Single Touch Payroll (STP) is a simple way to report your employees’ payroll information to the ATO and keep your business compliant. It’s included with your MYOB subscription, so there's no additional charges.

Once you're set up, you'll send your employees' salary, tax and super info to the ATO after each pay. This means end-of-year reporting is a breeze and your employees can access their up to date payroll information through the ATO's online service, MyGov.

1. Get set up

There's two things you need to do before you're ready to send STP reports. Don't worry, we'll guide you through the whole process.

Make sure your employee, company and payroll data is complete and in the right format. See Setting up Single Touch Payroll reporting

Let the ATO know that you're ready to go. See Notify the ATO for Single Touch Payroll reporting

Additional people who need to process payroll for your business will need to add themselves as STP declarers

When you're ready, let's get started.

2. Report payroll info to the ATO

Once you're set up, you'll report your employees' year-to-date payroll totals to the ATO every time you complete a pay run.

For all the details, see Do a pay run. You can then see each of your submitted pay runs in the Single Touch Payroll reporting centre.

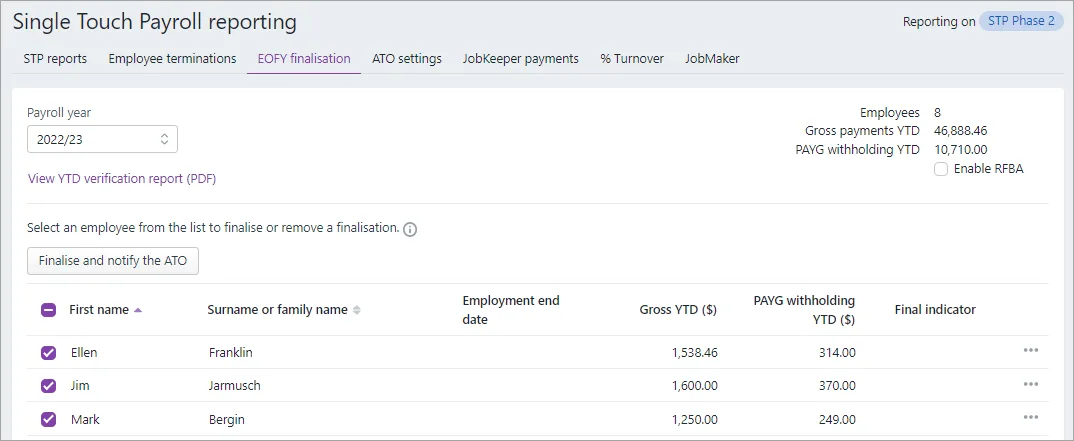

3. End-of-year finalisation

Now you're using STP, end-of-year is much easier. Instead of payment summaries, you just need to confirm that the payroll information you've sent to the ATO is final and correct. You can also enter reportable fringe benefits amounts (RFBA) at this step.

Once you've finalised your STP information, your employees will be able to complete their tax returns in MyGov.

See End of year finalisation with Single Touch Payroll reporting

Need more help?

The ATO website has lots of great info - see Single Touch Payroll.

If your employees want to know more, the ATO website has them covered too - see Single Touch Payroll for employees.

What's Single Touch Payroll?

Report your payroll to the ATO each time you do a pay run. Your employees' information in myGov is always up to date so they can check it any time and easily complete their tax returns.

Once you're set up, you'll send a report to the ATO with each pay, then finalise things at the end of the payroll year.

1. Set up Single Touch Payroll

There are two things you need to do before you're ready to send STP reports. First, make sure your employee, company and payroll data is in the right format. Then, let the ATO know that you're ready to go.

Don't worry, we'll guide you through the whole process.

Go to Set up Single Touch Payroll reporting >>

2. Report employees' pay to the ATO

Once you've set up Single Touch Payroll, you'll be prompted to send your employees' payroll totals to the ATO after each pay run.

Employee year-to-date totals are sent to the ATO. So if you adjust a previous pay, the next time you process a pay run, the latest year-to-date totals will be sent.

Go to View Single Touch Payroll reports >>

3. End-of-year finalisation

Now you're using Single Touch Payroll, end-of-year is much easier. Instead of payment summaries, you just need to confirm that the data you've already sent is final and correct. You can also enter reportable fringe benefits amounts (RFBA) at this step.

Once you've finalised your Single Touch Payroll information, your employees will be able to pre-fill and lodge their tax returns in myGov.

Go to End of year finalisation with Single Touch Payroll reporting >>

4. Need more help?

For heaps of free online learning, check out MYOB Academy.

Or if you need a helping hand, contact us.