How you fix a payroll mistake depends on your scenario.

If you've paid an employee the wrong amount, you can adjust their next pay to make up for it. For example, if you underpaid an employee $100, just increase their next pay by $100.

Or, if the employee hasn't been paid yet, you can simply delete the pay and do it again.

To adjust the employee's next pay

This is similar to recording a regular pay, but you'll adjust the employee's pay as required.

Start a new pay run (Create menu > Pay run). Need a refresher?

Adjust the employee's pay:

Click the employee to open their pay.

Enter or update hours or amounts as required. For example, if you're making up for an underpayment, increase their Salary or Ordinary hours as required.

To add leave, click Add holidays or leave, choose the type of leave and enter the details. Learn more about paying leave.

Complete the pay run as normal. Need a refresher?

To delete an employee's pay

When you delete a pay it also deletes the associated pay slip and removes the pay from your payroll reports.

If you've already paid the employees and reconciled your bank account, deleting the pay can affect future bank reconciliations. Therefore, we'd recommend you unmatch or unreconcile the pay before deleting it.

You can't delete a pay if it's been included in a downloaded bank file. You'll first need to delete the bank file transaction.

Go to the Payroll menu and chose Pay runs.

Use the Payment from and Payment to filters to help find the pay run containing the pay you want to delete.

Click the pay run to see its details.

Click the name of the employee whose pay you want to delete.

Click Delete.

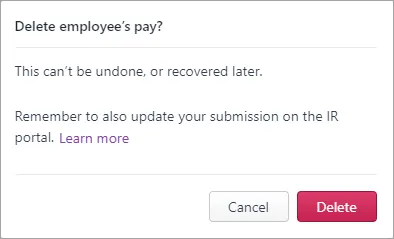

At the confirmation, click Delete.

If you need to record a replacement pay, use the same pay period dates as the deleted pay. If unsure, check with your accounting advisor.

What about payday filing?

If the pay you're deleting has been submitted for payday filing, you'll also need to remove it from myIR. See the FAQ below for details.

To delete all pays in a pay run

If you need to delete an entire pay run (all employee pays for a pay period), you'll need to delete the pay of each employee in the pay run as described above.

To fix a pay where you've used the wrong pay item

A common example is where an employee has been paid for regular hours worked but you need to change some of those hours to sick leave or annual leave.

You can fix this in the employee's next pay, or you can record a separate adjustment pay.

To fix it in the employee's next pay

When you're processing the employee's next pay:

Click Add holidays or leave in the employee's pay to add the leave payment. Need a refresher?

Reduce their salary or ordinary hours by the leave amount you've just added. For example, if the leave you added is worth $500, reduce their salary or ordinary hours by $500.

Finish processing the pay as normal.

To record a separate adjustment pay

You'll need to create a deduction pay item, and then use this in a new pay run to withhold the amount you paid as salary or ordinary hours. You can then add the leave to the new pay run.Create a new deduction

Go to Payroll > Employees > click the employee's name.

Click the Standard pay tab.

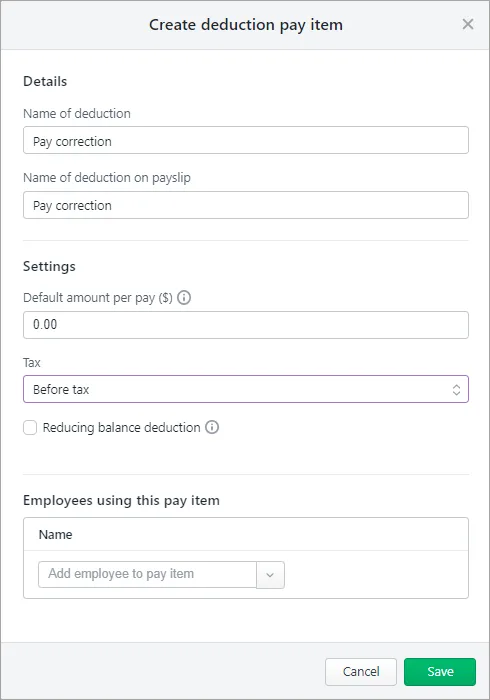

Click Add deductions > Create deductions pay item.

Name the deduction "Pay correction" or similar.

For the Tax, choose Before tax.

Click Save.

Here's our example.

Record the adjustment pay

Start a new pay run (Create menu > Pay run).

Choose the employee's Pay cycle and pay period dates. It doesn't matter which dates you choose as this will be a zero-dollar pay.

Click the employee to open their pay.

Click Add holidays or leave to add the leave payment. Learn more about paying leave.

Enter the amount of the leave payment against the Pay correction deduction. For example, if the leave you've added is worth $500, enter 500 against the deduction.

Remove all other hours and amounts from the pay. This should result in the net pay being $0.00.

Complete the pay run as normal. Need a refresher?

Record a journal entry

When you record the adjustment pay, the deduction amount is posted to the linked account you have set for your payroll liabilities. To ensure your the correct accounts are updated, you'll need to transfer the deducted amount to your wages expense account.

Which accounts are affected?

To find out the accounts to use in your general journal entry, go to the Accounting menu > Manage linked accounts > Payroll tab and confirm the accounts you have set for the Default employer deductions payable account and Default wages expense account.

Create a new general journal entry (Accounting menu > Create general journal).

Enter a Description of transaction to help you identify what this journal was for, for example "pay adjustment for John Smith".

Debit the deducted amount from the account you have set as your Default employer deductions payable account (see the note above).

Credit this amount to your Default wages expense account (see the note above).

Click Record.

If you need to adjust an employee's leave balance, see Updating leave balances - NZ

To delete a payroll electronic payment transaction

If a pay you want to delete is included in an electronic payment transaction, you'll first need to delete the electronic payment transaction. Note that this only deletes the electronic payment transaction in MYOB but doesn't affect your actual bank accounts.You can only delete an electronic payment if the associated bank file has not been uploaded to your bank for processing.

Go to the Banking menu and click Find transactions.

On the Debits and credits tab:

Enter a date range that includes the pay date in the Date from and Date to fields.

In the Account field, choose the Electronic Clearing Account.

Click the Reference no to open the pay transaction.

Click Delete.

At the confirmation message, click Delete. All the payments that were included in the electronic payment are now listed again on the Prepare electronic payments page.

You'll now be able to delete the pay. If required, you can also re-process the electronic payment to download a new bank file.

Add a note to the employee record about pay changes

Use the Notes field in an employee's record to add information about any changes you make to their pay (Payroll > Employees > click the employee > Personal tab > Notes).

FAQs

How do I update myIR if I delete a submitted pay run?

How you handle this in myIR depends on the status of the submission.

So start by logging in to myIR and checking the status.

If the status is:

Submitted - Delete the pay run from myIR (visit the IR website to learn how), then if applicable, redo the pay run.

Submission Received - Zero out the figures for the pay run in myIR (visit the IR website to learn how), then if applicable, redo the pay run.

Can I change the dates in a pay?

No, you'll need to delete the pay then record it again with different dates.