In this article

See the PDF version of the Solo Money Terms and Conditions here.

Important information

This document sets out the terms and conditions for the Banking Products and Services provided by Great Southern Bank, a business name of Credit Union Australia Ltd ABN 44 087 650 959, Australian Financial Services Licence and Australian Credit Licence 238317 (referred to in this document as “we”, “our” or “us”) and distributed by MYOB Australia Pty Ltd ABN 13 086 760 198, Australian Financial Services License 241059 (the “Distributor”).

The Distributor is not an authorised deposit-taking institution for the purposes of the Banking Act 1959 (Cth). Neither Great Southern Bank nor the Distributor guarantee or otherwise provide assurance in respect of the obligations of the other.

Your acceptance of these Terms and Conditions through the Solo by MYOB app binds you to the terms and conditions set out on this page.

You should read these Terms and Conditions. You can contact us through the Solo by MYOB app if you’d like more information about this document or our products and services.

Please contact us immediately through the Solo by MYOB app if you suspect that your Solo Money profile, or any of the Banking Products and Services you hold, have been subject to a security breach or other form of unauthorised access.

Important contact information

How to contact us

You can contact us via the Solo by MYOB app.

Lost and stolen debit cards

You need to log into Solo by MYOB, freeze or cancel the Card and report the Card as lost, stolen or damaged in Solo by MYOB.

Financial hardship

If you are experiencing difficulty repaying any overdrawn amount, contact us via the Solo by MYOB app.

Part A Setting up Solo Money

1. Solo Money

(a) Solo Money can only be accessed through the Solo by MYOB app.

(b) The MYOB Solo Terms of Use (available at www.myob.com/au/legal/myob-solo-terms-of-use) apply to your use of Solo by MYOB.

(c) In addition, Part A and Part B of these Terms and Conditions also apply to your set up and access to Solo Money products and services via the Solo by MYOB app and your use of the Solo by MYOB app when you have Solo Money products.

(d) The Solo by MYOB app is a digital platform that lets you:

(i) apply for and access the Banking Products and Services (you won’t be able to access the Banking Products and Services through any branches or telephone banking services); and

(ii) instruct us in relation to the Banking Products and Services and your relationship with us.

(e) The Banking Products and Services are listed in Schedule 1.

(f) If you delete or uninstall the Solo by MYOB app from your device it does not close or de-activate your Solo Money Account. Your account remains open and subject to these Terms and Conditions (where applicable) until you or we close the account.

2. Using Solo Money

2.1. How to access Solo Money

(a) Once you have accessed the Solo by MYOB app, you’ll be able to start the onboarding process for you and those authorised to act on your behalf (if any) and apply for the Banking Products and Services.

(b) As part of the Solo Money onboarding process, we’ll ask you to (amongst other things):

(i) accept these Terms and Conditions; and

(ii) acknowledge our Privacy Statement.

(c) We need to collect certain types of information from individuals who are authorised to act for you through Solo Money before we can provide you the Banking Products and Services. The information we collect from you and those authorised to act for you will depend on your business type and the Banking Products and Services you select. If you have any questions about this process, including electronic verification of identity, you can contact us via chat in the Solo by MYOB app.

(d) We may ask you for information relating to the individuals authorised to act for you so we can contact them directly.

(e) Once you and individuals authorised to act for you have satisfied our identification and verification requirements, you’ll be able to apply for the Banking Products and Services.

(f) Only the individual who has access to Solo by MYOB will have access to the Banking Products and Services. They will have sole authority over the bank accounts opened for you. Individuals without access to the Solo by MYOB app must provide consent for the individual with access to have sole authority to operate the accounts.

3. Suspension

(a) We may suspend, limit or cancel your access to the Banking Products and Services at our absolute discretion by giving notice with immediate effect if we consider that taking the action is reasonably required. We may suspend, limit or cancel your access to the Banking Products and Services in the following circumstances:

(i) to manage the risk of fraud or other harm to you, us or a third party;

(ii) to comply with our regulatory, payment system and compliance obligations (including but not limited to our obligations under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth));

(iii) to prevent the use of the Banking Products and Services in a way that could adversely affect our integrity, stability or reputation or that of any third party;

(iv) to prevent a transaction that potentially breaches Australian law or sanctions from being processed; and

(v) to address an actual or potential breach of these Terms and Conditions or law.

(b) We may delay, reject, freeze or block a transaction, an individual’s user permissions for the Banking Products and Services or a Card if we consider the action is reasonably required to manage risk or to comply with our regulatory obligations.

(c) We must make reasonable efforts to investigate any suspension as soon as reasonably practicable. We have the authority to keep a service suspended until the time that any issues are resolved to our reasonable satisfaction.

(d) Where we suspend, limit or cancel your access to the Banking Products and Services you may contact us in accordance with clause 39.

(e) We are not liable for any loss you or any other party suffers where we take any action referred to in this clause in accordance with these Terms and Conditions.

Part B Accessing Solo Money Terms

4. Device and browser compatibility

You may experience some issues when using the Solo by MYOB app and Solo Money if you use an older or out of date version of a web browser or operating system. We won’t be liable for any loss you suffer if you don’t use a compatible web browser or operating system.

5. Password security

5.1. Signing in

(a) Solo Money is accessed through Solo by MYOB and you’ll be required to use a password to access Solo by MYOB. You must take special care to protect this password you use to access Solo by MYOB.

(b) The steps you can take to protect your password include:

(i) don’t pick a password that’s easily associated with you (e.g., your birthday, your phone number etc) or easily guessed;

(ii) don’t write your password down or record it anywhere (i.e. try to memorise it);

(iii) if you do keep a record of your password, don’t keep it near the device you use to access Solo by MYOB and don’t keep it in a form that can be easily lost or stolen (unless you can disguise the password in a manner that reasonably prevents another person from accessing your profile in Solo by MYOB);

(iv) don’t tell anyone your password (including friends and family members); and

(v) don’t say or enter your password in front of others.

(c) If you do record your password or write it down, you must take reasonable steps to prevent unauthorised access to your password such as:

(i) hiding or disguising the password amongst other records;

(ii) hiding or disguising the password in a place where a password wouldn’t be expected to be found;

(iii) keeping the password in a securely locked container; or

(iv) preventing unauthorised access to an electronic copy of the password.

(d) You must not share your password with any other person. We and the Distributor will never ask you to share your password through email or over the phone.

(e) Failure to protect your password may increase your liability if there are unauthorised transactions on your account.

5.2. Accessing Solo Money using biometric information

(a) You may be able to use your biometric information (such as your fingerprints or facial recognition)instead of your password to log into the Solo by MYOB app. If this is the case, you should ensure that only biometric data belonging to you is contained on your device to prevent another person from accessing your profile in the Solo by MYOB app. Your biometric information is stored on your device and not in the Solo by MYOB app.

(b) You authorise us to act on any instruction provided by you through the Solo by MYOB app where you log into the Solo by MYOB app using your login credentials (including where a login has occurred using biometric information stored on your device).

5.3. Authentication

You may be prompted to authenticate instructions for certain types of banking interactions (including by using your password, multi-factor authentication or biometric data).

These include:

(a) creating and amending payee details;

(b) a payment to a new payee;

(c) updating your contact details; and

(d) any function that we reasonably determine requires an additional step of authentication from you.

5.4. Processing times

In some cases, instructions that you submit through Solo Money after a certain time may only be processed the next day or the next Business Day. Information about processing times can be found in the Solo by MYOB app.

PART C Bank Accounts

6. Product features

6.1. Business account

(a) Your bank account must be used solely for business purposes. Youmust not use your bank account for personal purposes or for a combination of business and personal purposes.

(b) Your bank account will be opened in the name of your legal entity. If you trade under a registered business name, you may be able to select that name to appear on statements, PayID and Confirmation of Payee lookup results through your account settings.

6.2. Deposits

(a) The proceeds of payments may be credited to your bank account through an electronic funds transfer initiated by you, or another person, that has been directed to your account including through your PayID (if applicable).

(b) We’ll try to deposit the proceeds of a payment to your account around the same time we receive an instruction to do so. However, in certain circumstances there may be a delay (for example, if we are screening the payment in accordance with our risk and regulatory requirements).

(c) You must ensure that the person sending you money uses the correct BSB, account number and account name when they initiate a payment to your account.

(d) Any account you access through Solo Money isn’t eligible for cash deposits or deposits in connection with standard cheques, bank cheques or foreign cheques.

6.3. Withdrawals

(a) Funds may be debited from your Solo Money Account through:

(i) an electronic funds transfer initiated by you using the payment features available on your account to another account with us or to another financial institution (see Section 7 entitled “Electronic funds transfers" below);

(ii) arranging a direct debit to be processed in accordance with an agreement between you and a merchant, a scheduled or recurring payment or a PayTo payment (if your Solo Money Account is eligible);

(iii) a payment initiated by you using your Card or Card details; or

(iv) a cash withdrawal at an ATM.

(b) Any withdrawals from your Solo Money Account will be subjectto the following types of daily limits (details of which are available in the ‘Frequently Asked Questions’ section of the Solo by MYOB app):

(i) the daily withdrawal limit applicable to ATMs or merchant terminals using your Card. Additional restrictions may be imposed by the ATM provider or merchant;

(ii) the daily payment limit for electronic funds transfers;

(iii) contactless payment limits for Cards.

(c) We may, at our discretion, reduce the limits applicable to the Banking Products and Services without providing you prior notice where it’s reasonably necessary to protect you or us from fraud or other harm.

(d) More information regarding payment features can be found in PART D.

6.4. Balances

The balance of funds in your account at any time reflects your current balance. However, there may be parts of your current balance that are either reserved for a payment that is due to be authorised or have not yet been cleared. As such, any reference to ‘available funds’ or ‘sufficient funds’ in these Terms and Conditions refers to those parts of your current balance that are available for processing transactions without overdrawing your account.

6.5. Adjustments

We may debit funds that have been credited to your account without notifying you in advance. This will usually be to manage the risk offraud orto correct an error. For example, if a person accidentally makes a payment to your account, we may be required to take stepsto return the funds in accordance with the requirements of the ePayments Code. We may also correct your balance if we think there’s been an error caused by us or another bank.

6.6. Interest

(a) If your account is eligible for credit interest, you may earn interest on the account.

(b) If you overdraw your account, you’ll be required to pay debit interest at the default interest rate.

(c) Information regarding the interest rates (including the default interest rate) that apply to your account can be accessed through the Solo by MYOB app.

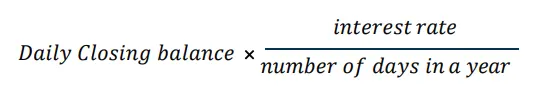

(d) Interest is calculated daily on the current balance of your account using the following formula:

(e) Interest is paid into or debited out of your account on the first day of the next month after interest has been earned or incurred.

(f) We may vary interest rates from time to time. We’ll notify you in accordance with clause 21 when we do.

6.7. Statements of Account

(a) You may view and download account statements through the Solo by MYOB app. Account statements reflect the transactions that were processed during the relevant statement period. Certain transactions may not be displayed on the statement (for example, where the statement was generated before the transaction was processed). These transactions will appear on the next account statement.

(b) You must review your account statement as soon as it is available to you and immediately contact us about any unauthorised transactions or errors.

6.8. Dormant Accounts

(a) We may close your account if it becomes dormant. An account is considered dormant if no transactions have occurred during a continuous six-month period (other than transactions initiated by us, such as crediting interest or debiting fees and charges). If we exercise our right to close your account under this clause, we’ll notify you in writing through the email address we hold for you in Solo Money.

(b) If:

(i) there haven’t been any customer-initiated deposits or withdrawals from your account for seven years; or

(ii) you haven’t advised us to keep your account active,

we may close your account and, where the account balance is above the amount specified by the government for unclaimed money purposes, transfer the money in your account to the government as unclaimed money. You can contact us through the Solo by MYOB app for help with recovering unclaimed money that we’ve transferred to the government.

6.9. Unarranged Limits

(a) We aren’t required to process a transaction you’ve initiated where you don’t have sufficient funds in your account. However, we may allow certain types of transactions to overdraw an account at our sole discretion. Where this is the case, we’ll provide you an Unarranged Limit.

(b) Subject to clause 6.9(c), an Unarranged Limit may be provided where:

(i) a transaction causes your account to go into a negative balance;

(ii) a transaction is processed that draws against uncleared funds; or

(iii) you incurfees or charges which take your account into a negative balance; or

(iv) a transaction causes you to exceed your overdraft limit under an overdraft facility with us.

(c) An Unarranged Limit may not always be available to you. You must ensure that:

(i) your account has sufficient funds for the purposes of clearing transactions initiated by you;

(ii) you don’t rely on us permitting a transaction that would result in us providing you an Unarranged Limit; and

(iii) you don’t overdraw your account or make attempts to overdraw your account on a regular basis.

(d) If we allow an Unarranged Limit on your account, you’ll owe us a debt of that amount and any fees and interest charged at the default interest rate applicable to the Unarranged Limit. The overdrawn amount and any fees and interest charged at default interest rate you incur must be repaid immediately. Further details on fees and default interest rate are available in Schedule 2.

(e) Any deposits into your account will first be applied against the overdrawn amount. Once the account has been credited the amount of the Unarranged Limit and any applicable fees and charges, the debt will be repaid and your account will return to a zero or credit balance.

(f) To avoid incurring fees and charges in connection with an Unarranged Limit, make sure you have money in your account to fund your payments (including any Card or direct debit transactions).

6.10. Hardship

If you are experiencing financial difficulty, including difficulty repaying any overdrawn amount on your Solo Money Account, please contact us via chat in the Solo by MYOB app. Once we understand your situation, we can let you know how we can assist.

6.11. Combining your accounts

(a) If you have more than one account with us, we may combine or set-off the balances of any type of account you hold with us. For example, we may use the credit balance in one of your accounts to pay the debit balance of another account to clear the debt you owe us. If we combine your accounts, we’ll notify you in writing after we have done so.

(b) However, we won’t exercise our rights under paragraph (a) if:

(i) we know that the funds aren’t held by you in the same capacity; or

(ii) your debt to us arises from some business with us other than banking.

PART D Payments

7. Electronic funds transfers

7.1. Making a payment

(a) Your Solo Money Account will be able to make the following kinds of funds transfers:

(i) Osko® (including via PayID);

(ii) Single Credit Transfer (including via PayID);

(iii) Direct Credit;

(iv) BPAY payments; and

(v) PayTo payments. Payments processed using your Card are dealt with under clause 12.

(b) The kind of payment that’s made normally depends on the payment instructions you provide and the functionality of the payee’s account. In terms of processing times, Osko payments are usually processed in less than a minute, the processing time of a Single Credit Transfer varies and depends on the payee’s bank and a Direct Credit payment may take up to three Business Days to be processed. BPAY payments will be processed in accordance with clause 8.

(c) We’ll usually try to process your payment as an Osko payment or a Single Credit Transfer. We may choose to process the payment using Direct Credit in certain circumstances(for example, if the payee’s account isn’t able to accept Single Credit Transfers).

(d) For a payment to be processed, the following conditions must be satisfied:

(i) there must be sufficient funds in your account;

(ii) your account and the transaction must not be subject to any restrictions or blocks that would prevent the debit to your account being processed;

(iii) your payee’s account must be valid, open and able to receive the payment you have initiated (for example, some accounts aren’t able to receive Osko payments or Single Credit Transfers);

(iv) your beneficiary’s bank must not reject the payment or return the payment to you.

7.2. Conducting a Confirmation of Payee Lookup

(a) For a payment made to a BSB and account number, it is your responsibility to ensure the BSB and account number you want to pay to is correct. Once available, the Confirmation of Payee service may provide you with a view on the likelihood that the account name you enter matches the name associated with the BSB and account number. If the Confirmation of Payee service suggests details are incorrect, you should only proceed if you have checked the account details with the intended recipient and you are confident that the account is legitimate.

(b) If the Confirmation of Payee lookup service becomes unavailable due to outages, scheduled maintenance or other reasons, we recommend you delay payments to BSB and account numbers until the service is restored.

(c) You must not misuse the Confirmation of Payee service in breach of these terms and conditions. We may limit or suspend your use if we believe it is reasonably necessary to protect you or us from possible fraudulent activity, scams or other activities that might cause you or us to lose money.

(d) We will ensure your account details are accurately recorded by us for the use of the Confirmation of Payee service.

(e) Your legal entity name will be displayed to people making payments to your bank account through the Confirmation of Payee service. In some cases, you may be able to display the registered business name that you nominate in clause 6.1(b). For more information on how to do this, please contact us via chat in the Solo by MYOB app.

(f) You acknowledge and authorise:

(i) us to use and disclose your account details in the Confirmation of Payee service; and

(ii) payers' financial institutions to use your account details for the purposes of the Confirmation of Payee service and prior to making payments to you.

(g) To the extent the actions detailed in this clause 8.2 constitutes disclosure, storage and use of your personal information within the meaning of the Privacy Law, you acknowledge and agree that you consent to that disclosure, storage and use.

(h) In limited circumstances, you may elect to opt-out of the Confirmation of Payee or provide an alternative name for your account, other than your registered business name nominated under clauses clause 6.1(b) and/or 8.2(e), by contacting us through the Solo by MYOB app.

7.3. Your obligations

(a) You must not enter inappropriate payment descriptions such as insulting or defamatory text. We may block the transaction or remove the payment description if we identify this language.

(b) You must ensure that all information you provide in relation to any payment is correct as we may not be able to cancel the payment once it’s been submitted by you.

(c) You must ensure you enter the correct BSB and account number for your payee. Some banks don’t check account names against the BSB and account number when processing payments. If you make a mistake, please contact us as soon as possible so we can try to recover the payment. It’s important to note that if a payment is credited to an unintended recipient, we may not be able to recover the funds and return them to you. We aren’t liable for any loss you suffer arising from a mistaken payment unless contributed to by our gross negligence, criminal conduct, fraud or wilful misconduct.

(d) If you become aware of a mistaken payment (including where a payment has been made to the wrong PayID), you must tell us immediately so that we can try and recover the funds for you.

7.4. Disclosures to BPAY

(a) To give you access to Osko and BPAY payments, we may need to disclose your information to BPAY and/or other payment system participants. If we don’t disclose this information to these parties, we won’t be able to give you BPAY or Osko services.

(b) You agree to our disclosing to BPAY, its service providers and other participants involved in BPAY or Osko payments your information to the extent necessary to facilitate the provision of BPAY or Osko payments to you.

8. BPAY® Payments

8.1. About BPAY payments

(a) BPAY provides an electronic payments service through which you can ask us to make payments to organisations known as Billers. To avoid doubt, Osko payments aren’t BPAY payments (and the terms and conditions outlined in this clause 8 don’t apply to Osko).

(b) If our BPAY membership or our subscription to BPAY payments is suspended or cancelled for any reason, we won’t be able to provide you BPAY services.

8.2. Making BPAY payments

(a) To make a BPAY payment, you must provide us with a valid payment instruction. When we receive this instruction, we’ll debit your account with the amount you specify.

(b) We’lltreat your payment instruction as valid if you give us the required information and comply with any applicable security procedures (for example, multi-factor authentication requirements). For the purposes of this clause, the required information you must give us includes:

(i) the relevant Biller’s Biller Code;

(ii) your Customer Reference Number;

(iii) the amount of the payment;

(iv) the account to be debited; and

(v) if the payment instruction relates to a scheduled payment, the date the payment is to be made.

(c) You may set up BPAY recurring or scheduled payments when you set up a new payee in Solo Money.

(d) You acknowledge that we may not process a payment if you don’t give us all of the required information or if any of the information that you give us is inaccurate.

(e) If a Biller has ended their arrangements with their financial institution, we won’t be able to process the payment and we may reject your payment instruction.

(f) You must make sure that your payment instructions are correct (including the payment amount). We won’t accept an order to stop a payment once you have instructed us to make that payment.

(g) You should notify us immediately if you become aware that an unauthorised payment has been processed or if you have made a mistake (except when you make an underpayment). Where you have made an underpayment, you can make another BPAY payment to the Biller to make up the difference.

(h) If we’re informed that your payment can’t be processed by a Biller, we’ll:

(i) advise you of this;

(ii) credit your account with the amount of the payment; and

(iii) take all reasonable steps to help you make the payment as quickly as possible.

(i) You acknowledge that the receipt by a Biller of a mistaken payment from a third party doesn’t constitute, under any circumstances, part or whole satisfaction of any underlying debt owed between you and that Biller.

8.3. Timing of Payments

(a) If you submit a valid BPAY payment instruction in the Solo by MYOB app before 6pm (Sydney time) on a Banking Business Day, it’ll be processed on the same day.

(b) If you make a payment after 6pm (Sydney time) on a Banking Business Day or on a day other than a Banking Business Day, it may be processed on the next Banking Business Day.

(c) Delays may occur in processing payments, including if:

(i) you make a payment on a weekend or public holiday; or

(ii) the Biller or another bank in the system doesn’t comply with BPAY rules.

These delays aren’t expected to continue for more than one Banking BusinessDay at a time but may continue for longer depending on the nature of the delay.

(d) Future-dated payments which fall on a date that’s not a Banking Business Day will be paid the next Banking Business Day.

8.4. Liability for BPAY payments

8.4.1. Overview

(a) We’ll take reasonable steps to ensure your payments are processed promptly by BPAY payment participants. You must promptly tell us if you:

(i) become aware of any delays or mistakes in processing your payment;

(ii) didn't authorise a payment that’s been made from your account; or

(iii) think that you’ve been fraudulently induced to make a payment. We’ll attempt to rectify these scenarios in relation to your payments in the way described in this clause 8.4.

(b) We won’t be liable for any loss or damage you suffer because of using BPAY payments except as set out in this clause 8.4 and unless contributed to by our gross negligence, criminal conduct, fraud or wilful misconduct.

(c) You must provide us such assistance as may be reasonably necessary to conduct investigations in respect of any mistaken, unauthorised or fraudulent payments.

(d) The longer the delay between when you tell us of the error and the date of your payment, the more difficult it may be to correct the error. For example, we or your Biller may not have sufficient records or information available to us to investigate the error. If this is the case, you may need to demonstrate that an error has occurred, based on your own records, or liaise directly with the Biller to correct the error.

(e) Subject to paragraphs 8.4.2 to 8.4.5, payments are irrevocable, unless the payment is:

(i) a mistaken payment referred to in paragraph 8.4.2;

(ii) an unauthorised payment referred to in paragraphs 8.4.1 (a) to 8.4.1 (c); or

(iii) a fraudulent payment referred to in paragraph 8.4.4.

No refunds will be provided through BPAY where you have a dispute with the Biller about any goods or services you may have agreed to acquire from the Biller. Any dispute must be resolved with the Biller.

8.4.2. Mistaken payments

If a payment is made otherwise than in line with your instructions (if any), we’ll credit that amount to your account. However, if you were responsible for a mistake resulting in that payment (e.g. due to entering the wrong details as part of a payment instruction) and we can’t recover the funds within 20 Business Days of us attempting to do so, you must pay us that amount.

8.4.3. Unauthorised payments

(a) If a payment appears to be made by you, or appears to be made on your behalf, but has been made without your authority, we’ll credit your account with the amount of that unauthorised payment. This doesn’t include a payment where the payment instruction was made by you or by anybody with your knowledge or consent. Further, in all cases, you must pay us the amount of an unauthorised payment if the payment was made because of you not complying with any relevant security requirements.

(b) If we can recover part of an amount you’re required to pay us under paragraph 8.4.3(a) from the payment recipient, you must pay us the amount that we can’t recover.

(c) If you tell us that a payment made from your account is unauthorised, you must give us your written consent (in a form we may specify), consenting to us obtaining from the payment recipient information about you, including your Customer Reference Number and such information as we reasonably need to investigate the payment. If you don’t give us that consent, the payment recipient may not be permitted under law to disclose to us the information we need to investigate or rectify that payment.

8.4.4. Fraudulent payments

If a payment is made because you were fraudulently induced into making that payment, and any other person involved in the payment committed, had actual knowledge of, or with reasonable diligence should have detected, the fraud, then that person should refund you the amount of the fraud-induced payment. However, if that person doesn’t refund you the whole amount of the fraud induced payment, you must bear the loss.

8.4.5. Resolution principles

(a) A payment that falls into more than one of the categories described in clause 8.4 will be handled as follows:

(i) if a payment you’ve made falls within the type described in paragraphs 8.4.3 (a) to 8.4.3 (c) (Unauthorised payments) and:

(A) paragraph 8.4.2 (Mistaken payments); or

(B) paragraph 8.4.4 (Fraudulent payments)

then we’ll apply the principles set out in paragraphs 8.4.3 to (Unauthorised payments).

(ii) If a payment you’ve made falls within both the types described in paragraphs 8.4.2 (Mistaken payments) and 8.4.4 (Fraudulent payments), then we’ll apply the principles set out in paragraph 8.4.4 (Fraudulent payments).

9. PayID®

9.1. About PayID

A PayID is a unique identifier that can be used to make and receive payments. You can use the PayID service to:

(a) register a PayID and use it to receive payments from people who have accounts at participating financial institutions; or

(b) make a payment to a PayID as an alternative to using a person’s BSB and account number.

9.2. Making payments to a PayID

(a) Subject to clause 7, you may use a payee’s PayID to make Osko or Single Credit Transfer payments to the payee from your account. You can pay a PayID without needing to create one for yourself.

(b) You must input the correct PayID details and check the payee’s PayID name before making a payment. If you make a payment to the wrong PayID, the funds may be sent to an unintended recipient and you may not be able to recover the money.

9.3. Creating a PayID

(a) A PayID can be created by linking a unique identifier to an eligible account through Solo Money. The PayID types we currently offer are mobile numbers and email addresses. We won’t create a PayID for you without your consent.

(b) You must have an eligible account and either own or be authorised to use the PayID to register it through Solo Money.

(c) A PayID can only be registered with one financial institution at a time and linked to a single account. You can create multiple PayIDs and link them to the same account or to multiple accounts, provided that each PayID is different and the nominated account is eligible.

(d) When you create a PayID, we’ll generate a PayID name using the details held for your account for your review. We’ll ensure that the PayID and the details linked to it (i.e. the PayID name and underlying account details) will be correctly recorded in the central register managed by NPPA. Your PayID name will be made available to parties who use the PayID service. Your PayID details may also be used for screening, disputes and investigations.

(e) To the extent that the creation and use of your PayID details constitutes a disclosure, storage and use of your personal information, you acknowledge and agree that you consent to that disclosure, storage and use. You also acknowledge that we may monitor your PayID use to manage the risk of misuse and fraud.

(f) If you try to create a PayID and identify that it has already been registered by another person and you believe that the other person is not entitled to use it, you can ask us to raise a dispute. We can’t disclose to you details of any personal information in connection with PayIDs that are already registered.

(g) You must:

(i) only create and keep a PayID if you are entitled to use it;

(ii) notify us if you’re aware of or suspect unauthorised use of a PayID;

(iii) close a PayID if you’re not authorised to use it;

(iv) be able to provide us information about your entitlement to use a PayID if requested from time to time;

(v) keep your PayID details up to date and notify us if any relevant details change;

(vi) make sure your customers are aware of any relevant changes to your PayID;

(vii) use the PayID logo in accordance with the brand standards made available by NPPA from time to time if you use the logo for commercial purposes.

9.4. Updating a PayID

(a) After you have successfully created a PayID through Solo Money, you can:

(i) lock the PayID to temporarily disable it from being used;

(ii) unlock the PayID where it has previously been locked by you;

(iii) update the linked account where that account is accessible through Solo Money;

(iv) close the PayID;

(v) initiate a transfer to another financial institution (subject to paragraph 9.4(b) below).

(b) Transferring your PayID to another financial institution is a two-step process. You must first initiate the transfer through Solo Money. Once you’ve taken this step, the transfer can only be completed after you’ve asked the other financial institution to process the transfer request by creating a new PayID for you. The new PayID must be created within 14 days, otherwise your transfer request will be cancelled and your PayID will remain active.

(c) If you have a PayID with another financial institution and you want to transfer it to us, you need to ask the other financial institution to transfer your PayID to us. We can’t transfer it for you. Once you have requested the other financial institution to transfer the PayID, you can create a PayID through Solo Money.

(d) If you instruct us to transfer, lock or close a PayID or update the linked account for a PayID, the existing linked account will be able to receive payments to the PayID until your request has been processed. Subject to the two-step process applicable to PayID transfers described in clause 9.4(b), we’ll generally process your request promptly. Once we’ve processed your request to lock or close your PayID, you won’t be able to receive payments using it, transfer it to another financial institution or otherwise update it.

(e) We may, acting reasonably, lock or close your PayID at any time including because:

(i) we suspect that you may not be entitled to use the PayID;

(ii) we believe that fraud has occurred or is occurring, or the PayID is being used in a way that may cause loss to you, us or a third party;

(iii) there is a conflict or dispute relating to the PayID; or

(iv) the PayID is inactive.

10. PayTo®

10.1. Creating a Payment Agreement

(a) PayTo allows payers to establish and authorise Payment Agreements with a Payee who offers PayTo as a payment option.

(b) If you choose to establish a Payment Agreement with a Merchant or Payment Initiator that offers PayTo payment services, you’ll need to have opened a Solo Money Account with us and the Payee will need to offer PayTo payment services. You’ll be required to provide the Payee with your personal information including BSB/Account number or PayID. You’re responsible for ensuring the correctness of the BSB/Account number or PayID you provide to the Payee for the purpose of establishing a Payment Agreement. Any personal information or data you provide to the Payee will be subject to the privacy policy and terms and conditions of the relevant Payee.

(c) The Payee will submit details of the Payment Agreement to their financial institution for their information and for it to be recorded in the Mandate Management Service. The details of the Payment Agreement will be recorded in the Mandate Management Service for NPP Payments to be processed in accordance with them. We’ll notify you of the creation of any Payment Agreement established using your account or PayID details through the Solo by MYOB app and/or any other method contemplated by these Terms and Conditions. We will also provide details of the Payment Agreement, including the Payee named in the Payment Agreement, the payment amount and payment frequency, which you must confirm are correct or if they are incorrect, decline the Payment Agreement and contact the Payee requesting that they amend and resubmit the Payment Agreement. If you confirm the details in the Payment Agreement are correct, we’ll record your confirmation against the record of the Payment Agreement in the Mandate Management Service and the Payment Agreement will then become effective. If you see that the details in the Payment Agreement are incorrect, and decline the Payment Agreement, we’ll note that against the record of the Payment Agreement in the Mandate Management Service and the Payment Agreement will be cancelled.

(d) We’ll process payment instructions in connection with a Payment Agreement, received from the Payee, only if you’ve confirmed the associated Payment Agreement. Payment instructions may be submitted to us for processing immediately after you’ve confirmed the Payment Agreement so you must take care to ensure the details of the Payment Agreement are correct before you confirm them. We won’t be liable to you or any other person for loss suffered because of processing a payment instruction submitted under a Payment Agreement that you establish, unless contributed to by our gross negligence, criminal conduct, fraud or wilful misconduct. If a Payment Agreement requires your confirmation within a timeframe stipulated by the Payee, and you don’t provide confirmation within that timeframe, the Payment Agreement may be withdrawn by the Payee.

10.2. Amending a Payment Agreement

(a) Your Payment Agreement may be amended by the Payee, or by us on your instruction.

(b) When the Payee requests an amendment to the Payment Agreement and it needs your authorisation:

(i) The Mandate Management Service will notify us of the Payee’s proposed amendment to the terms of Payment Agreement and we’ll notify you of those proposed amendments through the Solo by MYOB app and/or any other method contemplated by these Terms and Conditions for your approval. These amendments may include variation of the payment amount, where that is specified in the Payment Agreement as a fixed amount, or payment frequency. You may confirm or decline any amendment request. If you authorise the amendment, we’ll record the confirmation against the record of the Payment Agreement in the Mandate Management Service and the amendment will then be effective. If you decline the amendment, we’ll record this decision, notify the Mandate Management Service and the amendment won’t be made. A declined amendment request will not otherwise affect the Payment Agreement.

(ii) Amendment requests which aren’t authorised or declined within five calendar days of being sent to you, will expire. If you don’t authorise or decline the amendment request within this period of time, the amendment request will be deemed to be declined.

(c) If you decline the amendment request because it doesn’t reflect the updated terms of the Payment Agreement that you have with the Payee, you may contact the Payee and have them resubmit the amendment request with the correct details. We aren’t authorised to vary the details in an amendment request submitted by the Payee.

(d) You can only request that we amend your name or account details in the Payment Agreement after it has been established. Account details may only be replaced with the BSB and account number of an account you hold with us through Solo Money. If you want to amend the account details to refer to an account with another financial institution, you may give us a transfer instruction (see clause 10.4). We may decline to act on your instruction to amend your Payment Agreement if we aren’t reasonably satisfied that your request is legitimate. You may not request us to amend the details of the Payee, or another party.

(e) We may amend your Payment Agreement, if you instruct us to do so, provided that we are reasonably satisfied that such amendment is in line with these Terms and Conditions.

10.3. Pausing your Payment Agreement

(a) You may instruct us to pause and resume your Payment Agreement through the Solo by MYOB app. We’ll act on your instruction to pause or resume your Payment Agreement promptly by updating the record of the Payment Agreement in the Mandate Management Service. The Mandate Management Service will notify the Payee’s financial institution of the pause or resumption. During the period the Payment Agreement is paused, we won’t process payment instructions in connection with it. We won’t be liable for any loss that you or any other person may suffer because of us, in line with these Terms and Conditions, pausing a Payment Agreement that is in breach of the terms of an agreement between you and the relevant Payee.

(b) Payees may pause and resume their Payment Agreements. If the Payee pauses or resumes a Payment Agreement which you’re a party to, they’ll notify their financial institution and update the Mandate Management Service. We’ll promptly notify you of a pause and of any subsequent resumption through the Solo by MYOB app. We won’t be liable for any loss that you or any other person may suffer because of the pausing of a Payment Agreement by the Payee.

(c) We may pause and resume your Payment Agreement as we consider reasonably necessary to prevent or investigate any suspected fraud, unlawful activity, misconduct, or any suspicious activity. We’ll give you notice through the Solo by MYOB app where we’ve exercised our right to pause or resume your Payment Agreement, including the grounds for exercising this right. We may also pause your Payment Agreement where we reasonably suspect you have breached these Terms and Conditions. We may also pause your Payment Agreement if your account is no longer eligible to be used to process a payment initiation request. We’ll notify the Mandate Management Service to update your record and the Mandate Management Service will notify the Payee’s financial institution of this update. While your Payment Agreement is paused, we won’t process payment instructions in connection with your Payment Agreement. We must use reasonable endeavours to investigate any decision to pause and/or resume your Payment Agreement due to a suspected fraud, unlawful activity, misconduct or any suspicious activity as soon as reasonably practicable. We have the authority to keep a service paused until such a time that we are satisfied that the relevant issues are resolved to our reasonable satisfaction.

(d) If your Payment Agreement has been paused because your account is no longer eligible for PayTo, and you amend the Payment Agreement to link it to an eligible BSB and account number, your Payment Agreement will automatically resume.

10.4. Transferring your Payment Agreement

(a) When available, you may elect to have payments under your Payment Agreement made from an account at another financial institution if PayTo is offered by that financial institution. You may do this by selecting “Transfer your Payment Agreement” in the Solo by MYOB app. We’ll give you a Transfer ID to give to your new financial institution to enable them to complete the transfer.

(b) Your new financial institution will be responsible for arranging your authorisation of the transfer of the Payment Agreement and also updating the Payment Agreement in the Mandate Management Service. The updated Payment Agreement will become effective when it’s updated in the Mandate Management Service.

(c) Until the transfer is completed, the Payment Agreement will remain linked to your account with us and payments under the Payment Agreement will continue to be made from your account with us. If the other financial institution doesn’t complete the transfer within 14 calendar days of when the Transfer ID was issued, the transfer will be deemed to be ineffective and payments under the Payment Agreement will continue to be made from your account with us.

(d) To transfer a Payment Agreement that you have with another financial institution to us, you’ll need to obtain a Transfer ID from that institution and give it to us through the Solo by MYOB app. We’ll use reasonable endeavours to arrange a transfer within 14 days of receiving your instruction to process a Transfer of a Payment Agreement from another financial institution. We don’t guarantee that all Payment Agreements will be transferrable to us. If we can’t complete a transfer, we will notify you. The transfer of a Payment Agreement will become effective when it’s updated in the Mandate Management Service by us.

10.5. Cancelling your Payment Agreement

(a) You may instruct us to cancel a Payment Agreement on your behalf through the Solo by MYOB app. We’ll act on your instruction promptly by updating the record of the Payment Agreement in the Mandate Management Service. The Mandate Management Service will notify the Payee’s financial institution or payment processor of the cancellation. Before cancelling you should consider whether cancelling will breach the terms of an agreement between you and the relevant Payee because you’ll be liable for any loss that you suffer because of that breach (for example, any termination notice periods that haven’t been adhered to). We won’t be liable to you or any other person for loss incurred because of the cancellation of a Payment Agreement.

(b) Where your account is no longer eligible for PayTo, you won’t be able to cancel your PayTo Payment Agreement. In these circumstances, you can contact us through the Solo by MYOB app to request that we cancel the Payment Agreement on your behalf.

(c) Payees may cancel Payment Agreements. If the Payee cancels a Payment Agreement which you’re a party to, we’ll promptly notify you of that cancellation through the Solo by MYOB app. We won’t be liable to you or any other person for loss incurred because of the cancellation of your Payment Agreement by the Payee.

(d) We may cancel your Payment Agreement to prevent fraud, unlawful activity, misconduct, any other suspicious activity, if we believe it’s reasonably necessary to do so to comply with our obligations under Anti-Money Laundering and Counter Terrorism Financing Laws, or if your account is no longer eligible for PayTo. You may also request us to cancel a Payment Agreement on your behalf if you don’t have access to do so yourself through the Solo by MYOB app. We’ll notify the Mandate Management Service to update your record and the Mandate Management Service will notify the Payee’s financial institution of this update. We’ll notify you of this cancellation.

10.6. Payments under a Payment Agreement

(a) Once a payment has been made under a Payment Agreement it is irrevocable. Refunds and reversals won’t be provided by us, PayTo or the NPP where you have a dispute with a Payee about any goods or services you have agreed to or acquired from the Payee under a Payment Agreement.

(b) If you have any complaints about goods or services purchased using a Payment Agreement you must resolve the complaint directly with the Payee.

(c) If you become aware of a payment being made from your account, that’s not permitted under the terms of your Payment Agreement you should contact the Payee to resolve this matter. If you’ve made reasonable attempts to resolve this matter, we may, at our discretion, raise an enquiry with the Payee’s financial institution to recover funds on your behalf.

10.7. Migration of Direct Debit arrangements

(a) Payees who have existing Direct Debit arrangements with their customers, may establish Payment Agreements for these, as Migrated DDR Mandates, to process payments under those arrangements through the NPP rather than BECS. If you have an existing Direct Debit arrangement with a Payee, you may be notified by them that future payments will be processed from your account under PayTo. You’re entitled to provide prior written notice of variation of your Direct Debit arrangement and changed processing arrangements, as specified in your Direct Debit Service Agreement, from the Payee. If you don’t consent to the variation of the Direct Debit arrangement you must advise the Payee. We aren’t obliged to provide notice of a Migrated DDR Mandate to you for you to confirm or decline. We’ll process instructions received from a Merchant or Payment Initiator based on a Migrated DDR Mandate.

(b) You may amend, pause (and resume), cancel or transfer your Migrated DDR Mandates, or receive notice of amendment, pause or resumption, or cancellation initiated by Payee, in the manner described in clauses 10.3, 10.4, 10.5.

10.8. General

(a) Your responsibilities

(i) You must ensure that you carefully consider any Payment Agreement creation request, or amendment request made in respect of your Payment Agreement or Migrated DDR Mandates and promptly respond to such requests. We won’t be liable for any loss that you suffer because of any payment processed by us in accordance with the terms of a Payment Agreement or Migrated DDR Mandate.

(ii) You must notify us immediately if you no longer hold or have authority to operate the account from which a payment under a Payment Agreement or Migrated DDR Mandate have been /will be made.

(iii) You must promptly respond to any notification that you receive from us regarding the pausing or cancellation of a Payment Agreement or Migrated DDR Mandate for misuse, fraud or for any other reason. We won’t be responsible for any loss that you suffer because of you not promptly responding to such a notification.

(iv) You’re responsible for ensuring that you comply with the terms of any agreement that you have with a Payee, including any termination notice periods. You acknowledge that you’re responsible for any loss that you suffer in connection with the cancellation or pausing of a Payment Agreement or Migrated DDR Mandate by you which is in breach of any agreement that you have with that Payee.

(v) Once a Payment Agreement has been authorised by you (and is not paused), PayTo payments will be processed through the NPP as instructed by the Payee and remain subject to any associated terms and conditions that apply to PayTo. You’re responsible for ensuring that you have enough funds in your account to meet the requirements of all your Payment Agreements and Migrated DDR Mandates. Subject to any applicable laws and binding industry codes, we won’t be responsible for any loss that you suffer because of your account having insufficient funds. These Terms and Conditions will apply in relation to circumstances where there are insufficient funds in your account.

(vi) If you receive a Payment Agreement creation request or become aware of payments being processed from your account that you’re not expecting, or experience any other activity that appears suspicious, fraudulent or erroneous, please report this activity to us through the Solo by MYOB app.

(vii) You may receive a notification from us through the Solo by MYOB app requiring you to confirm that all your Payment Agreements and Migrated DDR Mandates are accurate and up to date. You must promptly respond to these notifications. If you don’t respond we may pause the Payment Agreement/s or Migrated DDR Mandate/s.

(b) All intellectual property, including but not limited to PayID, PayTo and other trademarks of NPPA and related documentation, remains our property, or that of our licensors (Our Intellectual Property). We grant to you a royalty free, nonexclusive license (or where applicable, sub-license) while you have access to Solo Money to use Our Intellectual Property for the sole purpose of using PayID or PayTo in a way that’s consistent with these Terms and Conditions.

(c) Where an intellectual property infringement claim is made against you, we’ll have no liability to you underthis agreement to the extent that any intellectual property infringement claim is based on: (i) modifications to Our Intellectual Property by or on behalf of you in a manner that causes the infringement; (ii) your failure to use corrections or enhancements to Our Intellectual Property that are made available to you (except where the use of corrections or enhancements would have caused a defect in PayTo or would have had the effect of removing functionality or adversely affecting the performance of PayTo); and (iii) your failure to use Our Intellectual Property in line with these Terms and Conditions.

(d) You must comply with all applicable lawsin connection with your use of PayTo.

10.9. Our responsibilities

(a) We’ll accurately reflect all information you give to us in connection with a Payment Agreement or a Migrated DDR Mandate in the Mandate Management Service.

(b) We may monitor your Payment Agreements or Migrated DDR Mandates for misuse, fraud and security reasons. You acknowledge and consent to us pausing or cancelling all or some of your Payment Agreement or Migrated DDR Mandates if we reasonably suspect misuse, fraud or security issues. We’ll promptly notify you through the Solo by MYOB app of any action to pause or cancel your Payment Agreement.

(c) If you become aware of a payment being made from your account that’s not permitted under the terms of your Payment Agreement or Migrated DDR Mandate or that was not authorised by you, please contact us as soon as possible through via chat in the Solo by MYOB app. We won’t be liable to you for any payment made that was in fact authorised by the terms of your Payment Agreement or Migrated DDR Mandate.

(d) If you or we close an account that’s linked to a Payment Agreement, we may cancel that agreement. In this event, we won’t be liable for any loss you or anyone else suffers if you breach any agreement you have with the Payee.

10.10. Privacy

(a) By confirming a Payment Agreement and / or permitting the creation of a Migrated DDR Mandate against your account with us, you acknowledge that:

(i) you authorise us to collect, use and store your name and account details (amongst other information) and the details of your Payment Agreement/s and Migrated DDR Mandates in the Mandate Management Service; and

(ii) these details may be disclosed to the financial institution or payment processor for the Payee, for the purposes of creating payment instructions and constructing NPP Payment messages and enabling us to make payments from your account.

11. Direct Debits

11.1. Setting up a direct debit

(a) A direct debit is a transaction debited to your account by another person (the ‘Debit User’), under an arrangement that you and the person have entered into.

(b) The Debit User sets the frequency, amount and dates on which amounts are drawn from your account.

(c) A direct debit is different from a scheduled payment or a recurring payment made using your Card.

11.2. Cancelling a direct debit

(a) You may cancel a direct debit arrangement by contacting us through the Solo by MYOB app.

(b) You may also request us to suspend or cancel an individual direct debit. If you do, we’ll take this action within one Business Day.

(c) You must also inform the Debit User if you want to cancel the direct debit authority you’ve given them or if you want to cancel or suspend one or more payments.

(d) You must promptly advise us of any direct debits processed to your account that haven’t been authorised by you so we can investigate the issue.

11.3. Direct debit dishonours

(a) If you don’t have sufficient funds in your account on the day a direct debit is due to be processed, we may not permit the transaction and we may charge you a dishonour fee.

(b) If we, at our sole discretion give you an Unarranged Limit so that the direct debit can be processed, you’ll incur the fees and charges that apply to Unarranged Limits.

12. Debit Card

12.1. About the Card

(a) You may request a Card to be linked to an eligible Solo Money Account at any time. Schedule 1 sets out which accounts are eligible for Cards.

(b) A physical Card will be sent to you, at the address we hold on file, within 10 Business Days of request. You must –

(i) sign the Card as soon as you receive it; and

(ii) activate the Card after you receive it, within 90 days of the date of issue. If you do not activate your Card, your Card will be cancelled, and you will need to request a new Card in accordance with clause 12(a). By activating a Card before receiving it, there is a risk that you will become liable for unauthorised transactions if the Card is misplaced or stolen on its way to you.

(c) Cards can be used to make purchases through chip (and PIN), magstripe and card-not-present transactions (e.g. online transactions) from merchants who can process payments from the Card Scheme. Cards can also be used to withdraw cash at ATMs which display the Card Scheme’s logo.

(d) You can make contactless transactions with a Card at merchant terminals that allow contactless payments. A contactless transaction is when you hold your card near a contactless terminal and don’t need to insert or swipe your Card.

(e) All Cards are digital-enabled and you may choose to add your Card to a compatible digital wallet on certain devices. When a Card is added to a digital wallet, it may be used for contactless transactions with participating merchants in accordance with clause 12(d).

(f) Only one Card may be issued per account, at a time.

12.2. Using the Card

(a) We may, acting reasonably, change the daily transaction limit for the Card or put temporary or permanent blocks preventing transactions from being processed to certain merchants, categories of merchants or geographical regions. We may do this for a number of reasons, including where we believe there is a high risk of fraud or criminal activity associated with the merchant or region or where we are obliged by law to take such action.

(b) We don’t warrant that merchants or ATMs displaying the Card Scheme’s logos or other promotional material will accept the Card and we don’t accept responsibility should a merchant or other party refuse to accept the Card. You should confirm with the relevant party that they are able to accept the Card before initiating a transaction.

(c) We aren’t responsible for any defects in the goods and services you acquire using the Card. You acknowledge that all matters regarding the goods and services you obtain from merchants must be addressed to the merchants.

(d) If you close the account which the Card is linked to, the Card will be cancelled.

12.3. Recurring payments

(a) You may use the Card to set up recurring payments with a merchant by authorising the merchant to process a regular payment using the Card number. The recurring payment will be processed as a Card transaction rather than as a direct debit.

(b) If your Card details change for any reason, you must request the merchant to change the details of the recurring payment to ensure payments under the arrangement can continue. If you don’t inform the merchant of the change to your Card details, the payment won’t be processed and the merchant may not provide you with the relevant goods and services. There may also be additional fees and charges imposed by them.

(c) If you want to cancel the recurring payment, you should contact the merchant at least 15 days before the next scheduled payment and retain a copy of this cancellation request.

(d) If you close the account linked to the Card or cancel the Card for any reason, you must immediately contact the merchant to change or cancel your payment arrangements.

12.4. Pre-authorisations

A merchant may request a confirmation from us that there are sufficient funds in your account to cover the anticipated cost of goods or services supplied by them. Where this is the case, the available funds in your account will be reduced by the amount of the anticipated cost of goods or services. The actual amount payable to the merchant may be different to the anticipated cost. Your balance will reflect any changes once the transaction has been processed.

12.5. Foreign Currency Transactions

(a) Foreign currency transactions processed using the Card may involve a conversion (for example, from an overseas currency into Australian dollars) and incur a foreign transaction fee. Foreign currency transactions include:

(i) where the Card is used overseas at an ATM or merchant;

(ii) any transaction that involves a conversion by the merchant even though the transaction is denominated in Australian dollars (for example, where the merchant processes their payment outside of Australia); and

(iii) a refund or chargeback (as described in clause 12.8(d)) processed in connection with the above transactions.

(b) When a foreign currency transaction is processed, the transaction is either converted into:

(i) Australian dollars at a rate determined by the Card Scheme (where the transaction is processed in United States dollars);

(ii) United States dollars and then into Australian dollars at rates determined by the Card Scheme (where the transaction is processed in a currency other than United States dollars).

(c) The Card Scheme uses either a wholesale exchange rate or government mandated exchange rate to determine the conversion rate that will apply to the foreign currency transaction on the day it is processed. The rate applicable on the day the transaction (including a chargeback or refund) is processed may be different to the rate applicable when the transaction originally occurred.

(d) The foreign transaction fee applicable to foreign currency transactions can be found in Schedule 2 to these Terms and Conditions. Each foreign transaction fee you incur will be shown as a separate amount on your statement.

(e) Where a chargeback is processed in connection with a foreign currency transaction, the foreign transaction fee charged to the original transaction will be reversed.

(f) Some overseas merchants and ATMs charge a surcharge for making a transaction using your Card. Once you’ve confirmed that transaction you’re not able to dispute the surcharge. The surcharge may appear on your bank statement as part of the purchase price.

(g) Some overseas merchants and electronic terminals give you the option to convert the value of the transaction into Australian currency at the point of sale, also known as‘Dynamic Currency Conversion’. If you accept this option, once you have confirmed the transaction you’re not able to dispute the exchange rate applied. Regardless of who completes the currency conversion, the foreign transaction fee will apply.

12.6. PIN and Security

(a) You must choose a PIN for the Card. A PIN can be set up and changed at any time within the “Cards” section of the Solo by MYOB app.

(b) You must follow the instructions for choosing a secure PIN. You must also keep the PIN confidential and not disclose it to any other person.

(c) For the Card and PIN to operate effectively, you must not tamper with or damage the Card in any way.

12.7. Loss, theft and misuse of the Card

(d) If you believe the Card has been misused, lost or stolen, you must log into the Solo by MYOB app, freeze the Card and report the Card as lost, stolen or damaged.

(e) We’ll acknowledge your notification by giving you a reference number. You must keep this reference number.

12.8. Liability for unauthorised transactions on your Card

a) You won’t be liable for losses resulting from unauthorised transactions where it’s clear that you haven’t contributed to the loss. You also won’t be liable for unauthorised transactions where:

(i) you haven’t activated the original or replacement Card but a transaction has been processed using the Card;

(ii) you have previously informed us that the Card has been misused, lost or stolen and you have requested to freeze or cancel the Card;

(iii) a transaction has been debited more than once to your account without your authorisation; or

(iv) our systems are malfunctioning in a manner that caused the unauthorised transaction to be processed.

b) Our liability in respect of unauthorised transactions in the circumstances described in clause 12.8(a) is limited to correcting any errors and refunding any fees or charges imposed on you.

c) You’ll be liable for loss arising from unauthorised transactions where:

(i) you don’t take reasonable steps to protect your PIN;

(ii) you provide the Card and/or PIN to another person; or

(iii) you delay notifying us that the Card has been lost, stolen, damaged or misused.

d) You can ask us to reverse a payment made using the Card if you believe a transaction on the Card was:

(i) unauthorised; or

(ii) for goods or services that were ultimately not delivered by the merchant or didn’t match the description given by the merchant (and no refund or credit note was offered by the merchant).

This is known as a ‘chargeback’. A chargeback for a transaction processed by the Card Scheme will be processed in accordance with the Card Scheme Rules.

e) If you want to recover the funds for unauthorised transactions on your Card, you must instruct us to process a chargeback within 120 days of the relevant transaction and provide us with any information we require for the purposes of the chargeback. If you instruct us outside of this timeframe, we may not be able to recover the funds.

(f) If the chargeback is declined in line with the Card Scheme Rules, we’ll notify you and give you a reason for the decision where the Card Scheme has made this available.

12.9. Card Expiration

(a) We’ll issue a replacement Card before your current Card expires.

(b) When you receive the replacement Card, you must:

(i) complete the steps set out in clause 12.1(b); and

(ii) destroy your previous Card by cutting it into several pieces and disposing of it securely.

12.10. Replacement Cards

(a) You may request a replacement Card through the Solo by MYOB app if your Card has been lost, stolen or damaged.

(b) We may issue a new Card to you at any time.

(c) We reserve the right not to re-issue a Card to you.

12.11. Card revocation and cancellation

(a) Youmay cancel the Card at any time through the Solo by MYOB app. You’ll be liable for any transactions you make or initiate using the Card before or after the Card’s cancellation.

(b) We may cancel the Card at any time without giving you prior notice, if we (acting reasonably) believe that ongoing use of the Card may cause loss to you or us. Once we’ve advised you of the cancellation, you must stop using the Card and destroy it immediately by cutting it into several pieces and disposing of it securely. You’ll be liable for any transactions you make or initiate using the Card once we’ve advised you of the Card’s cancellation.

(c) All Cards are issued at our discretion and we may determine the level of functionality made available in our Cards. We may choose not to provide you with a Card.

(d) All Cards remain our property.

PART E Bank Feeds

13. What is a Bank Feed?

(a) A Bank Feed connects each of your accounts to the Solo by MYOB app to provide the Transaction Data to the Distributor.

(b) By opening any Solo Money Account you will automatically activate a Bank Feed for that account.

14. Acknowledgments and consents

(a) You agree to be bound by this Part E when you open any Solo Money Products or Services and a Bank Feed is established.

(b) You give us permission to disclose your Transaction Data, as well as any personal information about you or third parties that the Transaction Data may contain, to the Distributor.

(c) You acknowledge and agree that:

(i) while we will make reasonable efforts to provide all of the Transaction Data through the Bank Feed, our ability to provide Transaction Data may be limited by compatibility limitations between the Banking Products and Services and the Distributor’s software platform;

(ii) once disclosed, any copies of the Transaction Data received by the Distributor will be subject to the privacy policy and information security controls of the Distributor. If, for any reason a Bank Feed is disconnected from an account, any Transaction Data which we disclosed before the disconnection will continue to be held by the Distributor;

(iii) the Distributor may deactivate your Bank Feed without notice to you and without your consent, and this is outside of our control; and

(iv) we reserve the right, acting reasonably, to suspend or discontinue the provision of Transaction Data to the Distributor at any time.

15. Liability in respect of Bank Feeds

(a) We make no representations or guarantees to you or any other person in relation to the completeness or accuracy of the Transaction Data received by the Distributor, and we are not liable for delays, non-performance and processing errors arising out of or in connection with a Bank Feed, except to the extent that it is caused by the negligence, fraud or wilful misconduct of us or our employees.

(b) You agree not to hold us liable in contract, tort (including negligence) or otherwise for any damage, special or consequential loss or cost (including legal costs) to you or any other person, caused by our action or omission in relation to any Transaction Data shared via a Bank Feed except to the extent that it is caused by the negligence, fraud or wilful misconduct of us or our employees.

(c) You agree to indemnify us against all loss, damage, cost, expense, claim, proceeding or liability of any kind in relation to the provision of your Transaction Data via a Bank Feed, unless it occurs as the result of the negligence, fraud or wilful misconduct by us or our employees.

General

16. Your conduct

(a) You agree that you will, at all times:

(i) use the Banking Products and Services in good faith;

(ii) comply with these Terms and Conditions;

(iii) comply with applicable laws; and

(iv) comply with any additional requirements we reasonably impose.

17. Anti-money laundering and counter-terrorism financing obligations

(b) We’re required to comply with laws and regulations relating to the prevention of money laundering and counter terrorism financing. From time to time, we may take various actions we believe necessary to comply with these laws and relevant internal policies.

(c) To comply with these laws and regulations, we may be required to delay, block, freeze or not process a transaction.

(d) We may be required to report information about you to relevant authorities and aren’t under any obligation to tell you when this occurs. These actions could result in a breach of the terms of a Payment Agreement.

(e) You undertake that you:

(i) won’t initiate or participate in a transaction that may be in breach of law or sanctions of any country;

(ii) won’t initiate or participate in a transaction that involves a payment to or from a sanctioned region;

(iii) aren't participating in any activity that breaches the law or sanctions of any country.

(f) You must help us if we require further information from you to comply with our regulatory obligations or to manage risk. This may include information from third parties as is necessary to verify your identity, your legal representative, anyone acting on your behalf and any beneficial owners and the source of monies used for the payment. This may include information concerning your related parties. We may also re-identify you.

(g) You acknowledge that we may provide any information we hold for you to third parties such as government (including law enforcement) agencies, other financial institutions and our service providers in line with the terms of the Privacy Statement

18. Audit requirements

We may request that you give access to documents or other records to confirm your compliance with these Terms and Conditions. Where this is the case, you must provide all information reasonably requested by us.

19. Fees

(a) Fees and charges for the Banking Products and Services are set out in Schedule 2.

(b) You must pay any fees you incur in respect of the Banking Products and Services as set out in Schedule 2.

(c) We can vary our fees or charges from time to time. We’ll notify you in accordance with clause 21 if we do. Where we make a change to fees or charges, we’ll give you 30 days prior notice through the Solo by MYOB app and/or email. If you don’t accept the updated fees, you should stop using our services. By continuing to use the services after the end of the relevant notice period, you agree to be bound by the updated fees and charges.

(d) From time to time, we may waive any of our fees or charges. However, this doesn’t mean that we’ll waive those same fees or charges in the future.

(e) We may also deduct relevant government taxes and charges from your bank account. We won’t be able to waive these. Please note that the government can change these without notice.

(f) Further information about the amounts that may be payable in respect of the Banking Products and Services is available through the Solo by MYOB app and on request.

20. Termination

(a) You may close your accounts and Cards by contacting us through the Solo by MYOB app at any time.

(b) You may also delete your Solo Money banking profile by making a request in the Solo by MYOB app at any time.

(c) We’ll action any request made by you under this clause within a reasonable time, unless destruction of the relevant records is prohibited by law.

(d) We’ll action any request made by you under this clause within a reasonable time, unless destruction of the relevant records is prohibited by law.

(e) We may terminate your access to the Banking Products and Services at any time. We’ll usually give you at least 14 days’ notice but we may not give you prior notice of such termination in certain circumstances including where we believe you’ve committed a material breach of these Terms and Conditions or where there’s fraud or a security breach.

(f) Where you have an account with a credit balance, we’ll take reasonable steps to return the funds to you or the government (where the funds are treated as unclaimed money).

21. Changes to Terms and Conditions

(a) We may make changes to your account and/or these Terms and Conditions from time to time. We will advise you of such changes via:

(i) the Solo by MYOB app;

(ii) your nominated email address for Solo Money; and/or

(iii) the MYOB website.

(b) If you don’t accept those changes, you should stop using our Banking Products and Services. By continuing to use our services after the end of the notice period stated in clause 21(c), you agree to be bound by the changes.

(c) The minimum notice period we’ll give you is as follows, however we may give you with a shorter period of notice if applicable law requires that an amendment to take effect more quickly:

Type of change | Notice period |

|---|---|

New fees and charges | 30 days |

Increases to existing fees and charges (except for interest rates) | 30 days |

Changes to minimum balance requirements | 30 days |

Reducing the number of fee-free transactions permitted on the account | 30 days |