Single Touch Payroll (STP) Phase 1 was switched off on 27 February 2025. To start reporting your payroll to the ATO again, you must move to STP Phase 2 (Payroll menu > Single touch payroll reporting > Move to Phase 2).

If you haven't made the move to STP Phase 2 and you've processed pays after STP Phase 1 was shut down, see below for what to do.

If you don't move to STP Phase 2

Pays you process in MYOB won't be reported to the ATO. This includes reversals and updates – so you won't be compliant with the ATO's payroll reporting rules.

You won't be able to complete your employees' end of year finalisation – so your employees won't be able to complete their tax returns because their income statement won't be for the full year

You won't be able to fix any incorrect or rejected STP submissions – so the ATO won't have your current year-to-date payroll totals.

What's changed from STP Phase 1?

There are many things that won't change under STP Phase 2, like:

how and when you lodge your STP reports

the types of payments you report

your tax and super obligations

end of year finalisation.

You'll need to enter some additional payroll details

To report successfully under STP Phase 2, the ATO require some additional employee and payroll details to be entered into MYOB. This is a one-off task and you'll be guided to enter this information when you first set up STP or when you make the move from STP Phase 1.

New ATO reporting categories

ATO reporting categories help the ATO classify the wage, deduction and superannuation payments in your employees' pays. For STP Phase 2, there are some updated and new ATO reporting categories to better classify your employee payments. This includes some new ATO reporting categories like Overtime and Bonuses and commissions that might previously have been reported as Gross payments. Similarly, leave payments were previously reported as gross payments, but now they have their own, more specific ATO reporting categories. Learn more about assigning ATO reporting categories.Income type and Home country (Country code)

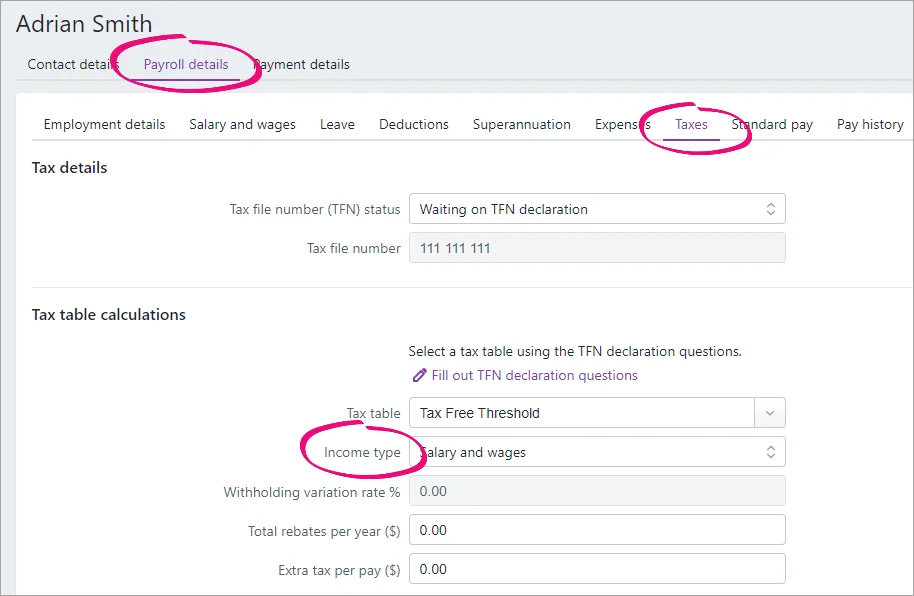

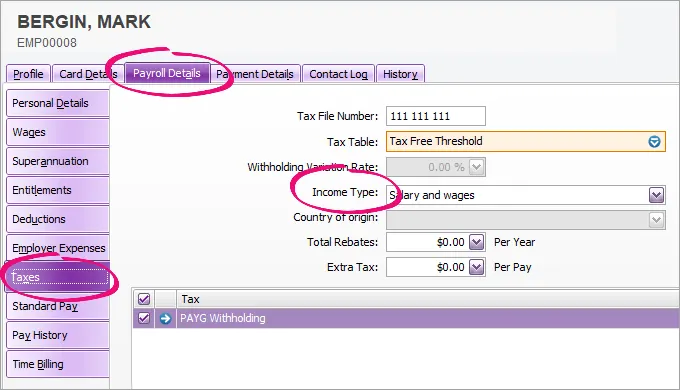

The ATO need to know what type of income you'll be paying each of your employees. For a lot of employees this would typically be Salary and wages, but other choices include Closely held payees, Labour hire, or Seasonal worker program. If you choose Working holiday maker, you'll also need to choose the employee's Home country (Country code). You'll find the Income type field via Payroll > Employees > click an employee > Payroll details tab > Taxes tab > Income type.

Lump sum E payments need the financial year they relate to

If you've paid a lump sum E payment (an amount of back payment that accrued, or was payable, more than 12 months before the date of payment and is $1200 or more), you'll need to advise the ATO which financial year the payment relates to. For all the details, see this help topic.

Some of your payroll processes will change (for the better!)

Tax file number declarations

Under STP Phase 2, when a new employee starts working for you, you won't have to send the ATO a tax file number declaration. Instead, the ATO will be provided all the required information when you report the employee's first pay run via STP. You'll find the employee's tax fine number via Payroll > Employees > click an employee > Payroll details tab > Taxes tab > Tax file number.Termination reason

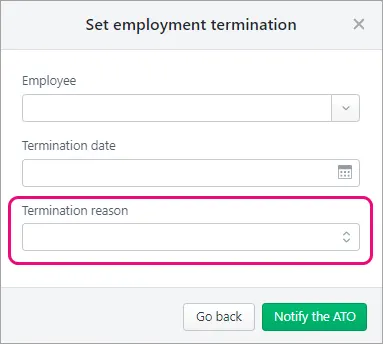

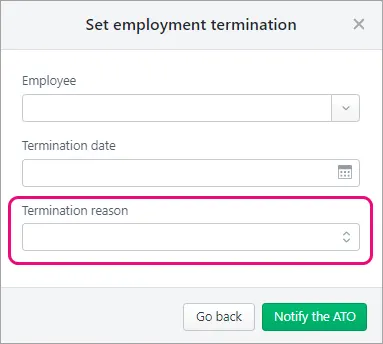

When you process a final pay for an employee who's leaving your business and you report this termination through the STP reporting centre, you'll need to select the Termination reason. This is now a requirement for both the ATO and Services Australia. Learn more about terminating an employee in Single Touch Payroll reporting.

Your end-of-year reports are clearer

After moving to STP Phase 2, your end of year reports will reflect STP Phase 2 information (Payroll > Single Touch Payroll reporting > EOFY finalisation tab).

The YTD verification report lists the new ATO reporting categories. In STP Phase 1 this report showed the aggregated gross wages, but it now shows the disaggregated values.

The Summary of Payments report (accessible by clicking the ellipsis button for an employee > View summary report (PDF)) only lists pay items that have been used for the employee in that payroll year. Previously all of the employee's pay items were listed, even those with $0.00 values.

Handling pays processed after STP Phase 1 shutdown

If you're still on STP Phase 1, any pays processed since 27 February haven't been reported to the ATO. To report these pay amounts, complete the following tasks.

1. Work out unreported pay amounts

Use the Payroll activity report to find the amounts you've paid your employees since the STP Phase 1 shutdown.

Go to the Reporting menu > Reports.

Click the Payroll tab.

Click to open the Payroll activity report.

Set the date range from 27/02/2025 to 30/06/2025.

Click Expand all to see a breakdown of all pay amounts paid to each employee.

Click View and print to display a PDF of the report on a new browser tab.

Save or print a copy if this report – you'll need the values in the report for the next few tasks.

2. Create a negative pay for the unreported pay amounts

You now need to "undo" the pay amounts identified above using negative pays. Instead of deleting each employee's pay, you can do it in a single unscheduled pay run.

Go to the Create menu > Pay run.

For the Pay cycle, choose Unscheduled.

Set today's date as the Pay period start date and click Next.

For each employee who appears on the Payroll activity report:

Select the employee.

Click to open their pay.

Enter the values from the Payroll activity report against the applicable pay items as negative values. Make sure all other hours and amounts are zero – including any leave accruals.

Once you've done this for each employee who appears on the Payroll activity report, click Next and finish recording the pay run as normal.

3. Move to STP Phase 2

When you move to STP Phase 2, your business and employee details are checked to make sure they meet the new STP requirements. This includes checking inactive and terminated employees you've paid in the current payroll year. If anything needs fixing, we'll let you know.

If you need help moving to STP Phase 2 we recommend speaking to an advisor.

Go to the Payroll menu > Single Touch Payroll reporting.

Click Move to Phase 2.

Click Check my payroll information. If any issues are found they'll be listed, ready to fix. To fix:

Business details: Click Edit business details. Details of what needs updating will be shown at the top of the screen. Make the required changes and click Save.

Employee details: Click the employee's name. Details of what needs updating will be shown at the top of the screen. Make the required changes and click Save. After updating and saving the employee's details, click the link at the top of the screen to continue preparing for STP Phase 2.

Employee income type: For each listed employee, choose the applicable Income type (Salary and wages, Closely held payees, Working holiday maker, Seasonal worker program or Labour hire). If unsure, check with your accounting advisor or the ATO. If you choose Working holiday maker, also choose the employee's Home country (Country code). Click Save and check details to see if anything else needs fixing.

ATO reporting categories: For each listed pay item, choose the applicable Phase 2 ATO category. Learn about assigning ATO reporting categories for Single Touch Payroll.

Click Save and check details to see if anything else needs fixing.

Lump sum E payments: If you paid a lump sum E payment that related to one financial year, specify which year the payment related to. You should also unlink the lump sum E pay item from all employees (Payroll > Pay items > Wages and salary tab > click to open the lump sum E pay item > click the remove icon next to each employee > Save). You can now repeat the above steps to move to STP Phase 2.If you paid a lump sum E payment that related to multiple financial years, you'll need to advise the ATO which financial years the payment related to. For all the details on how to do this, see Lump sum E payments.

When no more issues are found, click Transfer business to STP Phase 2.

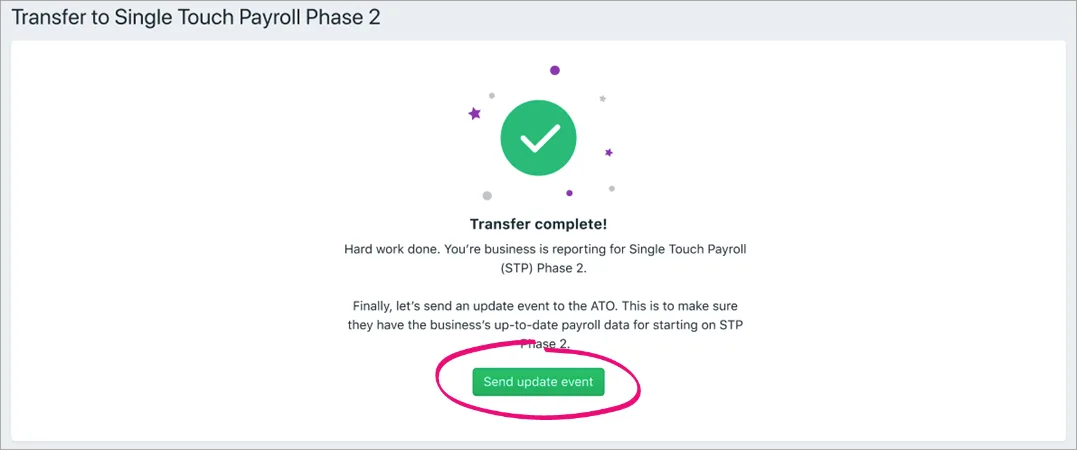

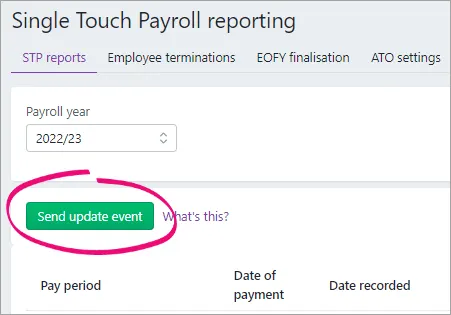

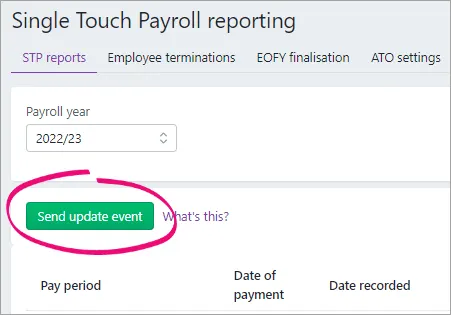

Finally, click Send update event to make sure the ATO has the current year-to-date payroll totals for your employees.

Avoid common STP mistakes

To find out about some common STP Phase 2 reporting questions and mistakes, see this ATO information.

5. Reprocess the unreported pays

You can now reprocess the pay amounts you undid earlier, so you'll need the Payroll activity report you generated earlier. This is the same as what you did earlier in an unscheduled pay, but this time you'll use positive numbers.

Go to the Create menu > Pay run.

For the Pay cycle, choose Unscheduled.

Set today's date as the Pay period start date and click Next.

For each employee who appears on the Payroll activity report:

Select the employee.

Click to open their pay.

Enter the values from the Payroll activity report against the applicable pay items as positive values. Make sure all other hours and amounts are zero – including any leave accruals.

Once you've done this for each employee who appears on the Payroll activity report, click Next and finish recording the pay as normal.

FAQs

What changes will I notice after moving to STP Phase 2?

After the move, you'll notice these changes:

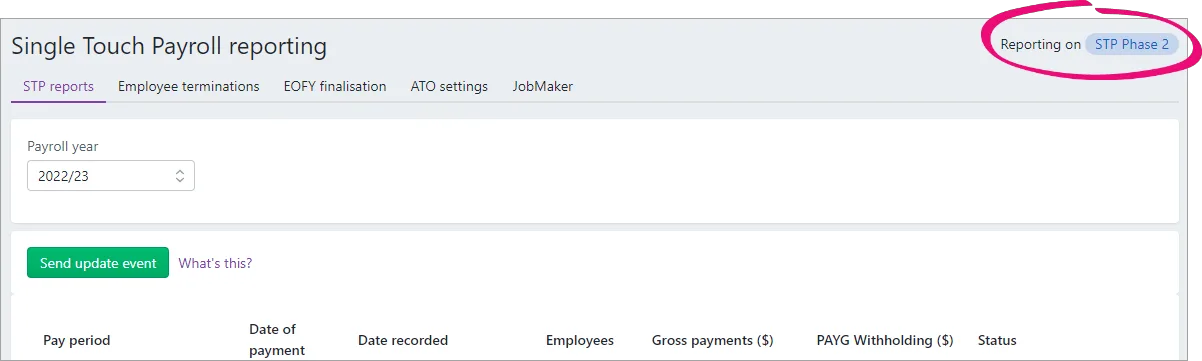

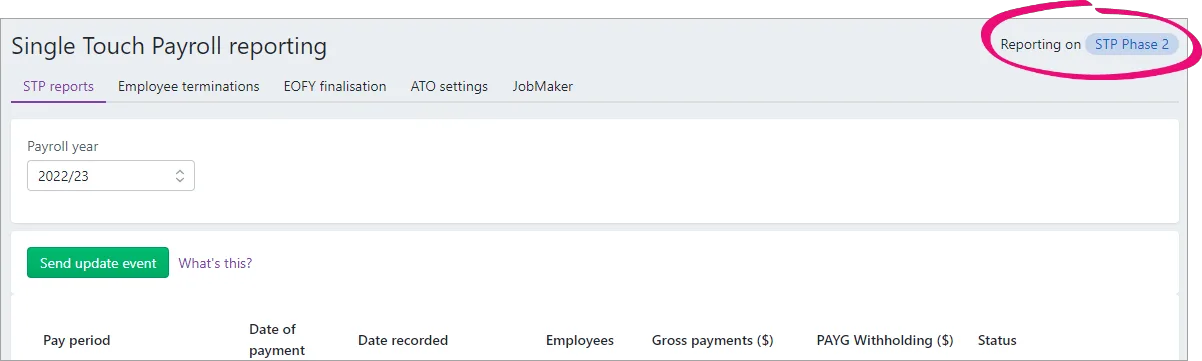

You'll see a label in the STP reporting centre showing you're reporting on STP Phase 2.

When terminating an employee in the STP reporting centre, you'll choose a Termination reason.

There's a new Send update event button in the STP reporting centre to send your employees' latest year-to-date payroll totals to the ATO. Previously you could only do this by recording a zero dollar ($0) pay.

What payroll details are checked during the move to STP Phase 2?

When you move from STP Phase 1 to STP Phase 2, the following details are checked in MYOB to make sure they meet the new STP requirements.

| What gets checked |

|---|---|

Business information | • Business name • ABN • GST branch number (if you have one) what is this? • Address You can access this information in MYOB by clicking the settings menu (⚙️) > Business settings. |

Employee details | Employees paid in the current and previous payroll year are included in the payroll check, including inactive and terminated employees. Here is the information that's checked for your employees (accessed via the Payroll menu > Employees > click an employee).On the Contact details tab: • First name • Surname or family name • Country • Address • Suburb/town/locality • State/territory • Postcode On the Payroll details tab > Employment details section: • Date of birth • Start date • Employment basis On the Payroll details tab > Taxes section: • Tax file number • Income type Do you employ working holiday makers? If you choose Working holiday maker as the Income type, you'll also need to choose the worker's Home country (Country code). Also check that the correct Tax table is assigned to working holiday makers based on your business's working holiday maker registration status. |

Pay items | Wages and salary, superannuation and deduction pay items used in the current and previous payroll year are included in the check. You can access your pay items via the Payroll menu > Pay items. Each of these must have an ATO reporting category assigned. By default, this is set to To be assigned, so you know what pay items still need assigning. |

Single Touch Payroll (STP) Phase 1 was switched off on 27 February 2025. To start reporting your payroll to the ATO again, you must move to STP Phase 2 (Payroll command centre > Payroll Reporting > Move to Phase 2).

If you haven't made the move to STP Phase 2 and you've processed pays after STP Phase 1 was shut down, see below for what to do.

If you don't move to STP Phase 2

Pays you process in AccountRight won't be reported to the ATO. This includes reversals and updates – so you won't be compliant with the ATO's payroll reporting rules.

You won't be able to complete your employees' end of year finalisation – so your employees won't be able to complete their tax returns because their income statement won't be for the full year

You won't be able to fix any incorrect or rejected STP submissions – so the ATO won't have your current year-to-date payroll totals.

What's changed from STP Phase 1?

There are many things that won't change under STP Phase 2, like:

how and when you lodge your STP reports

the types of payments you report

your tax and super obligations

end of year finalisation.

You'll need to enter some additional payroll details

To report successfully under STP Phase 2, the ATO require some additional employee and payroll details to be entered into MYOB. You'll be guided to enter this information when you first set up STP or when you make the move from STP Phase 1.

New ATO reporting categories

ATO reporting categories help the ATO classify the wage, deduction and superannuation payments in your employees' pays. For STP Phase 2, there are some updated and new ATO reporting categories to better classify your employee payments. This includes some new ATO reporting categories like Overtime and Bonuses and commissions that might previously have been reported as Gross payments. Similarly, leave payments were previously reported as gross payments, but now they have their own, more specific ATO reporting categories. Learn more about assigning ATO reporting categories.Income Type and Country of origin

The ATO need to know what type of income you'll be paying each of your employees. For a lot of employees this would typically be Salary and wages, but other choices include Closely held payees, Labour hire, or Seasonal worker program. If you choose Working holiday maker, you'll also need to choose the employee's Country of origin. You'll find the Income type field via Card File > Cards List > Employee tab > open an employee's card > Payroll Details tab > Taxes tab > Income Type.

Lump sum E payments need the financial year they relate to

If you've paid a lump sum E payment (an amount of back payment that accrued, or was payable, more than 12 months before the date of payment and is $1200 or more), you'll need to advise the ATO which financial year the payment relates to. For all the details, see this help topic.

Some of your payroll processes will change (for the better!)

Tax file number declarations

Under STP Phase 2, when a new employee starts working for you, you won't have to send the ATO a tax file number declaration. Instead, the ATO will be provided all the required information when you report the employee's first pay run via STP. You'll find the Tax File Number field via Card File > Cards List > Employee tab > open an employee's card > Payroll Details tab > Taxes tab > Tax File Number.Termination reason

When you process a final pay for an employee who's leaving your business and you report this termination through the STP reporting centre, you'll need to select the Termination reason. This is now a requirement for both the ATO and Services Australia. Learn more about terminating an employee in Single Touch Payroll reporting.

Your end-of-year reports are clearer

After moving to STP Phase 2, your end of year reports will reflect STP Phase 2 information (Payroll command centre > Payroll Reporting > EOFY finalisation tab).

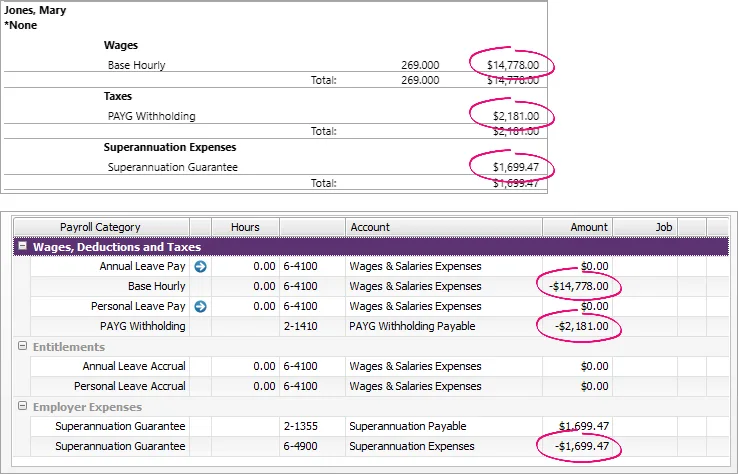

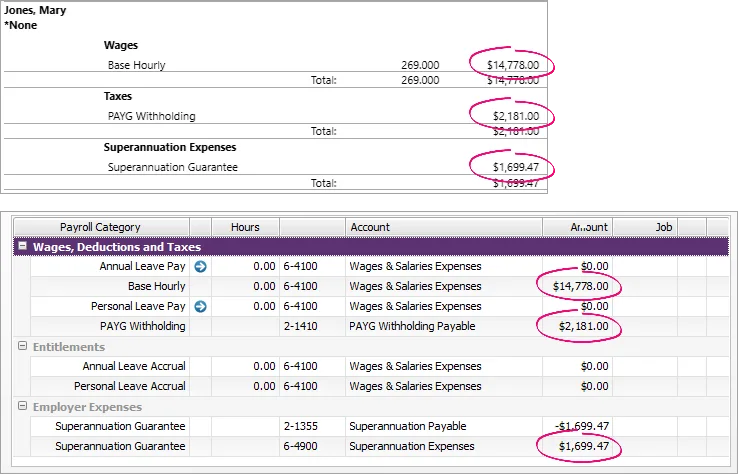

The YTD verification report lists the new ATO reporting categories. In STP Phase 1 this report showed the aggregated gross wages, but it now shows the disaggregated values.

The Summary of Payments report (accessible by clicking the ellipsis button for an employee > View summary report (PDF)) only lists payroll categories that have been used for the employee in that payroll year. Previously all of the employee's payroll categories were listed, even those with $0.00 values.

If it isn't already, you'll need to put your company file online before moving to STP Phase 2. To learn more about why your file needs to be online, see the FAQs below.

Handling pays processed after STP Phase 1 shutdown

If you're still on STP Phase 1, any pays processed since 27 February haven't been reported to the ATO. To report these pay amounts, complete the following tasks.

1. Work out unreported pay amounts

Use the Payroll Activity Report to find the amounts you've paid your employees since the STP Phase 1 shutdown.

Go to the Reports menu and choose Index to Reports.

Click the Payroll tab.

Under Employees, click the Activity Detail report.

Set the date range from 27/02/2025 to 30/06/2025.

Click Display Report to see a breakdown of all pay amounts paid to each employee.

Click the dropdown arrow in the top-left corner to save or print a copy of this report – you'll need the values in the report for the next few tasks.

2. Create a negative pay for the unreported pay amounts

You now need to "undo" the pay amounts identified above using negative pays. Instead of deleting each employee's pay, you can do it in a single pay run.

Go to the Payroll command centre and choose Process Payroll.

At the Process all employees paid field, choose Bonus/Commission.

Set today's date as the Payment Date and the Pay period start and Pay period end dates.

Click Next.

For each employee who appears on the Payroll Activity report:

Select the employee.

Click the blue zoom arrow to open their pay.

Enter the values from the Payroll Activity report against the applicable payroll category as negative values. Make sure all other hours and amounts are zero – including any leave accruals.

Once you've done this for each employee who appears on the Payroll Activity report, click Record and finish recording the pay run as normal.

3. Move to STP Phase 2

When you move to STP Phase 2, your business and employee details will be checked to make sure they meet the new STP requirements. This includes checking inactive and terminated employees if you've paid them in the current payroll year. If anything needs fixing, we'll let you know.

If you need help moving to STP Phase 2 we recommend speaking to an advisor.

In AccountRight, go to the Payroll command centre and click Payroll Reporting.

Click Move to Phase 2. You'll be prompted to continue in a web browser. If it isn't already, you'll be prompted to put your company file online before moving to STP Phase 2. To learn more about why your file needs to be online, see the FAQs below.

Click Go to browser.

If you're prompted to sign in to your MYOB account:

Sign in using your MYOB account details (email address and password).

Go to the Payroll menu > Single Touch Payroll reporting.

Click Get started at the top of the screen.

Click Check my payroll information. If any issues are found they'll be listed, ready to fix. To fix:

Business details: Click Edit business details. Details of what needs updating will be shown at the top of the screen. Make the required changes and click Save.

Employee details: Click the employee's name. Details of what needs updating will be shown at the top of the screen. Make the required changes and click Save. After updating and saving the employee's details, click the link at the top of the screen to continue preparing for STP Phase 2.

Employee income type: For each listed employee, choose the applicable Income type (Salary and wages, Closely held payees, Working holiday maker, Seasonal worker program or Labour hire). If unsure, check with your accounting advisor or the ATO. If you choose Working holiday maker, also choose the employee's Home country (Country code). Click Save and check details to see if anything else needs fixing.

ATO reporting categories: For each listed pay item, choose the applicable Phase 2 ATO category. Learn about assigning ATO reporting categories for Single Touch Payroll.

Click Save and check details to see if anything else needs fixing.

If you paid a lump sum E payment that related to one financial year, specify which year the payment related to. You should also remove all employees from the lump sum E payroll category (Payroll > Payroll Categories > Wages tab > click to open the lump sum E payroll category > Employees > deselect all employees > OK > OK). You can now repeat the above steps to move to STP Phase 2.If you paid a lump sum E payment that related to multiple financial years, you need to advise the ATO which financial year the payment related to. For all the details on how to do this, see Lump sum E payments.

When no more issues are found, click Transfer business to STP Phase 2.

Finally, click Send update event to make sure the ATO has the current year-to-date payroll totals for your employees.

You can now return to AccountRight, or continue using AccountRight in a web browser.

Avoid common STP mistakes

To find out about some common STP Phase 2 reporting questions and mistakes, see this ATO information.

5. Reprocess the unreported pays

You can now reprocess the pay amounts you undid earlier, so you'll need the Payroll Activity report you generated earlier. This is the same as what you did earlier, but this time you'll use positive numbers.

Go to the Payroll command centre and choose Process Payroll.

At the Process all employees paid field, choose Bonus/Commission.

Set today's date as the Payment Date and the Pay period start and Pay period end dates.

Click Next.

For each employee who appears on the Payroll Activity report:

Select the employee.

Click the blue zoom arrow to open their pay.

Enter the values from the Payroll Activity report against the applicable payroll category as positive values. Make sure all other hours and amounts are zero – including any leave accruals.

Once you've done this for each employee who appears on the Payroll Activity report, click Record and finish recording the pay run as normal.

FAQs

What changes will I notice after moving to STP Phase 2?

After the move, you'll notice these changes:

When you access the STP reporting centre, it'll open in the web browser version of AccountRight (Payroll command centre > Payroll Reporting > Payroll Reporting Centre) and you'll see a label showing you're reporting on STP Phase 2.

When terminating an employee in the STP reporting centre, you'll choose a Termination reason.

There's a new Send update event button in the STP reporting centre to send your employees' latest year-to-date payroll totals to the ATO. Previously you could only do this by recording a zero dollar ($0) pay.

What payroll details are checked during the move to STP Phase 2?

When you move from STP Phase 1 to STP Phase 2, the following fields are checked for missing information.

| What gets checked |

|---|---|

Business information | • Business name • ABN • GST branch number (if you have one) what is this? Address You can access this information in MYOB by clicking your business name > Business settings. |

Employee details | All employees paid in the current and the previous payroll year are included in the payroll check. Employees made inactive or terminated in the current payroll year will also be checked.Here is the information that's checked for your employees (accessed via the Payroll menu > Employees > click an employee).On the Contact details tab: • First name • Surname or family name • Country • Address • Suburb/town/locality • State/territory • Postcode On the Payroll details tab > Employment details section: • Date of birth • Start date • Employment basis On the Payroll details tab > Taxes section: • Tax file number • Income type Do you employ working holiday makers? If you choose Working holiday maker as the Income type, you'll also need to choose the worker's Home country (Country code). Also check that the correct Tax table is assigned to working holiday makers based on your business's working holiday maker registration status. |

Pay items/Payroll Categories | Wages, superannuation and deduction payroll categories used in the current and previous payroll year are included in the check. You can access your payroll categories via the Payroll command centre > Payroll Categories. Each of these must have an ATO reporting category assigned. By default, this is set to To be assigned, so you know what payroll categories still need assigning. |

Why does my file need to be online?

You'll complete the move to STP Phase 2 online (via a web browser) so you can integrate with the ATO's online services. This is only possible if your company file is online.

If your company file is offline (saved on your computer or a network server), you'll need to put your company file online to move to STP Phase 2. Having your file online is included with your subscription, so there's no extra cost.