At the end of the payroll year, there's not much you need to do. But it's a good idea to make sure everything is in order before you start paying your employees in the new payroll year.

You don't have to do all the things below, but if anything is amiss it's better to find it now rather than a few months down the track.

1. Invite your accounting advisor

If there's one person you need on your side at this time of year – it's your accounting advisor. Whether it's a bookkeeper, accountant or payroll expert, you can invite them so they have access to your MYOB Business file. This lets them check your numbers and make any necessary adjustments.

If they already have access to your file, skip to the next task.

To invite your accounting advisor

Click the settings menu (⚙️) and choose Users and permissions.

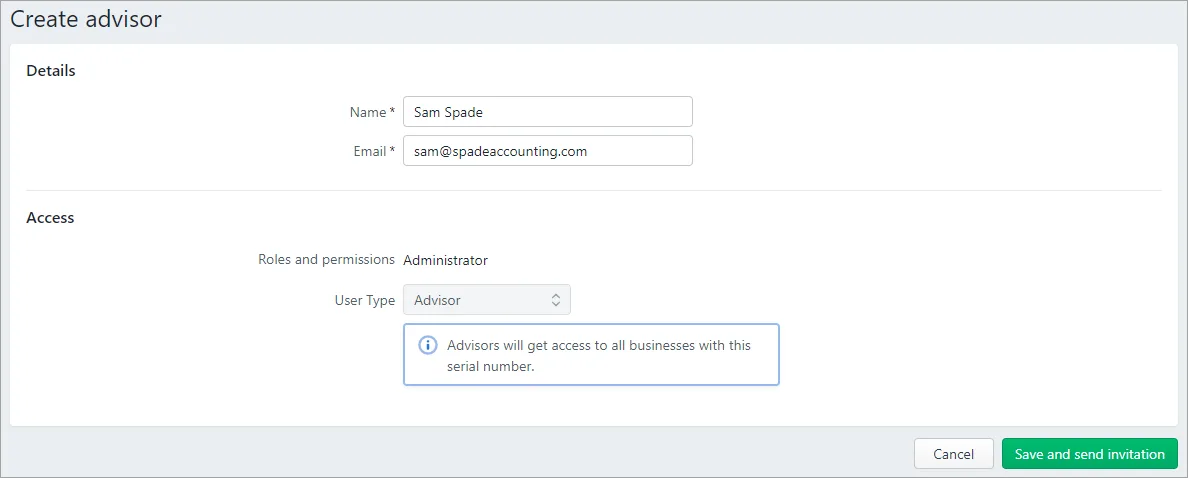

Click Create advisor.

Enter the advisor's Name and Email.

The advisor will have the role of Administrator and the User Type of Advisor which gives them access to all businesses with this serial number.

Click Save and send invitation. The invitation is sent to your advisor. A message appears next to the advisor's email address that the invitation is pending.

When the advisor accepts their invitation, they'll be prompted to log in with their MYOB account details or create an account.

If after a few days your advisor hasn't accepted the invitation (that is, it's still pending), this could be because the invitation has been sent to the wrong address. Check their email address and see the FAQs below for how to resend the invitation.

Need to change a user's details or remove them? See Edit and delete users.

2. Check your payday filing submissions

If you have any pay runs to complete up to the end of March, complete them now and file to Inland Revenue (IR).

Then make sure all your submissions have a status of Submitted.

To check the status

Go to Payroll > Payday filing.

Click the Employment information submissions tab to see your payday filing submissions and their statuses.

Click the Employee details submissions tab to check that new employee details have been submitted successfully to IR.

Click a submission to see more details.

Statuses explained

Status | Description | Resolution |

|---|---|---|

Not submitted | The information has not been submitted to IR. It's likely the pay run was processed by someone who hasn't set up payday filing. | You need to set up payday filing to submit this to IR. |

Submitted | The information has been received by IR. | No action required. |

Rejected | If things don't go to plan, you might get an error or two. Not to worry, we'll help you out. |

3. Reconcile your account with IR

It's a good idea at the end of the payroll year to confirm that the value of your employer deductions in MYOB matches the amount you've submitted to IR.

You can do this easily by running the Employer deductions report (Reporting > Reports > Payroll tab > Employer deductions). This report displays the total amounts deducted from your employees’ pays that is payable to IR.

You can then compare the totals in this report to the amounts in myIR.

See it in action:

What if the report doesn't match myIR?

This can happen if you've deleted a pay in MYOB after filing with IR, but you haven't amended the pay in myIR.

Visit the IR website to learn how to amend a submission – and remember to do this whenever you delete a pay that's been filed with IR.

What happens now?

That's it – you're done for another year! No need to roll over the payroll year, and the latest PAYE rates are ready to use in your new pays. Find out about the compliance changes for 1 April.

See you in 12 months...