MYOB Business helps you run your business and get a clear view of how it's performing.

It comes with all the tools you need to start working, but there’s a few things you may need to do to tailor it to your business needs. These tasks vary depending on the features that you use (like payroll). We've picked out a few of the more relevant tasks and we'll guide you through them. You can do these at your own pace whenever you're ready and you don't have to do them all at once.

Start with the checklist on your Dashboard

Open MYOB Business and follow the onscreen checklist on your Dashboard. The tasks you'll see are tailored to your subscription. If you need help, click the tiles below for more information:

Top tips for working smarter

-

Bookmark MYOB Business sign-in: app.myob.com, so it's there for you every day.

-

When you sign in, check the Up next section of your Dashboard for tasks you need to do.

-

Create transactions and other things using the Create menu.

-

Automate your reconciliation by connecting your bank account.

-

Pre-fill the details in bills and expenses by uploading documents.

-

Give your customers an easy way to pay you, using online payments.

-

Create invoices and capture expenses on-the-go with the MYOB Assist app.

Customise MYOB Business for your needs

There’s a lot you can do already, but if you want MYOB Business to reflect the way you prefer to do business, you should set some preferences and options. Here’s some things you might want to change.

If you have an accounting advisor, payroll officer or other staff, consider inviting them into your MYOB Business to help you complete your setup.

Choose how to communicate with customers and suppliers

Maintain good relations with customers and suppliers and keep your communications looking professional. Set up your business communications to reflect your business's brand:

Customise the default email messages sent with invoices and bills

Enter the email address you send emails from

Set up how you buy and sell

Use invoices to track what you sell to customers and use bills to buy from suppliers. Keep track of what you owe and what you’re owed.

Set up your default payment terms

Choose your payment methods, including online invoice payments

Enter the details of the products and services you buy and sell

Switch on freight cost tracking

Easily match money in and out in your bank feeds against the invoices and bills you’ve entered in MYOB Business.

Tailor MYOB Business to your business structure and accounting needs

Your business and accounting details should reflect the nature of your business. They include your organisation's name, contact details, list of categories (your chart of accounts), financial year info and GST settings. Some of these details will appear on your business documents, including invoices and statements.

You might have entered some business details when you purchased MYOB Business, like your organisation's name and contact details. If you need to add more details or change what's there, a user with Administrator access can do it at any time.

If you're not sure about any of these tasks, talk to your accounting advisor before making any changes.

Choose whether you report GST and how often

Check your business details

Make sure your financial year details are set up right

Look over your categories (chart of accounts) and customise it to your needs

Check your linked categories are set up the way you want

Add your team as users in MYOB Business

Users are the people who work in your MYOB Business file, including your staff and accounting advisor. Assign roles and permissions to control what information they see and what tasks they can do.

Invite users to your business

Assign roles and permissions to control who sees what

Invite your accountant to help you set up and run your business

Get ready to pay your employees

Before you can start doing pay runs for your employees, there are a few setup tasks you'll need to do. This makes sure your pays are correct and you stay on top of your reporting obligations.

Enter your employees' details and what they'll be paid – make it easy with employee self-onboarding

Set up pay items to cover each part of your employees' pay, like wages, leave and super

Choose how you'll pay each employee and set up electronic payments

Sign up for Pay Super to start making super payments

Set up Single Touch Payroll (STP) to report payroll information to the ATO

If your employees use timesheets, get your team using the MYOB Team mobile app

Run your business with MYOB

Now that you've set things up to suit you, start working with the main areas of MYOB Business:

Sales – sell products and services to your customers and keep track of what you're owed.

Purchases – buy what you need from your suppliers and stay on top of what you owe.

Banking – keep track of the money going into and out of your bank accounts.

Payroll – make sure your staff are paid correctly and on time.

Inventory – track what you buy, manufacture, store, use and sell.

Contacts – store information about, and keep in touch with, the people and businesses you deal with.

Reports – gain valuable insight into your business and comply with ATO and IR reporting requirements like BAS and GST returns.

Get more help

There are lots of resources that can help you learn about and make the most of MYOB Business:

Help where you need it. At the top right of any MYOB Business page, click the question mark to open the help panel. You'll see info relating to the MYOB page you're on, without having to leave your software.

When you need more detailed information, go to MYOB Business online help.

Learn at your own pace. Take advantage of our online self-paced training courses and other training options.

Got a question? Ask other MYOB users for help in the community forum.

Chat with support. Click the chat bubble at the bottom of any page and our virtual assistant MOCA can connect you to our team.

Submit a support request. Log in to My Account and click Contact support. Let us know what help you need, and we’ll get back to you via email.

Create your file

Your business and transaction details are stored in a company file, and you can keep the file online or on your desktop. With your file online, you can access it from any computer that has AccountRight installed or from a web browser on any device.

If you don't have a file, it's easy to create one and then open it.

Been invited to access a company file? Accept the invitation and download AccountRight.

Learn the basics

If you're new to MYOB, bookkeeping, or accounting software, take a look at this short video that'll give you a nice introduction to AccountRight and explain your next steps.

For one-on-one tailored help, book a 30-minute session with an expert to help you get started – it's all part of AccountRight Priority Support.

You can practice using AccountRight with its built-in sample company file. You can save, delete, and change as much information as you like and learn as you play with it. See Using the sample company file (Clearwater).

Set up and get started

You can do a lot in AccountRight, but you don't need to set up everything before you can get going. Just set up what you want to use.

Here are some suggestions to get you started:

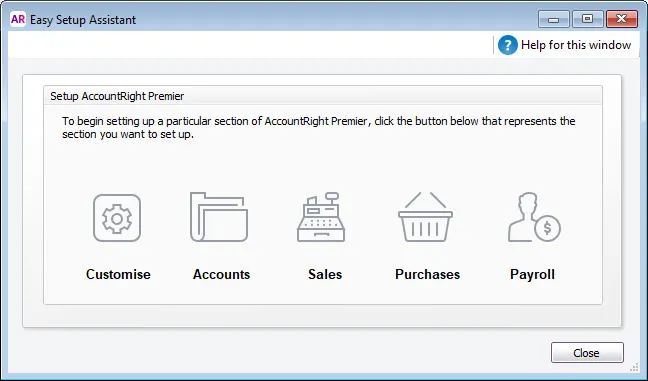

Use the Easy Setup Assistant to help you get started

Set up your accounts list the way your accountant wants them.

Enter your customer, supplier and employee contact details.

Set up your sales preferences, form layouts and history.

Set up payroll (Australia only).

Work smarter

There are some really smart features in AccountRight that'll save you time and effort from day one.

Here are some of our favourites:

Link your bank and credit card accounts and all your bank transactions will appear in AccountRight, making it easier to track and reconcile money you spend and receive.

Put your file online (if it isn't already) so you, your team, and your accountant can access it anywhere and anytime — even via a web browser.

Drop your bills into AccountRight's In Tray, to save time entering the details, and to keep a copy of your bills with your accounts.

And there are many more ways AccountRight can help you work smarter.

Master MYOB

There are lots of resources that can help you learn and make the most of AccountRight:

Book a 30-minute setup session with an expert – it's all part of AccountRight Priority Support.

Take advantage of our online self-paced training courses and other training options.

Ask questions and learn from others at the community forum.

Click the chat bubble below to ask MOCA, our virtual assistant

Log into My Account and submit a help request

Keep track of what's new in AccountRight – visit (and bookmark) the AccountRight release notes.