Data reconciliation lets you ensure your clients' tax data is accurate by checking and reconciling MYOB transactions against Inland Revenue (IR) transactions. You can see whether your client owes any money to Inland Revenue, has paid the money owing, or accrued any penalties or interest.

To view a list of available periods for all clients, select All clients and go to Compliance > Data reconciliation.

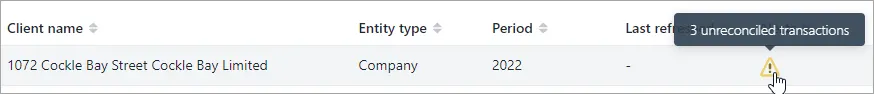

The all clients' Data reconciliation page lists all tax clients, their entity type, and:

Period – which year a transaction took place.

Last refreshed date – the date data was last received from IR

Alerts – if there are any unreconciled transactions. Hover your mouse over the alert icon to view more details.

Once you’ve found the entry you’re looking for, click anywhere in the row to open the entry for the period displayed in the Period column.

Find a Data reconciliation entry

These options to find and filter are only available when viewing all clients.

To find a specific client, type their name in the Search field and press Enter. The list shows clients that match the name you typed.

To show only clients assigned to a particular staff member, select the staff member from the Staff member drop-down. If you use MYOB AE/AO, you manage assigned staff from your client's Responsibility tab in AE/AO. If you’re using MYOB Practice without having previously migrated from AE/AO, you can’t assign staff as partners or managers, so all staff will appear as Team member in the filter.

If you use MYOB AE/AO, to show only clients assigned to a particular partner, select the partner from the Partner drop-down. You manage assigned partners from your client's Responsibility tab in AE/AO.

If you use MYOB AE/AO, to show only clients belonging to a particular family group, select the family group from the Family group drop-down. You set up and manage family groups from your client's Family group tab in AE/AO.

To show only clients with unreconciled transactions, click the Unreconciled alert filter and select either:

All – to show all clients. This option is selected by default.

MYOB transaction – to show clients with unreconciled MYOB transactions on or before today's date.

IR transaction – to show clients who have unreconciled IR transactions on or before today's date.

To see all clients of a specific entity type, use the Entity type drop-down list. For example, if you select Company from the drop-down, the list only shows clients that are companies.

To reset filters, click Reset.

Export Data reconciliation list data to a spreadsheet

To help with reviewing work, you may find it helpful to export data to an XLSX file. This lets you open the data in Microsoft Excel, which can be a handy way to review the data, and to make and share notes and comments.

The user who is logged in to Practice Compliance and who exports the data will be displayed as the author in the XLSX file's properties.

Exporting includes all your practice-wide Data reconciliation data and more:

Client name

IRD number

Entity type and subtype

Balance month

GST registration status and taxable period

Periods

Extension of Time

IR balance and total assessment for income tax, tax credits, student loan and Working for families

Last refreshed date

IR and MYOB unreconciled transactions.

-

Your comments aren't included in the exported data.

-

If a dataset has a filter associated with it above the Data reconciliation list, you can filter that data before exporting to control the data that is displayed in the export.

See To find a Data reconciliation entry above for filter options.

Disclaimer

The data you’re exporting may include an individual's personal information. You should take steps to keep that information secure.

To export:

Go to All Clients > Compliance > Data reconciliation.

Optionally, use the filters and sort the columns in the list to control the data that is shown in the export.

On the top right of the page, click Export (XLSX). The XLSX file is downloaded to your browser's download location, using the file name format YYYY-DD-MM_DataReconciliationList.xlsx.