Plus $2/month + GST

per employee paidSimple payroll software that won't break the bank

Save time with smart, flexible payroll management. Less admin for you, great tools for your team and automatic Payday filing reporting to IR.

Accurate, automated, easy-to-use payroll software

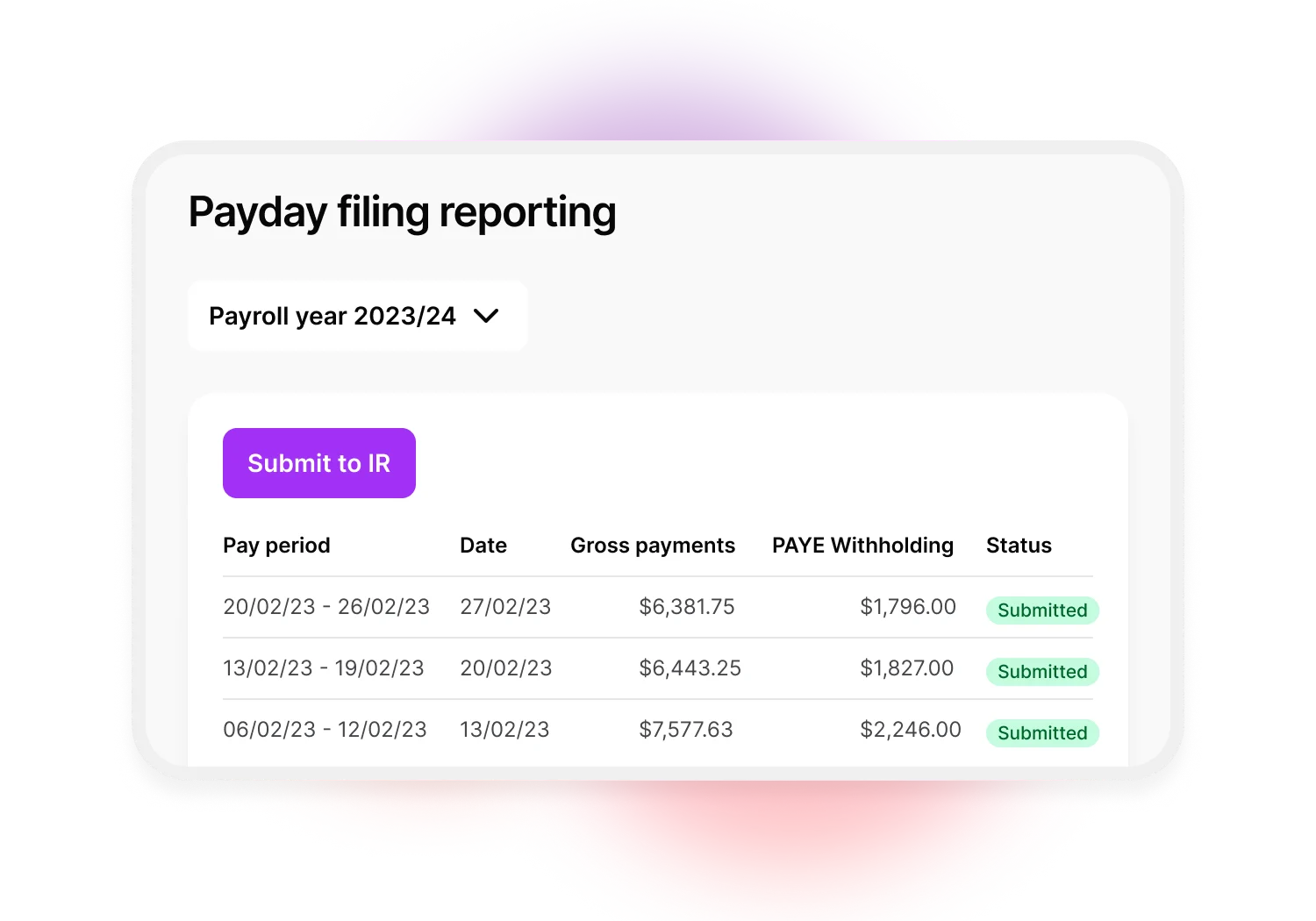

Payday filing, handled

Save time and stay in the IR’s good books. With the click of a button, you can now generate and send payday filing reports directly from your software to the IR.

Feel confident you're up to date

Your software automatically updates in line with payroll and tax legislation, so you can be sure you're up to date and giving your employees everything they’re entitled to. Accurate and automated, just the way you like it.

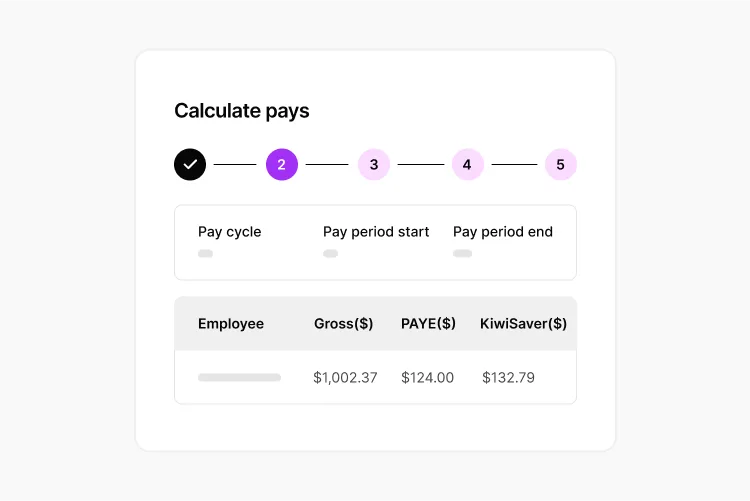

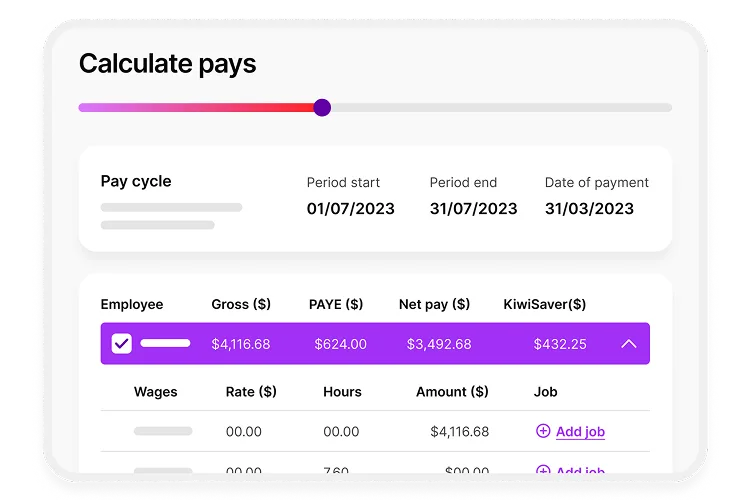

Calculate tax, leave and KiwiSaver in just a few clicks

We’ll automatically calculate KiwiSaver, tax, and annual leave so you can complete your pay run in 4 simple steps. We'll even alert you if something looks wrong, like extra annual leave.

Streamline your payroll process with MYOB

Payroll compliance, simplified

Stay in IR’s good books. Generate and send Payday filing reports directly from MYOB Business so you can rest easy. You can rest easy for end of year reporting, and your employees can access their payroll information at any time.

Calculate PAYE, KiwiSaver and leave in just a few clicks

With automatic KiwiSaver calculations and PAYE payments to Inland Revenue - you'll always know where you stand.

Only pay for what you use and need

As your business grows and adapts, so might your payroll requirements. Whether you employ one person or many, you’ll only be charged for who you pay each month.

Get started with MYOB Business Payroll Only

MYOB BUSINESS

Payroll Only

Pay your staff, calculate PAYE payments and keep IR happy with automated reporting.

- Simple pay runs

- Direct reporting to IR

- Automated tax compliance

- Automated KiwiSaver calculations

- Manage timesheets online

- Automated annual leave calculations

Manage your business on desktop or mobile

Access your information anywhere

Freedom to cancel at any time

All your questions about MYOB Business, Payroll Only, answered

Is there a minimum subscription period?

Nope. And there are no lock-in contracts either. Pay monthly and enjoy the flexibility to cancel anytime.

How long does it take to set up MYOB Business Payroll Only?

Just a few minutes — honestly.

Choose the software plan that's right for your business

Sign up to access your software immediately

Log in to your software. Once you've logged in, we'll guide you through the set-up so you can spend less time on admin and more time doing what you do best.

Do I need to install MYOB Business Payroll?

MYOB Business Payroll Only is 100% web-based. No downloads required.

Can I change from MYOB Business Payroll Only to another plan later?

You sure can. If your business grows (congrats!) and you need software with more features like invoicing, expense tracking, or inventory you can upgrade your account in just a few clicks.

Can I use my account on my phone?

Yep, our software is compatible with all browsers on desktop, mobile and tablets.

Can I let other people access my software?

Absolutely. You can share your account with your advisor, accountant, bookkeeper or business partner at any time for no extra cost. You can also control what they can see and do by adjusting their access levels.

Is my data secure?

Yes. MYOB takes the security and protection of our customers’ data seriously. We use secure, encrypted channels for all communications between us and follow industry best practices including ISO 31000 Risk Management Standard.