After you record a payment to a supplier or employee in MYOB, you can then transfer the funds into their bank accounts using a bank (ABA) file.

Why you should use electronic payments

More secure – no carrying wads of cash

Cash and cheque payments are becoming rare – your employees and suppliers are likely to expect cashless payments

Paying electronically from your accounting software makes it easier to keep tabs on payments as it creates an audit trail

Using a bank file

Create a bank file from MYOB then upload it to your bank for processing.

Bank files are also called Australian Banking Association (ABA) files

This functionality is included with your MYOB subscription (bank fees may apply)

Internet banking is required

Setting up electronic payments

Before you can make electronic payments you'll need to set up a few things. Take a look at Setting up electronic payments for all the details.

Making payments

Once you're set up, you're ready to start making electronic payments. For all the details, see Making electronic payments.

FAQs

Do I have to pay my employees and suppliers electronically?

No, but there's good reasons to pay electronically, such as greater security and convenience and to keep an audit trail of payments in your MYOB.

When you're setting up your employees, you can decide which ones you want to pay electronically by choosing their payment method.

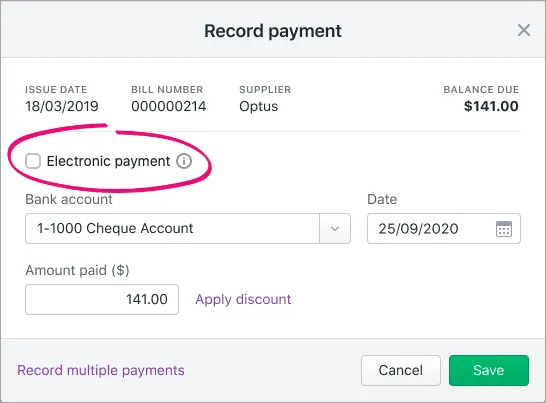

You can also decide which supplier payments you want to pay electronically when you enter their payment transaction by selecting the option Electronic payment.

For more information, see:

Who in the MYOB business can use electronic payments?

Anyone who has access to the Banking, Payroll or Purchases areas of the MYOB business can set up and process electronic payments. Access to these areas is controlled by the roles and permissions that are assigned to each user in the MYOB business – see Users.

If you want to pay straight into your suppliers' and employees' bank accounts you can use a bank file.

Using a bank file

Create a bank file from AccountRight then upload it to your bank for processing.

Available for both online and desktop company files

Included with your AccountRight subscription (bank fees may apply)

Internet banking is required

Setting up electronic payments

Before you can make electronic payments using bank files, you'll need to set up a few things. For all the details see Setting up electronic payments for bank files.

Making payments

Once you've set up electronic payments, you're ready to start making payments. If you're set up for bank files see Making electronic payments with a bank file.