The Tax > Tax notices page is where you can find your clients' provisional and terminal tax notices. View a list of available tax notices for one or all clients, or click into a tax notice to view the details.

Learn more about creating and preparing tax notices.

Learn more about the details of the tax notices workflow.

Find a tax notice

Use filters to see more

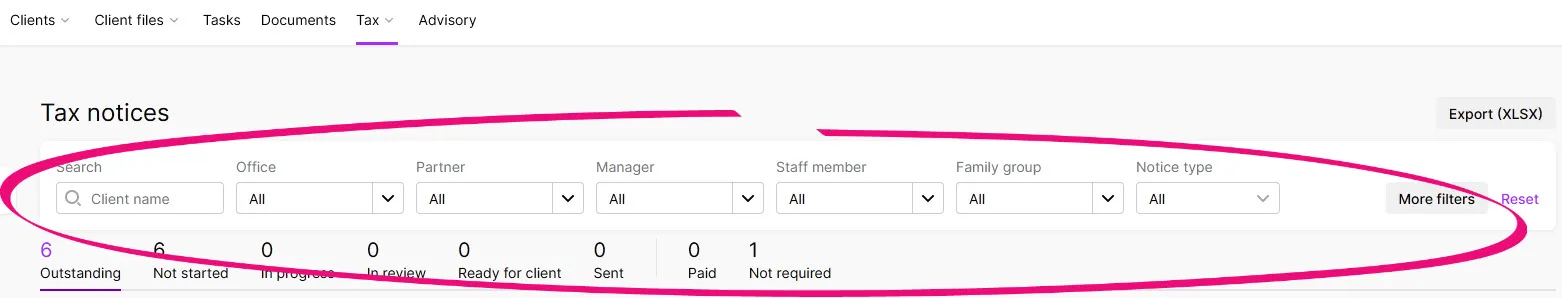

By default, you'll see tax notices for the current month and first couple of weeks of the next month. But tax notices will be automatically created for your clients 90 days before they’re due. To see more tax notices or to find specific tax notices, use the filters at the top of the Tax notices page.

You can use the filters individually or use them together. For example, you can search for a client name, or you can narrow it down further by also entering the To and From due date range.

Once you've found the tax notice, click the row to open it.

Make sure the tax settings allow tax notice creation

If you're expecting to see a tax notice but it's not in the Tax notices list, there may be some Tax settings preventing it from being created.

Tax settings for tax notice creation

To apply these settings, select a client on the client side bar, click the Settings icon (the grey cog) on the top right of the page and click Edit in the Tax settings section.

Tax client set to Yes.

Balance month set to the last month in your client's accounting year.

GST taxable period set to how often you file your GST returns.

Year-based tax details completed for the relevant year. Extension should be set to Yes if your client's due dates for filing returns and paying terminal tax have been extended.

For full details, see Setting up your client's Tax settings.

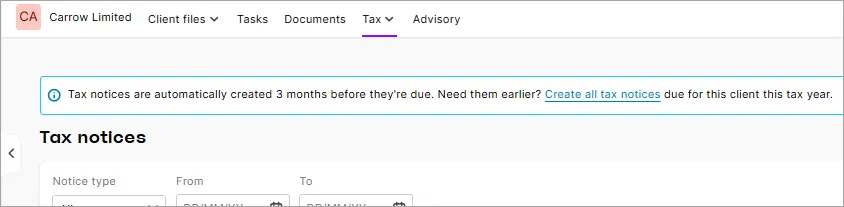

The tax notices will be created once you apply these settings. If you need to create tax notices for the current year beyond 90 days, select a client and click Create all tax notices.

Finding clients with incorrect settings for tax notice creation

Go to the Tax clients page and apply each of the following filter combinations. If a client appears in the list after applying the filter combination, it means that client's settings will not allow tax notices to be created. Revisit the client's compliance settings that corresponds to the filter option.

On the Tax > Tax clients page:

In the Show filter, choose Non-tax clients only and note any clients that are shown.

In the Show filter, choose Tax clients only and note any clients with no Balance month.

In the Show filter, choose Tax clients only and note any clients with GST registered set to Yes but no GST taxable period.

More tips and tricks for finding tax notices

Whether you're looking for a specific tax notice, or if you want to see a particular set of tax notices so you can easily perform bulk actions, Tax provides handy options to help you quickly display what you're looking for. Here are some examples.

Most of these find and filter options are only available when viewing all clients.

Depending on the size of your browser window, some filter options may be hidden behind a More filters button in the filter bar.

To find a tax notice for a specific client, type their name in the Search field. The list displays tax notices for the name you typed.

To show only clients assigned to a particular staff member, select the staff member from the Staff member drop-down. If you use MYOB AE/AO, you manage assigned staff from your client's Responsibility tab in AE/AO. If you’re using Tax without having previously migrated from AE/AO, you can’t assign staff as partners or managers, so all staff will appear as Team member in the filter.

If you use MYOB AE/AO, to show only clients assigned to a particular partner, select the partner from the Partner drop-down. You manage assigned partners from your client's Responsibility tab in AE/AO.

If you applied an office category to your clients in MYOB AE/AO, you can filter by office. For example, to filter clients with an office category of Auckland.

If you use MYOB AE/AO, to show only clients belonging to a particular family group, select the family group from the Family group drop-down. You set up and manage family groups from your client's Family group tab in AE/AO.

By default, the list of tax notices is filtered by due date. This helps you see the most relevant upcoming tax notices straight away.

At the start of each month, the From date will be set to the 1st of the current month (regardless of whether the 1st is a weekend or public holiday), and the To date will be set to the 15th of the next month (or the next closest working weekday if the 15th falls on a weekend or public holiday). For example, on the 1/10/22 the tax notices are filtered to show those due between 1/10/22 to 15/11/22.

There are a couple of ways you can find tax notices that have a Use of money interest (UOMI) amount.

To choose whether to display notices with 0.00 amounts, click More filters and select Nil notice amount.

To choose whether to display tax notices that have been marked as tax pooling instalments, click More filters and select an option from the Tax pooling drop-down. (Learn more about tax pooling for provisional or terminal tax notices.)

To display tax notices based on which provisional option they use (only standard, only estimation or all tax notices regardless of whether they are provisional tax notices), click More filters and select an option from the Provisional tax option drop-down.

To choose whether to display tax notices that have a voluntary adjustment, click More filters and select an option from the Voluntary adjustment drop-down:

All – Displays all tax notices whether they have a voluntary adjustment or not.

Any – Displays all tax notices that have any type of voluntary adjustment.

None – Displays tax notices that don't have a voluntary adjustment.

FAM (Working for families), FBT (Fringe benefits tax), GST (Goods and services tax), INC (Income tax) or SLS (Student loan) – Displays tax notices with a specific voluntary adjustment type.

To choose whether to display tax notices that are set to Send manually, Send task to client, Send email to client or All, click More filters and select an option from the Delivery preference drop-down. The tax notices that need to be sent manually can't be sent in bulk, so this filter lets you easily exclude those tax notices. It also lets you easily see just those tax notices that you need to prepare for sending manually.

To access the delivery preferences for a client, select the client and click the grey cog icon on the top right of the page. You set these options when preparing tax notice email or Portal task settings.

To choose whether to display tax notices that have Working for families or student loan tax type payments due, click More filters and select an option from the Assessment drop-down. The filter checks for a value in Residual income tax (INC), Student loan repayment obligation (SLS) or Working for Families tax credit (FAM).

Any – Displays all tax notices with assessment amounts, regardless of whether they are for income tax (INC), a student loan (SLS) or Working for Families (FAM).

None – Excludes all tax notices with assessment amounts for any tax type.

Only has INC – Includes tax notices with assessment amounts for INC only, excluding notices with assessment amounts for SLS or FAM.

Includes SLS –Includes tax notices with assessment amounts for SLS, and which may also have assessment amounts for INC or FAM.

Includes FAM – Includes tax notices with assessment amounts for FAM, and which may also have assessment amounts for INC or SLS.

To filter by status, select one of the following tabs.

Status | Description |

|---|---|

Outstanding | The number of tax notices with a status of Not started, In progress, In review, Ready for client or Sent. |

Not started | You haven't started preparing the tax notice. |

In progress | You're in progress preparing the tax notice. |

In review | Waiting for a manager or a partner to review the tax notice. |

Ready for client | A manager or partner has approved the tax notice (if applicable). The tax notice is finalised and ready to send to the client. |

Sent | You've sent the tax notice to the client to review and pay. |

Paid | The client's paid the tax notice amount. |

Not required | If your client doesn't require a tax notice for this instalment. |

To reset filters, click Reset.

Understanding alerts

The Alerts column shows the following alerts:

Alert | Description |

|---|---|

Overdue | Where tax notice is overdue. |

Return data available | Where the tax notice: has a status of Ready for client or Sent, and... was prepared using the prior year's filed tax return data instead of the current year, and... the latest tax return has been filed or we've received assessment data from Inland Revenue. For example, if you have a 2021 provisional tax notice that's been prepared using 2019 as the basis year, if the tax notice is in the status of Ready for client or Sent when the 2020 tax return is filed, you'll see the Return data available alert. To resolve this alert, open tax notice and click Send for rework. Then you can change the basis year to the latest year. |

Email bounced | The email couldn't be delivered. You might see this during the process of sending tax notices. |