In this article

Paying yourself as a sole trader takes careful consideration. You’ll need to decide how to balance the needs of your business with your living expenses.

In this guide, you’ll learn how to withdraw money from your business, what to consider and tips for paying yourself.

Methods of withdrawing money from your business

The methods of withdrawing money from your business are limited for a sole trader — you can only take money out as drawings.

This is when you take funds from your business account for personal use. It’s important to keep an accurate record of these withdrawals for cash flow management and tax purposes. From a tax perspective, drawings are counted as profit which you’ll need to pay tax on at the end of the financial year.

How to pay yourself as a sole trader

Paying yourself as a sole trader can be tricky. You’ll need to strike a balance between making sure you have enough money to live on, setting funds aside for tax and super, reinvesting in your business and factoring in any unforeseen costs. Here’s what to consider:

1. Determine a fair income to pay yourself

Determining a fair income to pay yourself will vary based on how established your business is. If you’re just starting out, get a handle on your living expenses and begin with a modest weekly or monthly income to cover this. If additional cash reserves build up in your business, you may be able to take bonus payments. If you’re fairly established with predictable cash flow consider what you’d be paying if you employed someone else in your role.

2. Draw money from the business account at scheduled intervals

Drawing money from your business account at scheduled intervals — either weekly or monthly — could make budgeting for your expenses easier. By regularly withdrawing a consistent amount, you may also be able to manage your business’s cash flow more effectively. It’s important to review your business’s profit and loss statements regularly in case you need to make any adjustments.

3. Consider income tax

Income tax is important when paying yourself as a sole trader. At the end of the financial year, you’ll pay income tax on your earnings after deducting business expenses. You can either set aside a portion of funds every time you pay yourself or make pay-as-you-go (PAYG) instalments. By regularly setting aside tax funds, you won’t get caught out at the end of the year.

4. Consider building an emergency fund

Build an emergency fund to give you financial security in your business and at home. It’s a good idea to keep a couple of months’ worth of expenses aside so you can comfortably cover unexpected costs without straining your business or personal finances.

5. Consider student loans and superannuation

Student loan repayments and superannuation contributions become your responsibility as a sole trader. Student loan repayments are compulsory for sole traders once your income reaches a certain threshold, just like if you were employed.

Check out the ATO’s current thresholds. Contributing to your superannuation isn’t compulsory, but there are plenty of benefits to doing so. You’ll contribute to your long-term financial stability and may be able to reduce your tax burden.

Tips when paying yourself as a sole trader

Here are some solid tips for paying yourself as a sole trader:

Stay on top of your tax obligations

Stay on top of your tax obligations by setting aside any funds necessary to make end-of-year tax payments. Also, ensure you’re familiar with the filing deadlines and reporting requirements.

Look into sole trader tax deductions

Sole trader tax deductions can help you maximise your business’s profitability. These deductions include business-related expenses like office supplies, work-related travel and advertising and marketing expenses.

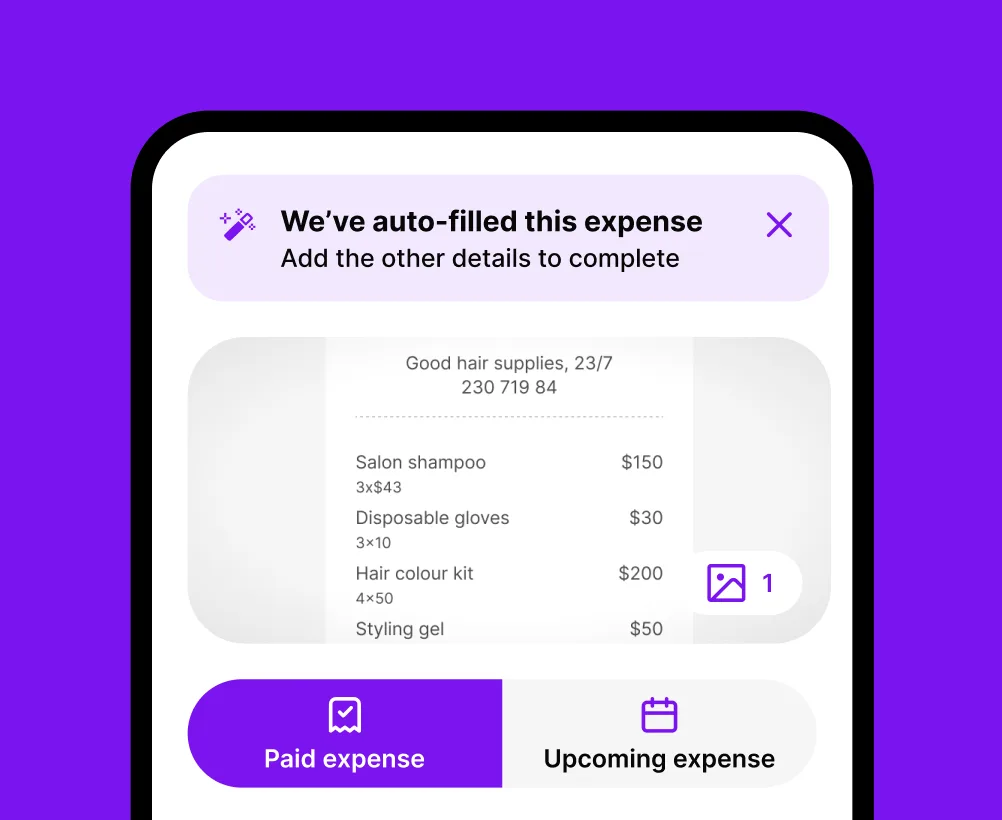

You need to store receipts and other documentation for at least five years after you lodge your tax return. You can save time by using Solo by MYOB — a specialist app for sole operators. Solo lets you scan and store receipts as you get them.

Keep your business and personal finances separate

Keeping your business and personal finances separate is the best approach for accurate financial tracking — even if you’re just starting out. Setting up a separate business bank account simplifies your accounting process, as you’ll have absolute clarity on your business income, expenses and profits.

Always keep enough money in the business for expenses

Always keep enough money in the business to cover expenses like power bills, leases and software subscriptions.

Consider paying into your superannuation fund.

Consider paying into your superannuation fund, even in the early stages of your business. You're unlikely to regret it in the long run.

Use financial software

Using a specialist app for sole operators makes all these processes simpler. Solo by MYOB tracks your income and expenses and automates time-consuming paperwork.

You can capture expenses as they happen with Solo and even take payments in person via the Solo app. You can also create and send invoices when you’re out and about. Solo will track who’s paid and who hasn’t and prompt you to send reminders. If you’re registered for GST, the app will calculate what you owe and pre-fill your business activity statement ready for you to send.

With real-time and accurate insights into your business performance, you’ll know what you can pay yourself and when.

How to pay yourself as a sole trader FAQs

Can sole traders pay themselves a salary or wage?

Sole traders can’t technically pay themselves a salary or wage because they’re not employees. Instead, they withdraw money from the business, as needed.

Can sole traders get paid dividends?

Sole traders can’t receive dividends because dividends are payments made to company shareholders. A sole trader is a different type of business structure.

Should I use accounting software as a sole trader?

Sole traders should use accounting software to simplify business financial management and save hours each day. It makes tracking income and expenses easy, helps you keep up with your tax obligations and ensures you keep accurate records.

Can sole traders take drawings from the business whenever they want?

As a sole trader, you can take drawings from your business whenever you want. However, this can make it difficult to track your tax obligations and your business performance. It’s best to pay yourself a set amount regularly.

Gone solo? Get Solo!

You didn't go out on your own to run on fumes. You need money coming in to keep on going, and you need the right tools to make running a business a cinch.

With features like chase-free invoicing, tap to pay, snap and track expenses, tax-ready records and a spotlight on your cashflow, you've got everything you need with Solo. Get started today.

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.