Before filling out your inventory, it's important to consider the kind of items you sell — are they slow-moving items that are easy to count manually, or do you buy and sell them so quickly it's difficult to keep track of how many you have? Depending on the answer to this you'll use either a perpetual or a periodical (also known as physical) inventory method. Don't worry about the terminology, it's a lot easier than it sounds.

Perpetual inventory:

is best for businesses with high-volume sales where physical inventory counts are time-consuming and costly

can also work well for smaller businesses, as it ensures more accurate bookkeeping and can easily be scaled up as the business grows

automatically updates stock quantities in real time for each sale and purchase

gives you an instant view of the quantity of goods on hand, enabling you to plan restocking

almost completely reduces human errors through automation.

Periodical inventory:

is best for businesses that sell low-volume products that can be easily counted, such as cars or artwork

requires that items are tracked by a periodical physical count, like at the end of the financial year

means you need to create journals to report the value of stock you have on hand

involves manual processes, so it can be tedious, time-consuming and prone to errors.

Try perpetual inventory

As perpetual inventory has clear advantages over periodical inventory – and because perpetual inventory for up to 10 items is included with your MYOB Business subscription – we recommend that you give perpetual inventory a go, perhaps testing it with a few items if you're not sure.

Once you use an item in a transaction, you can't change it's inventory method – see the FAQs below.

If you're still not sure which method to choose, check with your accounting advisor.

Using perpetual inventory

When a business uses the perpetual inventory method, they're continually tracking the monetary and physical movement of their stock; so, their inventory balance will always be up-to-date and have less reliance on physical inventory counts.

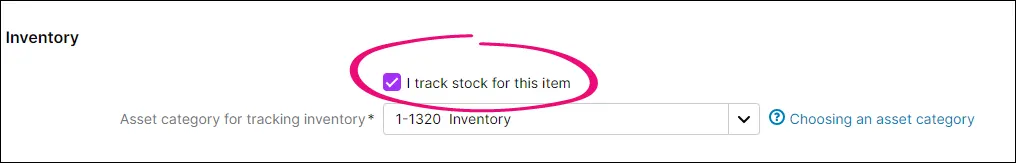

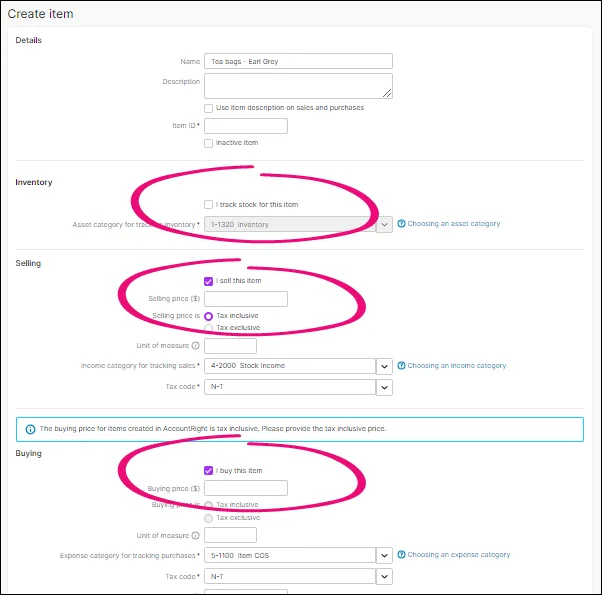

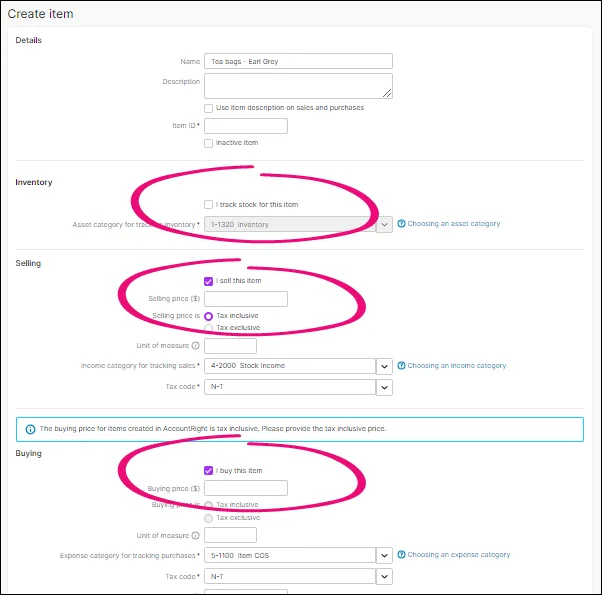

If you want to use the perpetual inventory method for an item, you need to make sure you check I track stock for this item in the Inventory section of the item.

You also need to choose an asset category for tracking inventory and complete the Buying and Selling details sections of the item. For more information on setting up your items, see Creating items.

When using a perpetual inventory in MYOB Business, your inventory's monetary value is tracked using the average costing method.

Unlike other valuing methods, such as First in First Out (FIFO), the average costing method values your inventory by calculating its weighted average value, using the formula: Average Cost = Total Value of the item ÷ Total Quantity of items. Let's take a look at an example of how this would work in everyday business.

Example

Let's say you purchase 10 wine glasses for $10.00 each. This will result in an average cost of $10.00 per item. The following day, 10 more wine glasses are purchased, this time for $12.00 each. Your inventory looks like this:

-

Total Quantity of wine glasses: 20

-

Total Value of wine glasses: $220.00

-

Average Cost: $11.00 ($220.00÷20)

From this example, you'll notice your average cost rose by $1.00 after purchasing the second lot of glasses. This number will be automatically calculated and updated after each purchase. Another transaction that can impact the average cost is an inventory adjustment.

Using periodical inventory

Under a periodical (or physical) inventory method, an inventory balance is recorded only after a physical inventory count.

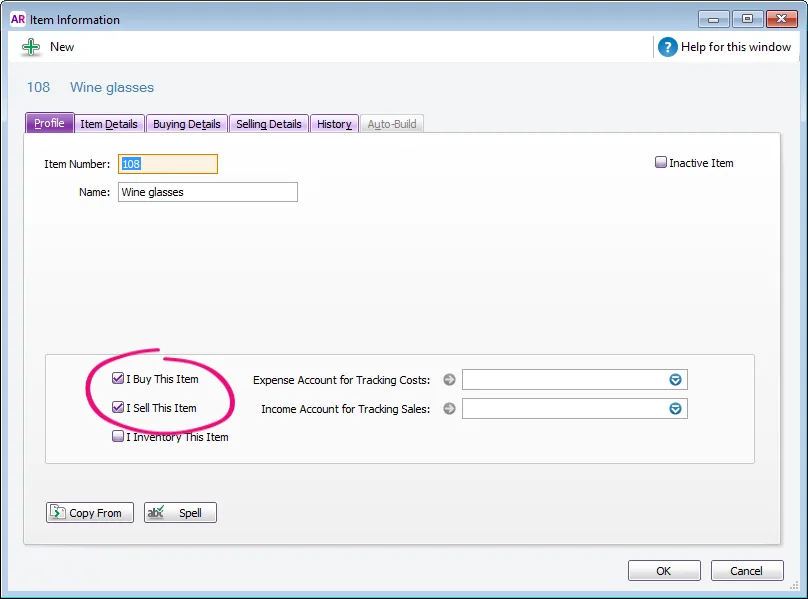

If you want to use the periodical inventory method in your MYOB Business, you need to make sure you do not check I track stock for this item, but rather I Buy This Item and I Sell This Item when creating an item.

Recording your inventory periodically requires just a few more steps each time a physical stocktake is conducted. For more information on recording a periodical inventory, see Periodical inventory. Before implementing periodical inventory, you should discuss its suitability with your accounting adviser.

What's next?

Once you've decided which inventory method to use, see our Inventory help topic to learn what else you can do and how to set up your inventory items.

FAQs

What if I need to change my inventory method?

You can only change the inventory method an item uses if you haven't used the item in a transaction.

For example, suppose you create an item that you buy and sell, by selecting the options, I buy this item and I sell this item, but you don't want to track stock levels for it and so you don't select the option, I track stock for this item:

If you then use that item in a purchase or sale transaction, those selections are locked in and you're not able to later select I track stock for this item. You could create a new item with similar details and track the stock for it. For more information, see Updating items to use stock tracking.

Are there additional fees for using inventory in MYOB Business?

With your MYOB Business Lite or MYOB Business Pro subscription, you can use perpetual inventory (that is, track the on-hand quantity) of up to ten items. So, you can set up ten items in MYOB Business with the I track stock for this item option selected for no additional cost.

If you want to set up more than ten items with the I track stock for this item option selected, you'll need to add Premium Inventory to your subscription. For more information, see Add Premium Inventory.

There are no additional fees for using periodical inventory and no limits on the number of items you can set up.

Before filling out your inventory, it's important to know whether you'll be using a perpetual or periodical (also known as physical) inventory method. If you already know what you want to use, have a look below for more information on how AccountRight handles each method.

If you're not sure what method works best for your business, don't worry! It's a lot easier than it sounds. This information will help you choose the the best method for your business and give you greater control over managing your stock.

Perpetual and periodical inventory methods

Generally speaking, perpetual inventories, in which the inventory system is automatically updated for each sale and purchase, is used in businesses with high-volume sales where physical inventory counts are time-consuming and costly.

Periodical inventory is usually best for suited for businesses that sell low-volume products, such as cars or artwork, that can easily be tracked by a physical count, or by businesses that already use a third-party POS system to track inventory.

Check with your accounting advisor on whether perpetual or periodical is right for your business. But no matter which method you choose, you'll be able to tailor your AccountRight inventory to make your business life easier.

Perpetual inventory

When a business uses the perpetual inventory method, they're continually tracking the monetary and physical movement of their stock; so, their inventory balance will always be up-to-date and have less reliance on physical inventory counts.

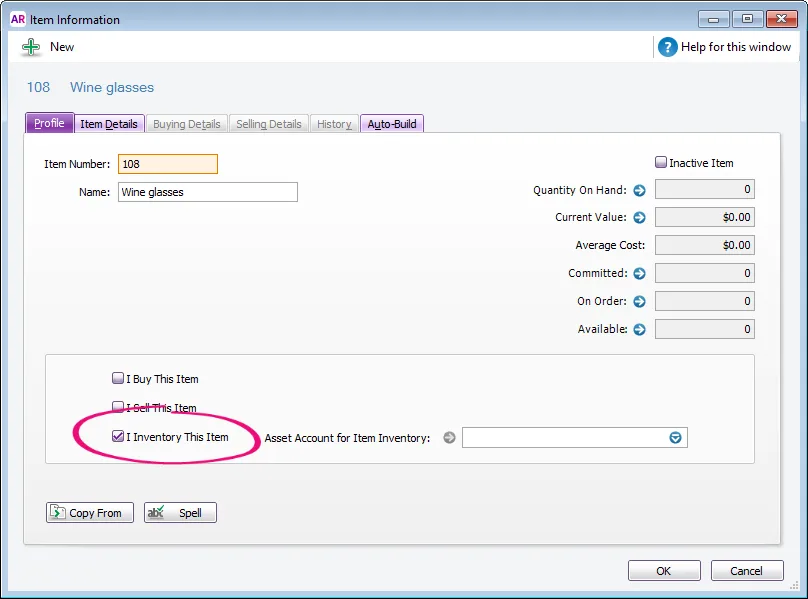

If you want to use the perpetual inventory method in your AccountRight, you need to make sure you check I Inventory This Item when creating an item.

For more information on this process, see Creating items.

When using a perpetual inventory in AccountRight, your inventory's monetary value is tracked using the average costing method.

Unlike other valuing methods, such as First in First Out (FIFO), the average costing method values your inventory by calculating its weighted average value, using the formula: Average Cost=Total Value of the item÷Total Quantity of items. Let's take a look at an example of how this would work in everyday business.

Example

Let's say you purchase 10 wine glasses for $10.00 each. This will result in an average cost of $10.00 per item. The following day, 10 more wine glasses are purchased, this time for $12.00 each. Your inventory looks like this:

-

Total Quantity of wine glasses: 20

-

Total Value of wine glasses: $220.00

-

Average Cost: $11.00 ($220.00÷20)

From this example, you'll notice your average cost rose by $1.00 after purchasing the second lot of glasses. This number will be automatically calculated and updated after each purchase. Another transaction that can impact the average cost is an inventory adjustment.

Periodical inventory

Under a periodical (or physical) inventory method, an inventory balance is recorded only after a physical inventory count.

If you want to use the periodical inventory method in your AccountRight, you need to make sure you do not check I Inventory This Item, but rather I Buy This Item and I Sell This Item when creating an item.

Recording your inventory periodically requires just a few more steps each time a physical stocktake is conducted. For more information on recording a periodical inventory, see Periodical inventory. Before implementing periodical inventory, you should discuss its suitability with your accounting adviser.

What's next?

Once you've decided which inventory method to use, see our Inventory help topic to learn what else you can do and how to set up your inventory items.