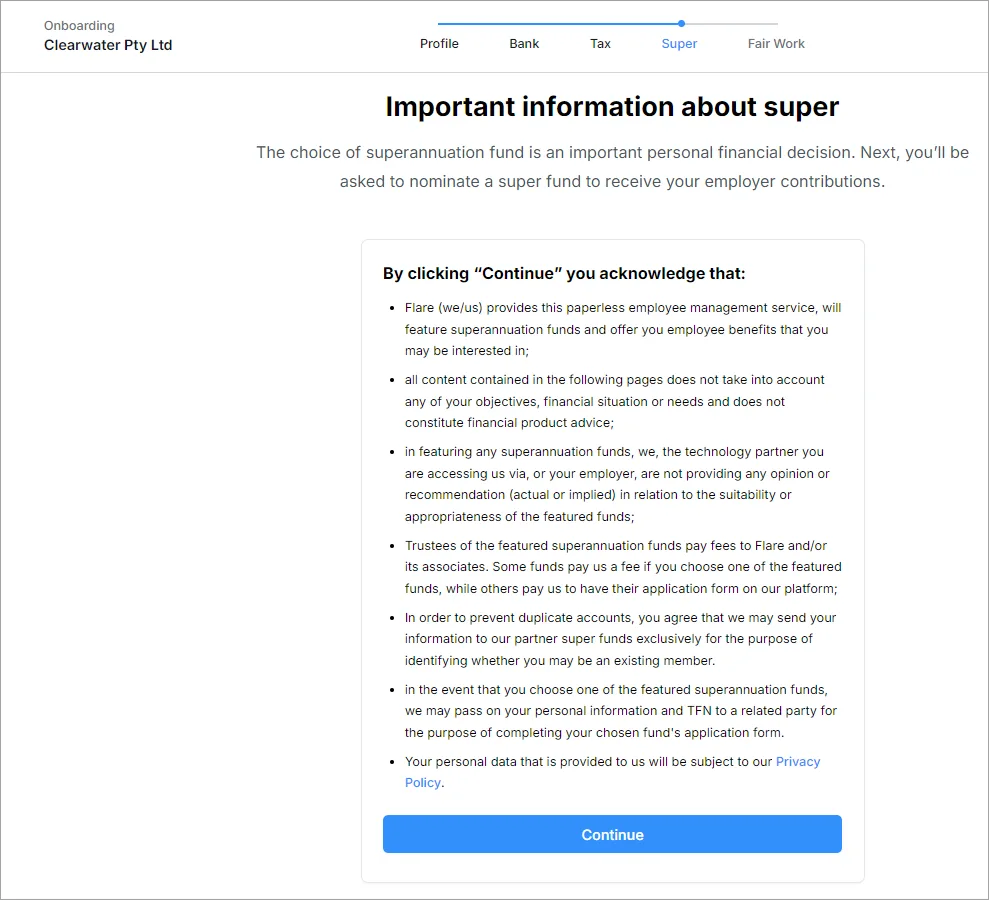

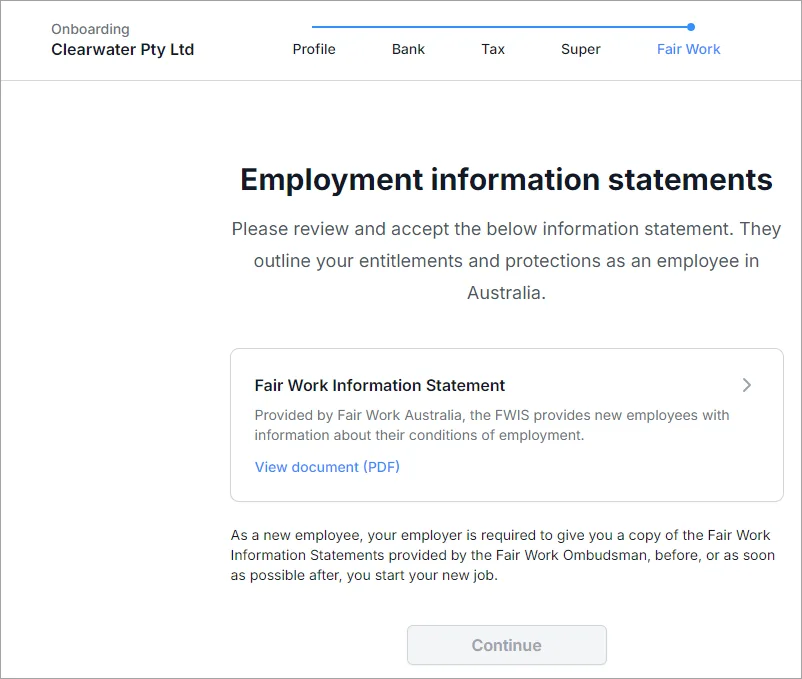

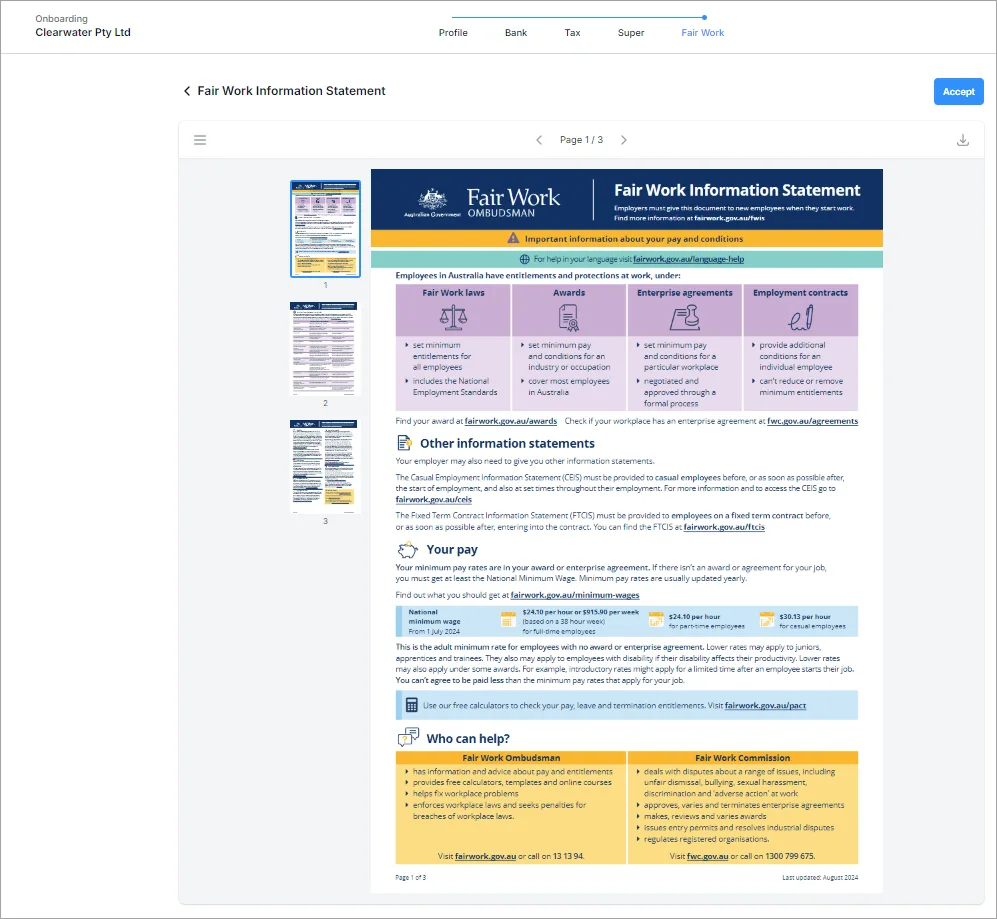

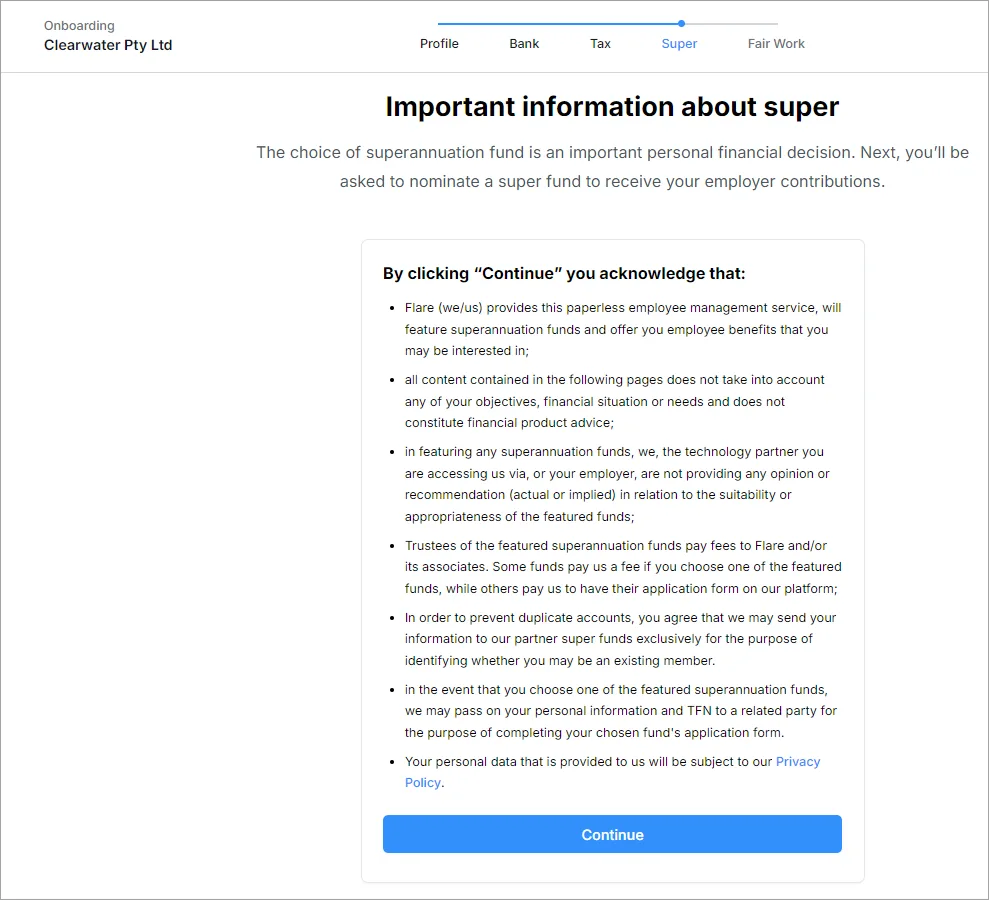

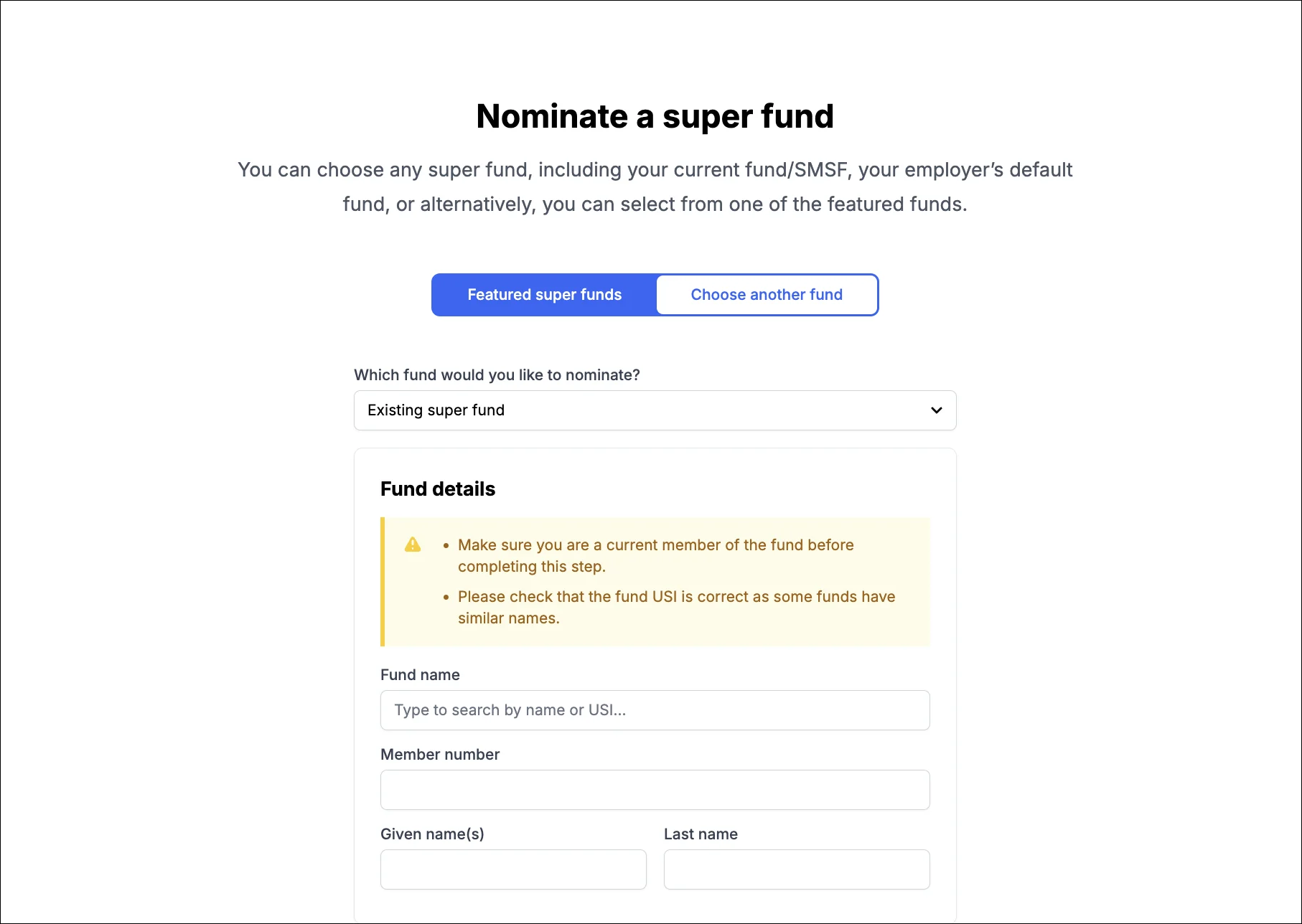

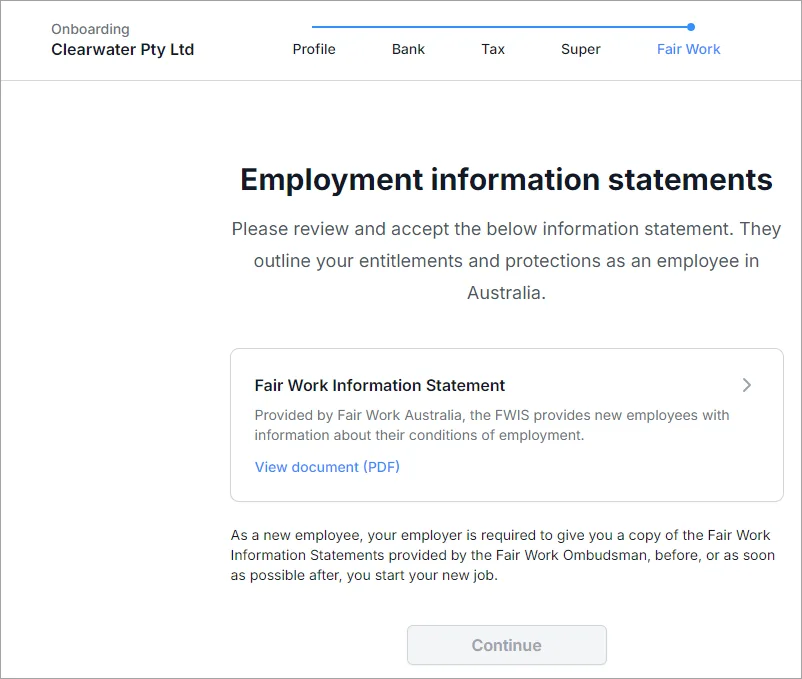

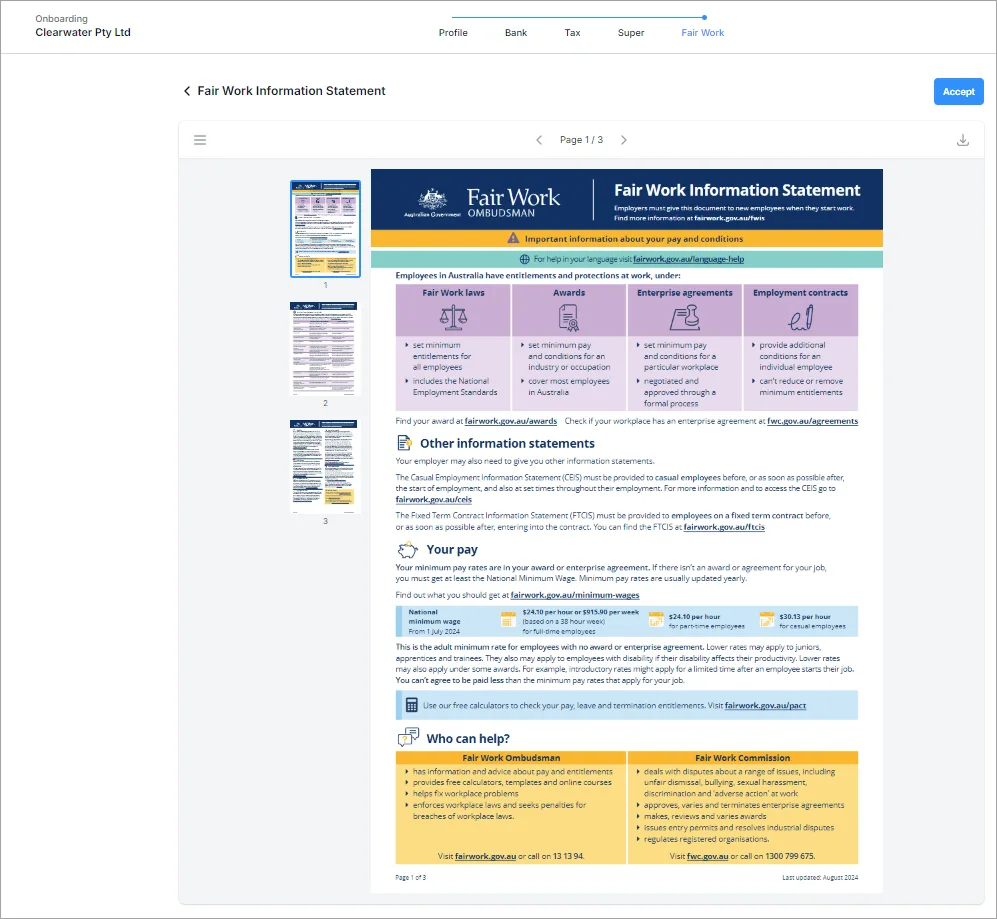

Choose the employee’s Employment basis and Employment category. When the employee self-onboards, and you've selected the fair work information statement option in your payroll settings (settings menu (⚙️) > Payroll settings > General payroll information), the employee will be provided the applicable Fair Work Information Statement (as required by Fair Work). If you choose Casual the employee will also be provided the Casual Employee Information Statement.

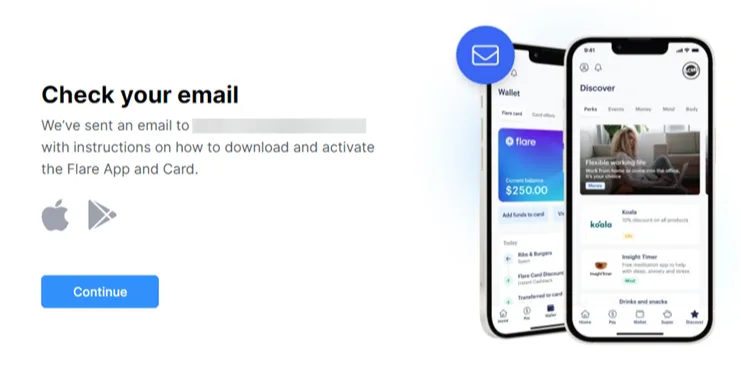

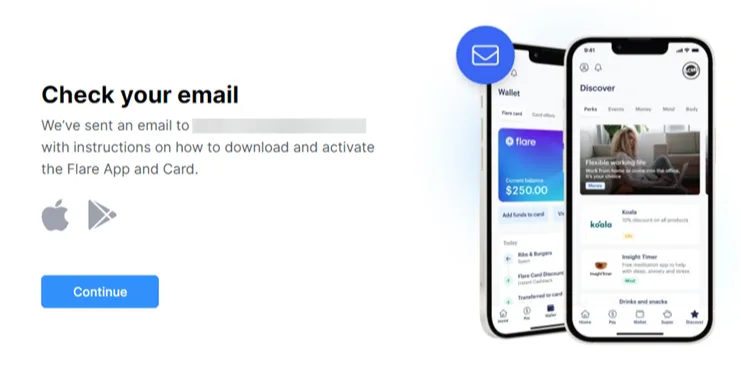

If you see the option Invite to employee benefits, choose whether you want to give the employee access to employee benefits.

If you’ve already set up employee benefits you won’t see this option as your employee will already get access to employee benefits via the Flare app once they’ve completed reviewing their details.

Click Send. An email (and SMS text message if you've entered a mobile number) is sent to the employee guiding them through the process.

What the employee sees

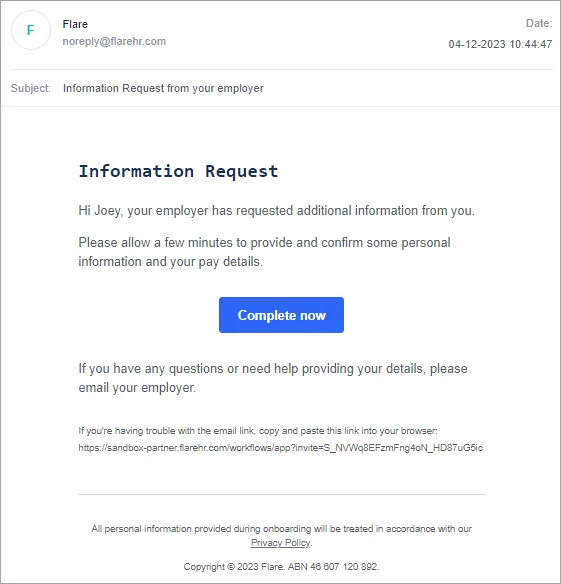

The employee will receive an email similar to this one (and a text message if you entered their mobile number) containing a link to a secure online form.

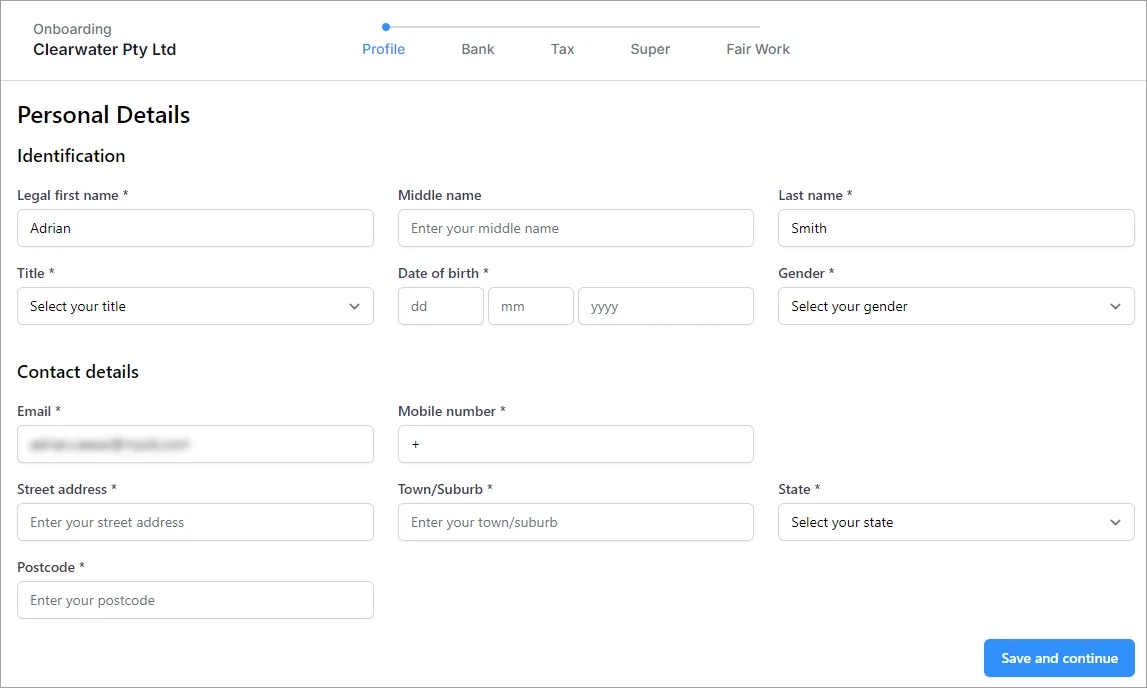

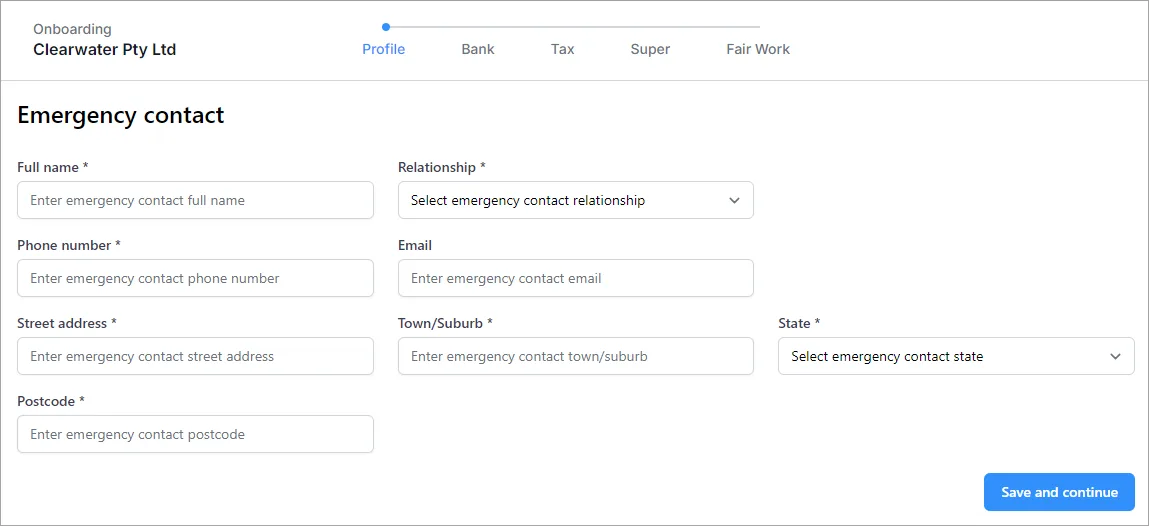

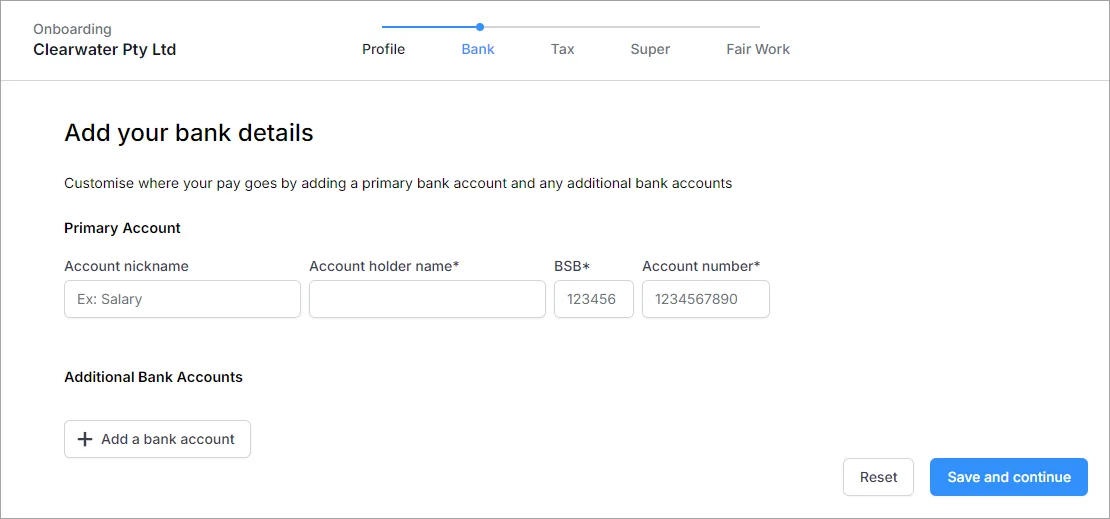

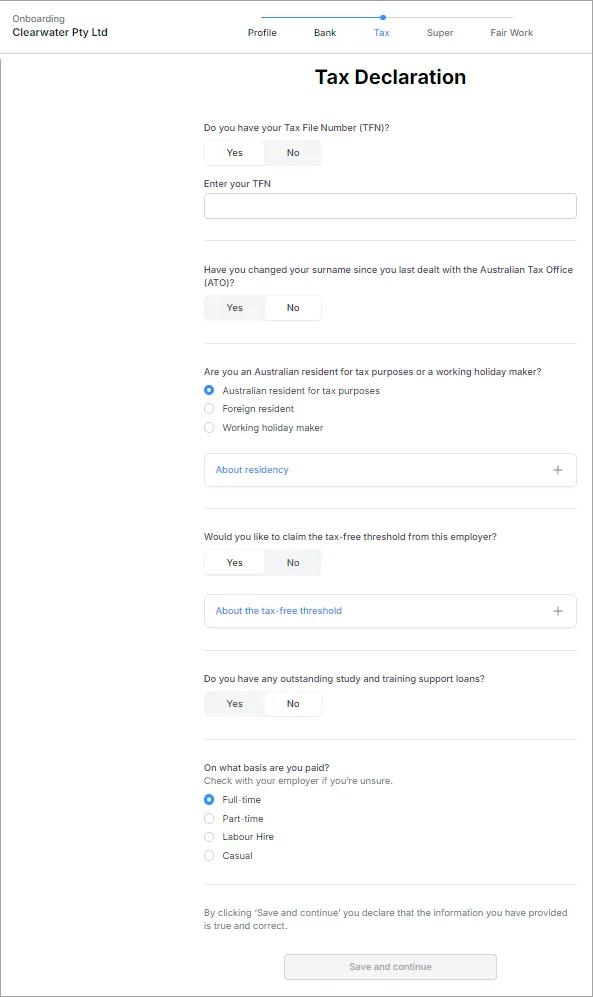

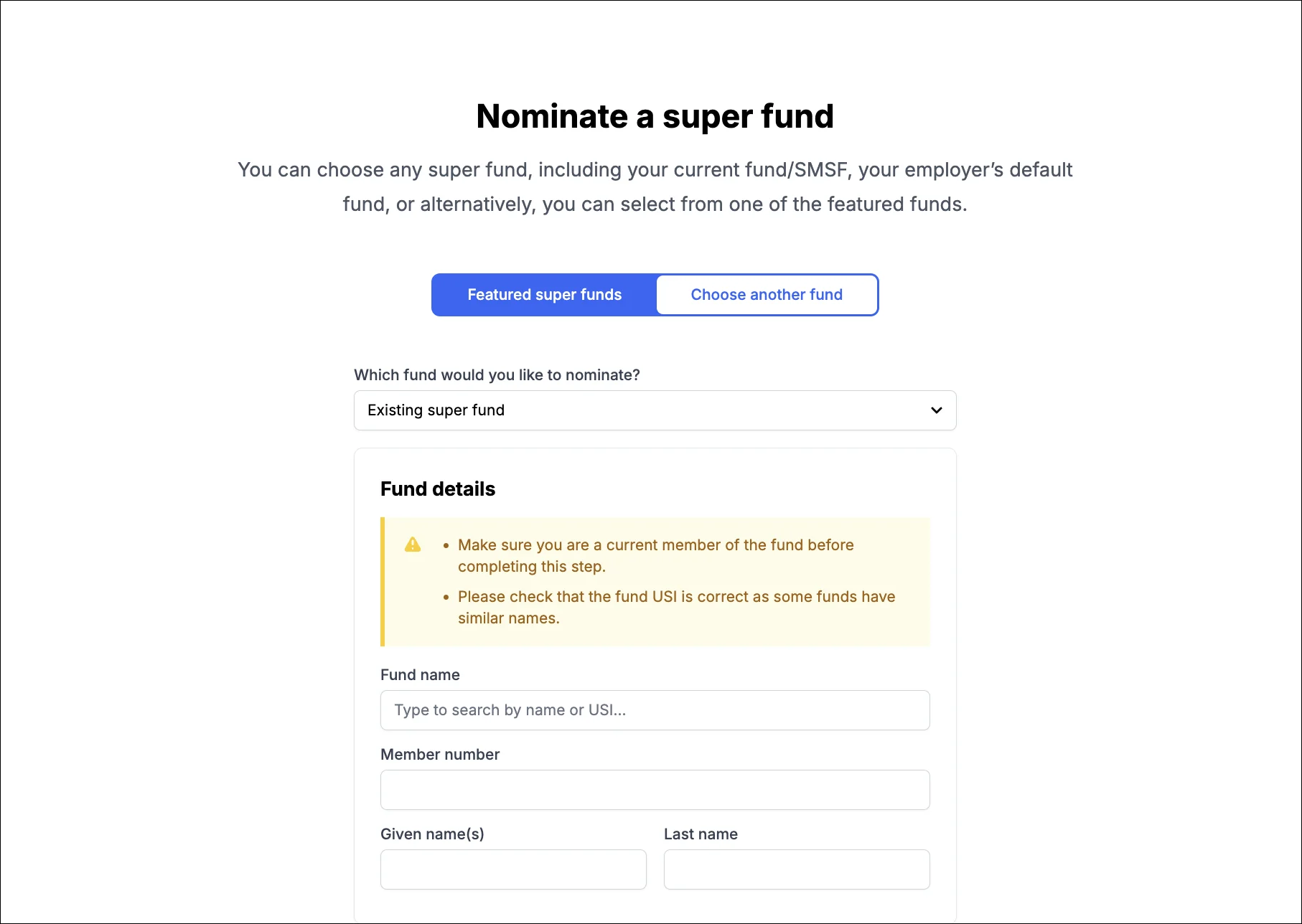

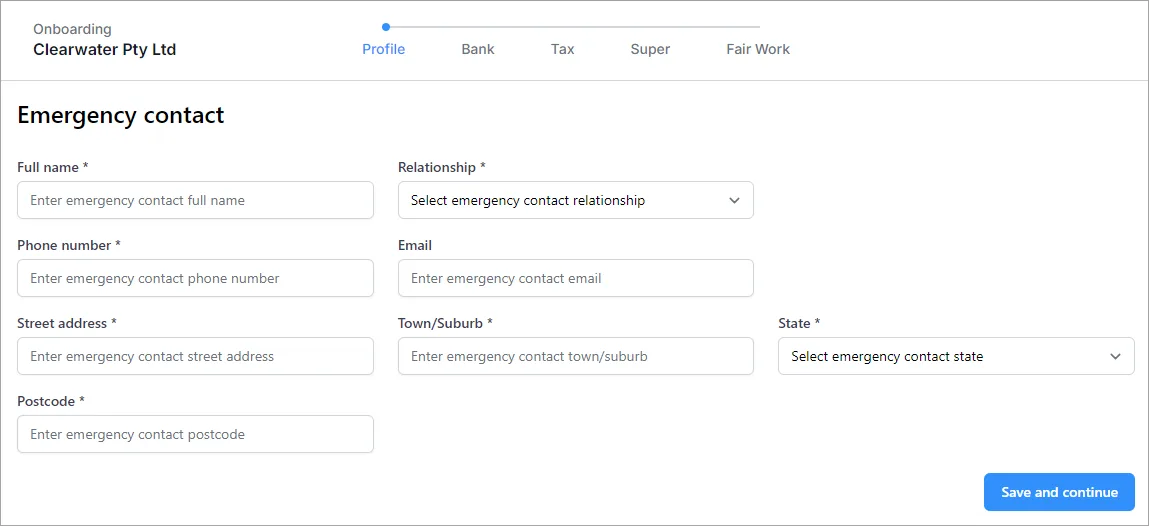

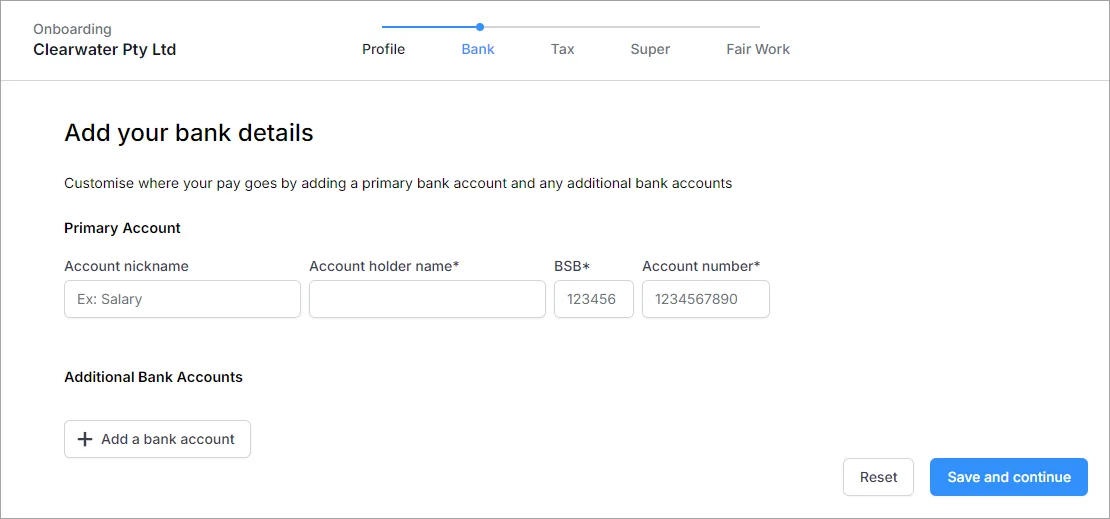

When they open the form, they'll see their details from your MYOB business. They can double-check what's there, make any changes or enter any missing information (fields marked with an asterisk are mandatory).

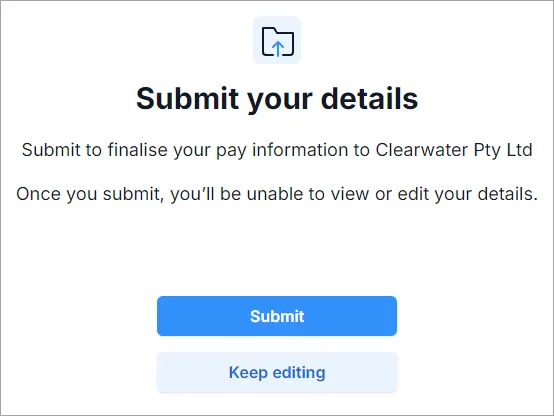

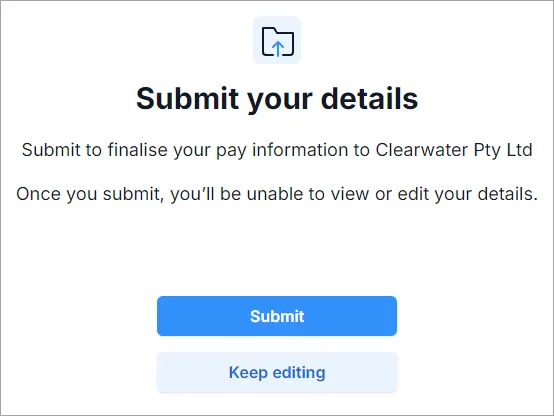

They can click Save and continue to progress to the next tab, until finally submitting the info.

Displaying the Tax Details or Bank Details tabs

If you've set the employee's payment method to cash or cheque in MYOB, they won't be shown the Bank details tab.

Similarly, if you've already entered a tax file number for them, the Tax details tab won't be shown. To show this tab, you'll need to remove the tax file number from their employee record.

Once the employee has completed all mandatory information, they can click Submit.

*This service is provided by our related entity Flare HR Pty. Ltd.

After the employee submits their details

When the employee submits their details, you'll receive an email detailing what they've provided. You can view the employee's updated details in their record (Payroll menu > Employees > click to open the employee's record).

Upload employee documents

Use the Documents tab in an employee's record to store things like workplace contracts, licenses and certificates. Take a look

AccountRight Plus and Premier online company files only

If you've manually set up an employee (instead of the employee self-onboarding), or you want an employee to confirm their details are up to date, you can send them a secure request to review their details.

This request is sent via email and an optional text message to ensure the employee sees it – and responds – as soon as possible.

The employee can then correct anything that's wrong or missing, and submit any changes straight into your AccountRight company file*.

If you're prompted to sign on to your AccountRight company file and you see the option Link this User ID to your my.MYOB account on the Sign in window, make sure you select this option. This is required to be able to send your employees a request to check their details.

To send a review request

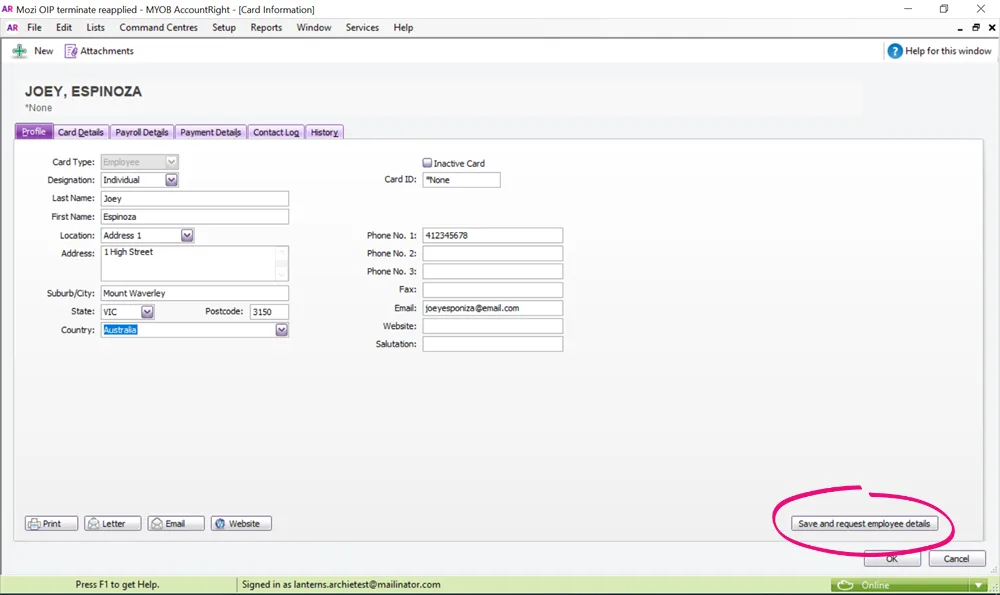

Go to the Card File command centre > Cards List.

Click the Employee tab.

Click the zoom arrow to open the employee's card.

On the Profile tab, click Save and request employee details.

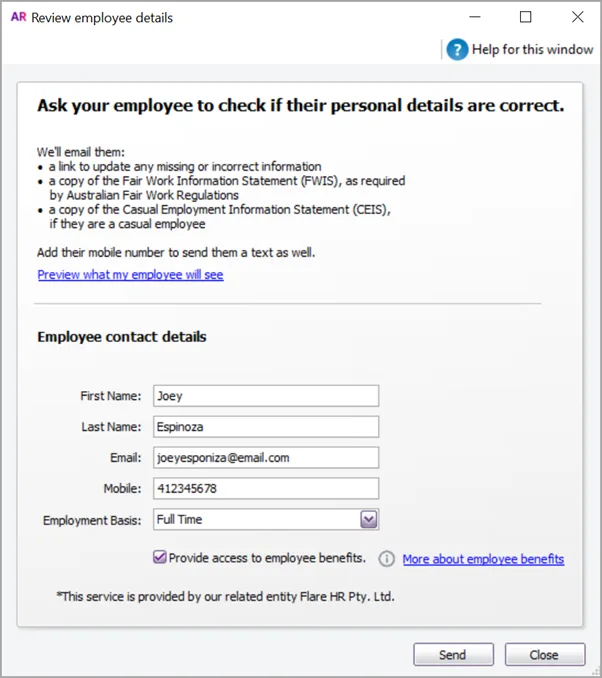

Enter or confirm the employee's name and email address. The email address must be unique for each employee.

If you need the employee to submit a new or updated tax file number declaration, make sure there's no tax file number in their employee card (Payroll Details tab > Taxes tab).If you'd like to also send the request via SMS text, enter the employee's mobile number.

Choose the employee’s Employment Basis and Employment Category. When the employee self-onboards, and you've selected the fair work information statement option in your payroll settings (Setup menu > General Payroll Information), the employee will be provided the applicable Fair Work Information Statement (as required by Fair Work). If you choose Casual the employee will also be provided the Casual Employee Information Statement.

If you see the option Provide access to employee benefits, choose whether you want to give the employee access to employee benefits.

If you’ve already set up employee benefits you won’t see this option as your employee will already get access to employee benefits via the Flare app once they’ve completed reviewing their details.

Click Send. An email (and SMS text message if you've entered a mobile number) is sent to the employee guiding them through the process.

What the employee sees

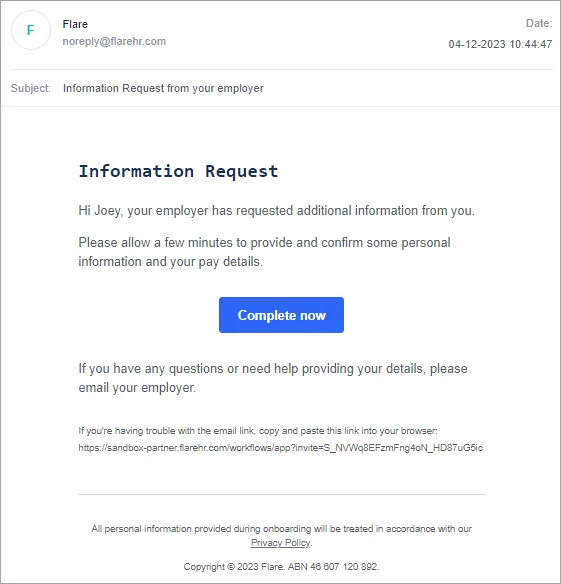

The employee will receive an email similar to this one (and a text message if you entered their mobile number) containing a link to a secure online form.

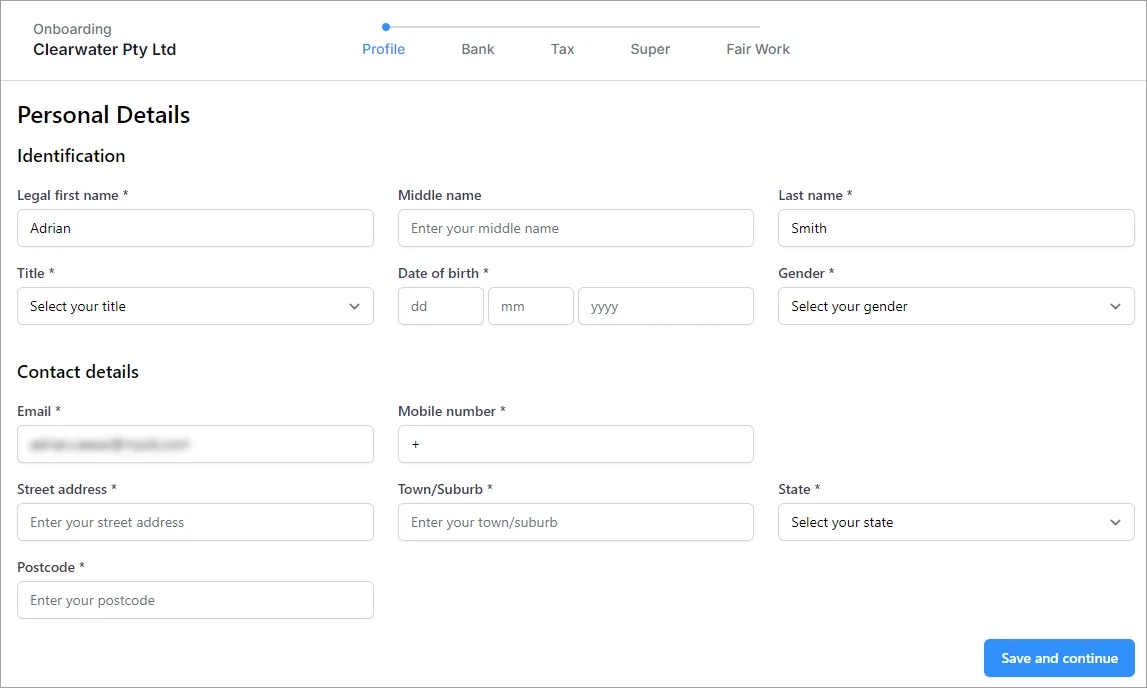

When they open the form, they'll see their details from AccountRight. They can double-check what's there, make any changes or enter any missing information (fields marked with an asterisk are mandatory).

They can click Save and continue to progress to the next tab, until finally submitting the info.

Displaying the Tax Details or Bank Details tabs

If you've set the employee's payment method to cash or cheque in MYOB, they won't be shown the Bank details tab.

Similarly, if you've already entered a tax file number for them, the Tax details tab won't be shown. To show this tab, you'll need to remove the tax file number from their employee record.

Once the employee has completed the review and entered all mandatory information, they can click Submit.

*This service is provided by our related entity Flare HR Pty. Ltd.

After the employee submits their details

When the employee submits their details, you'll receive an email detailing what they've provided. You can view the employee's updated details in their card (Card File command centre > Cards List > Employee tab > click to open the employee's card).