Understanding job costing and when to use it means you can accurately calculate each job's direct and indirect costs. That helps you decide what to charge for the project, taking the guesswork out of making a profit.

What is job costing?

Job costing is an accounting method for tracking all costs associated with a project or job. These costs include your direct costs, like materials and staff time, and your indirect costs, like tools or external labour. You also need to include your overheads, like rent and utilities.

Why is job costing important?

Job costing is important because it gives you an accurate overall project cost, including any indirect costs. This is vital when pricing your project and ultimately making a profit. It also reduces the likelihood that you’ll miss costs and makes it easier to cost similar jobs more accurately in the future.

When should you use job costing?

You should use job costing when you’re working on specific projects. For example, construction companies use job costing to calculate all costs associated with a building project. Equally, a marketing company may use it to work out how much to charge a client for an advertising campaign.

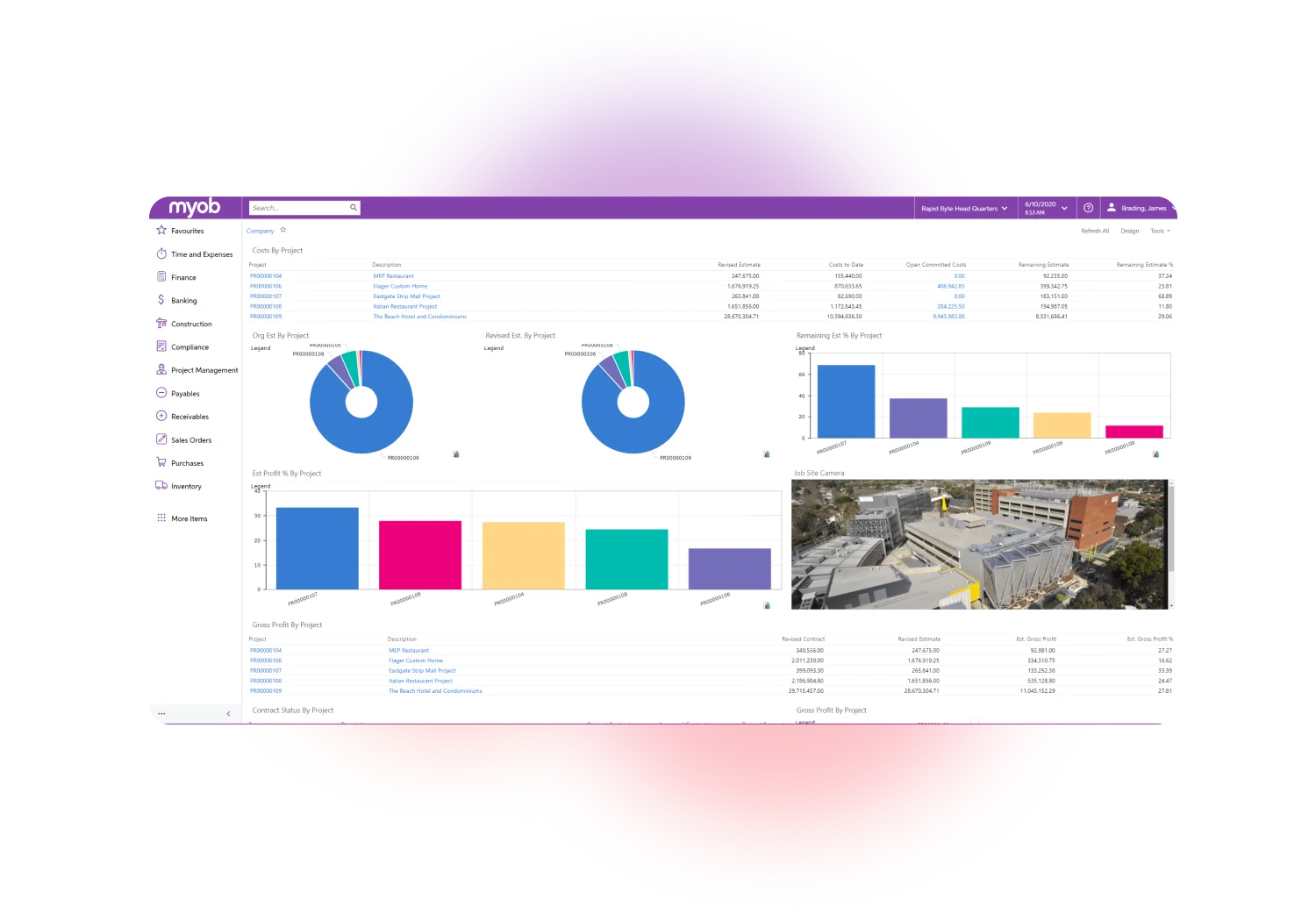

To simplify job costing, it's a good idea to use software that allows billing by time, like MYOB AccountRight or has job costing functionality, like MYOB Acumatica.

Job costing use cases

Job costing use cases can help you understand how other businesses are using this technique to improve their profitability:

Transportation companies

Transportation company projects are nearly all one-offs, with variations in delivery speed, distance, vehicle type, cargo and labour hours. Job costing identifies the true cost of each project so you can set a price that’ll deliver a profit.

Read: Smooth road ahead for Arrow Transport

Marketing agencies

In marketing agencies, one campaign is rarely like the next. With so many individual projects on the go, job costing and tracking are essential to accurate accounting, so you can ensure you aren’t short-changing yourself on profit.

Read: Chugg Entertainment gets VIP accounting system with Chugg Entertainment

Construction companies

Construction companies are well-known for their use of job costing. Construction projects are nearly always unique, with different materials, labour costs and other overheads. Job costing helps construction companies track actuals versus budget and accurately quote and price each job so they turn a profit.

Read: MYOB Acumatica gives Doolan Plumbing complete visibility

How to calculate job costing

To calculate job costing, you'll need to determine all the costs involved. Here's how:

Calculate labour costs

Calculating labour costs involves determining how much you pay all employees, including contractors and freelancers. Then, multiply this by the number of days your company will work on the project. Make sure to include the fees of any third-party vendors, too.

Calculate material costs

To calculate material costs, add up everything you'll use to complete the job. For example, if you're calculating the material costs of a weekly cleaning service, you should factor in how much cleaning product you'll use each week.

Calculate overheads

Calculating overheads is important, especially if you expect the project to run over a few months or years. Even if you're working off-site, the power bill still needs to be covered. Including those overheads keeps you on track to profit from the job.

Using the right software can make job costing significantly easier for businesses. For example, MYOB Acumatica Construction’s in-depth job costing and reporting lets construction-sector businesses stay on top of their projects. You can book a demo here.

Benefits of job costing

The main benefit of job costing is that you profit from your work. But there are other benefits, too:

Accurate job pricing and cost control

Accurate job pricing and cost control mean that since you have accurate details about the project's cost, you can cost and price the job to fit you and your client. These measures mean you won't get caught out and end up making a loss.

Maximise profitability

Maximising profitability is another excellent benefit of job costing — you can set your price knowing you’ll make a profit.

Minimise customer conflict

Minimising customer conflict is far easier when you both know how much everything will cost — no surprises with accurate price quotes every time.

Example of job costing

Here’s an example of job costing. Let’s say your company is building a backyard shed for a customer. To cost the project, you should account for labour, materials and overheads. When calculating costs like utilities or labour, taking a portion of what you spend overall makes sense.

For example, if your facility’s running costs are $4,000 a month, but you’ll only be spending a week on a project, you can calculate your overhead costs at $1,000.

Raw materials: $3,000

Other direct costs: $200

Labour costs: $2,400

Overheads: $1,000

Total cost: $6,600

Job costing FAQs

What is the difference between job costing and process costing?

The difference between job costing and process costing is that job costing tells you how much you’ll need to spend to complete a one-off product or service. Process costing is best used for mass-produced products and considers only direct costs and some kinds of indirect costs.

How is standard costing different to job costing?

Standard costing is different from job costing – standard costing is a way of calculating process costing, which you should use for services or products that are the same each time. Job costing allows for varying costs.

What is a predetermined overhead rate?

A predetermined overhead rate is a way of calculating overhead costs or ongoing expenses for work-in-process inventory. Work-in-process inventory is the cost of unfinished goods you have still in production at the end of each accounting period.

What are the disadvantages of job costing?

The disadvantages of job costing are that it’ll take time to cost each job, and there’s a risk of forgetting to include some indirect costs.

Don't leave profit to chance

With job costing, it's easier to ensure you'll make a profit on each project.

By tracking all costs associated with the job, you’ll know what to charge and how much profit you stand to gain. With the right software for your business and industry, fast and accurate job costing can be a cinch. Check out MYOB AccountRight today, or get in touch to set up a demo of MYOB Acumatica.

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.