When using perpetual inventory in MYOB Business, your inventory's monetary value is tracked using the average costing method.

Unlike other valuing methods, such as First in First Out (FIFO), the average costing method values your inventory by calculating its weighted average value, using the formula: Average Cost=Total Value of the item÷Total Quantity of items.

Let's take a look at an example of how this would work in everyday business.

Example

Let's say you purchase 10 wine glasses for $10.00 each. This will result in an average cost of $10.00 per item. The following day, 10 more wine glasses are purchased, this time for $12.00 each. Your inventory looks like this:

-

Total Quantity of wine glasses: 20

-

Total Value of wine glasses: $220.00

-

Average Cost: $11.00 ($220.00÷20)

From this example, you'll notice your average cost rose by $1.00 after purchasing the second lot of glasses. This number will be automatically calculated and updated after each purchase. Another transaction that can impact the average cost is inventory adjustments.

What affects average cost?

As shown in the example above, average cost is calculated after each purchase.

An item's average cost will also be recalculated if you make any of these changes to a recorded bill:

enter a memo

update the ship to address on the bill screen

change the date

change the purchase number

enter a supplier invoice number

Need to adjust the average cost? You'll need to make an inventory adjustment.

When using a perpetual inventory in AccountRight, your inventory's monetary value is tracked using the average costing method.

Unlike other valuing methods, such as First in First Out (FIFO), the average costing method values your inventory by calculating its weighted average value, using the formula: Average Cost=Total Value of the item÷Total Quantity of items.

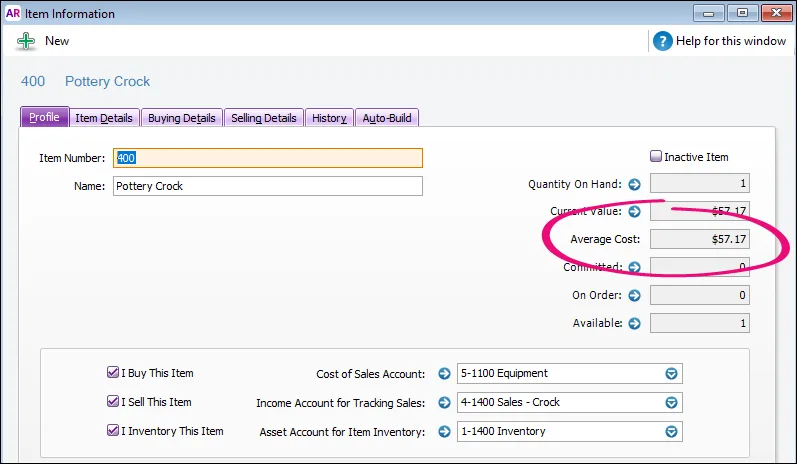

You can view the average cost of an item in the Item Information window > Profile tab:

Example

Let's say you purchase 10 wine glasses for $10.00 each. This will result in an average cost of $10.00 per item. The following day, 10 more wine glasses are purchased, this time for $12.00 each. Your inventory looks like this:

-

Total Quantity of wine glasses: 20

-

Total Value of wine glasses: $220.00

-

Average Cost: $11.00 ($220.00÷20)

What affects average cost?

As shown in the example above, average cost is calculated after each purchase.

An item's average cost will also be recalculated if you make any of these changes to a recorded bill:

enter a memo

update the ship to address on the bill screen

change the date

change the purchase number

enter a supplier invoice number

Need to adjust the average cost? You'll need to make an inventory adjustment.